MHMarkets:Federal Reserve Governor Cook: The debt issue will not pose a significant threat to the US economy.

Sommario:At the end of the Asian market on Tuesday (November 7), in response to the debt issue of the US government, Federal Reserve Governor Lisa Cook countered on Monday that the financial conditions of households, businesses, and banks were quite good and did not seem to pose a significant threat to the US economy.

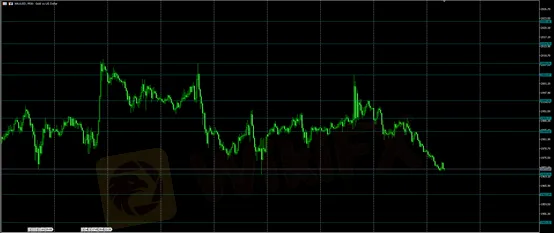

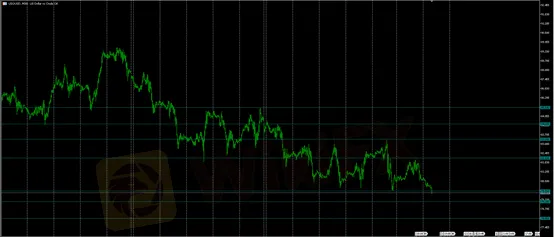

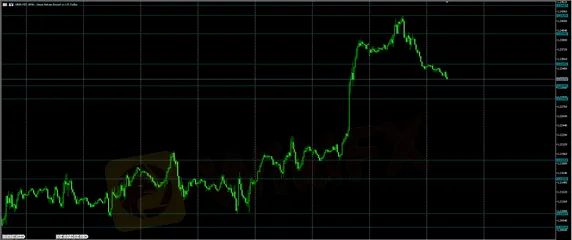

At the end of the Asian market on Tuesday (November 7), in response to the debt issue of the US government, Federal Reserve Governor Lisa Cook countered on Monday that the financial conditions of households, businesses, and banks were quite good and did not seem to pose a significant threat to the US economy. The US dollar index rebounded and rose after receiving support from below yesterday. Today, the Asian market continued to rise, but the current upward trend has not changed the weakening trend of the US dollar index. The current US dollar index quotation is around 105.43. Gold continued to decline yesterday and broke below support during the session. Gold continued its downward trend in the Asian market today. Due to the Palestinian-Israeli conflict and the weakening of its fundamentals, there is a further downward trend in future gold prices, with the current gold price around 1971.60. US crude oil prices continued to decline yesterday due to uncertain policies from oil producing countries, but did not break through the lower boundary of the triangular shape. US crude oil continued to decline during today's Asian market, and the price is gradually approaching yesterday's low. If it continues to hit new lows in the future, the downward space for US crude oil will open up. Currently, US crude oil prices are around 80.06. EURUSD fluctuated slightly yesterday and fell after being blocked at 1.0756 above. Today, it opened short and opened low in the Asian market, and continued its previous decline after filling the gap. The current quotation is around 1.0705.The preliminary statistical results released by the Japanese Ministry of Health, Labour and Welfare on the November 7 showed that after deducting the factor of price increases, Japan's actual wage income decreased by 2.4% year-on-year in September, marking the 18th consecutive month of year-on-year decrease. The statistical results show that the per capita nominal cash wage of Japanese workers in September was 279300 yen (approximately 148 yen per US dollar), an increase of 1.2% year-on-year. USDJPY rose significantly yesterday and closed near the intraday high. Today, the Asian market continued to rise, and the current price is approaching resistance around 150.45 above, quoting around 150.38.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on November 7, Beijing time.

| Gold XAUUSD· | |

| Resistance | 1984.62 – 1989.17 – 1995.20 |

| Support | 1969.84 – 1962.94 – 1953.32 |

| |

| Crude Oil USOUSD· | |

| Resistance | 82.13 – 83.38 – 84.43 |

| Support | 79.91 – 79.19 – 78.05 |

| |

| EURUSD· | |

| Resistance | 1.0749 - 1.0764 - 1.0794 |

| Support | 1.0694 - 1.0675 - 1.0619 |

| |

| GBPUSD· | |

| Resistance | 1.2346 – 1.2398 – 1.2428 |

| Support | 1.2310 - 1.2289 – 1.2185 |

| |

WikiFX Trader

Exness

Pepperstone

IB

ATFX

TMGM

EC Markets

Exness

Pepperstone

IB

ATFX

TMGM

EC Markets

WikiFX Trader

Exness

Pepperstone

IB

ATFX

TMGM

EC Markets

Exness

Pepperstone

IB

ATFX

TMGM

EC Markets

Rate Calc