【MACRO Alert】"Little Non-farm" Hits New Low for the Year, But Market Expectations for Rate Cuts Remain Stable!

Sommario:The US ADP employment report (known as "Little Non-farm") was released on Wednesday, showing a slowdown in job growth in May, mainly due to a sharp decline in manufacturing and weak hiring in the leisure and hospitality industries. The number of jobs added in May was 152,000, the lowest since January this year, below the expected 175,000, and down from 188,000 (initially reported as 192,000) in April.

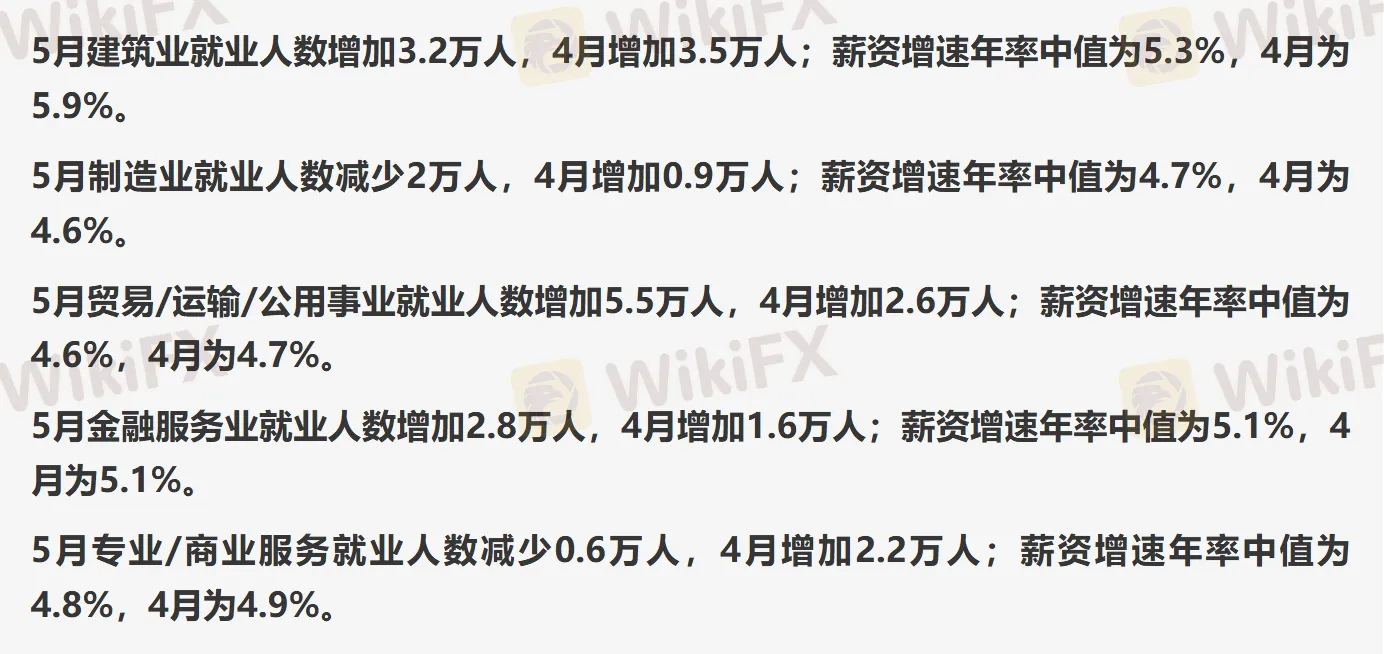

The US ADP employment report (known as “Little Non-farm”) was released on Wednesday, showing a slowdown in job growth in May, mainly due to a sharp decline in manufacturing and weak hiring in the leisure and hospitality industries. The number of jobs added in May was 152,000, the lowest since January this year, below the expected 175,000, and down from 188,000 (initially reported as 192,000) in April.

ADP's Chief Economist Nela Richardson noted that although the labor market remains stable, job and wage growth are slowing down. She mentioned that the service industry is the main source of recruitment, while goods producers only contributed 3,000 jobs. The report also pointed out that the year-over-year wage growth rate for job-hoppers in May fell for the second consecutive month to 7.8%, while the wage growth for non-job-hoppers remained stable at 5%.

Despite the ADP employment data not meeting expectations, economists believe it is still within an acceptable range. The US Secured Overnight Financing Rate (SOFR) only fluctuated slightly after the report was released. Analysts believe that the ADP report indicates that the job market has not collapsed under the pressure of the Federal Reserve's interest rate hikes, although other data suggest that the job market is moving towards balance.

The data released by the US Department of Labor on Tuesday shows that job vacancies in April fell to their lowest point in more than three years, with the ratio of job vacancies to the number of unemployed people returning to the state before the outbreak of the pandemic in early 2020. Recent economic indicators, including the slowdown in employment growth and the downward trend in inflation, have strengthened investors' expectations that the Federal Reserve may lower interest rates before the end of the year.

However, strategists at UBS believe that the likelihood of the Federal Reserve cutting interest rates more than twice this year is not high, and the worst-case scenario may be no rate cuts at all, indicating that the extent of rate cuts this year may be small. The latest Reuters survey also shows that most economists surveyed expect the Federal Reserve to cut interest rates for the first time in September, but there is a possibility of only one rate cut or no rate cuts at all. The median forecast of these economists also predicts that inflation will remain high and will not reach the 2% target before at least 2026.

After the release of the data, there was no significant short-term fluctuation in the prices of the US dollar and gold. The yield on two-year US Treasury bonds reached an intraday low but did not fall below 4.75% on Tuesday; while the yield on 10-year US Treasury bonds fell to 4.312%, the lowest level since April 5th.

The data released by the US Department of Labor on Tuesday shows that job vacancies in April fell to their lowest point in more than three years, with the ratio of job vacancies to the number of unemployed people returning to the state before the outbreak of the pandemic in early 2020. Recent economic indicators, including the slowdown in employment growth and the downward trend in inflation, have strengthened investors' expectations that the Federal Reserve may lower interest rates before the end of the year.

However, strategists at UBS believe that the likelihood of the Federal Reserve cutting interest rates more than twice this year is not high, and the worst-case scenario may be no rate cuts at all, indicating that the extent of rate cuts this year may be small. The latest Reuters survey also shows that most economists surveyed expect the Federal Reserve to cut interest rates for the first time in September, but there is a possibility of only one rate cut or no rate cuts at all. The median forecast of these economists also predicts that inflation will remain high and will not reach the 2% target before at least 2026.

After the release of the data, there was no significant short-term fluctuation in the prices of the US dollar and gold. The yield on two-year US Treasury bonds reached an intraday low but did not fall below 4.75% on Tuesday; while the yield on 10-year US Treasury bonds fell to 4.312%, the lowest level since April 5th.

WikiFX Trader

IC Markets Global

Ultima Markets

GTCFX

JustMarkets

FXTRADING.com

Vantage

IC Markets Global

Ultima Markets

GTCFX

JustMarkets

FXTRADING.com

Vantage

WikiFX Trader

IC Markets Global

Ultima Markets

GTCFX

JustMarkets

FXTRADING.com

Vantage

IC Markets Global

Ultima Markets

GTCFX

JustMarkets

FXTRADING.com

Vantage

Rate Calc