Gold Surge to All-time High

Sommario:he U.S. equity market continued its rally in yesterday's session, with the Dow Jones approaching its all-time high near the 41,000 mark. The Russell 2000 (US2000) small-cap index surged more than 10% since last Thursday, suggesting that strategists have been rotating their exposure to small-cap counters, which are more sensitive to interest rate changes.

Wall Street continues to rally as the U.S. Retail Sales reading supports the rate cut view.

Gold Prices surged to all-time high on a softening dollar.

BTC prices continue to surge on Donald Trump effect and passed the $65000 mark.

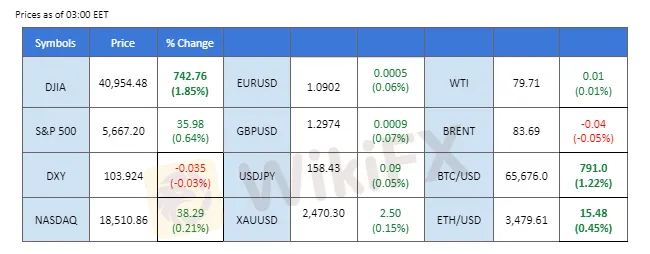

Market Summary

The U.S. equity market continued its rally in yesterday's session, with the Dow Jones approaching its all-time high near the 41,000 mark. The Russell 2000 (US2000) small-cap index surged more than 10% since last Thursday, suggesting that strategists have been rotating their exposure to small-cap counters, which are more sensitive to interest rate changes.

The U.S. retail sales reading released yesterday fueled optimism that the Federal Reserve may start cutting rates soon, heightening risk appetite in the market while the dollar continued to trade dully. In contrast, New Zealand's CPI came in lower than market consensus at 3.3%, showing signs of easing inflation and exerting downside pressure on the Kiwi. Traders are keeping an eye on todays UK and eurozone CPI readings, which may serve as catalysts to propel the Sterling and the euro higher.

In the commodity market, gold has risen to its zenith above the $2480 territory on rate cut expectations, while oil prices have been lacklustre due to a lack of catalysts. Additionally, Bitcoin prices topped $65,000 as positive sentiment continues to drive the cryptocurrency higher, bolstered by hopes that Donald Trump, a crypto-friendly U.S. presidential candidate, will win the election.

Current rate hike bets on 31st July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (93.3%) VS -25 bps (6.7%)

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which tracks the US dollar against a basket of six major currencies, extended its losses as investors continued to digest the dovish tone from Federal Reserve members. Fed Chair Jerome Powell recently stated that progress in stabilising US inflation has been positive, hinting that the Fed might consider rate cuts soon. However, he reiterated that the Feds decisions remain data-dependent, so investors should keep monitoring further US economic data for trading signals.

The dollar index is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 41, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 104.45, 104.75

Support level: 104.05, 103.65

XAU/USD, H4

Gold prices rebounded, supported by the depreciation of the US Dollar and rising political tensions ahead of the US Presidential election, prompting investors to shift their portfolios toward safe-haven gold. Traders are pricing in over a 90% chance of a 25 basis point rate cut in September and a small possibility of a 50 basis point cut, according to CME FedWatch. Expectations of rate cuts from global central banks are likely to diminish the appeal of currencies, increasing demand for gold.

Gold prices are trading higher following prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 80, suggesting the commodity might enter overbought territory.

Resistance level: 2490.00, 2500.00

Support level: 2455.00, 2445.00

GBP/USD,H4

The GBP/USD pair continues to trade sideways at its yearly high, awaiting a catalyst to drive further movement. Today‘s UK CPI reading may fuel the uptrend momentum for the pair. Meanwhile, the U.S. retail sales data released yesterday suggests that the Federal Reserve may soon start cutting rates, which has hindered the dollar’s strength and provided buoyancy for the GBP/USD pair.

The GBP/USD is supported at a 1.2950 level, suggesting that the pair will continue trading within its uptrend trajectory. The RSI, despite dropping out from the overbought zone, remains at the upper region while the MACD has crossed on the above, suggesting the bullish momentum is easing.

Resistance level: 1.3000, 1.3065

Support level: 1.2940, 1.2850

EUR/USD,H4

The EUR/USD pair is positioned at its recent high, testing resistance at 1.0920, indicating a bullish bias. The upcoming eurozone CPI reading, due later today, may be pivotal for a potential breakout. Meanwhile, euro traders are closely watching tomorrow's ECB interest rate decision, with market expectations leaning towards the ECB holding rates unchanged.

EUR/USD traded sideways for the past few sessions and is testing its resistance level, which suggests a bullish bias for the pair. The RSI slid below the overbought zone, while the MACD has formed a double-top and crossed above, suggesting the bullish momentum is easing.

Resistance level: 1.0940, 1.0985

Support level: 1.0853, 1.0816

Russell 2000 (US2000), H4

The Russell 2000 index surged by over 10% in recent sessions and is nearing its all-time high of 2463.00. This rally is driven by optimism surrounding a potential Fed rate cut, which is particularly beneficial for interest rate-sensitive small-cap stocks. The U.S. Retail Sales data released yesterday bolstered this sentiment, further fueling the index's upward momentum.

The Russell 2000 index has been extremely bullish and is approaching its all-time high at 2463. The RSI has surged into the overbought zone while the MACD has broken above the zero line and diverged, suggesting the bullish momentum remains strong.

Resistance level: 23320.00, 2444.00

Support level: 2220.00, 2108.00

NZD/USD, H4

The New Zealand dollar eased slightly following the release of a downbeat inflation report. However, the NZD/USD pair managed to rebound on dip-buying, with expectations that the Fed might ease interest rates, prompting further drops in the dollar and supporting the NZD/USD. Inflation in New Zealand, measured by the change in the Consumer Price Index (CPI), dropped to 0.4% QoQ in the second quarter (Q2) of 2024 from 0.6% in the previous reading, as reported by Statistics New Zealand. This figure was below the market consensus of 0.6%

NZD/USD is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 46, suggesting the pair might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 0.6100, 0.6155

Support level: 0.6040, 0.5970

BTC/USD, H4

Bitcoin prices surged past $65,000for the first time in a month, buoyed by optimism surrounding Donald Trump's prospects in the U.S. presidential election. However, a slight decline occurred when the defunct crypto exchange Mt. Gox moved another $3 billion worth of BTC. Later, the favourable U.S. retail sales data boosted risk appetite, pushing BTC to its monthly high.

BTC prices continue to trade in an uptrend trajectory with strong bullish momentum. The RSI remains in the upper region, while the MACD continues to edge higher, suggesting that the bullish momentum remains strong with BTC.

Resistance level: 67540.00, 70880.00

Support level: 62600.00, 57060.00

CL OIL, H4

Oil prices are trading lower following prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 37, suggesting the commodity might enter oversold territory.

Resistance level: 81.35, 82.90

Support level: 79.70, 78.30

WikiFX Trader

Pepperstone

HFM

FBS

VT Markets

FXTM

FP Markets

Pepperstone

HFM

FBS

VT Markets

FXTM

FP Markets

WikiFX Trader

Pepperstone

HFM

FBS

VT Markets

FXTM

FP Markets

Pepperstone

HFM

FBS

VT Markets

FXTM

FP Markets

Rate Calc