【MACRO Alert】Policy Choices and Foreign Exchange Market Reactions - The Complex Interweaving of the Bank of Japan's Interest Rate Decisions and Foreign Exchange Market Interventions

Sommario:The Bank of Japan is in a complex and highly sensitive decision-making environment and must find a balance between controlling inflation and supporting economic growth. Although inflation continues to rise, reaching 2.6%, exceeding the central bank's target, the decline in real wages and weak consumption pose challenges to the decision to raise interest rates. Market expectations for the central bank's interest rate hike are inconsistent, and the fluctuations in the yen exchange rate and governm

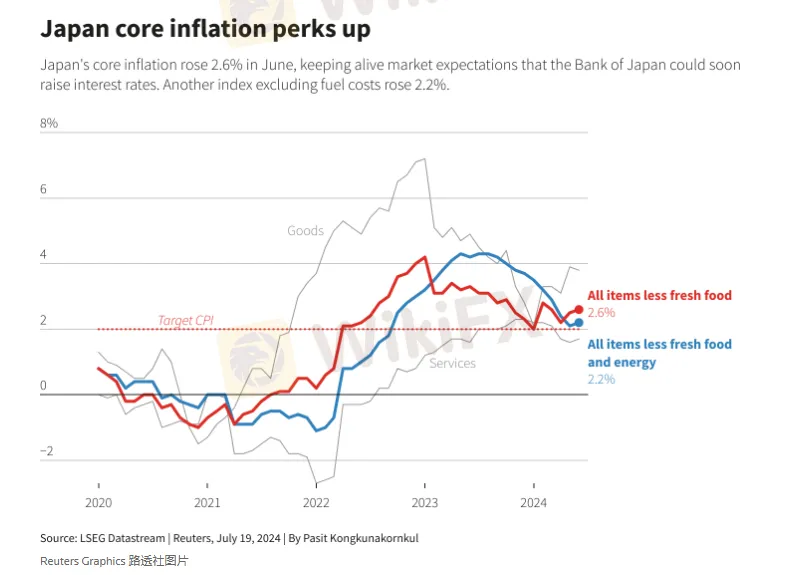

Amidst the global economic fluctuations, the decisions of the Bank of Japan are closely linked to the dynamics of the foreign exchange market, and recent events have further highlighted this connection. The Bank of Japan is facing a complex decision-making environment, having to address persistent inflationary pressures while considering a sluggish consumer market. In June, Japan's core inflation rate continued to accelerate for the second consecutive month, reaching 2.6%, slightly below the market's expectation of 2.7%, but has exceeded the central bank's 2% target for 27 consecutive months. This upward trend is mainly driven by the surge in energy costs, with the reduction of public utility subsidies leading to a 7.7% increase in energy costs.

Despite the continuous rise in inflation, which seems to provide a rationale for raising interest rates, market expectations are not uniform. A Reuters survey shows that more than three-quarters of economists expect the Bank of Japan to hold off on raising interest rates at this month's policy meeting. Takeshi Minami, the chief economist at Norinchukin Research Institute, pointed out that the rise in import costs leading to price increases is reducing real wages and suppressing consumption, and he maintains his forecast that the Bank of Japan will not raise interest rates until October at the earliest.

In March, the Bank of Japan exited negative interest rates and bond yield control (YCC), marking its abandonment of a decade-long aggressive stimulus plan. The central bank governor, Haruhiko Kuroda, hinted that if wage and service price increases enhance the prospect of achieving a sustainable 2% inflation target, the central bank will further raise interest rates. However, whether the conditions for raising interest rates are ripe is a matter of debate in the market. Against this backdrop, the policy makers of the Bank of Japan must find a balance between maintaining the inflation target and supporting economic growth. They need to consider the potential impact of interest rate hikes on consumption and the overall economy, while also considering the negative impact of the weak yen and rising prices on households. Policy makers will release new quarterly forecasts at the upcoming policy meeting and debate whether to adjust interest rates.

At the same time, Japanese Finance Minister Shunichi Suzuki warned Cabinet Minister Taro Kono to be more cautious when discussing the yen exchange rate. Taro Kono's recent remarks seem to have helped the yen appreciate against the US dollar. In an interview, he said that the Bank of Japan needs to raise interest rates to promote the appreciation of the yen and reduce the cost of energy and food. Market participants regard Kono's speech as one of the drivers of the yen's appreciation. Finance Minister Shunichi Suzuki said that he hopes Kono will be cautious in his remarks, as his words may have unexpected effects on the market.

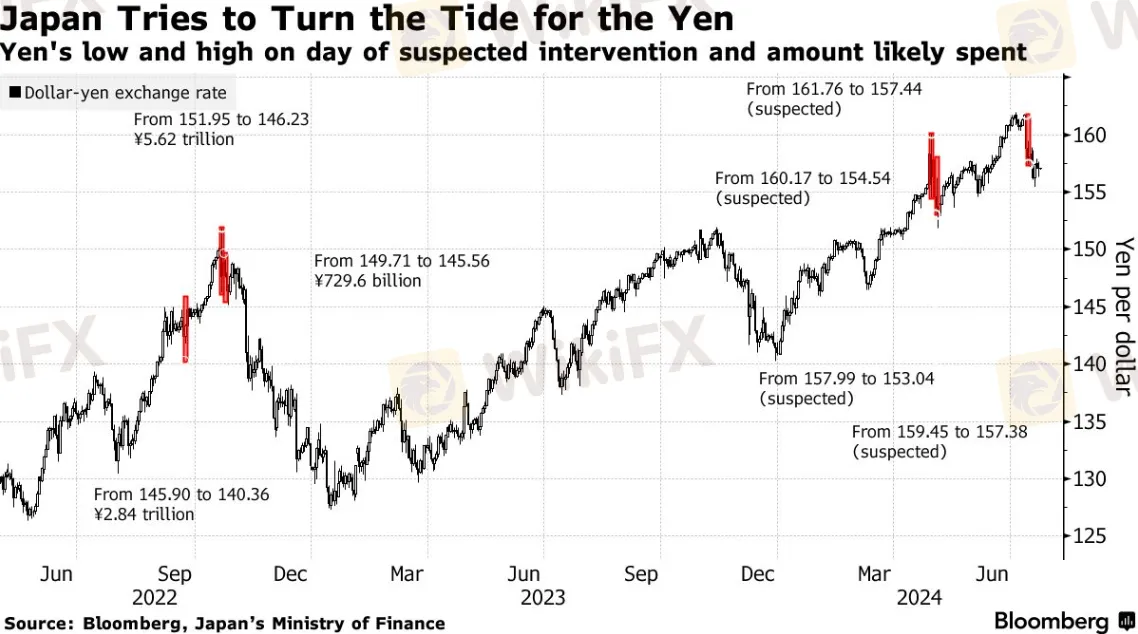

The Japanese authorities have always adhered to a strategy of keeping traders in the dark, refusing to comment immediately on whether the government will intervene in the foreign exchange market, and also trying not to provide information about intervention. This makes Kono's speech on Wednesday eye-catching. Japan is suspected of intervening in the exchange market twice last week to support the yen, with an estimated cost of about 56 trillion yen (35.6 billion US dollars). Kono clarified at a regular press conference on Friday that he did not directly ask the Bank of Japan to raise interest rates, but only said that if interest rates were raised, the yen would strengthen. He added that monetary policy is decided by the Bank of Japan.

Against this background, the Bank of Japan may make a final decision at the end of the meeting on July 31st after checking the latest data on the market and economic conditions. At that time, the central bank will also announce a plan to reduce bond purchases, but it is expected not to create a big surprise. Market participants have a better understanding of the Bank of Japan's stance on reducing bond purchases, and it is expected that the pace of bond purchases will be reduced from the current 6 trillion yen to 3 trillion yen within two years.

If bond yields rise sharply, the Bank of Japan may intervene, although this commitment may not be written in the statement. Most observers expect that the Bank of Japan will maintain interest rates at this meeting, as raising borrowing costs while reducing bond purchases is considered too radical. The Japanese government has revised down the economic growth forecast for this fiscal year to 0.9%, and the Bank of Japan may further revise down the economic growth forecast from 0.8% to 0.5%, mainly because the revision of GDP data shows that consumer spending has declined in the four quarters ending in March. Officials also said there is no need to make significant adjustments to inflation forecasts next week.

At the same time, analysts at Citigroup predict that if the euro to yen exchange rate approaches the level of 180, Japanese authorities may intervene in the market to sell euros to support the yen. This prediction is based on the exchange rate fluctuation on July 11th, when the euro to yen once reached as high as 175.43, setting a record high since the introduction of the euro in 1999. Although the euro to yen exchange rate fell back to around 171, this fluctuation has attracted high attention from the market.

The Japanese authorities may have spent about 3.5 trillion yen on July 11th to support the yen against the US dollar, which is considered the third intervention this year. Subsequently, the Bank of Japan conducted a check on the euro to yen exchange rate, and then a suspected intervention on the US dollar to yen. Exchange rate checks are usually seen as a signal that the Japanese government is preparing to intervene in the foreign exchange market. Since September 2022, the euro to yen exchange rate has risen by about 30 yen, while the US dollar to yen has only risen by about 10 yen during the same period.

Citigroup analysts Osamu Takashima, Daniel Tobon, and Brian Levine pointed out in a research report that 20%-30% of Japan's foreign exchange reserves are in euros, and due to the authorities' sales of US dollars to defend the yen over the past two years, Tokyo also has reasons to reduce euros to avoid distortion in the allocation of foreign exchange reserves. They believe that if the US dollar to yen rises to around 165, and the euro to yen “threatens” the 180 level, it is very likely that Japan will sell euros and buy yen.

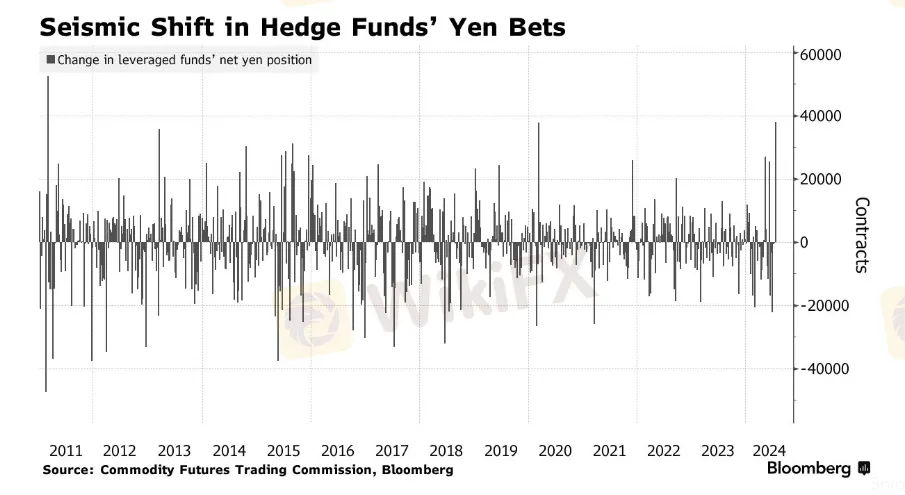

At the same time, the Japanese authorities are suspected of taking dual intervention measures to support the yen exchange rate, leading to hedge funds reducing their short bets on the yen with astonishing strength. Data from the US Commodity Futures Trading Commission (CFTC) shows that leveraged funds reduced 38,025 yen net short position contracts in the week ending July 16, which is the most since March 2011. Although hedge funds still hold a net of 76,588 short position contracts, the position shift coincided with an improvement in the popularity of the yen.

It is estimated that Japan spent 5.64 trillion yen in two consecutive trading days this month to lift the yen from its weakest level since the 1980s. Yukio Ishizuki, a senior currency market strategist at Daiwa Securities in Tokyo, said that after a series of intervention measures by Japan, there is not much demand for selling yen. He added that the trend of closing short positions in yen seems to dominate before the Bank of Japan makes a policy decision on July 31.

The recent appreciation of the yen also reflects the strengthening of expectations for the Federal Reserve to cut interest rates in September and the support brought by Trump's criticism of the weak yen. The next major test for traders will come at the end of the month when both the Federal Reserve and the Bank of Japan will make policy decisions. Any dovish hints from the Bank of Japan may be seen as a reason to go short on the yen again.

Data from the CFTC shows that asset management companies have also reduced their short positions in yen, the largest reduction in a year. As consumer prices in Japan continued to rise for the second consecutive month in June, the rationale for policy makers to raise interest rates again is becoming more and more sufficient. According to a survey by Bloomberg last month, about one-third of Bank of Japan observers expect the Bank of Japan to raise interest rates at the meeting ending on July 31.

State Street Global Advisors' Asia-Pacific economist Krishna Bhimavarapu wrote in a report: “We expect the Bank of Japan to raise interest rates in July, which may add some much-needed sustainability to the yen's rise.” If this expectation comes true, it will further affect the dynamics of the foreign exchange market, especially on the eve of the Bank of Japan's policy meeting. Against this background, the policy makers of the Bank of Japan must weigh a variety of factors, including domestic economic conditions, inflation rates, foreign exchange reserve allocation, and the global economic environment, to make the most appropriate policy decisions. Their choices will directly affect the exchange rate of the yen and have a profound impact on the global financial market. At the policy meeting on July 31, the central bank may maintain interest rates while reducing bond purchases, but still need to respond cautiously to market changes and updates in economic data.

The Bank of Japan is in a complex and highly sensitive decision-making environment and must find a balance between controlling inflation and supporting economic growth. Although inflation continues to rise, reaching 2.6%, exceeding the central bank's target, the decline in real wages and weak consumption pose challenges to the decision to raise interest rates. Market expectations for the central bank's interest rate hike are inconsistent, and the fluctuations in the yen exchange rate and government interventions in the foreign exchange market also affect the central bank's decision-making. Overall, the policy choices of the Bank of Japan will greatly affect the yen exchange rate and have a profound impact on the global financial market. At the policy meeting on July 31, the central bank may maintain interest rates unchanged while reducing bond purchases, but still needs to respond cautiously to market changes and updates in economic data.

WikiFX Trader

GTCFX

octa

HFM

D prime

fpmarkets

FXTM

GTCFX

octa

HFM

D prime

fpmarkets

FXTM

WikiFX Trader

GTCFX

octa

HFM

D prime

fpmarkets

FXTM

GTCFX

octa

HFM

D prime

fpmarkets

FXTM

Rate Calc