【MACRO Insight】The Eye of the Financial Storm—The Bank of Japan's Interest Rate Decision and Market Panic!

Sommario:This week, the global financial market experienced intense fluctuations, especially significant fluctuations in the Japanese stock market and exchange rate that attracted widespread attention. Bank of Japan Deputy Governor Shinichi Uchida announced that against the backdrop of instability in the financial and capital markets, it was decided to pause further interest rate increases, eliminating market expectations for further rate hikes within the year. Although the policy changes of the Bank of

On August 7, Bank of Japan Deputy Governor Shinichi Uchida announced that against the backdrop of instability in the financial and capital markets, the Bank of Japan has decided to pause further interest rate increases. This decision was seen by the market as the Bank of Japan's response to the current economic situation, and it also eliminated expectations of further rate hikes within the year. Shinichi Uchida's statement reflected a profound understanding of the financial market instability and a decision to maintain interest rate stability in the short term. Shinichi Uchida's dovish stance is consistent with his identity as an early participant in Abenomics. His remarks indirectly acknowledged the potential negative impact of Japan's interest rate hikes on the global financial market.

Earlier this week, the global market experienced intense volatility, especially significant fluctuations in the Japanese stock market and exchange rates that attracted widespread attention. Many friends are confused about the underlying causes and future trends. In fact, this may be the day when the Japanese stock market and exchange rates have attracted the most attention on the Chinese Internet in recent years. Despite the large fluctuations in the yen exchange rate and the Japanese stock market, the strong performance of the Nikkei index at the beginning of the year and the depreciation of the yen have attracted the attention of many investors.

The Nikkei 225 index suffered the second-largest drop in history on Monday of this week, described as “Black Monday,” which shook the financial world. However, this shock seems to be limited to the financial industry. In Japan, the media responded relatively calmly, and the calm on the streets of Tokyo contrasted sharply with the turmoil in the market. This reminds us of the scenario during the A-share stock disaster in 2015, where market participants felt desperate, but daily life was not too affected. This phenomenon highlights the information cocoon effect - the things we pay attention to are infinitely magnified, affecting our investment thoughts.

At the same time, “arbitrage and carry trade” have suddenly become the focus of news media. Although the market fluctuations in these two days cannot be called a financial crisis, they may be a dress rehearsal. Observing the process of turmoil can help us understand the patterns of crises and prepare for potential crises in the future.

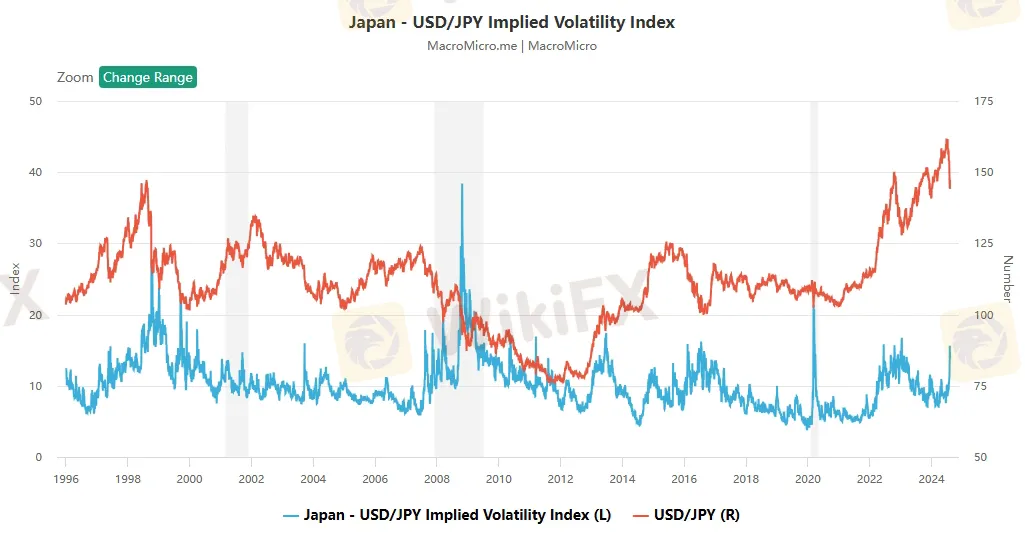

We can observe that as one of the international mainstream currencies with larger fluctuations, the yen often appears at both ends of the rise and fall list. Japan's long-term low-interest-rate policy has made the yen an ideal financing currency for carry trade. However, carry trade is divided into two types: hedged and unhedged exchange rate risk, and most carry trades choose not to hedge in order to maintain a higher return rate. When market sentiment changes, under the risk-averse model, the yen, as a safe-haven currency, will trigger the closing of carry trade, leading to the appreciation of the yen. This pro-cyclical effect will amplify currency fluctuations.

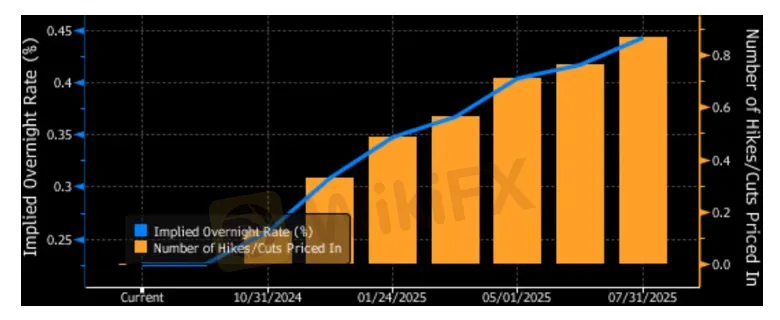

This year, although the Bank of Japan began to normalize monetary policy, the depreciation of the yen exceeded expectations. In March, Japan abandoned the Yield Curve Control (YCC) and exited negative interest rates, but the depreciation trend of the yen did not decrease. In April, the yen's short position had already reached an extreme level, but the yen continued to depreciate, which was unexpected in the market. In July, the yen began to strengthen, and there were three opportunities behind this: foreign exchange intervention, politicians' speeches, and the convergence of the divergence of monetary policy. In addition, the excessive yen short position reached an extreme value and naturally reversed, promoting the appreciation of the yen.

However, the rapid appreciation of the yen may be related to the recent release of the United States' economic data that was below expectations. The market is worried about a recession, leading to the closing of carry trade, and the appreciation of the yen exchange rate. At the same time, Japanese technology stocks are affected by the U.S. stock market, and the sentiment of risk aversion has faded.When the market reverses after extreme positions and emotions, investors, especially institutional investors, usually sell first and ask questions later, which can easily lead to a stampede effect. The prevalence of quantitative trading and passive index funds has exacerbated market volatility. At present, although the market has experienced violent fluctuations, there are no signs that large financial institutions have problems, nor has there been a global liquidity crisis.

Fundamental data, including the balance sheet of the U.S. private sector, is still healthy. The rise in yen financing costs has not significantly squeezed investment returns. The occurrence of a financial crisis often sees changes in fundamentals and excessive financialization, but the liquidity crisis is still worth being vigilant. Even if we have not seen signs of a recession, the sharp fluctuations in the market are still a dress rehearsal for a future crisis, and carry trade may become the fuse of a financial crisis.

At the same time, we must recognize that Japan's decision alone cannot guarantee that the current financial crisis will end. To fully understand this crisis, it is necessary to determine whether the root of the crisis is in Japan or the United States. Confusion about this key issue may lead to incorrect judgments and policy responses. With the sharp fluctuations in the global stock market, “yen carry trade” has become a hot topic. Some views believe that the Bank of Japan's interest rate hike and balance sheet reduction plan on July 31 led to a large-scale closing of yen carry trade, which in turn triggered a sharp decline in the global stock market.

But this view ignores a fact: before July 31, the market was already trading based on expectations of a recession in the U.S. economy, which was also one of the reasons for the market's decline since July 11. The basic principle of the yen carry trade is to use the interest rate difference between Japan and the United States, borrow yen at a low-interest rate, and invest in high-yield dollar assets. However, as the Federal Reserve aggressively raised interest rates, this interest differential model changed. The sharp depreciation of the yen led to an increase in hedging costs, and some funds chose not to hedge exchange rates to obtain higher returns. When the Bank of Japan raised interest rates and the yen appreciated, these unhedged yen carry trade funds were forced to sell dollar assets and replenish yen assets.

Although the Bank of Japan's interest rate hike and balance sheet reduction plan may lead to the closing of some yen carry trades and have an impact on the global financial market, this is not the root cause of the crisis. The real problem lies in the Federal Reserve's aggressive interest rate hikes and the huge U.S. debt problem. The United States has rich experience in the financial propaganda war, able to guide public opinion, and let the Bank of Japan bear the responsibility for the financial crisis. Historically, the Federal Reserve's aggressive interest rate hikes once forced Japan to raise interest rates in 1989, puncturing the bubble of the 1990s in Japan. However, public opinion often overlooks this historical background and blames the Bank of Japan's decision-making.

In addition, some views regard Japan's interest rate hikes in 2000 and 2007 as the causes of the U.S. internet bubble burst and the outbreak of the subprime mortgage crisis. This statement ignores the real impact of the Federal Reserve's interest rate hike cycle and wrongly blames Japan. The Bank of Japan's decision-making, yen carry trade, and financial propaganda war are all part of the current turmoil in the global financial market. However, attributing the financial crisis to the Bank of Japan or yen carry trade ignores the fundamental impact of the Federal Reserve's aggressive interest rate hikes and the U.S. debt problem. We must be vigilant against this propaganda trap.

This week, the global financial market experienced intense fluctuations, especially significant fluctuations in the Japanese stock market and exchange rate that attracted widespread attention. Bank of Japan Deputy Governor Shinichi Uchida announced that against the backdrop of instability in the financial and capital markets, it was decided to pause further interest rate increases, eliminating market expectations for further rate hikes within the year. Although the policy changes of the Bank of Japan and the yen carry trade have a certain impact on the market, they are not the root cause of the crisis. The real problem lies in the Federal Reserve's aggressive interest rate hikes and the huge U.S. debt problem. We must be vigilant against propaganda traps to avoid misjudging U.S.-Japan relations, and at the same time, in the complex situation of the global financial market, we need to analyze various factors in depth and formulate reasonable policies and response strategies. The sharp fluctuations in the market may be a dress rehearsal for future crises, and carry trade may become the fuse of a financial crisis, requiring us to remain clear-headed and prepared.

WikiFX Trader

HFM

EC Markets

Vantage

GO MARKETS

FBS

Exness

HFM

EC Markets

Vantage

GO MARKETS

FBS

Exness

WikiFX Trader

HFM

EC Markets

Vantage

GO MARKETS

FBS

Exness

HFM

EC Markets

Vantage

GO MARKETS

FBS

Exness

Rate Calc