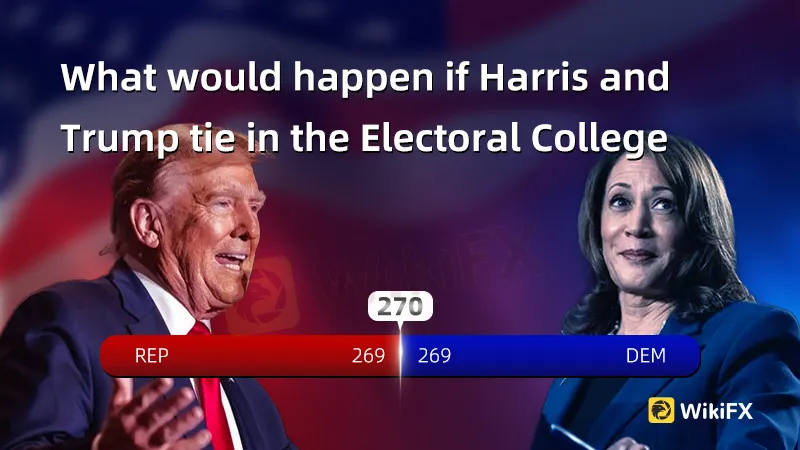

What would happen if Harris and Trump tie in the Electoral College?

Sommario:As the 2024 U.S. presidential race approaches, investors worldwide are closely watching potential outcomes and their implications for global markets. While a 269-269 Electoral College tie between Vice President Kamala Harris and former President Donald Trump remains unlikely, its occurrence would set the stage for an unprecedented period of political uncertainty, triggering a contingent election decided by Congress. Such uncertainty would ripple across forex, stock, and oil markets, where stability and predictability are prized. Here’s a look at how a tie could affect these key financial sectors.

As the 2024 U.S. presidential race approaches, investors worldwide are closely watching potential outcomes and their implications for global markets. While a 269-269 Electoral College tie between Vice President Kamala Harris and former President Donald Trump remains unlikely, its occurrence would set the stage for an unprecedented period of political uncertainty, triggering a contingent election decided by Congress. Such uncertainty would ripple across forex, stock, and oil markets, where stability and predictability are prized. Heres a look at how a tie could affect these key financial sectors.

1. Forex Market Forecast: A Surge in USD Volatility

In a 269-269 scenario, the U.S. dollar (USD) would likely experience increased volatility as global investors react to political instability. Historically, uncertain electoral outcomes tend to weaken the USD, as international investors seek safer alternatives in less politically divided countries. For instance:

- Risk of USD Depreciation: Market uncertainty often leads to reduced demand for USD-denominated assets, potentially triggering a depreciation. Major currencies, like the euro (EUR) and Japanese yen (JPY), could appreciate as investors pivot to safe-haven or less-affected currencies.

- Heightened Safe-Haven Demand: A potential dollar dip could also prompt capital flow into traditional safe-haven currencies, like the Swiss franc (CHF), as investors look for stability amid the uncertainty.

However, if a Republican-favoring House and Senate favor Trump and his historically pro-business policies, some analysts might expect a faster USD recovery, contingent on a clear and swift outcome in the contingent election.

2. Stock Market Projections: Market Resilience Tested by Uncertainty

The U.S. stock market typically reacts sharply to any signs of political upheaval. A contingent election would introduce notable risk:

- Market Decline and Rebound Patterns: In the short term, sectors most vulnerable to regulatory changes, such as tech and green energy, could face sell-offs due to anticipated delays in policy clarity. However, defense, financial, and fossil fuel sectors could see varied responses depending on investor perceptions of potential policy outcomes.

- Sector-Specific Implications: If Trump were ultimately favored, sectors tied to traditional energy and defense might see a resurgence, reflecting his previous administrations policy preferences. Conversely, sectors reliant on tech, renewable energy, and social equity may face temporary declines.

An unclear or drawn-out process would likely see a prolonged downturn, as investors hesitate to commit capital in a politically divided environment. However, if resolved efficiently, the impact might stabilize quickly, restoring investor confidence.

3. Oil Price Predictions: Geopolitical Sensitivity in Focus

Given the tight interplay between U.S. energy policy and global oil markets, an Electoral College tie would be especially impactful in the oil sector:

- Price Fluctuations Linked to Policy Uncertainty: Oil prices may initially drop as demand forecasts fluctuate. Both candidates' stances toward energy policy could sway oil markets, as traders anticipate either a regulatory tightening under Harris or a return to a more lenient approach under Trump. As oil is sensitive to regulatory shifts, even temporary uncertainty can significantly affect crude oil futures.

- Potential Boost in Oil Volatility: A prolonged election process could result in higher price volatility, mirroring investor uncertainty over the administration's stance on energy production, emission targets, and U.S. involvement in global oil markets. Any delays in deciding the president would increase risk in oil futures trading, as global markets try to anticipate the regulatory environment under the next administration.

Global Economic Implications

An unresolved election would affect not only U.S. markets but also international economies closely tied to U.S. policy. For instance, the EU could experience increased capital inflows into the euro as investors hedge against U.S. political instability. Emerging markets may face heightened pressure, as a shift in U.S. policy priorities could influence trade agreements, particularly with countries in Latin America and Asia.

The Path Ahead for Investors

For investors in forex, stock, and oil markets, a 269-269 Electoral College tie scenario is a stark reminder of the critical link between political stability and financial markets. While rare, the potential for a contingent election should prompt investors to closely monitor developments in U.S. policy, particularly in battleground states whose electoral outcomes might affect the global economic landscape.

In conclusion, while a tied Electoral College remains improbable, its hypothetical impact underscores the profound sensitivity of financial markets to political outcomes. For both domestic and international markets, the resolution of political uncertainty, especially in the United States, will remain a linchpin for stability in 2024.

Disclaimer: The information provided in this article is for reference only and should not be construed as any investment, trading, or specific financial advice provided by WikiFX. Investment involves risks, and readers should evaluate them themselves and consult professional financial advisors when necessary.

WikiFX Trader

WikiFX Trader

Rate Calc