DBG Markets: Market Report for Dec 16, 2024

Sommario:Market OverviewIn the U.S., Flash Manufacturing and Services PMI data will be released on Monday, followed by Core Retail Sales and Retail Sales m/m on Tuesday. On Thursday, the much-anticipated FOMC

Market Overview

In the U.S., Flash Manufacturing and Services PMI data will be released on Monday, followed by Core Retail Sales and Retail Sales m/m on Tuesday. On Thursday, the much-anticipated FOMC statement on interest rates will be accompanied by Final GDP q/q and Unemployment Claims data. Finally, Core PCE Price Index m/m will be released on Friday. According to the CME FedWatch Tool, there is a 93.4% probability of a 25 basis point rate cut.

Europe will see French and German Flash Manufacturing and Services PMI data on Monday.

The UK is also set to release Flash Manufacturing and Services PMI data on Monday, Unemployment data on Tuesday, CPI y/y on Wednesday, and its rate decision on Thursday, which is expected to hold rates steady. Retail Sales m/m data will follow on Friday.

In Japan, the Bank of Japan (BOJ) will release its policy statement on Thursday, with rates expected to remain unchanged. A source stated, "Japan isn't in a situation where imminent rate hikes are needed," with others echoing the view that inflation remains benign, allowing time for further data scrutiny. While over half of economists surveyed by Reuters last month predicted a rate hike by December, only 30% of markets currently price in such a move. About 90% of economists, however, anticipate rates reaching 0.5% by the end of March.

New Zealand will release its GDP figures on Thursday, while Canada is set to report Retail Sales data on Friday.

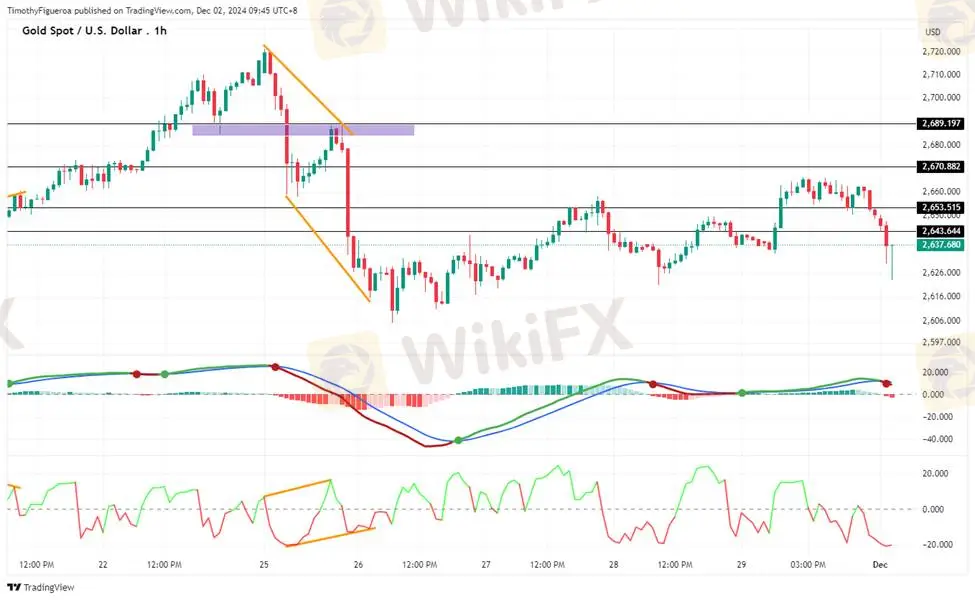

GOLD - Gold prices fell last week, erasing gains as the dollar strengthened. This week's key data releases will likely determine the market's overall direction. Analysts anticipate a rate cut on Thursday, which may bolster gold prices. However, the current trend shows confirmation of continued selling momentum, as price action has shifted downward.

The MACD turning upward indicates the potential for a pullback, though the RSI suggests limited strength or momentum, with overbought levels despite minor price movements.

SILVER - Silver prices have declined further, shifting momentum toward a selling continuation. Analysts expect this bearish trend to persist in the coming days. While the MACD has turned upward, suggesting a potential upside, the RSI shows overbought levels, signaling insufficient momentum for sustained upward movement.

DXY - The dollar has reached new highs despite rate-cut expectations. Speculation around inflationary policies from Trumps administration adds to buying momentum. The RSI shows oversold conditions despite minor price movements, reflecting strong buying pressure.

The MACD indicates increasing strength and volume for selling, seemingly contradicting overall price action that suggests continued buying. While the dollar's potential for a downturn remains high from a fundamental perspective, confirmation from price charts is awaited

GBPUSD - The pound has shifted back to selling momentum. While the MACD indicates potential buying, the RSI shows overbought conditions, pointing to a continuation of the bearish trend.

AUDUSD - The Australian dollar remains weak, with prices consolidating between 0.63407 and 0.64086. Momentum suggests continued selling, as reflected in overbought RSI levels despite minimal upward movement. The MACD turning flat reinforces the lack of conviction for upward moves. Analysts expect the bearish trend to persist.

NZDUSD - The kiwi exhibits bearish momentum, with price pullbacks reflecting overbought conditions and signaling increased selling pressure. While the MACD shows growing volume and momentum for buying, the broader trend suggests continued selling with potential for higher pullbacks.

EURUSD - The euro remains in consolidation ahead of the rate cut decision, with potential for a higher pullback as the MACD reflects increased momentum. However, the RSI shows a divergence with overbought levels, suggesting a potential decline from current prices.

USDJPY - The yen continues to weaken as the BOJ signals a cautious approach to rate hikes. Momentum indicates a stronger likelihood for yen buying, though the MACD reflects diminishing momentum, hinting at a pullback. The RSI shows divergence in price and highlights strong buying movement despite potential corrections.

USDCHF - The franc is slowing down after reaching a previous high, signaling increasing weakness. The MACD reflects rising momentum for selling, suggesting a deeper pullback. However, the RSI indicates oversold conditions, leaving room for a potential return to buying momentum. Overall price action supports a continuation of the bullish trend following the breakout from previous consolidation.

USDCAD - The CAD shows continued weakness after last weeks session, with prices consolidating and the RSI printing oversold levels despite minimal price movement. While the MACD shows growing momentum for selling, upcoming histograms suggest calmer activity, indicating potential buying continuation. Price action supports strong momentum for buying.

WikiFX Trader

GO MARKETS

IC Markets Global

FOREX.com

Vantage

VT Markets

XM

GO MARKETS

IC Markets Global

FOREX.com

Vantage

VT Markets

XM

WikiFX Trader

GO MARKETS

IC Markets Global

FOREX.com

Vantage

VT Markets

XM

GO MARKETS

IC Markets Global

FOREX.com

Vantage

VT Markets

XM

Rate Calc