Gold Gains as Safe-Haven Demand Returns, But “Bond-Dollar Double Whammy” Signals Risk Ahead

Sommario:Gold Gains as Safe-Haven Demand Returns, But “Bond-Dollar Double Whammy” Signals Risk AheadThis week, a sharp surge in long-term U.S. Treasury yields has become a key factor in the markets risk repric

Gold Gains as Safe-Haven Demand Returns, But “Bond-Dollar Double Whammy” Signals Risk Ahead

This week, a sharp surge in long-term U.S. Treasury yields has become a key factor in the markets risk repricing. The 20-year Treasury yield jumped 13 basis points to 5.12%, while the 30-year yield neared 5.09% and the 10-year climbed to a three-month high of 4.60%. Simultaneously, the U.S. dollar weakened against major currencies, and U.S. equities also came under pressure—marking a rare “triple whammy” across stocks, bonds, and currencies.

This is not a mere technical correction. Rather, it reflects growing market concerns over the long-term challenge of high interest rates combined with persistent U.S. fiscal deficits. The dollar's weakness in particular points to declining foreign appetite for U.S. Treasuries—investors are increasingly reluctant to finance Americas mounting fiscal shortfall.

1. Despite Higher Short-Term Rates, Gold Finds Support from Renewed Safe-Haven Demand

Rising yields typically weigh on gold prices due to the metals lack of yield. Yet gold has remained resilient, highlighting its role as a safe-haven and an alternative asset. Several risk factors are reinforcing this narrative: ongoing uncertainty around U.S. trade policies, persistent fears of a technical recession, and unresolved geopolitical tensions—particularly in the Middle East. These factors form a fundamental base for medium-term upside in gold, offsetting the drag from short-term interest rate hikes.

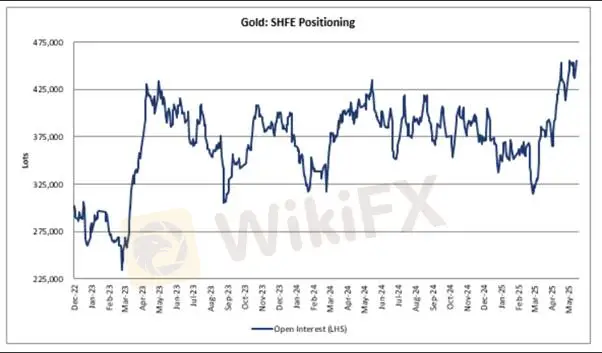

2. Chinese Demand Returns, Supporting Bullish Gold Positioning

According to Goldman Sachs analyst Adam Gillard, gold's recent rally is no coincidence—it has been driven by a resurgence in Chinese buying. Night trading activity on the Shanghai Futures Exchange (SHFE) has triggered follow-through gains on COMEX, while SHFE-COMEX arbitrage opportunities have widened, encouraging further flows. In May, SHFE gold open interest climbed back to historic highs, and overall Chinese holdings (ETFs + exchange positions) remain elevated. This type of “structural physical buying” often reflects stronger long-term conviction, providing solid support for gold prices.

3. Hidden Risk: Overreliance on Rate-Cut Bets, Ignoring Real Yield Dynamics

Some investors are betting that expected Fed rate cuts later this year will continue to boost gold. However, this logic has a blind spot. Gold‘s long-term performance is more closely tied to real interest rates (nominal rates minus inflation). Even if the Fed cuts, if inflation expectations don’t ease, real rates could still rise. Moreover, short-term rate adjustments dont fully determine the path of medium- to long-term rates. As a result, the steepening of the yield curve or reversal of inversion will make gold more dependent on sustained dollar weakness and stable long-term yields.

In short, gold‘s future upside hinges on whether 10-year and longer Treasury yields can retreat—and that’s not something the Feds policy alone can dictate.

4. Fiscal Risk Is Contained, But Rolling Debt Issuance Presents a Challenge

Currently, the U.S. government‘s debt-to-GDP ratio stands around 112%, placing it at the higher end among developed nations. Over the past three years, the Treasury has issued predominantly short- and medium-term debt (over 80%), creating a “refinancing wall” in 2024. While the debt ceiling crisis has been temporarily defused, continued fiscal indiscipline and widening deficits could place structural upward pressure on long-term yields. Unless an extreme event such as a U.S. debt default or prolonged government shutdown materializes (which remains unlikely), solvency is not in question. However, the rate market’s price-discovery function will likely keep pushing yield spreads wider—adding volatility to gold pricing.

Conclusion: Gold remains in a short-term uptrend, supported by risk aversion and global buying interest. Yet investors should be cautious about relying solely on rate-cut narratives. Key variables remain the dollar trend, changes in real yields, and the global rebalancing of capital flows. Structural gold bulls should monitor shifts in long-dated Treasury yields to time their medium-term entry and position scaling.

[Gold Price Outlook]

After gaining more than $20 in the short term, gold is now approaching critical resistance levels at $3,340 and $3,350. The RSI has re-entered the overbought zone above 70, indicating strong but potentially overheated momentum. If the U.S. dollar stabilizes and rebounds, gold could face downward pressure. Investors should closely watch the $3,350 breakout level—failure to sustain above it could trigger a pullback.

Resistance: $3,350/oz

Support: $3,200–$3,220, $3,248, $3,300/oz

Disclaimer: The views, analysis, and price levels mentioned above are intended for general market commentary only. They do not represent the views of this platform. All readers should conduct their own research and assume full responsibility for any trading decisions. Trade with caution.

WikiFX Trader

FXTRADING.com

ATFX

IronFX

GTCFX

EC Markets

IC Markets Global

FXTRADING.com

ATFX

IronFX

GTCFX

EC Markets

IC Markets Global

WikiFX Trader

FXTRADING.com

ATFX

IronFX

GTCFX

EC Markets

IC Markets Global

FXTRADING.com

ATFX

IronFX

GTCFX

EC Markets

IC Markets Global

Rate Calc