【MACRO Insight】The Fed’s data dilemma and the euro exchange rate game: Dual variations of global mon

Sommario:In Q3 2023, the U.S. Bureau of Labor Statistics (BLS) suddenly announced that it would suspend the high-frequency collection of a number of core economic data, which stems from the strict cuts in non-

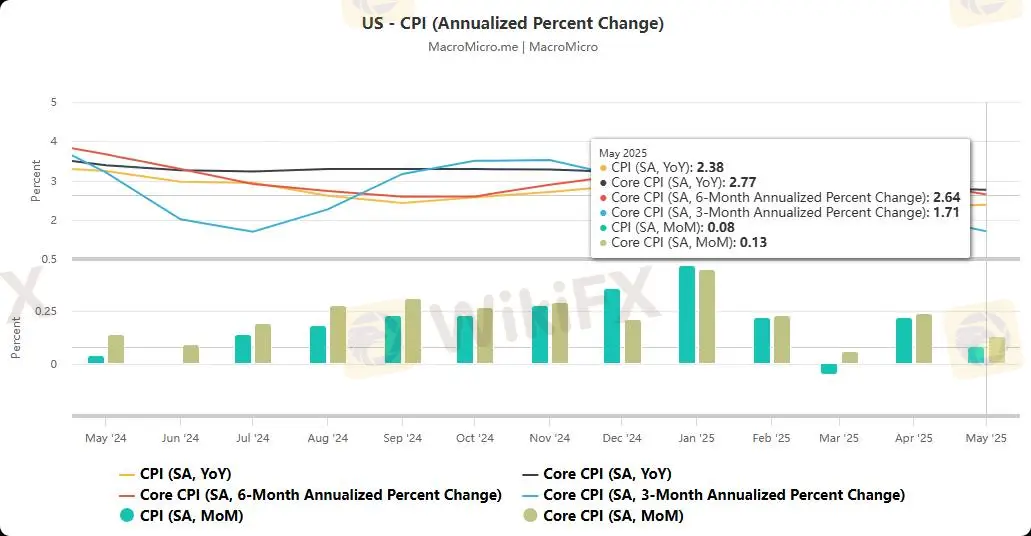

In Q3 2023, the U.S. Bureau of Labor Statistics (BLS) suddenly announced that it would suspend the high-frequency collection of a number of core economic data, which stems from the strict cuts in non-essential government spending in the congressional budget. As an important reference indicator for the Federal Reserve's monetary policy decision-making, the frequency of non-farm payroll data collection has been reduced from monthly fine tracking to quarterly sampling surveys, and the sample coverage of the Consumer Price Index (CPI) has been reduced by 30%.

一、The Federal Reserve in the data fog: the struggle between policy prudence and political pressure

Some data even relied on the estimated values of other collection points. This phenomenon of "data hollowing out" was particularly evident in the May non-farm report: the number of 139,000 new jobs was questioned for being inflated. Analysis pointed out that small businesses delayed reporting due to tariffs, causing the statistical system to miss the real economic trends, and the final data may be revised down to around 100,000.

Data distortion has exacerbated policy differences within the Fed. Powell adheres to the principle of "cautious adjustment", believing that although inflationary pressures are temporarily under control, the impact of tariffs on the economy is not yet clear, and hasty interest rate cuts may amplify policy lags. He specifically pointed out: "The uncertainty caused by tariffs provides a reason to maintain interest rates, and inflation may show a 'meaningful increase' due to trade policies." This position is in sharp contrast to Trump's radical claims - the latter has repeatedly denounced Powell on social media as "stupid and stubborn", believing that high interest rates have pushed up government borrowing costs, and even hinted that interest rate cuts must be initiated in July.

二、Euro 1.17 attack and defense: the resonance of institutional bullishness and the dollar's decline

If it breaks through effectively, it will open the channel to the highest water level in four years, $1.20. In June 2025, the euro rose to 1.1645 against the dollar, a new high since October 2021, with multiple positive factors behind it: the ceasefire between Iran and Israel eased geopolitical risks, the largest drop in new home sales in the United States in May in nearly three years exposed economic weakness, and Powell's statement that "there are multiple paths for monetary policy" opened up room for imagination for interest rate cuts.

HSBC strategists raised their year-end target price from 1.15 to 1.20. Danske Bank and Deutsche Bank both predicted that this level would be reached within 12 months. UBS even pointed out that "US interest rates will fall faster than other G10 countries" and expected the euro to reach 1.23 against the US dollar at the end of the year.

三、The linkage logic of global markets: the transmission chain from data crisis to exchange rate game

It affects the global market through three channels: first, the "false prosperity" of data estimates may conceal the truth of the US economic slowdown, causing the Federal Reserve's policy lag and the market to price in interest rate cut expectations in advance; second, the policy tussle between Trump and Powell has exacerbated uncertainty, and the attractiveness of the US dollar as a "safe haven asset" has weakened; finally, the divergence in expectations of interest rate differentials between Europe and the United States has directly driven capital flows to euro assets, forming a transmission chain of "weak data - expectations of policy easing - weaker US dollar - rising euro".

This linkage is particularly prominent in the current market: when the BLS is forced to rely on historical trends to estimate employment data due to a shortage of funds, foreign exchange traders are betting on a euro breakthrough based on the Fed's possible policy shift; when Powell emphasized "cautious rate cuts" at the hearing, the options market has voted for the euro's 1.20 target with real money. The disconnect between data quality and market expectations constitutes the core contradiction of global monetary policy in 2025.

Conclusion: Policy and market competition in an era of uncertainty

The Fed‘s data dilemma and the euro’s exchange rate offensive are essentially two sides of the same coin. Against the backdrop of declining reliability of economic data and challenges to policy transparency, the market is redefining asset value with a more aggressive pricing logic. For Powell, how to maintain policy credibility in the fog of data while resisting the dual impact of political pressure and market expectations will determine whether the Fed can take the initiative in this “game of data and exchange rates.” For global investors, the 1.17 euro mark is not only a technical resistance level, but also a touchstone for measuring the credibility of the Fed‘s policies and the resilience of the dollar’s hegemony.

WikiFX Trader

IronFX

FXTM

ATFX

FBS

STARTRADER

OANDA

IronFX

FXTM

ATFX

FBS

STARTRADER

OANDA

WikiFX Trader

IronFX

FXTM

ATFX

FBS

STARTRADER

OANDA

IronFX

FXTM

ATFX

FBS

STARTRADER

OANDA

Rate Calc