January FOMC Meeting Review

Sommario:As widely anticipated by the market, the Federal Open Market Committee (FOMC) kept interest rates unchanged at 3.50%–3.75% during its January meeting. In the policy statement, the Fed noted that econo

As widely anticipated by the market, the Federal Open Market Committee (FOMC) kept interest rates unchanged at 3.50%–3.75% during its January meeting. In the policy statement, the Fed noted that economic activity continues to expand at a steady pace. Although job growth has moderated, the unemployment rate has shown signs of stabilization. Inflation risks have eased to some extent, and tariff-related inflation is expected to fade by mid-2026.

While the Fed maintained a neutral-to-restrictive policy stance, Chair Jerome Powell emphasized that policy could be loosened once the peak impact of tariffs becomes evident. In other words, if inflation peaks and begins to decline as expected by mid-year, a rate-cut cycle could be initiated as early as June or July.

The January meeting remained heavily focused on labor market conditions. Powell highlighted that after a prolonged cooling phase, the U.S. labor market has entered a more stable phase. The unemployment rate stood at 4.4% in December. Although job creation remains modest, with nonfarm payrolls averaging only 22,000 additions per month, the slowdown in labor supply is largely driven by declining labor force participation and reduced immigration.

Other key indicators, including job openings, layoffs, hiring activity, and nominal wage growth, have shown little change in recent months. This stability supports the Feds decision to pause rate cuts in January and closely monitor upcoming economic developments.

Weekly Initial Jobless Claims published by the U.S. Department of Labor further reinforce this view. As of the week ending January 22, initial claims remained low at around 200,000, indicating that the U.S. labor market has continued to demonstrate resilience since the start of the year.

On inflation, Powell noted that as of December, headline PCE inflation stood at 2.9% year-over-year, still above the Feds long-term target of 2%. However, much of the upside pressure reflects rising goods inflation, largely driven by tariffs. In contrast, services inflation continues to cool steadily.

The Fed emphasized that tariff effects have already been largely passed through to real-economy prices. High-frequency CPI data from Truflation show that the Truflation CPI index has slowed sharply to 1.16% year-over-year. Following the seasonal surge in demand during the holiday period, goods demand is now easing meaningfully, which is a clearly positive signal for the inflation outlook.

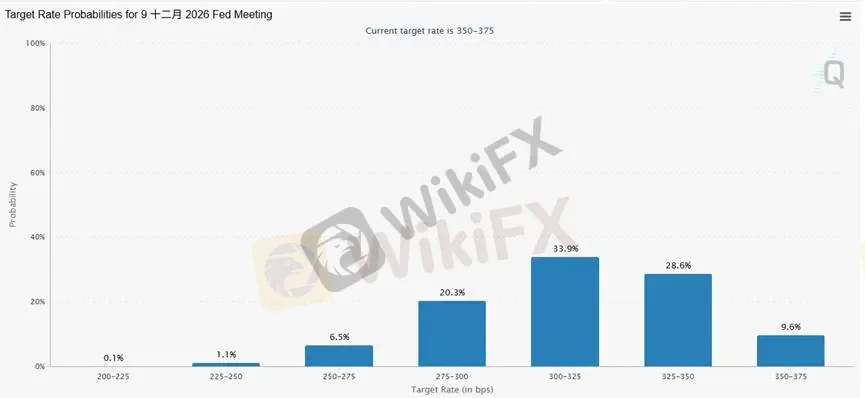

According to the FedWatch Tool, markets are currently pricing in a total of 50 basis points of rate cuts over the course of the year. However, based on ongoing inflation dynamics, we continue to believe that the cumulative magnitude of rate cuts in 2026 could ultimately exceed current market expectations.

Nasdaq Technical Analysis

The index has decisively broken above the key resistance level at 25,877, providing stronger confirmation of bullish momentum. Following the breakout, a pullback toward 25,877 would present potential opportunities for long positioning.

The MACD histogram remains above the zero line, signaling a strong bullish regime. Trading strategies should remain biased toward the long side, with short-selling discouraged.

Using Fibonacci extensions, the 1.618 projection at 27,143 remains our short-term upside target following the breakout.

Risk Disclaimer

Suggested stop-loss: 200 points.

Support:

SUP: 25,073

Resistance:

Resistance A: 25,877

Resistance B: 27,143

The above views, analyses, research, prices, or other information are provided solely as general market commentary and do not represent the position of this platform. All readers assume full responsibility for any risks incurred. Please trade with caution.

WikiFX Trader

FXCM

TMGM

GO Markets

octa

eightcap

HFM

FXCM

TMGM

GO Markets

octa

eightcap

HFM

WikiFX Trader

FXCM

TMGM

GO Markets

octa

eightcap

HFM

FXCM

TMGM

GO Markets

octa

eightcap

HFM

Rate Calc