Golden Royal Index-Overview of Minimum Deposit, Leverage, Spreads

概要:Golden Royal Index, a trading name of Golden Royal Index Financial, is allegedly an unregulated execution-only forex trading firm founded in 2010 and registered in the UK. The broker claims to provide its clients with various tradable assets with flexible leverage up to 1:200 and fixed spreads of 2 pips on the industry-standard MetaTrader4 trading platform, as well as a choice of three different account types.

General Information & Regulation

Golden Royal Index, a trading name of Golden Royal Index Financial, is allegedly an unregulated execution-only forex trading firm founded in 2010 and registered in the UK. The broker claims to provide its clients with various tradable assets with flexible leverage up to 1:200 and fixed spreads of 2 pips on the industry-standard MetaTrader4 trading platform, as well as a choice of three different account types.

Market Instruments

Golden Royal Index advertises that it mainly offers four different asset classes in financial markets, including forex, spot metals, futures and shares.

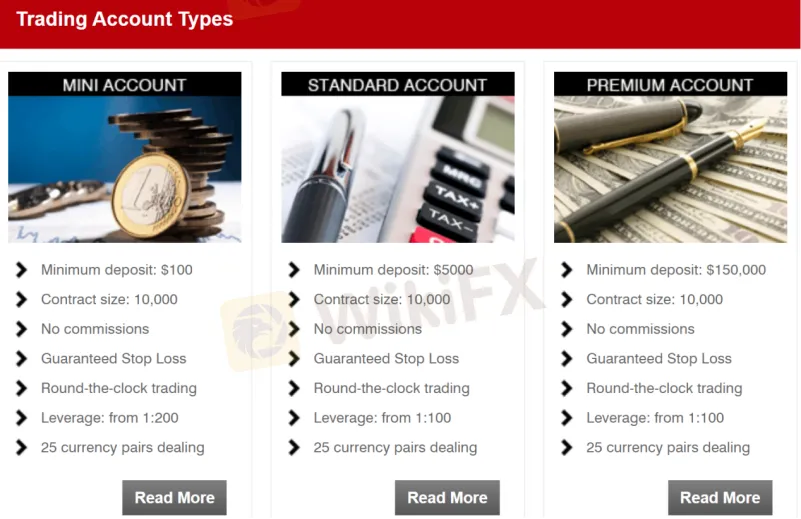

Account Types

Apart from demo accounts, there are three live trading accounts offered by Golden Royal Index, namely Mini, Standard and Premium. Opening a Mini account requires the minimum initial deposit amount of $100, while the other two account types have much higher minimum initial capital requirements of $5,000 and $150,000 respectively.

Leverage

From the information on its home page, Golden Royal Index mentions that the maximum leverage is 1:200. However, in another section of its official site, we found the broker offers flexible leverage and the maximum leverage ratio is 1:500. Anyway, inexperienced traders are advised not to use too much leverage since leverage magnifies gains and losses.

Spreads & Commissions

Golden Royal Index claims to offer fixed spreads of 2 pips and all charging no commissions.

Trading Platform Available

The platform available for trading at Golden Royal Index are Metatrader4, iPhone Trading App, iPad Trading App, Android Trading App, as well as a Webtrader. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Deposit & Withdrawal

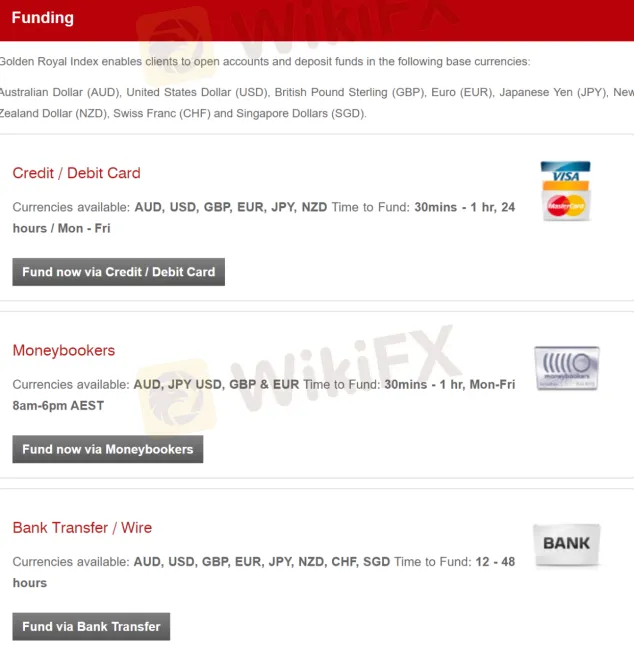

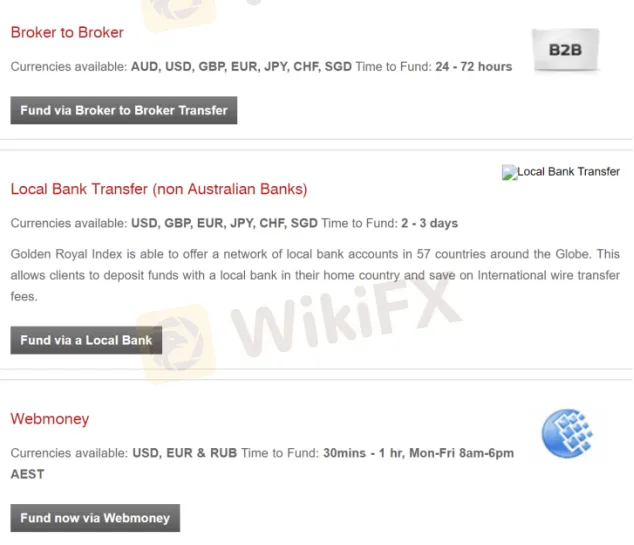

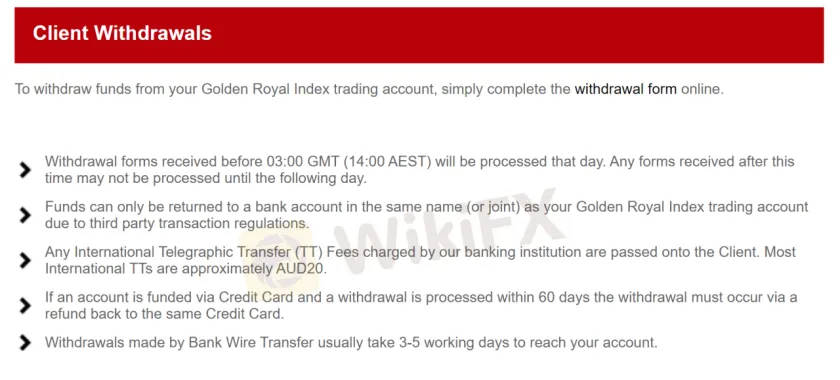

Golden Royal Index works with numerous means of deposit and withdrawal choices, consisting of credit/debit cards (Visa, MasterCard), Moneybookers, Bank Transfer/Wire, broker to broker, local bank transfer (non-Australian banks) and Webmoney. The minimum initial deposit requirement is $100.

The broker states that it does not charge any internal fees for deposits or withdrawals. However, the payments to and from international banking institutions may attract transfer fees from either party. Any International Telegraphic Transfer (TT) Fees charged by the brokers banking institution are passed on to the clients. Most International TTs are approximately AUD20.

As for the processing time to fund, it varies depending on fund payments. For example, 30mins-1 hr, 24 hours / Monday-Friday on credit/debit cards, 30mins-1 hr, Monday-Friday 8 am-6 pm AEST on Moneybookers and Webmoney, 12-48 hours on Bank Transfer/Wire, 24-72 hours on the broker to broker and 2-3 days on local bank transfer (non-Australian banks). Withdrawals made by Bank Wire Transfer usually take 3-5 working days to reach the account.

Customer Support

You can follow Golden Royal Index on some social media platforms such as Twitter, Facebook, YouTube and LinkedIn. Headquarters: Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, St.Vincent and the Grenadines. However, this broker doesnt disclose other more direct contact information like telephone numbers or email that most brokers offer.

WikiFXブローカー

話題のニュース

DMM.comが2024年もFX市場を席巻、世界ランキングトップを維持

WikiFXで勝ち組に!ご家族・お友達紹介プログラム

レート計算