CMF

概要:China Merchants Futures Co., Ltd. was founded in 1993 and is a wholly-owned subsidiary of China Merchants Securities Co., Ltd. As one of the first wholly-owned futures companies in China, CMF has a registered capital of 35.98 billion yuan. The company operates under the regulation of China Financial Futures Exchange Co. Ltd. (CFFEX), which was established with the approval of the State Council of the People's Republic of China and CSRC.

| CMF Review Summary | |

| Founded | 1993 |

| Registered Country/Region | China |

| Regulation | CFFEX |

| Business Scopes | Commodity futures brokerage, Futures investment consulting and Asset managements |

| Demo Account | Available |

| Trading Software | Bo Yi Master Cloud Trading Edition, Fast new generation V3, the China Merchants Bo Yi App, the E-Star App Mobile Terminal, and the Flush Futures App for Android and iOS |

| Minimum Deposit | $1 |

| Customer Support | Live chat, phone, email, fax and zip code |

What is CMF?

China Merchants Futures Co., Ltd. was founded in 1993 and is a wholly-owned subsidiary of China Merchants Securities Co., Ltd. As one of the first wholly-owned futures companies in China, CMF has a registered capital of 35.98 billion yuan. The company operates under the regulation of China Financial Futures Exchange Co. Ltd. (CFFEX), which was established with the approval of the State Council of the People's Republic of China and CSRC.

CMF offers a range of services including commodity futures brokerage, financial futures brokerage, futures investment consulting, and asset management. Its dedication to providing top-notch quotation and trading software within the country has earned it positive reviews from numerous customers.

If you would like, we extend an invitation for you to read the forthcoming article where we will conduct a comprehensive evaluation of this broker from various perspectives. We will present well-structured and concise information to give you a thorough understanding of the broker's important attributes. At the conclusion of the article, we will provide a brief summary to provide you with a complete overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Pros of CMF:

- Multiple trading platforms and mobile apps: CMF offers a variety of trading platforms and mobile applications, providing flexibility and convenience for traders to access the markets.

- Demo accounts available: CMF provides demo accounts, allowing traders to practice and familiarize themselves with the platform and market conditions before investing real money.

- Live chat available: CMF offers live chat support, enabling customers to easily communicate with the support team and seek assistance in real-time.

- Multi-channel support to contact: CMF provides multiple channels for customers to contact the support team, ensuring prompt and efficient customer service.

- Regulated by CFFEX: CMF is regulated by CFFEX, a reputable exchange specializing in financial derivatives.

Cons of CMF:

- Limited funding options: CMF has limited options for funding accounts, which can be restrictive for some traders who prefer a wider range of payment methods.

- No social media presence: CMF has a presence on social media platforms, which can limit accessibility and visibility for potential customers seeking information or updates through these channels.

Is CMF Safe or Scam?

CMF is a regulated brokerage firm overseen by the China Financial Futures Exchange Co. Ltd. (CFFEX), which has been approved by both the State Council of the People's Republic of China and the China Securities Regulatory Commission (CSRC). CFFEX is a legitimate exchange that specializes in facilitating trading and clearing services for financial futures, options, and derivatives. With a solid track record of operation and positive customer feedback, CMF can be considered a reliable and trustworthy broker. However, it is crucial for investors to recognize that all investments come with inherent risks, and it is important to conduct thorough research and consider all available options before making any investment decisions.

Business Scopes

The business scopes of CMF include:

- Commodity Futures Brokerage: CMF provides services for trading commodity futures contracts. This involves facilitating the buying and selling of futures contracts on various commodities such as metals, energy, agriculture, and more.

- Financial Futures Brokerage: CMF offers services for trading financial futures contracts. This includes facilitating the trading of futures contracts on financial instruments like stock indices, interest rates, currencies, and bonds.

- Futures Investment Consulting: CMF provides consulting services to individuals and institutions interested in futures investment. They offer advice, market analysis, and recommendations to help clients make informed investment decisions in the futures market.

- Asset Management: CMF also offers asset management services, where they manage portfolios and investment funds on behalf of clients. This involves making investment decisions, executing trades, and monitoring the performance of the managed assets.

Account

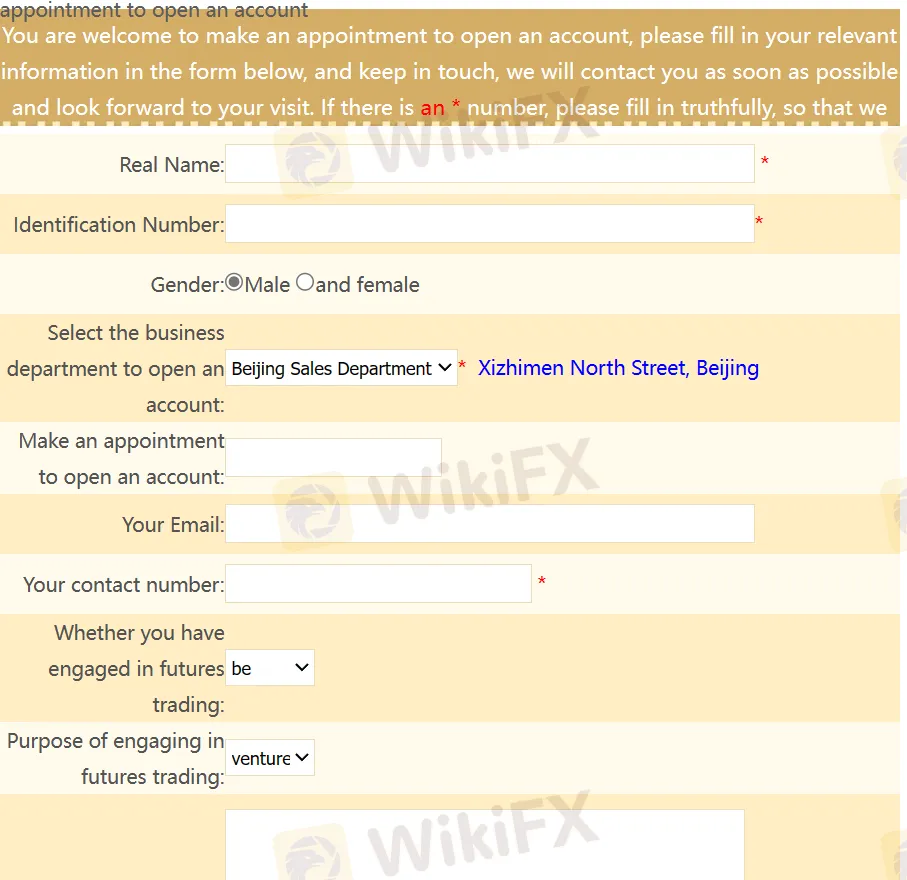

Tp open an account, traders can visit the website and make an appointment to open an account. They are asked to fill in their relevant information in the form below, and keep in touch so that the staff will contact them as soon as possible.

CMF also provides demo accounts for traders who want to practice and familiarize themselves with the platform before trading with real funds. Demo accounts simulate real market conditions, allowing traders to execute trades using virtual funds.

Trading Software

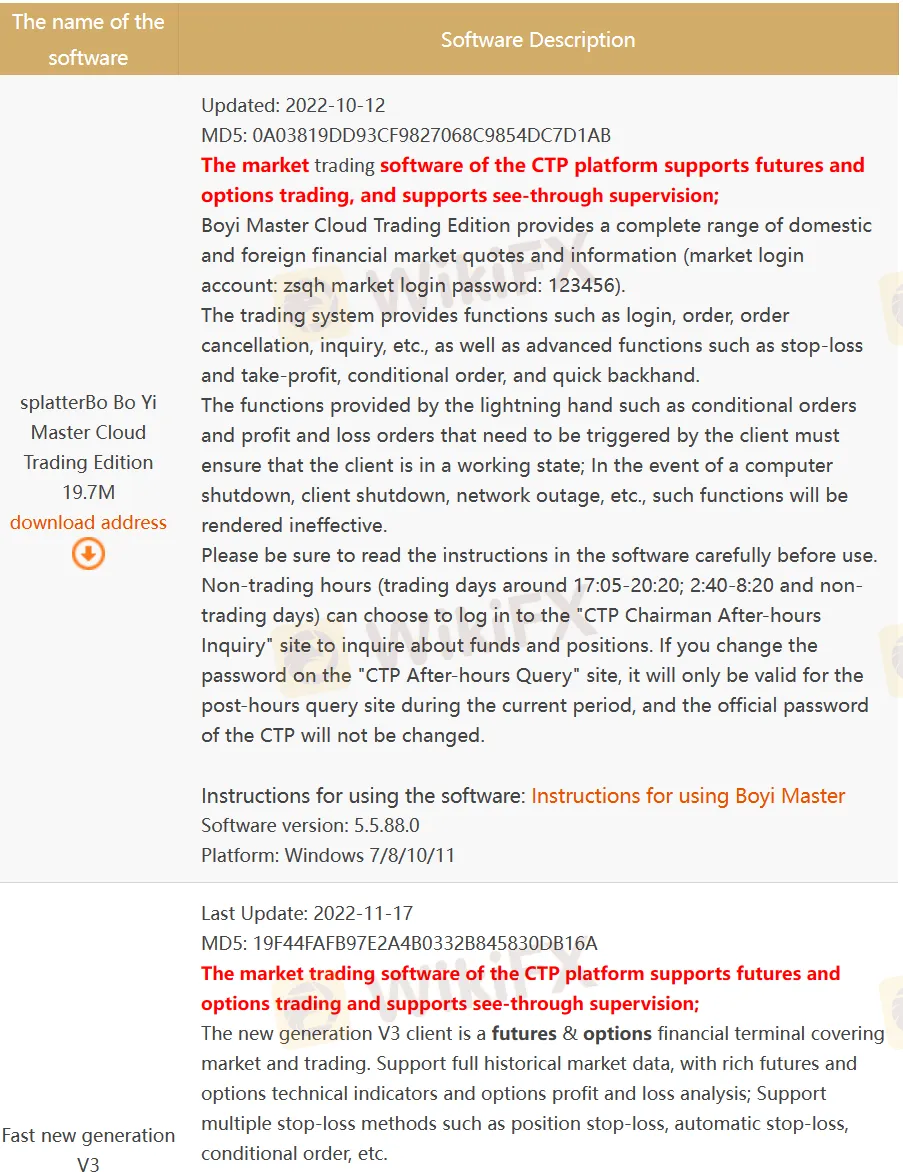

China Merchants Futures offers customers top-notch quotation and trading software within the country. Investors have the flexibility to select the most suitable quotation and trading method based on their individual circumstances. Prior to downloading and utilizing online trading software, please ensure that your current environment meets the requirements for online trading, including a stable and secure computer or electronic terminal device that is free from any Trojan horses, viruses, or other malicious programs, as well as a reliable and smooth network connection.

The available software options comprise Bo Yi Master Cloud Trading Edition, Fast new generation V3, the China Merchants Bo Yi App, the E-Star App Mobile Terminal, and the Flush Futures App for Android and iOS.

Deposits & Withdrawals

China Merchants Futures (CMF) provides traders with a few options for depositing and withdrawing funds from their trading accounts. These options include Bank Future Transfer, online banking transfer, and bank counter.

For those looking to deposit funds using Bank Future Transfer, the process is relatively straightforward. The minimum deposit limit for each deposit is ¥1, while the maximum limit is set by bank regulations. Traders can initiate a bank to bank transfer to deposit funds into their trading account. Once the funds have been received, traders can view their balance and begin trading.

Alternatively, depositing funds via online banking transfer is also an option. Traders can transfer funds from their bank account to their CMF trading account through an online banking platform. This option may be attractive to traders who prefer the convenience of managing all their finances online.

Finally, traders can opt to deposit and withdraw funds using a bank counter. To do so, traders will need to visit a bank that supports CMF and provide the necessary details to complete the transaction. Once the funds have been deposited, traders can view their balance and begin trading.

In terms of withdrawals, traders can initiate a Futures to Bank transfer to withdraw funds from their trading account. The cumulative maximum daily withdrawal limit is 3 million RMB, and the maximum single transfer limit is 3 million RMB. Additionally, traders can withdraw funds up to three times per day. These restrictions ensure a secure and regulated environment for traders to conduct their financial transactions.

Customer Service

CMF offers live chat. With live chat, customers can get their questions answered quickly and receive help with any issues they may have. It's a convenient and effective communication channel that can improve customer satisfaction and increase sales.

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: 95565-9-2/0755-95565-9-2

Email: zsqh@cmschina.com.cn

Fax: 0755-82763130

Zip code: 518048

Address: 111th and 16th floors of China Merchants Securities Building, No. 17, Fuhua Road, Futian District, Shenzhen

Conclusion

In conclusion, China Merchants Futures Co., Ltd. is a futures company, with a strong focus on commodity and financial futures brokerage, futures investment consulting, and asset management. The company is regulated by CFFEX. With its dedication to providing top-notch quotation and trading software, CMF has received positive reviews from many customers and has established itself as a leading institution in the futures market. Overall, CMF's compliance with government regulations makes it a trustworthy and safe option for investors and traders alike.

Frequently Asked Questions (FAQs)

| Q 1: | Is CMF regulated? |

| A 1: | Yes. It is regulated by CFFEX. |

| Q 2: | How can I contact the customer support team at CMF? |

| A 2: | You can contact via Telephone: 95565-9-2/0755-95565-9-2, email: zsqh@cmschina.com.cn, fax: 0755-82763130 and Zip code: 518048. |

| Q 3: | Does CMF offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does CMF offer the industry leading MT4 & MT5? |

| A 4: | No. Instead, it offers Bo Yi Master Cloud Trading Edition, Fast new generation V3, the China Merchants Bo Yi App, the E-Star App Mobile Terminal, and the Flush Futures App for Android and iOS. |

| Q 5: | Is CMF a good broker for beginners? |

| A 5: | Yes. It is a good choice for beginners because it is regulated well and has many years' experience in the industry. Besides, it offers multiple choices of trading software and untra-low minimum deposit, |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

WikiFXブローカー

レート計算