2024-11-09 08:06

業界Dollar forecast: DXY remains overall positive afte

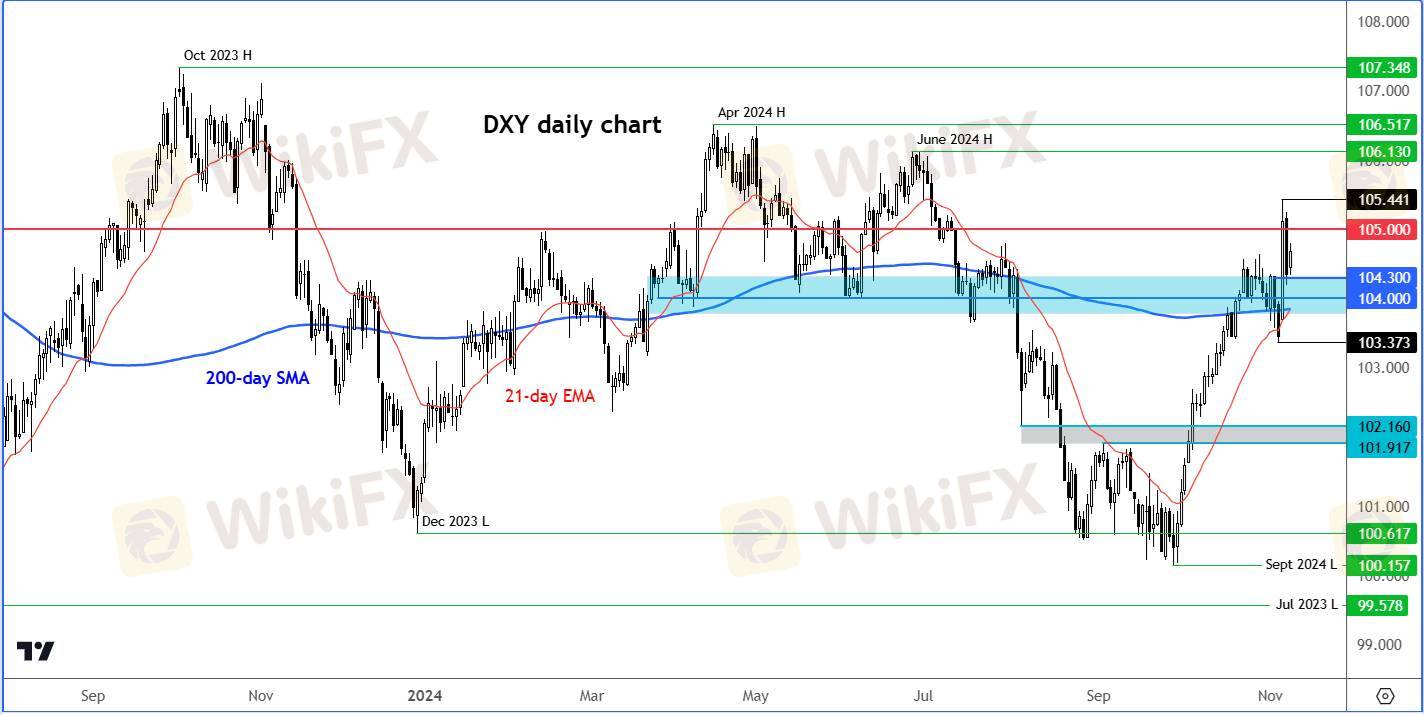

The US dollar traded mixed in the first half of Friday’s session, after an eventful week. It was up against the commodity currencies after investors were left unimpressed with China’s $1.4 trillion programme to refinance local government debt. The greenback was also a little firmer against European currencies, while the Japanese yen outperformed as bond yields dipped. The dollar’s failure to add onto its gains to its post-election rally suggests we may have seen a near-term peak, ahead of next week’s US inflation data. Still, major pairs remain below key levels – for example, the GBP/USD was still below the 1.30 handle, while the EUR/USD had only made up half of the election-related losses. So, the picture was muddled overall. Helping weigh on the dollar was easing of bond yields, with the benchmark 10-year Treasury yields having returned to their starting point after a volatile two-day swing. While one can argue the greenback has made a short-term peak, the overall dollar forecast remains positive, especially against currencies subject to increased tariff risks from Trump’s administration.

いいね 0

FX1793146900

ブローカー

人気の話題

業界

米国株式や日経などのクロスボーダー ETF は大量に高値で償還され

市場分類

会社ナビ

エキスポ

IB

募集

EA

業界

相場

指標

Dollar forecast: DXY remains overall positive afte

| 2024-11-09 08:06

| 2024-11-09 08:06The US dollar traded mixed in the first half of Friday’s session, after an eventful week. It was up against the commodity currencies after investors were left unimpressed with China’s $1.4 trillion programme to refinance local government debt. The greenback was also a little firmer against European currencies, while the Japanese yen outperformed as bond yields dipped. The dollar’s failure to add onto its gains to its post-election rally suggests we may have seen a near-term peak, ahead of next week’s US inflation data. Still, major pairs remain below key levels – for example, the GBP/USD was still below the 1.30 handle, while the EUR/USD had only made up half of the election-related losses. So, the picture was muddled overall. Helping weigh on the dollar was easing of bond yields, with the benchmark 10-year Treasury yields having returned to their starting point after a volatile two-day swing. While one can argue the greenback has made a short-term peak, the overall dollar forecast remains positive, especially against currencies subject to increased tariff risks from Trump’s administration.

いいね 0

私もコメントします

質問します

0コメント件数

誰もまだコメントしていません、すぐにコメントします

質問します

誰もまだコメントしていません、すぐにコメントします