2024-12-14 14:32

業界Emotional Control in Trading: Mastering Your Minds

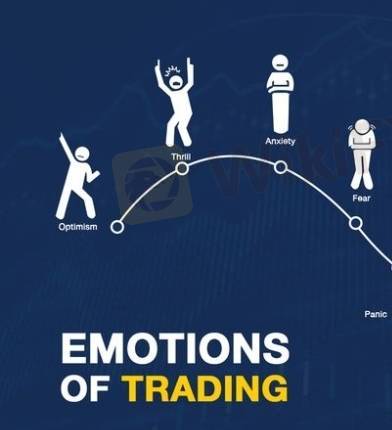

Emotional control is crucial in trading, as emotions can significantly impact trading decisions. Mastering your emotions can help you make rational, informed decisions and achieve greater success in trading.

Common Emotional Pitfalls in Trading

1. Fear: Fear of loss or missing out can lead to impulsive decisions.

2. Greed: Excessive desire for profits can lead to over-trading and poor risk management.

3. Revenge Trading: Attempting to recoup losses quickly can lead to impulsive, high-risk trades.

Strategies for Achieving Emotional Control

1. Develop a Trading Plan: A solid plan helps you stay focused and disciplined.

2. Practice Mindfulness: Mindfulness techniques can help you stay present and focused.

3. Set Realistic Expectations: Understand that trading involves losses and setbacks.

4. Take Breaks and Practice Self-Care: Manage stress and maintain a healthy work-life balance.

5. Seek Support: Connect with fellow traders, mentors, or trading communities for support and guidance.

Tips for Mastering Emotional Control

1. Stay Present: Focus on the present moment, rather than worrying about the future or past.

2. Manage Stress: Use stress-reducing techniques like deep breathing, exercise, or meditation.

3. Stay Disciplined: Stick to your trading plan and avoid impulsive decisions.

4. Learn from Mistakes: Analyze and learn from mistakes to improve your trading skills.

By mastering emotional control, you can make more informed, rational trading decisions and achieve greater success in the markets.

いいね 0

Y.S.Z

Trader

人気の話題

業界

米国株式や日経などのクロスボーダー ETF は大量に高値で償還され

業界

包括的なリスク管理計画を策定する

業界

高度なテクノロジーとテクニカル分析を活用する

業界

📢2025年1月9日11:00の通貨ペア

業界

危険】:米国でVarna Tradeを訪問しましたが、オフィスは見つかりませんでした‼ 詳細は下の画

業界

👀#WikiFX 「先週、日本人ユーザーが最も検索されたFX会社が発表されました!」

市場分類

会社ナビ

エキスポ

IB

募集

EA

業界

相場

指標

Emotional Control in Trading: Mastering Your Minds

| 2024-12-14 14:32

| 2024-12-14 14:32Emotional control is crucial in trading, as emotions can significantly impact trading decisions. Mastering your emotions can help you make rational, informed decisions and achieve greater success in trading.

Common Emotional Pitfalls in Trading

1. Fear: Fear of loss or missing out can lead to impulsive decisions.

2. Greed: Excessive desire for profits can lead to over-trading and poor risk management.

3. Revenge Trading: Attempting to recoup losses quickly can lead to impulsive, high-risk trades.

Strategies for Achieving Emotional Control

1. Develop a Trading Plan: A solid plan helps you stay focused and disciplined.

2. Practice Mindfulness: Mindfulness techniques can help you stay present and focused.

3. Set Realistic Expectations: Understand that trading involves losses and setbacks.

4. Take Breaks and Practice Self-Care: Manage stress and maintain a healthy work-life balance.

5. Seek Support: Connect with fellow traders, mentors, or trading communities for support and guidance.

Tips for Mastering Emotional Control

1. Stay Present: Focus on the present moment, rather than worrying about the future or past.

2. Manage Stress: Use stress-reducing techniques like deep breathing, exercise, or meditation.

3. Stay Disciplined: Stick to your trading plan and avoid impulsive decisions.

4. Learn from Mistakes: Analyze and learn from mistakes to improve your trading skills.

By mastering emotional control, you can make more informed, rational trading decisions and achieve greater success in the markets.

いいね 0

私もコメントします

質問します

0コメント件数

誰もまだコメントしていません、すぐにコメントします

質問します

誰もまだコメントしていません、すぐにコメントします