2025-01-31 17:56

業界How to Determine your forex trading lot sizes.

#firstdealofthenewyearAKEEL

Determining the correct lot size in forex trading is crucial for risk management and account sustainability. Here’s how to do it:

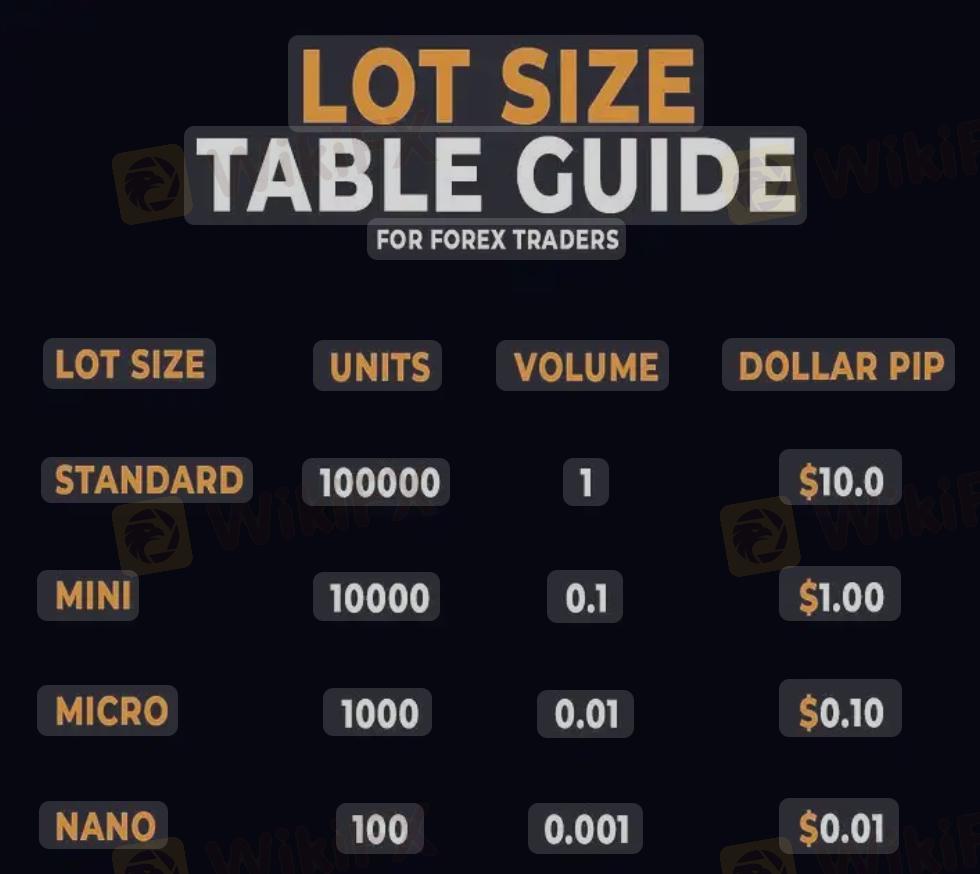

1. Understand Lot Sizes in Forex

Standard Lot = 100,000 units (1 lot)

Mini Lot = 10,000 units (0.1 lot)

Micro Lot = 1,000 units (0.01 lot)

Nano Lot = 100 units (0.001 lot) (not offered by all brokers)

2. Define Your Risk Per Trade

Risk should be 1-2% of your account balance per trade.

Example: If your account is $10,000, a 2% risk = $200 per trade.

3. Determine Stop Loss in Pips

Choose a logical stop-loss level based on market structure.

Example: If your stop loss is 50 pips, this helps determine position size.

4. Calculate the Lot Size Using This Formula

\text{Lot Size} = \frac{\text{Risk Amount}}{\text{Stop Loss (pips)} \times \text{Pip Value}}

For USD pairs (e.g., EUR/USD, GBP/USD):

1 standard lot = $10 per pip

1 mini lot = $1 per pip

1 micro lot = $0.10 per pip

5. Example Calculation

Scenario:

Account Balance = $10,000

Risk = 2% ($200)

Stop Loss = 50 pips

Trading EUR/USD (1 pip = $10 per standard lot)

\text{Lot Size} = \frac{200}{50 \times 10} = \frac{200}{500} = 0.4 \text{ lots}

6. Adjust for Leverage & Margin

Ensure you have enough free margin to open the trade.

Higher leverage allows larger positions but increases risk exposure.

Would you like a lot size calculator or help setting up a risk management plan?

#firstdealofthenewyearAKEEL

いいね 0

Boss8889

ट्रेडर

人気の話題

業界

米国株式や日経などのクロスボーダー ETF は大量に高値で償還され

業界

包括的なリスク管理計画を策定する

業界

高度なテクノロジーとテクニカル分析を活用する

業界

📢2025年1月9日11:00の通貨ペア

業界

危険】:米国でVarna Tradeを訪問しましたが、オフィスは見つかりませんでした‼ 詳細は下の画

業界

👀#WikiFX 「先週、日本人ユーザーが最も検索されたFX会社が発表されました!」

市場分類

会社ナビ

エキスポ

IB

募集

EA

業界

相場

指標

How to Determine your forex trading lot sizes.

ナイジェリア | 2025-01-31 17:56

ナイジェリア | 2025-01-31 17:56#firstdealofthenewyearAKEEL

Determining the correct lot size in forex trading is crucial for risk management and account sustainability. Here’s how to do it:

1. Understand Lot Sizes in Forex

Standard Lot = 100,000 units (1 lot)

Mini Lot = 10,000 units (0.1 lot)

Micro Lot = 1,000 units (0.01 lot)

Nano Lot = 100 units (0.001 lot) (not offered by all brokers)

2. Define Your Risk Per Trade

Risk should be 1-2% of your account balance per trade.

Example: If your account is $10,000, a 2% risk = $200 per trade.

3. Determine Stop Loss in Pips

Choose a logical stop-loss level based on market structure.

Example: If your stop loss is 50 pips, this helps determine position size.

4. Calculate the Lot Size Using This Formula

\text{Lot Size} = \frac{\text{Risk Amount}}{\text{Stop Loss (pips)} \times \text{Pip Value}}

For USD pairs (e.g., EUR/USD, GBP/USD):

1 standard lot = $10 per pip

1 mini lot = $1 per pip

1 micro lot = $0.10 per pip

5. Example Calculation

Scenario:

Account Balance = $10,000

Risk = 2% ($200)

Stop Loss = 50 pips

Trading EUR/USD (1 pip = $10 per standard lot)

\text{Lot Size} = \frac{200}{50 \times 10} = \frac{200}{500} = 0.4 \text{ lots}

6. Adjust for Leverage & Margin

Ensure you have enough free margin to open the trade.

Higher leverage allows larger positions but increases risk exposure.

Would you like a lot size calculator or help setting up a risk management plan?

#firstdealofthenewyearAKEEL

いいね 0

私もコメントします

質問します

0コメント件数

誰もまだコメントしていません、すぐにコメントします

質問します

誰もまだコメントしていません、すぐにコメントします