2025-02-06 15:11

業界The role of market makers in trading

#firstdealofthenewyearFateema

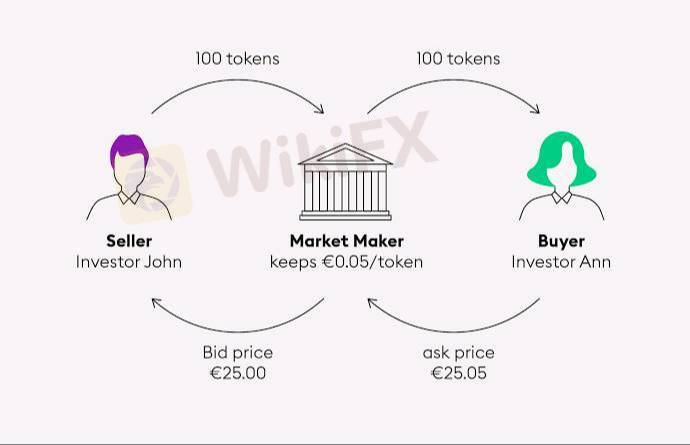

Market makers play a crucial role in trading by providing liquidity and ensuring smooth price discovery. Their main responsibilities include:

1. Providing Liquidity – Market makers continuously place buy and sell orders in the order book, ensuring traders can execute trades without significant delays.

2. Reducing Bid-Ask Spreads – By actively quoting both buy (bid) and sell (ask) prices, they narrow the spread, making it cheaper for traders to buy or sell assets.

3. Enhancing Market Efficiency – By maintaining active order books, market makers help prevent drastic price swings and contribute to a fair valuation of assets.

4. Risk Management – Market makers balance their inventory by adjusting their orders based on market conditions to minimize potential losses.

5. Facilitating Large Trades – In traditional finance and crypto, market makers help institutions execute large trades without causing excessive price impact.

In crypto, market makers operate on centralized exchanges (CEXs) and decentralized exchanges (DEXs). On DEXs like Uniswap, liquidity providers (LPs) perform a similar function by supplying assets to automated market maker (AMM) pools.

Would you like a deeper dive into market-making strategies or its role in DeFi?

いいね 0

murphy

ブローカー

人気の話題

業界

米国株式や日経などのクロスボーダー ETF は大量に高値で償還され

業界

包括的なリスク管理計画を策定する

業界

高度なテクノロジーとテクニカル分析を活用する

業界

📢2025年1月9日11:00の通貨ペア

業界

危険】:米国でVarna Tradeを訪問しましたが、オフィスは見つかりませんでした‼ 詳細は下の画

業界

👀#WikiFX 「先週、日本人ユーザーが最も検索されたFX会社が発表されました!」

市場分類

会社ナビ

エキスポ

IB

募集

EA

業界

相場

指標

The role of market makers in trading

ナイジェリア | 2025-02-06 15:11

ナイジェリア | 2025-02-06 15:11#firstdealofthenewyearFateema

Market makers play a crucial role in trading by providing liquidity and ensuring smooth price discovery. Their main responsibilities include:

1. Providing Liquidity – Market makers continuously place buy and sell orders in the order book, ensuring traders can execute trades without significant delays.

2. Reducing Bid-Ask Spreads – By actively quoting both buy (bid) and sell (ask) prices, they narrow the spread, making it cheaper for traders to buy or sell assets.

3. Enhancing Market Efficiency – By maintaining active order books, market makers help prevent drastic price swings and contribute to a fair valuation of assets.

4. Risk Management – Market makers balance their inventory by adjusting their orders based on market conditions to minimize potential losses.

5. Facilitating Large Trades – In traditional finance and crypto, market makers help institutions execute large trades without causing excessive price impact.

In crypto, market makers operate on centralized exchanges (CEXs) and decentralized exchanges (DEXs). On DEXs like Uniswap, liquidity providers (LPs) perform a similar function by supplying assets to automated market maker (AMM) pools.

Would you like a deeper dive into market-making strategies or its role in DeFi?

いいね 0

私もコメントします

質問します

0コメント件数

誰もまだコメントしていません、すぐにコメントします

質問します

誰もまだコメントしていません、すぐにコメントします