2025-02-06 20:13

業界Stock market’s prediction for 2025 and free tradin

#firstdealofthenewyearchewbacca#

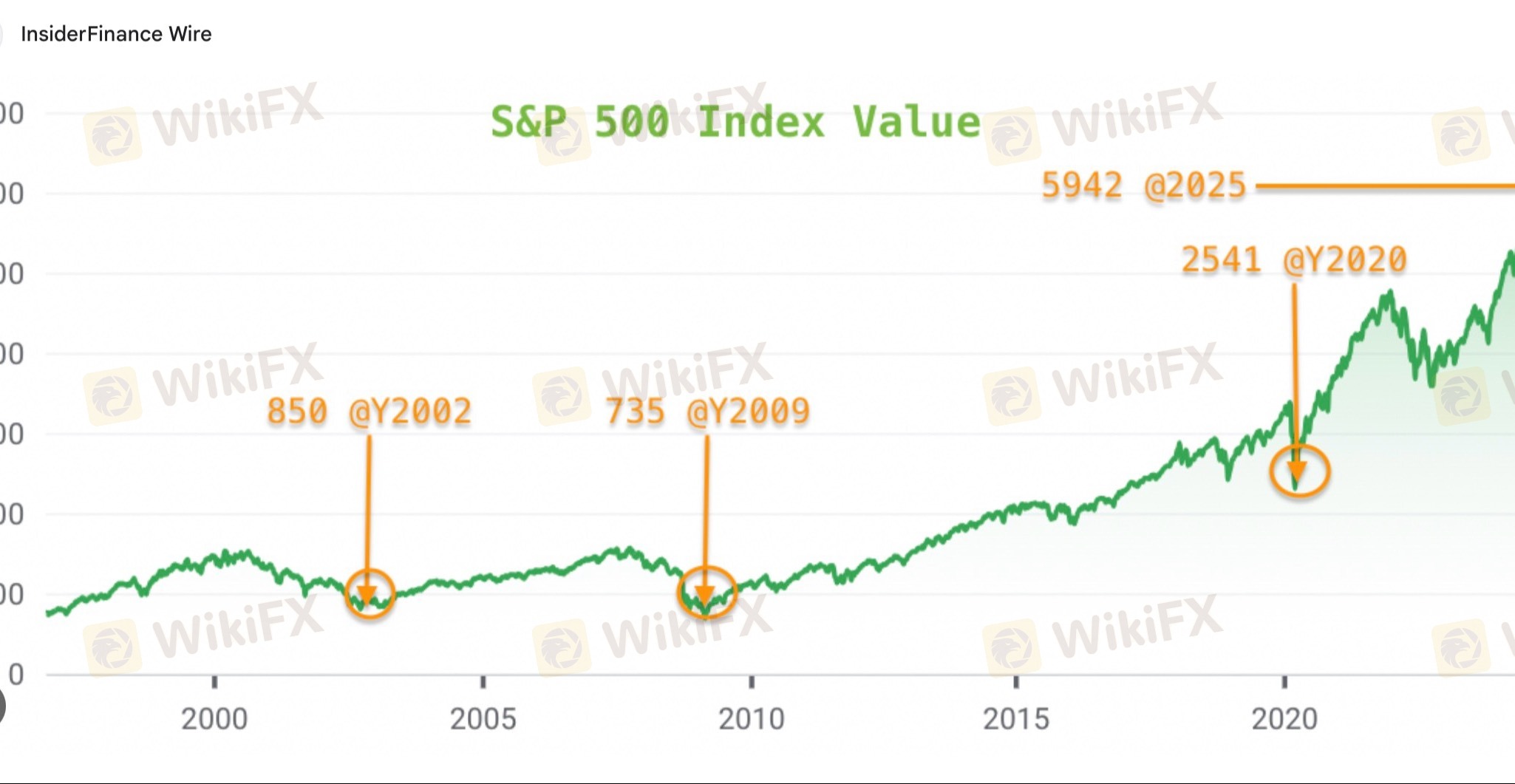

The stock market in 2025 will be influenced by a variety of factors, including economic trends, geopolitical events, technological advancements, and monetary policies. While no one can predict the market with certainty, here are some insights and guidelines to consider:

2025 Stock Market Outlook: Key Predictions

1. Tech Dominance:

The technology sector is expected to continue leading, with advancements in AI, renewable energy, and 5G infrastructure driving growth.

2. Green Investments:

ESG (Environmental, Social, and Governance) investments and renewable energy companies are likely to see strong demand as global efforts to combat climate change ramp up.

3. Interest Rates and Inflation:

Central bank policies regarding interest rates will play a significant role. Moderate inflation could benefit certain sectors like commodities, while high rates may pressure growth stocks.

4. Geopolitical Stability:

Global events, including trade relations and conflict resolutions, could create volatility, so diversification remains key.

5. AI and Automation:

Companies leveraging AI and automation may outperform, particularly in healthcare, finance, and industrials.

Free Trading Guidelines for 2025

1. Diversify Your Portfolio:

Spread your investments across sectors, geographies, and asset classes to reduce risk.

2. Focus on Fundamentals:

Analyze companies’ earnings, growth potential, and valuation before investing. Don’t follow the hype.

3. Monitor Economic Indicators:

Keep an eye on interest rates, inflation, and employment data to anticipate market trends.

4. Use Stop-Loss Orders:

Protect your investments by setting stop-loss levels to limit downside risk.

5. Invest for the Long Term:

Avoid reacting to short-term market noise and stay focused on your long-term financial goals.

6. Stay Updated on Market News:

Subscribe to trusted financial news sources and stay informed about changes in policies, regulations, and industries.

7. Leverage Tools:

Use charting tools, analysis platforms, and reliable trading signals to make data-driven decisions.

Would you like me to provide detailed predictions for specific sectors, create a portfolio strategy, or recommend free trading resources? Let me know!

いいね 0

saad940

交易者

人気の話題

業界

米国株式や日経などのクロスボーダー ETF は大量に高値で償還され

業界

包括的なリスク管理計画を策定する

業界

高度なテクノロジーとテクニカル分析を活用する

業界

📢2025年1月9日11:00の通貨ペア

業界

危険】:米国でVarna Tradeを訪問しましたが、オフィスは見つかりませんでした‼ 詳細は下の画

業界

👀#WikiFX 「先週、日本人ユーザーが最も検索されたFX会社が発表されました!」

市場分類

会社ナビ

エキスポ

IB

募集

EA

業界

相場

指標

Stock market’s prediction for 2025 and free tradin

インド | 2025-02-06 20:13

インド | 2025-02-06 20:13#firstdealofthenewyearchewbacca#

The stock market in 2025 will be influenced by a variety of factors, including economic trends, geopolitical events, technological advancements, and monetary policies. While no one can predict the market with certainty, here are some insights and guidelines to consider:

2025 Stock Market Outlook: Key Predictions

1. Tech Dominance:

The technology sector is expected to continue leading, with advancements in AI, renewable energy, and 5G infrastructure driving growth.

2. Green Investments:

ESG (Environmental, Social, and Governance) investments and renewable energy companies are likely to see strong demand as global efforts to combat climate change ramp up.

3. Interest Rates and Inflation:

Central bank policies regarding interest rates will play a significant role. Moderate inflation could benefit certain sectors like commodities, while high rates may pressure growth stocks.

4. Geopolitical Stability:

Global events, including trade relations and conflict resolutions, could create volatility, so diversification remains key.

5. AI and Automation:

Companies leveraging AI and automation may outperform, particularly in healthcare, finance, and industrials.

Free Trading Guidelines for 2025

1. Diversify Your Portfolio:

Spread your investments across sectors, geographies, and asset classes to reduce risk.

2. Focus on Fundamentals:

Analyze companies’ earnings, growth potential, and valuation before investing. Don’t follow the hype.

3. Monitor Economic Indicators:

Keep an eye on interest rates, inflation, and employment data to anticipate market trends.

4. Use Stop-Loss Orders:

Protect your investments by setting stop-loss levels to limit downside risk.

5. Invest for the Long Term:

Avoid reacting to short-term market noise and stay focused on your long-term financial goals.

6. Stay Updated on Market News:

Subscribe to trusted financial news sources and stay informed about changes in policies, regulations, and industries.

7. Leverage Tools:

Use charting tools, analysis platforms, and reliable trading signals to make data-driven decisions.

Would you like me to provide detailed predictions for specific sectors, create a portfolio strategy, or recommend free trading resources? Let me know!

いいね 0

私もコメントします

質問します

0コメント件数

誰もまだコメントしていません、すぐにコメントします

質問します

誰もまだコメントしていません、すぐにコメントします