2025-02-06 23:38

業界CORRELATION BETWEEN FOREX PAIRS

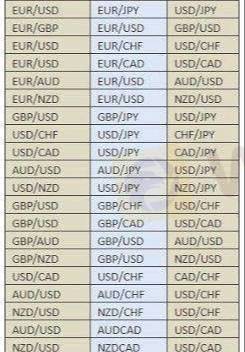

Correlation Between Forex Pairs

In forex trading, correlation refers to the relationship between two currency pairs and how they move in relation to each other. A positive correlation means both pairs move in the same direction, while a negative correlation means they move in opposite directions.

Types of Correlation:

1. Positive Correlation – Pairs like EUR/USD and GBP/USD tend to move together because both are often affected by the US dollar.

2. Negative Correlation – Pairs like EUR/USD and USD/CHF usually move in opposite directions since the Swiss franc often strengthens when the US dollar weakens.

Why Correlation Matters:

Helps traders diversify their positions and reduce risk.

Prevents overexposure to the same market move.

Can be used for hedging strategies to protect against losses.

Traders often use correlation coefficients (ranging from -1 to +1) to measure the strength of the relationship between pairs. A value close to +1 indicates strong positive correlation, while a value near -1 suggests strong negative correlation.

#firstdealofthenewyear-Bronz

いいね 0

BeastBoy2159

Trader

人気の話題

業界

米国株式や日経などのクロスボーダー ETF は大量に高値で償還され

業界

包括的なリスク管理計画を策定する

業界

高度なテクノロジーとテクニカル分析を活用する

業界

📢2025年1月9日11:00の通貨ペア

業界

危険】:米国でVarna Tradeを訪問しましたが、オフィスは見つかりませんでした‼ 詳細は下の画

業界

👀#WikiFX 「先週、日本人ユーザーが最も検索されたFX会社が発表されました!」

市場分類

会社ナビ

エキスポ

IB

募集

EA

業界

相場

指標

CORRELATION BETWEEN FOREX PAIRS

アルジェリア | 2025-02-06 23:38

アルジェリア | 2025-02-06 23:38Correlation Between Forex Pairs

In forex trading, correlation refers to the relationship between two currency pairs and how they move in relation to each other. A positive correlation means both pairs move in the same direction, while a negative correlation means they move in opposite directions.

Types of Correlation:

1. Positive Correlation – Pairs like EUR/USD and GBP/USD tend to move together because both are often affected by the US dollar.

2. Negative Correlation – Pairs like EUR/USD and USD/CHF usually move in opposite directions since the Swiss franc often strengthens when the US dollar weakens.

Why Correlation Matters:

Helps traders diversify their positions and reduce risk.

Prevents overexposure to the same market move.

Can be used for hedging strategies to protect against losses.

Traders often use correlation coefficients (ranging from -1 to +1) to measure the strength of the relationship between pairs. A value close to +1 indicates strong positive correlation, while a value near -1 suggests strong negative correlation.

#firstdealofthenewyear-Bronz

いいね 0

私もコメントします

質問します

0コメント件数

誰もまだコメントしていません、すぐにコメントします

質問します

誰もまだコメントしていません、すぐにコメントします