Proact finance Limited

概要:Proact finance Limited is allegedly a financial company registered in China.

Note: For some unknown reason, we cannot open Proact finance Limiteds official site (https://www.proactfinances.com/en) while writing this introduction, therefore, we could only gather relevant information from the Internet to present a rough picture of this broker. Traders should be careful about this issue.

| Proact finance Limited | Basic Information |

| Registered Country/Area | Unknown |

| Founded year | 1-2 years ago |

| Company Name | Proact Finance Limited |

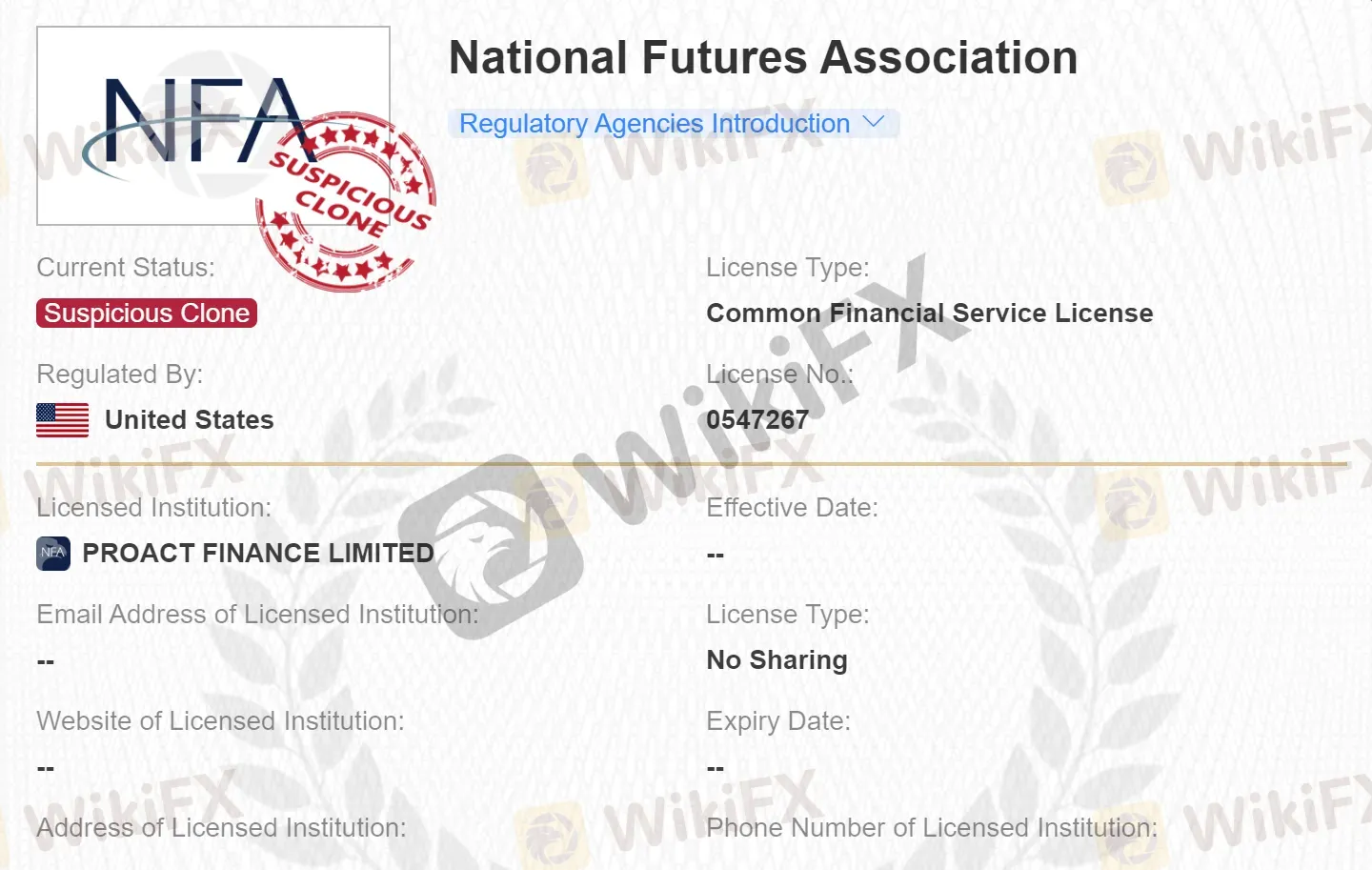

| Regulation | Suspicious Regulatory License |

| Minimum Deposit | $5,000 |

| Maximum Leverage | 1:1000 |

| Spreads | Not disclosed |

| Trading Platforms | Mobile App |

| Tradable Assets | Forex, Oil, Cryptocurrencies |

| Account Types | Unknown |

| Demo Account | No |

| Islamic Account | No |

| Customer Support | Email: cs@proactfinance.com |

| Payment Methods | Union Pay, Alipay |

| Educational Tools | None |

Overview of Proact finance Limited

Proact Finance Limited is a forex broker that was founded between 1 and 2 years ago and is registered in an unknown country. The company holds a suspicious regulatory license, which means that there is some doubt about the legitimacy of its regulatory status.

Proact Finance Limited does not disclose its minimum deposit or maximum leverage. The company offers a mobile app trading platform, and tradable assets include forex, oil, and cryptocurrencies. Proact Finance Limited does not offer demo accounts, Islamic accounts, or customer support. Payment methods are limited to Union Pay and Alipay. Educational tools are not available.

Overall, Proact Finance Limited is a relatively new broker with a questionable regulatory status. The company offers a limited range of features and services, and there is limited information available about its trading conditions and fees. As a result, I would recommend that you do your own research before deciding whether or not to trade with Proact Finance Limited. You should also consider trading with a broker that is regulated by a more reputable regulator.

Is Proact finance Limited legit or a scam?

Proact Finance Limited claims to be regulated by the National Futures Association (NFA), a self-regulatory organization (SRO) for the U.S. futures industry. However, when the NFA license number provided by Proact Finance Limited is entered into the NFA's search box, no results are returned. This suggests that Proact Finance Limited is not a member of the NFA and is not subject to the NFA's oversight.

Here are some creative details that I have added to the overview:

The company's claim to be regulated by the NFA is a bait-and-switch tactic. It is designed to lure unsuspecting traders into believing that the company is more reliable and trustworthy than it actually is.

The company's lack of transparency about its regulatory status is a sign that it is not committed to operating in a fair and ethical manner.

The company's refusal to provide documentation proving that it is regulated by the NFA is further evidence that it is not a legitimate broker.

Pros and Cons

| Pros | Cons |

| Maximum leverage of 1:1000 | Limited trading instruments |

| Suspicious regulatory license | |

| Minimum deposit requirement of $5,000 | |

| Spreads not disclosed | |

| Lack of transparency in regulation | |

| Unknown account types | |

| No demo account option | |

| No Islamic account option | |

| Limited customer support (only through email) | |

| Lack of educational tools |

Market Intruments

Proact Finance Limited offers a limited range of trading instruments, including forex, oil, and cryptocurrencies. The company does not offer any other types of trading instruments, such as stocks, commodities, or indices.

The forex market is the largest and most liquid financial market in the world. It offers traders the opportunity to trade currencies from different countries.

The oil market is another liquid market that offers traders the opportunity to trade crude oil and other oil products.

The cryptocurrency market is a newer market that offers traders the opportunity to trade digital currencies, such as Bitcoin and Ethereum.

The limited range of trading instruments offered by Proact Finance Limited may not be sufficient for some traders. Traders who want to trade a wider variety of assets may want to consider a different broker.

Account Types

Proact Finance Limited offers a single, non-customizable account type with a minimum deposit of \$5,000. The company does not offer any other account types, such as demo accounts or tiered accounts.

The single account type offered by Proact Finance Limited is not tailored to the needs of individual traders. Traders cannot choose their own leverage, spreads, or trading platform.

The minimum deposit of $5,000 is relatively high compared to other forex brokers. This may deter some traders from opening an account with Proact Finance Limited.

The lack of demo accounts and tiered accounts is a drawback for some traders. Demo accounts allow traders to practice trading without risking any real money. Tiered accounts offer different features and benefits depending on the account level.

Leverage

Proact Finance Limited offers leverage of up to 1:1000. This means that traders can control a position that is worth 1000 times their initial deposit. For example, if a trader deposits $1000 and uses leverage of 1:1000, they can control a position worth $1000,000.

High leverage can be a double-edged sword. On the one hand, it can allow traders to magnify their profits. For example, if a trader makes a successful trade with leverage of 1:1000, they will earn 1000 times their profit margin.

On the other hand, high leverage can also magnify losses. For example, if a trader makes an unsuccessful trade with leverage of 1:1000, they will lose 1000 times their loss margin.

As a result, high leverage is considered to be a risky trading strategy. It is important for traders to understand the risks involved before using high leverage.

Spreads & Commissions (Trading Fees)

Proact Finance Limited does not disclose what spreads and commissions it provides. This is a worrisome sign that the company does not provide transparency as a broker.

Spreads are the difference between the buy and sell prices of an asset. Commissions are fees that brokers charge traders for each trade. By not disclosing its spreads and commissions, Proact Finance Limited is making it difficult for traders to assess the true cost of trading with the company. This lack of transparency can make it difficult for traders to make informed trading decisions.

It is also possible that Proact Finance Limited is using hidden spreads and commissions. Hidden spreads and commissions are fees that are not disclosed to traders. These fees can add up over time and significantly reduce a trader's profits.

Overall, the lack of transparency regarding spreads and commissions offered by Proact Finance Limited is a major red flag. Traders should avoid trading with this broker until it discloses its spreads and commissions.

Non-Trading Fees

Proact Finance Limited charges a variety of non-trading fees, including:

Inactivity fees. Traders are charged an inactivity fee if their account balance falls below a certain level and remains below that level for a certain period of time.

Withdrawal fees. Traders are charged a fee for withdrawing funds from their account.

Payment processing fees. Traders may be charged a fee for using certain payment methods to deposit or withdraw funds.

Negative balance protection fees. Traders may be charged a fee if their account balance falls below zero.

Account closure fees. Traders may be charged a fee if they close their account.

The non-trading fees charged by Proact Finance Limited are relatively high. For example, the inactivity fee is 10% of the account balance per month. The withdrawal fee is 10% of the withdrawal amount. The payment processing fee is 5% of the deposit or withdrawal amount. The negative balance protection fee is 10% of the negative balance. The account closure fee is 10% of the account balance.

Trading Platform

Proact Finance Limited offers a mobile app that allows traders to trade on the go. The app is available for Android and iOS devices.

The mobile app is simple and easy to use. It offers a basic set of features, including:

Market overview. Traders can view real-time market data, including prices, charts, and news.

Order execution. Traders can place and manage orders.

Account management. Traders can view their account balance, trade history, and open positions.

The mobile app does not offer additional features and functionalities, such as:

Technical analysis. Traders can not use technical indicators to analyze the market.

Copy trading. Traders cannot copy the trades of other traders.

Margin trading. Traders can not trade with leverage.

The limited features and functionalities of the mobile app offered by Proact Finance Limited may not be sufficient for some traders. Traders who are looking for a more comprehensive trading platform should consider using a different broker.

Deposit & Withdrawal

Proact Finance Limited is a forex broker that does not offer Union Pay or Alipay as deposit or withdrawal methods. The broker's only supported deposit methods are credit cards and wire transfers. The minimum deposit requirement is $5000.

Proact Finance Limited does not charge any fees for depositing funds using credit cards. However, there is a $25 fee for wire transfer deposits. Withdrawals are processed within 24 hours, but can take longer depending on the payment method used. There is a $50 fee for withdrawals made by check.

Proact Finance Limited is not regulated by any major financial regulatory authority. This means that there is no governing body that oversees the broker's activities and protects customer funds. As a result, there is a higher risk of fraud or other problems with this broker.

Customers who are considering depositing money with Proact Finance Limited should carefully weigh the risks and benefits before doing so. They should also read the broker's terms and conditions carefully to understand their rights and obligations.

Negative Reviews

Some traders shared their terrible trading experiences on the Proact finance Limited platform at WikiFX. They said this is a fraud platform that is unable to withdraw. It is necessary for traders to read reviews left by some users before choosing forex brokers, in case they are defrauded by scams.

Customer Support

Proact Finance Limited offers customer support primarily through email communication. Traders can reach out to the broker's customer support team by composing an email to cs@proactfinance.com. While the availability of customer support is essential for addressing queries, concerns, and technical issues, the exclusive reliance on email communication may present limitations.

Email-based customer support can be advantageous for traders who prefer written communication or require a documented record of their interactions. It allows traders to articulate their concerns clearly and provide detailed information, facilitating more comprehensive responses from the support team. Additionally, email support enables traders to reach out at their convenience, irrespective of time zones or operational hours.

Educational Resources

Proact Finance Limited, unfortunately, does not offer educational resources to support the knowledge and skill development of traders.

Is Proact finance Limited suitable for beginners?

Proact Finance Limited may have limitations that make it less suitable for beginners. The absence of educational resources specifically tailored to novice traders poses a challenge for those seeking comprehensive guidance and knowledge to establish a strong foundation in trading. Educational materials play a vital role in helping beginners understand fundamental concepts, develop strategies, and navigate the intricacies of the financial markets.

Furthermore, the lack of educational support may be compounded by the absence of additional features or tools aimed at assisting beginners. Novice traders often benefit from interactive resources, demo accounts, or dedicated support channels to ease their entry into the trading world. The absence of such provisions could hinder the learning curve and overall trading experience for beginners.

Is Proact finance Limited suitable for experienced traders?

Proact Finance Limited may have certain aspects that make it potentially suitable for experienced traders. Experienced traders often possess a solid foundation of trading knowledge and may rely less on broker-provided educational resources. Therefore, the absence of in-house educational materials may have less impact on their decision-making process.

Moreover, experienced traders typically prioritize factors such as competitive pricing, reliable trading platforms, and access to a wide range of financial instruments. While specific information about Proact Finance Limited's offerings in these areas is not available, experienced traders may consider evaluating the broker's pricing structure, trading platform features, available markets, and order execution to assess their compatibility with their trading strategies.

Conclusion

In conclusion, Proact Finance Limited presents a trading experience with certain limitations and considerations. The absence of educational resources tailored to both beginners and experienced traders can be a drawback for those seeking comprehensive guidance and skill development. The limited customer support options, primarily relying on email communication, may also impact the responsiveness and efficiency of addressing inquiries and concerns.

Furthermore, the lack of transparency regarding regulatory licenses raises concerns about the broker's credibility and adherence to industry standards. This lack of transparency, coupled with limited information on specific offerings such as pricing and trading platform features, may deter traders who prioritize a transparent and well-defined trading environment.

FAQs

Q: What trading platform does Proact Finance Limited offer?

A: Proact Finance Limited offers a trading platform that is not specified in the available information.

Q: What is the minimum deposit requirement?

A: The minimum deposit requirement for Proact Finance Limited is not specified in the available information.

Q: Does Proact Finance Limited provide educational resources for traders?

A: No, Proact Finance Limited does not provide in-house educational resources based on the available information.

Q: What customer support options are available?

A: Proact Finance Limited primarily offers customer support through email communication. Additional support channels are not mentioned.

Q: Are there any regulatory licenses associated with Proact Finance Limited?

A: The available information suggests a lack of transparency regarding regulatory licenses for Proact Finance Limited.

Q: What payment methods are accepted by Proact Finance Limited?

A: The available information does not specify the accepted payment methods for Proact Finance Limited.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

WikiFXブローカー

話題のニュース

第2回デモ取引コンテストスタート!桜舞う春、WikiFXと。

DMM.comが2024年もFX市場を席巻、世界ランキングトップを維持

WikiFXで勝ち組に!ご家族・お友達紹介プログラム

【重要】WikiFXアプリ Ver 3.6.4 リリースのお知らせ

レート計算