Zenita Finance

概要:Zenita Finance is an online trading platform offering a range of account types, including Standard, Fixed-Spread, and Raw-Spread Accounts, catering to traders' diverse preferences. With a minimum deposit starting at $100, it provides access to a maximum leverage of up to 1:1000. The broker offers a variety of tradable assets, including Forex, Metals, Indices, Spot Energies, Stocks, and Cryptocurrencies, all accessible through the MetaTrader 5 (MT5) trading platform. Traders can also benefit from educational resources such as a Forex Glossary and a blog. While Zenita Finance offers a Demo Account and Islamic Accounts for certain account types, it's important to note that it operates as an unregulated broker, which may be a consideration for some traders. Customer support is available through email, phone, and live chat, offering multiple channels for assistance. Additionally, the broker supports various payment methods, including credit/debit cards, bank wire transfers, electronic payme

| Aspect | Information |

| Registered Country/Area | United States |

| Company Name | Zenita Finance |

| Regulation | Unregulated |

| Minimum Deposit | $100 for Standard and Fixed-Spread Accounts, $300 for Raw-Spread Account |

| Maximum Leverage | Up to 1:1000 |

| Spreads | Standard Account: Floating from 1 pip, Fixed-Spread Account: Fixed from 3 pips, Raw-Spread Account: Floating from 0 pips |

| Trading Platforms | MetaTrader 5 (MT5) |

| Tradable Assets | Forex, Metals, Indices, Spot Energies, Stocks, Cryptocurrencies |

| Account Types | Standard Account, Fixed-Spread Account, Raw-Spread Account |

| Demo Account | Available |

| Islamic Account | Available for Standard and Raw-Spread Accounts |

| Customer Support | Email, Phone, Live Chat |

| Payment Methods | Credit/Debit Cards, Bank Wire Transfers, Electronic Payment Systems, Crypto Wallets |

| Educational Tools | Forex Glossary, Blog |

Overview

Zenita Finance is an online trading platform offering a range of account types, including Standard, Fixed-Spread, and Raw-Spread Accounts, catering to traders' diverse preferences. With a minimum deposit starting at $100, it provides access to a maximum leverage of up to 1:1000. The broker offers a variety of tradable assets, including Forex, Metals, Indices, Spot Energies, Stocks, and Cryptocurrencies, all accessible through the MetaTrader 5 (MT5) trading platform. Traders can also benefit from educational resources such as a Forex Glossary and a blog. While Zenita Finance offers a Demo Account and Islamic Accounts for certain account types, it's important to note that it operates as an unregulated broker, which may be a consideration for some traders. Customer support is available through email, phone, and live chat, offering multiple channels for assistance. Additionally, the broker supports various payment methods, including credit/debit cards, bank wire transfers, electronic payment systems, and cryptocurrency wallets, providing flexibility for depositing and withdrawing funds.

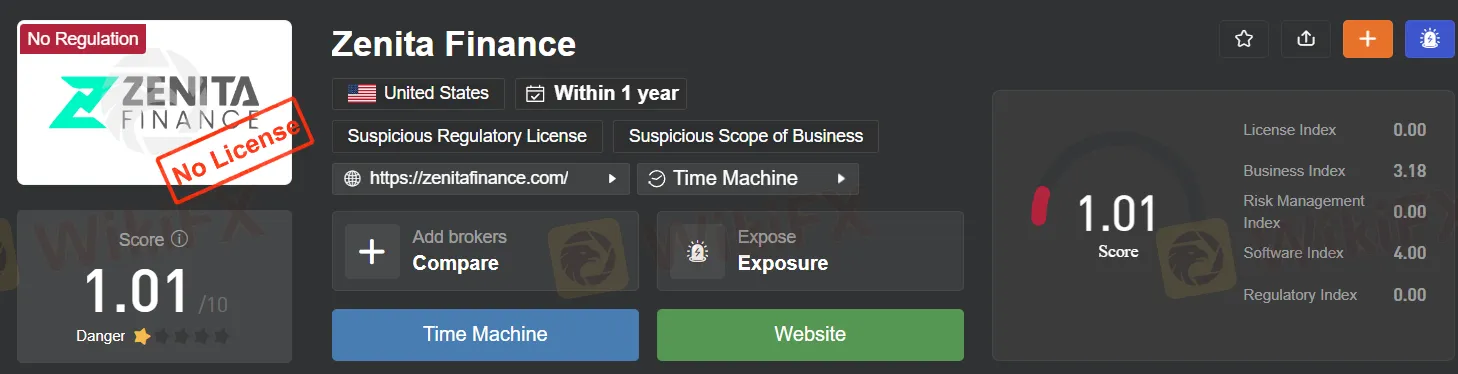

Regulation

Zenita Finance operates as an unregulated forex broker, posing significant concerns for potential traders and investors. Unregulated brokers lack the oversight and accountability that regulated ones offer, leading to issues such as a lack of transparency, inadequate risk management, and reduced investor protection. Traders should exercise caution and opt for regulated brokers to ensure a safer and more secure trading experience.

Pros and Cons:

| Pros | Cons |

| Diverse Range of Trading Instruments | Unregulated Broker |

| High Maximum Leverage (Up to 1:1000) | Lack of Regulatory Oversight |

| Multiple Account Types | Limited Customer Support |

| No Commissions on Certain Accounts | Variable Service Quality |

| Advanced MT5 Trading Platform | |

| Cost-Effective Cryptocurrency Deposits | |

| Educational Resources Available |

Zenita Finance offers a range of advantages, including a diverse array of trading instruments, high maximum leverage, multiple account types, and the use of the advanced MT5 trading platform. Additionally, the broker provides cost-effective cryptocurrency deposits and access to educational resources. However, it operates as an unregulated broker, lacking the oversight and regulatory protections of regulated counterparts. Customer support quality may vary, posing potential challenges for traders seeking consistent assistance. As with any broker, traders should carefully consider their preferences and risk tolerance when choosing Zenita Finance as their trading platform.

Market Instruments

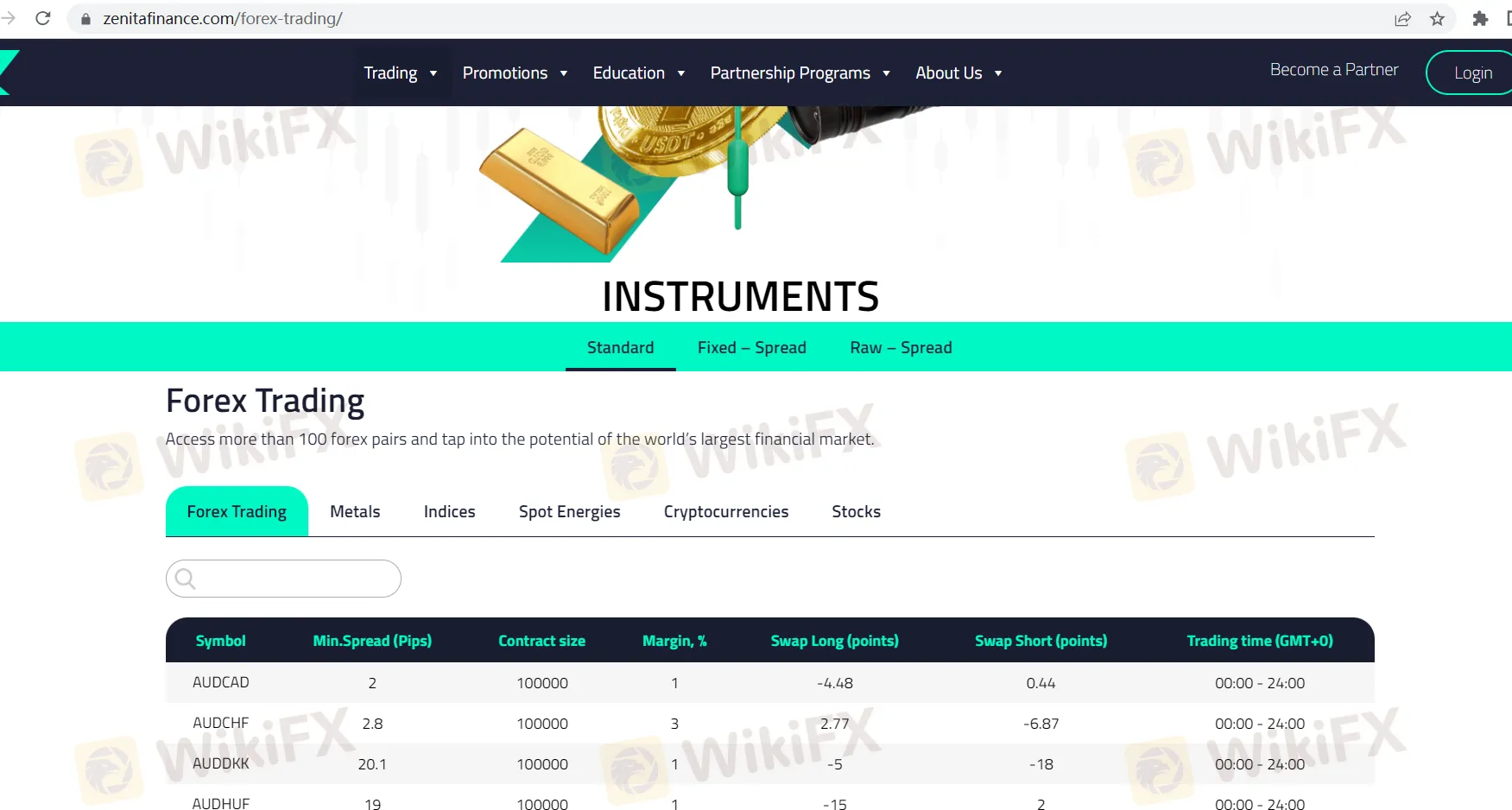

Zenita Finance offers a diverse range of trading instruments, catering to the varied needs and preferences of traders. These instruments encompass forex, metals, indices, spot energies, stocks, and cryptocurrencies, providing traders with a comprehensive selection to choose from.

Forex: The forex market, also known as the foreign exchange market, is the world's largest financial market. Zenita Finance allows traders to engage in currency trading, facilitating transactions in major currency pairs like EUR/USD, GBP/JPY, and many more. This provides opportunities for traders to speculate on exchange rate fluctuations.

Metals: Zenita Finance offers trading in precious metals such as gold and silver. These metals are often considered safe-haven assets and can act as a hedge against economic uncertainty, making them attractive options for traders looking to diversify their portfolios.

Indices: Trading indices allows investors to speculate on the overall performance of a basket of stocks representing a particular market or sector. Zenita Finance offers access to a variety of global indices, enabling traders to participate in broader market movements without having to trade individual stocks.

Spot Energies: The inclusion of spot energies in Zenita Finance's offerings allows traders to engage in the energy markets. This can involve trading commodities such as crude oil and natural gas, which are influenced by factors like geopolitical events and supply-demand dynamics.

Stocks: Zenita Finance enables traders to invest in individual stocks, providing access to a wide range of publicly traded companies. This allows traders to take positions in specific companies based on their research and market analysis.

Cryptocurrencies: Cryptocurrencies have gained immense popularity in recent years, and Zenita Finance allows traders to participate in this dynamic market. Traders can trade popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin, potentially capitalizing on price volatility.

Now, let's create a detailed table summarizing the trading instruments offered by Zenita Finance:

| Trading Instrument | Description |

| Forex | Trading in major and minor currency pairs |

| Metals | Trading in precious metals like gold and silver |

| Indices | Speculating on the performance of global indices |

| Spot Energies | Engaging in energy market trading (e.g., oil, gas) |

| Stocks | Investing in individual publicly traded companies |

| Cryptocurrencies | Trading popular cryptocurrencies like Bitcoin |

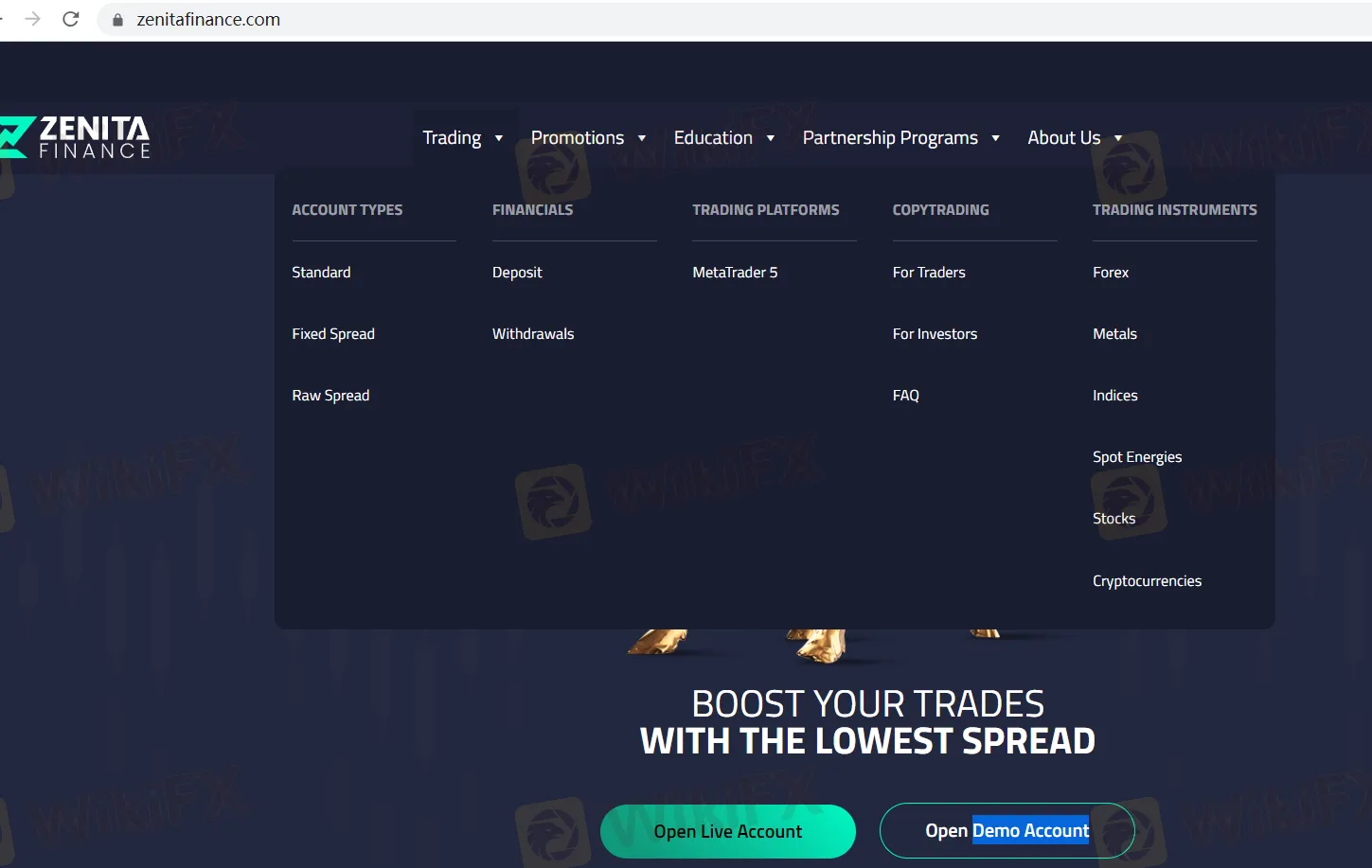

Account Types

Zenita Finance provides a range of account types to cater to the diverse needs of traders, offering flexibility in trading conditions and preferences. The broker offers three distinct trading accounts: the Standard Account, Fixed-Spread Account, and Raw-Spread Account.

Standard Account

The Standard Account is positioned as the ultimate trading solution suitable for traders of all levels. It features a floating spread starting from just 1 pip, making it versatile for various trading strategies. With no commission charges for trading Forex currency pairs and metals, this account ensures cost-effective trading. Traders benefit from market execution and have access to the popular MT5 trading platform. The leverage offered is up to 1:1000, providing traders with ample flexibility. Account base currency options include USD and EUR, with a low initial deposit requirement of $100. Additionally, Islamic accounts are available, ensuring inclusivity for all traders.

Fixed-Spread Account

Zenita Finance's Fixed-Spread Account is designed to provide traders with confidence and stability. It offers fixed spreads starting from 3 pips, guaranteeing a consistent cost structure for traders. Similar to the Standard Account, there is no commission charged for trading Forex currency pairs and metals. This account type utilizes instant execution for swift order processing and operates on the MT5 platform. Traders can leverage their positions up to 1:1000 and have the option to choose between USD and EUR as their account base currency. The initial deposit requirement is $100, maintaining the same margin call and stop-out levels of 50% and 20%, respectively.

Raw-Spread Account

The Raw-Spread Account is tailored for traders who seek the tightest spreads and lowest trading costs. It features floating spreads starting from 0 pips, appealing to traders who prioritize cost efficiency. However, this account type does come with a commission of $2.5 per side for 1 Lot, which allows for highly competitive spreads. Market execution ensures rapid order execution, and traders utilize the MT5 platform with access to advanced trading tools. Leverage is available up to 1:1000, and traders can select their account base currency from USD or EUR. The minimum deposit for this account type is $300, and it operates with different margin call and stop-out levels of 80% and 50%, respectively.

Demo Account

In addition to the live trading accounts, Zenita Finance offers a Demo Account. This account is a vital tool for traders to practice and test their trading strategies in a risk-free environment. It mirrors live trading conditions and provides traders with an opportunity to:

Practice trading strategies without real financial risk.

Test various approaches and techniques.

Familiarize themselves with the MT5 trading platform.

Observe real-time market conditions and gain insights.

Learn and build confidence without an initial deposit, as it does not involve real profits or losses.

The Demo Account is an invaluable resource for traders of all experience levels, offering a safe space to develop skills and strategies before transitioning to live trading with real funds.

Here's a summary table for easy comparison of the three live account types:

| Account Type | Spread | Commission | Execution Type | Platform | Leverage | Initial Deposit | Base Currency | Islamic Accounts | Margin Call Level | Stop Out Level |

| Standard Account | Floating from 1 pip | None (for Forex)1 | Market Execution | MT5 | Up to 1:1000 | $100 | USD, EUR | Yes | 50% | 20% |

| Fixed-Spread Account | Fixed from 3 pips | None (for Forex)1 | Instant Execution | MT5 | Up to 1:1000 | $100 | USD, EUR | No | 50% | 20% |

| Raw-Spread Account | Floating from 0 | $2.5 per side for 1 Lot | Market Execution | MT5 | Up to 1:1000 | $300 | USD, EUR | Yes | 80% | 50% |

These account options ensure that Zenita Finance caters to the specific trading needs of its diverse clientele, whether they prioritize cost efficiency, stability, or accessibility.

Leverage:

Zenita Finance offers a maximum trading leverage of up to 1:1000 for its trading accounts. Leverage allows traders to control larger positions in the market with a relatively smaller amount of capital. With a leverage of up to 1:1000, traders can potentially amplify their trading positions, which can magnify both profits and losses. While higher leverage can provide opportunities for increased gains, it also carries a higher level of risk, and traders should exercise caution and employ risk management strategies when utilizing such high leverage to ensure responsible and informed trading decisions.

Spreads & Commissions:

Zenita Finance offers a range of spreads and commissions to cater to traders' diverse preferences and strategies.

Standard Account:

Floating spreads from 1 pip.

No commissions for Forex currency pairs and metals.

Fixed-Spread Account:

Fixed spreads from 3 pips.

No commissions for Forex currency pairs and metals.

Raw-Spread Account:

Floating spreads from 0 pips.

$2.5 per side commission for 1 Lot.

Traders can select the account type that best aligns with their trading style and cost considerations, whether they prioritize tight spreads, stability, or a balance between both.

Deposit & Withdrawal

Deposit Methods:

Wire Transfer: This method allows you to deposit funds in either USD or EUR with a minimum amount of $100. The fees associated with this method are determined by your bank's fee structure, and the processing time typically takes up to 5 business days. While it may take a bit longer, it provides a secure option for transferring larger sums of money.

Cryptocurrencies (USDTRC20, BTC, ETH, LTC, XRP): For instant deposits, Zenita Finance accepts cryptocurrencies with a minimum deposit requirement of just $10. The standout feature is that there are no fees associated with cryptocurrency deposits, making it a cost-effective choice for traders looking for quick access to their funds.

Online Payment System (Any Currency): Zenita Finance offers the convenience of online payment systems, allowing deposits in any currency with a minimum amount of $10. Similar to cryptocurrency deposits, there are no fees, and the funds are instantly available for trading.

Online Payment System (USD, EUR): For those preferring to transact in USD or EUR, this online payment system accommodates minimum deposits ranging from $5 to $100. Like other online payment methods, there are no fees, and funds become instantly accessible for trading.

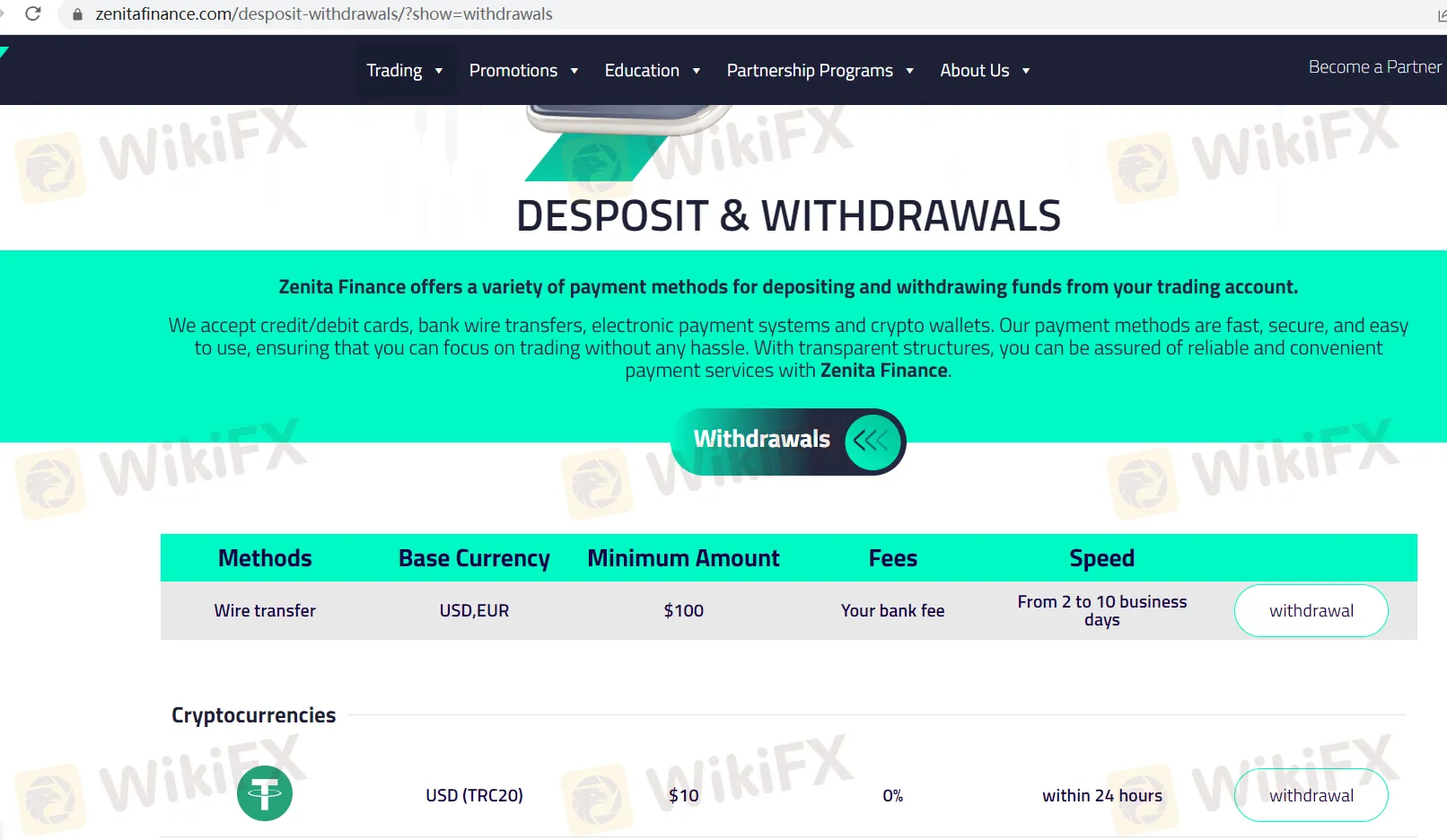

Withdrawal Methods:

Wire Transfer: To withdraw funds via wire transfer, you can use either USD or EUR as the base currency. The minimum withdrawal amount is $100, and the fees are determined by your bank's fee structure. Withdrawals using this method typically take from 2 to 10 business days to process.

Cryptocurrencies (USDTRC20, USDERC20, BTC, ETH, LTC, XRP): For cryptocurrency withdrawals, the minimum amount varies between $10 and $20, depending on the cryptocurrency used. Zenita Finance charges no fees for cryptocurrency withdrawals, and the process is expedited, typically within 24 hours.

Online Payment System (Any Currency): When withdrawing via online payment systems, the minimum withdrawal amount is $10, and a fee of 2% is applied. Processing times range from 2 to 10 business days, providing flexibility for those who prefer this method.

Online Payment System (USD, EUR): If you opt for USD or EUR as your base currency for withdrawals, the minimum withdrawal amount ranges from $5 to $100. The fees applied are 0.5%, and the processing time is swift, typically within 24 hours.

In summary, Zenita Finance offers a comprehensive range of deposit and withdrawal methods to cater to traders' preferences and needs. Whether you prioritize speed, cost-effectiveness, or specific currencies, these options ensure that you can efficiently manage your trading account with ease and convenience.

Trading Platforms

Zenita Finance offers the renowned MT5 trading platform, known for its user-friendliness and robust features. With MT5, traders have access to advanced charting, technical indicators, and quick order execution. This platform is flexible, allowing trading in various markets, including Forex and metals. Whether you're a novice or an experienced trader, MT5 provides the tools and resources needed for successful trading at Zenita Finance.

Customer Support

Zenita Finance provides customer support; however, it may not always meet clients' expectations in addressing concerns or inquiries related to its products and services. The support team, while available, may not consistently deliver the level of service clients desire.

Contact Options:

Address:

The company's physical location is as follows:

Fomboni, Island of Moheli, Comoros Union

53-55 Pavtos Buzand Bldg., Office 1, Yerevan, Armenia

Email:

Email: Support@zenitafinance.com

Phone:

Phone: +374 94 669 117

Live Chat:

“Let's Talk”

Clients should be aware that Zenita Finance's customer support may not always provide the swift or satisfactory assistance they expect through their preferred contact method.

Educational Resources

Zenita Finance offers a valuable array of educational resources designed to empower traders with knowledge and insights. These resources are instrumental in helping traders enhance their understanding of the financial markets and refine their trading strategies.

Forex Glossary: The Forex Glossary is a comprehensive repository of trading terminology and definitions. It serves as an invaluable reference for both novice and experienced traders. This resource enables traders to decode complex jargon, ensuring that they are well-informed and can make informed decisions in the fast-paced world of Forex trading.

Blog: Zenita Finance's blog is a dynamic source of market analysis, insights, and updates. Traders can access a wealth of articles covering a wide range of topics, including market trends, trading strategies, and economic developments. Whether traders are seeking the latest market news or in-depth analysis to refine their trading approach, the blog offers a wealth of information.

Zenita Finance is committed to equipping traders with the tools and knowledge they need to succeed. The educational resources, including the Forex Glossary and blog, are just one facet of the comprehensive support provided to traders, ensuring they have the information and insights required to navigate the financial markets effectively.

Summary

Zenita Finance offers a wide range of trading instruments, including Forex, metals, indices, spot energies, stocks, and cryptocurrencies, catering to diverse trading preferences. The broker provides three distinct account types, each with unique features, including the Standard Account, Fixed-Spread Account, and Raw-Spread Account. Traders can access leverage of up to 1:1000, providing flexibility in managing positions. Zenita Finance supports multiple deposit and withdrawal methods, accommodating various currencies and preferences. The platform of choice is the widely recognized MT5, offering advanced tools and features. While the broker offers educational resources like the Forex Glossary and blog, it operates as an unregulated forex broker, which may raise concerns for some traders. Customer support is available through various channels, though service levels may vary.

FAQs:

Q1: What account types does Zenita Finance offer?

A1: Zenita Finance provides three distinct account types: the Standard Account, Fixed-Spread Account, and Raw-Spread Account, catering to various trading preferences and strategies.

Q2: What is the maximum leverage available at Zenita Finance?

A2: Zenita Finance offers a maximum trading leverage of up to 1:1000, allowing traders to control larger positions with a relatively smaller amount of capital.

Q3: Are there fees for depositing funds with cryptocurrencies at Zenita Finance?

A3: No, there are no fees associated with depositing funds using cryptocurrencies at Zenita Finance, making it a cost-effective option for traders.

Q4: What trading platform does Zenita Finance use?

A4: Zenita Finance utilizes the MetaTrader 5 (MT5) trading platform, known for its user-friendliness and robust features, providing traders with advanced charting and technical tools.

Q5: Is Zenita Finance a regulated broker?

A5: No, Zenita Finance operates as an unregulated forex broker, which may raise concerns for traders seeking the oversight and accountability that regulated brokers offer. Traders are advised to exercise caution when trading with unregulated brokers.

WikiFXブローカー

話題のニュース

第2回デモ取引コンテストスタート!桜舞う春、WikiFXと。

DMM.comが2024年もFX市場を席巻、世界ランキングトップを維持

WikiFXで勝ち組に!ご家族・お友達紹介プログラム

【重要】WikiFXアプリ Ver 3.6.4 リリースのお知らせ

レート計算