Shinhan Bank

概要:Shinhan Bank, established in 2001 and headquartered in Australia, operates under the regulatory framework of the Australian Securities and Investments Commission (ASIC) with license number 483679. The bank provides a wide array of financial products and services, including savings accounts, time deposits, installment accounts, loans, foreign exchange transactions, and comprehensive internet banking facilities. Shinhan Bank is committed to customer support and engagement, offering services through its Global Portal and Foreign Language Support Service. Despite imposing various service and foreign transaction fees, the bank maintains a strong focus on delivering efficient financial solutions to both personal and corporate clients.

| Shinhan Bank | Basic Information |

| Company Name | Shinhan Bank |

| Founded | 2001 |

| Headquarters | Australia| |

| Regulations | ASIC (Exceeded) |

| Products and Services | Savings accounts, time deposits, installment accounts, foreign exchange transactions, loans, internet banking |

| Fees | Service fees, foreign cash deposit/withdrawal fees |

| Customer Support | Global Portal, Foreign Language Support Service (Phone: 1577-8380 or +82-2-3449-8380) |

| Education Resources | IR Library, Credit Rating information, Stock Quotes, AML and Sanctions compliance, Covered Bond Programme, Investor Reports |

Overview of Shinhan Bank

Shinhan Bank, since its inception in 2001, has grown to become a reputable financial institution, renowned for its comprehensive range of services and strong regulatory compliance. Operating under the regulation of the ASIC, the bank offers a diverse suite of products catering to both individual and corporate financial needs. From standard banking services like savings and deposit accounts to more complex offerings such as loans and foreign exchange transactions, Shinhan Bank positions itself as a versatile and customer-centric bank.

The bank's commitment to customer service is evident in its multi-faceted support system, which includes a global portal and foreign language support services, ensuring accessibility and convenience for a diverse clientele. Moreover, Shinhan Bank has made significant strides in digital banking, providing robust internet banking services that cater to the evolving needs of modern consumers.

Is Shinhan Bank Legit?

Shinhan Bank is regulated by the Australian Securities and Investments Commission (ASIC) under license number 483679. However, it's important to note that there is a cautionary statement indicating that the broker exceeds the business scope regulated by ASIC under the Investment Advisory License Non-Forex License. This notice advises clients to be aware of the associated risks due to the broker's expanded business scope beyond the specified license. Traders and investors should exercise caution and carefully consider these risks before engaging in financial activities with Shinhan Bank. The regulatory framework provided by ASIC establishes certain standards and protections, but the cautionary statement highlights additional considerations related to the broker's business practices.

Pros and Cons

Shinhan Bank distinguishes itself as a robust financial institution with its comprehensive range of services and strong regulatory compliance under ASIC. It caters effectively to both personal and corporate clients, offering a spectrum of banking solutions from savings accounts to complex loan and foreign exchange services. The bank's commitment to customer service is evident through its accessible Global Portal and Foreign Language Support Service. However, customers must navigate its structure of service fees and foreign transaction fees, which could be a consideration for cost-conscious clients. While its digital banking platform enhances accessibility, the cautionary note regarding the broker's business scope exceeding ASIC's regulation could be a concern for some clients.

| Pros | Cons |

|

|

|

|

|

|

|

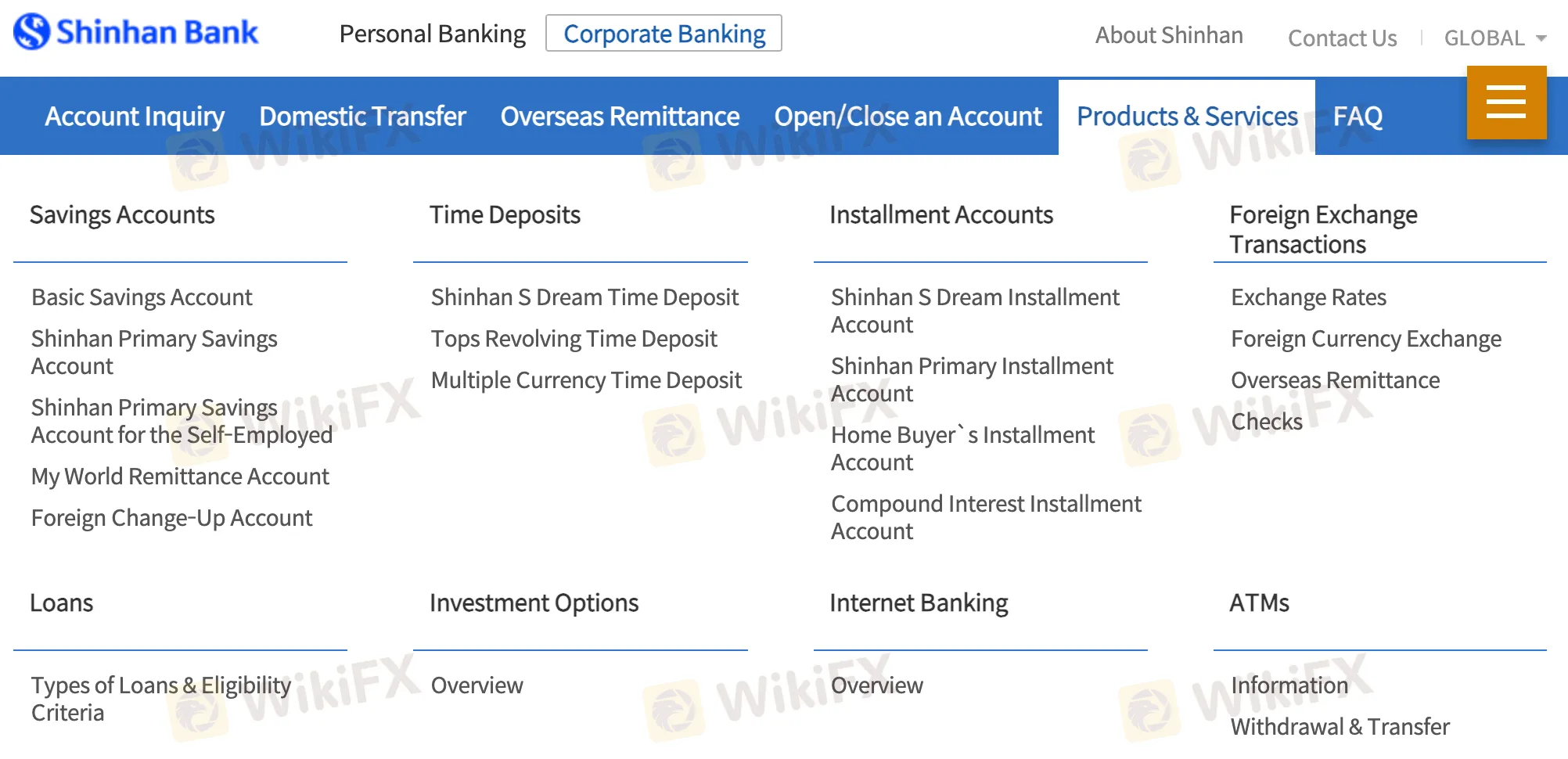

Products and Services

Personal Banking:

Shinhan Bank offers a comprehensive range of personal banking services to cater to the financial needs of individuals. This includes savings accounts, providing customers with a secure place to grow their funds while maintaining easy access. Time deposits offer fixed-term investment options with competitive interest rates, while installment accounts allow for structured savings. Foreign exchange transactions enable currency exchange for international needs. The bank also provides various loan options, accommodating diverse financial requirements. For those looking to grow their wealth, Shinhan Bank offers investment options. Additionally, the convenience of internet banking ensures customers can manage their finances seamlessly from anywhere.

Corporate Banking:

Shinhan Bank extends its services to meet the financial demands of businesses through its corporate banking offerings. Tailored to support corporate financial activities, these services include business accounts, lending solutions, treasury management, and trade finance. Business accounts provide a secure platform for managing corporate finances, while lending solutions cover a spectrum of financial needs, including working capital and project financing. Treasury management services assist businesses in optimizing their financial assets and ensuring liquidity. Furthermore, Shinhan Bank facilitates international trade through its trade finance services, providing letters of credit, guarantees, and other instruments to facilitate global business transactions.

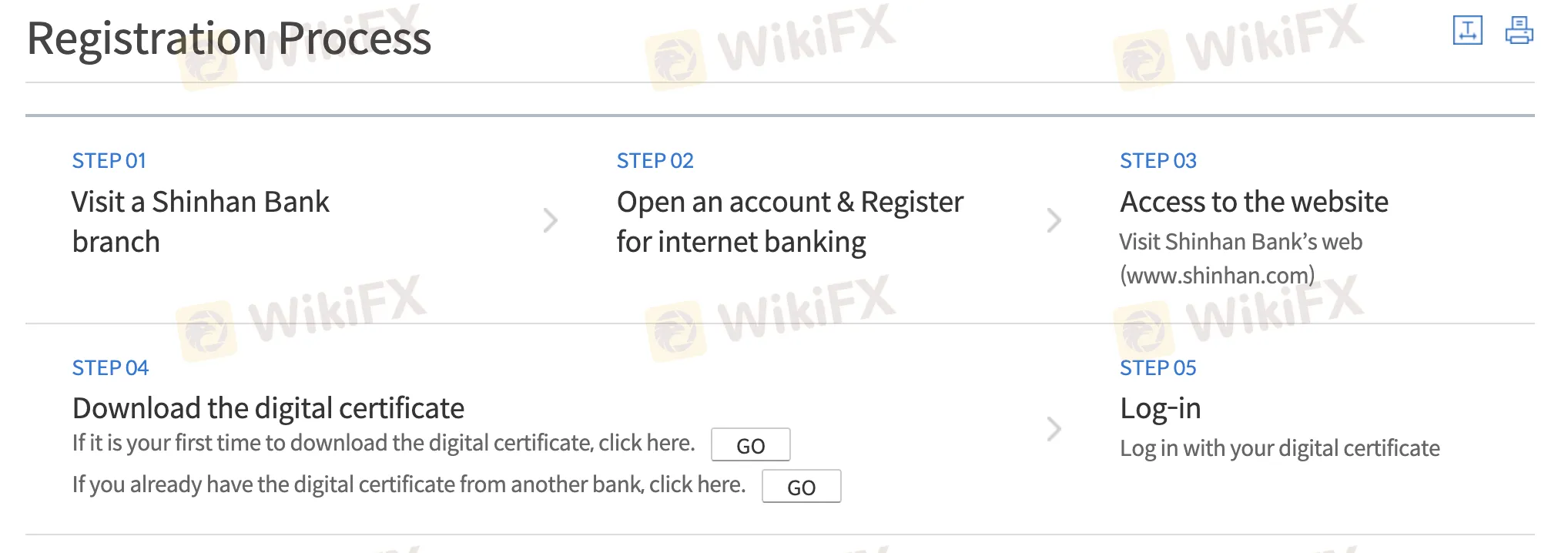

How to Open an Account?

To open an account with Shinhan Bank, follow these steps.

1. Visit a Branch: Start by visiting a Shinhan Bank branch in person to begin the account opening process. This allows you to provide necessary information and choose the type of account you want.

2. Open an Account: During your branch visit, you'll be guided through the account opening steps. You can also opt to register for internet banking services at this stage.

3. Access the Website: After the initial account setup, go to Shinhan Bank's official website (www.shinhan.com) to access various banking services, including internet banking.

4. Download Digital Certificate: Enhance security by downloading the digital certificate from the website. This step ensures secure online transactions.

5. Log-in to Internet Banking: With the digital certificate, log in to the internet banking portal for secure and convenient management of your account online.

Combining in-person assistance with online accessibility, Shinhan Bank provides a seamless process for opening an account and enjoying banking services.

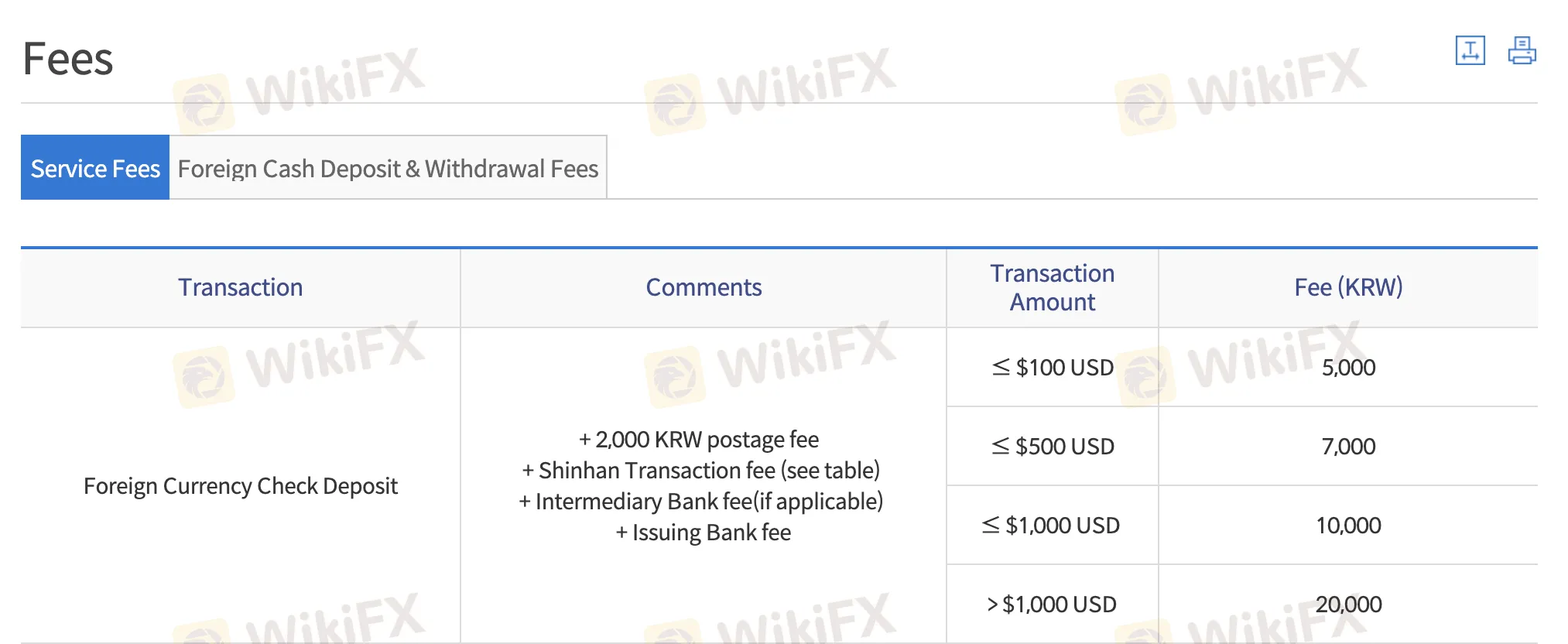

Fees

Service Fees:

Shinhan Bank imposes various service fees based on transaction amounts and types. For transactions up to $100 USD, a fee of 5,000 KRW, along with a 2,000 KRW postage fee and Shinhan Transaction fee, is applicable. Larger transactions, such as those exceeding $500 USD, incur a fee of 7,000 KRW. Foreign Currency Check Deposit fees range from 10,000 KRW for amounts up to $1,000 USD to 20,000 KRW for amounts exceeding $2,000 USD.

Foreign Currency Check Issuance fees vary from 15,000 KRW for amounts up to $5,000 USD to 20,000 KRW for amounts exceeding $5,000 USD. Travelers Checks (TC) Issuance and Cashing Travelers Checks incur fees based on transaction amounts and currency types. Security Card Issuance, OTP (One-Time Password) Card, SMS Notifications, and Digital Certificate Issuance & Renewal involve specific fees, with variations for individuals and corporates.

Foreign Cash Deposit & Withdrawal Fees:

Fees for Foreign Cash Deposit and Withdrawal depend on the type of transaction, currency involved, and timing. For deposits, a fee is applied at the time of depositing, and for withdrawals, fees vary based on whether the transaction is within seven days or later. Foreign currencies like USD, AUD, CAD, CHF, DKK, EUR, GBP, HKD, JPY, NOK, NZD, SEK, SGD, AED, UAD, BHD, CNY, IDR, KWD, MYR, SAR, and THB have specific handling fees and percentage charges.

Shinhan VIP Customer Discounts are applicable, with Premier customers receiving a 50% discount on Cash handling fees, Ace customers getting a 40% discount, and Best customers enjoying a 30% discount. The Foreign Exchange (FX) Spread involves different rates for buyers and sellers of foreign currency, with Shinhan Bank and customers having varying spreads based on the transaction type. A formula is provided to calculate the Cash Handling Fee, taking into account the amount, percentage charged, and the current Base Rate.

Customer Support

Shinhan Bank provides a convenient and efficient customer support system for its clients. To quickly locate information about domestic branches, ATMs, and foreign branches, customers can visit the Shinhan Global portal. This portal offers a user-friendly interface, allowing users to access details about contactable numbers, branch locations in Korea and overseas, and other essential information related to Shinhan Bank's services.

For a world-class financial service experience, customers can explore the Global Portal, which provides comprehensive information about Shinhan Bank's financial services. Whether seeking details on domestic branches, ATMs, or overseas subsidiaries, the portal offers an interactive map to assist customers in locating the nearest service points.

In addition to online resources, Shinhan Bank offers a dedicated Foreign Language Support Service, accessible by calling 1577-8380 (or +82-2-3449-8380 from overseas). This service is available from Monday to Friday, 9 am to 6 pm (Korean Standard Time). Customers can inquire about various aspects of Shinhan Bank's services, seek assistance, or get information in multiple languages through this support line. The bank is committed to ensuring that customers have access to the assistance they need, fostering a positive and supportive banking experience.

Educational Resources

Shinhan Bank offers a range of educational resources through its online platform, providing users with valuable insights and information on various financial aspects. The IR Library serves as a repository of materials related to investor relations, offering reports, presentations, and updates that enable investors and stakeholders to stay informed about the bank's performance and strategic initiatives.

Credit Rating information is available to provide users with an assessment of the bank's creditworthiness and financial stability. This resource is crucial for investors and clients seeking a comprehensive understanding of Shinhan Bank's financial health.

Stock Quotes are accessible on the platform, offering real-time information on the bank's stock performance. Investors can track stock prices, monitor market trends, and make informed decisions based on the latest market data.

Shinhan Bank prioritizes compliance and provides resources related to Anti-Money Laundering (AML) and Sanctions. These materials aim to educate users on regulatory requirements and the bank's commitment to maintaining a secure and compliant financial environment.

The Compliance section offers insights into the bank's adherence to regulatory standards, ensuring transparency in its operations. Frequently Asked Questions (FAQs) and Documents are valuable resources that address common queries and provide essential documentation to enhance user understanding.

For those interested in detailed financial instruments, Shinhan Bank offers resources such as the Covered Bond Programme, Offering Circular, and Pricing Supplements. These documents provide in-depth information about the bank's financial products and offerings.

Investor Reports and Asset Monitor Reports are additional educational resources that offer detailed analyses of the bank's financial performance, helping investors make informed decisions. These reports contribute to a transparent and open communication channel between the bank and its stakeholders, fostering trust and confidence.

Conclusion

In summary, Shinhan Bank, founded in 2001 and headquartered in Australia, operates under ASIC regulation (license number 483679). While offering an array of financial services, including personal and corporate banking, the bank's regulatory status comes with a cautionary note about exceeding business scope regulation. Clients navigating the intricate structure of service fees and foreign transaction fees may find the banking experience less favorable. Despite its comprehensive offerings, advanced internet banking, and educational resources, including the IR Library, Shinhan Bank presents a cautious landscape for potential users.

FAQs

Q: Is Shinhan Bank regulated?

A: Yes, Shinhan Bank is regulated by ASIC (license number 483679). However, clients should be aware of the cautionary statement indicating business scope exceeding regulation.

Q: What services does Shinhan Bank offer for personal banking?

A: Shinhan Bank provides various personal banking services, including savings accounts, time deposits, installment accounts, foreign exchange transactions, loans, and internet banking facilities.

Q: How can I open an account with Shinhan Bank?

A: To open an account, visit a Shinhan Bank branch for in-person account setup. Internet banking services can be registered during the branch visit.

Q: What educational resources does Shinhan Bank offer?

A: Shinhan Bank provides educational resources such as the IR Library, credit rating information, stock quotes, AML, and sanctions compliance materials, a Covered Bond Programme, Offering Circular, Pricing Supplements, investor reports, and asset monitor reports.

Q: How can I access customer support at Shinhan Bank?

A: Customer support is available through the Global Portal, offering details about branches and ATMs. Additionally, a Foreign Language Support Service can be reached by calling 1577-8380 (or +82-2-3449-8380 from overseas) from Monday to Friday, 9 am to 6 pm (Korean Standard Time).

WikiFXブローカー

話題のニュース

【MACDの使い方】初心者でもわかる!テクニカル分析の基本と活用方法

日本国内における海外FX業者のIB活動:リスクと回避の理由

レート計算