UBB

요약:UBB, a recently established unregulated financial institution based in Bulgaria, offers a range of financial services to both individual and business clients. They provide access to various tradable assets, including forex currencies, Bulgarian stocks, commodities, and international indices, catering to diverse trading preferences. UBB offers multiple account types, with minimum deposits starting at $10 for forex and $100 for stocks, commodities, and indices. Leverage ratios vary, with the highest being 1:1000 for forex trading. The company also provides a variety of deposit and withdrawal methods, such as bank transfers, credit/debit cards, and e-wallets. Clients can access their services through trading platforms like MetaTrader 4, MetaTrader 5, WebTrader, and UBB Mobile, with customer support available in English and Bulgarian through phone.

| Key Information | Details |

| Company Name | UBB |

| Years of Establishment | 2-5 years |

| Headquarters | Bulgaria |

| Office Locations | N/A |

| Regulation | Unregulated |

| Tradable Assets | Forex, Bulgarian Stocks, Commodities, International Indices |

| Account Types | Individual clients, Business clients |

| Minimum Deposit | $10 |

| Leverage | Up to 1:1000 |

| Deposit/Withdrawal Methods | Bank transfer, Credit/debit card, E-wallets |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, UBB Mobile |

| Customer Support Options | Phone |

Overview of UBB

UBB, a recently established unregulated financial institution based in Bulgaria, offers a range of financial services to both individual and business clients. They provide access to various tradable assets, including forex currencies, Bulgarian stocks, commodities, and international indices, catering to diverse trading preferences.

UBB offers multiple account types, with minimum deposits starting at $10 for forex and $100 for stocks, commodities, and indices. Leverage ratios vary, with the highest being 1:1000 for forex trading. The company also provides a variety of deposit and withdrawal methods, such as bank transfers, credit/debit cards, and e-wallets. Clients can access their services through trading platforms like MetaTrader 4, MetaTrader 5, WebTrader, and UBB Mobile, with customer support available in English and Bulgarian through phone.

Regulatory Status

UBB operates without any regulatory oversight, making it an unregulated broker. This absence of regulation encompasses the company's operations, meaning it lacks external supervision or oversight from financial authorities. As a result, UBB does not adhere to specific regulatory guidelines or compliance standards that are typically enforced within the financial industry. This absence of regulatory authority means that clients who choose to engage with UBB do so without the protection or assurance that a regulated broker might provide.

Pros and Cons

| Pros | Cons |

| Wide Asset Range | Unregulated Status |

| User-Friendly Platforms | Limited Leverage Information |

| Active Community Engagement | Establishment Date Unclear |

Pros:

Wide Asset Range: UBB offers a diverse selection of tradable assets, including forex pairs, Bulgarian stocks, commodities, and international indices, providing clients with various options to diversify their portfolios.

User-Friendly Platforms: The availability of user-friendly trading platforms like MetaTrader 4, MetaTrader 5, WebTrader, and UBB Mobile ensures accessibility and flexibility in trading activities, accommodating both novice and experienced traders.

Active Community Engagement: UBB actively engages with its community through social media platforms, enhancing client-company interaction and offering valuable updates and resources.

Cons:

Unregulated Status: The lack of regulatory oversight raises concerns about the security and protection of clients' investments, as regulatory authorities typically offer a layer of oversight and accountability in the financial industry.

Limited Leverage Information: While UBB provides leverage options, the lack of detailed information about leverage ratios for specific asset classes and account types may pose challenges for traders in determining their risk exposure accurately.

Market Instruments

UBB offers a diverse range of market instruments, including Forex, Bulgarian Stocks, Commodities, and International Indices, placing them in competition with other brokerages in the industry.

Forex: UBB provides access to the Forex market, allowing traders to engage in currency exchange. This market is the largest and most liquid financial market globally, where traders can speculate on the price movements of various currency pairs. For example, clients can trade pairs like EUR/USD, GBP/JPY, and USD/JPY, among others, based on their trading preferences and strategies.

Bulgarian Stocks: UBB offers the opportunity to invest in Bulgarian stocks, which are shares of publicly-traded companies listed on the Bulgarian stock exchange. UBB offers trading opportunities in Bulgarian stocks, including companies such as Sopharma AD (SO5A), Dundee Precious Metals Inc. (DPM), First Investment Bank AD (5F4), Telerik AD (TEL), Dsk Bank AD (DSK), and Sofia Med AD (6S4). This market instrument allows investors to take positions in the performance of these companies and potentially benefit from their growth and dividends.

Commodities: Commodities trading with UBB encompasses various raw materials, including precious metals like gold and silver, as well as agricultural products like wheat and coffee. These commodities are traded on international markets, and clients can speculate on their price movements, making it a diverse market instrument.

International Indices: UBB extends its market instrument offering to include International Indices, such as the S&P 500, FTSE 100, and DAX 30. Trading these indices allows investors to track and speculate on the performance of a broad range of companies from different sectors and regions, making it a valuable tool for portfolio diversification.

Now, let's create the table comparing UBB to other brokerages in terms of market instruments with this additional descriptive information:

| Broker | Market Instruments |

| UBB | Forex, Bulgarian Stocks, Commodities, International Indices |

| OctaFX | Forex, Metals, Indices, Cryptocurrencies |

| FXCC | Forex, Metals, Indices, Energies |

| Tickmill | Forex, Metals, Indices, Bonds, Energies |

| FxPro | Forex, Shares, Indices, Energies |

Account Types

UBB offers two types of accounts: one for individual clients and another for business clients. Specifics are as follows:

Individual Clients Account:

Cards: UBB offers a comprehensive range of card services for individual clients, including debit and credit cards. These cards provide convenience and flexibility for day-to-day financial transactions, both domestically and internationally. Clients can access their accounts, make purchases, and withdraw cash at ATMs worldwide. These cards often come with additional benefits such as rewards programs or cashback offers, enhancing the overall banking experience.

Accounts and Payments: UBB's individual clients can choose from various account types, each designed to meet specific financial needs. These accounts provide a secure and efficient way to manage funds, make payments, and receive deposits. The bank also offers online and mobile banking platforms, allowing clients to monitor their accounts, pay bills, and transfer funds conveniently.

Loans: UBB extends loan options to individual clients, providing access to credit for various purposes. Whether it's a personal loan for unexpected expenses, a mortgage for homebuyers, or an auto loan, the bank offers competitive interest rates and flexible repayment terms. Clients can work with UBB to find a loan product that aligns with their financial goals and circumstances.

Savings and Investments: UBB empowers individual clients to grow their wealth through savings and investment solutions. These options include savings accounts with competitive interest rates, fixed-term deposits, and investment opportunities in various financial instruments. Whether clients aim to save for the future or build a diversified investment portfolio, UBB provides the necessary tools and expertise.

Insurance: UBB understands the importance of financial security and offers a range of insurance products to individual clients. These insurance solutions cover various aspects of life, such as health, property, and personal belongings. Clients can choose from a selection of insurance packages to safeguard their assets and loved ones, providing peace of mind in an unpredictable world.

Business Clients Account:

Financing: UBB's business clients have access to a diverse set of financing solutions tailored to their unique needs. These solutions encompass loans, credit lines, and other financial products designed to support business growth and expansion. Whether it's funding for capital investments, working capital, or operational expenses, UBB collaborates with businesses to provide flexible financing options.

Cash Management: UBB offers cash management services that enable businesses to optimize their financial operations. These services assist in enhancing liquidity management, streamlining payment processes, and improving overall financial efficiency. Business clients can benefit from automated solutions, ensuring that their funds are effectively managed.

Trade Finance: UBB provides trade finance solutions to facilitate international trade transactions. Businesses engaged in import and export activities can rely on UBB to handle the complexities of international trade, including letters of credit, documentary collections, and trade financing. These services help mitigate risks and ensure smoother cross-border trade.

POS Terminals and ATMs: UBB offers point-of-sale (POS) terminals and ATMs to businesses, allowing them to provide convenient payment options to customers. POS terminals enable secure card payments at brick-and-mortar locations, while ATMs provide 24/7 access to cash. These services enhance customer satisfaction and support businesses in expanding their payment capabilities.

Markets and Investments: UBB assists business clients in exploring investment opportunities across various markets. Whether it's investing in stocks, bonds, or other financial instruments, UBB offers guidance and access to investment platforms. This allows businesses to potentially diversify their portfolios and make informed investment decisions.

Business Partnership Package Advisor: As part of its business partnership package, UBB provides advisory services to businesses. These advisors offer expert insights and guidance to help businesses make informed financial decisions. UBB collaborates closely with business clients to understand their goals and tailor financial strategies that align with their objectives.

How to open an account?

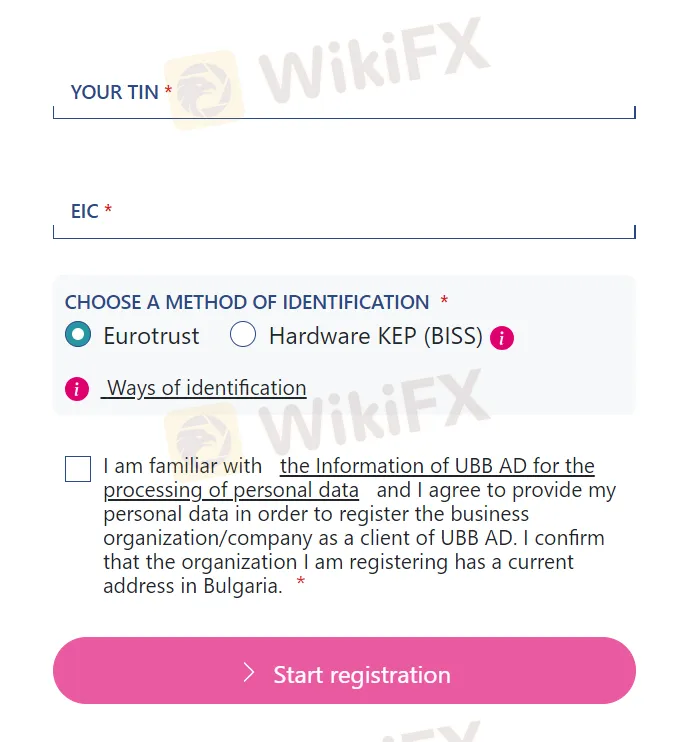

It needs to be noted that the main prerequisite of making an account for this company would be that the individual or business is required to have a Bulgarian ID.

In order to make an account, the user should first navigate to the home page and press the “Find out more” button.

This will forward the user to the account creation process where the user is able to input their TIN ID and EIC. After this, the user needs to choose their method of identification to confirm Bulgarian residency.

Finally, the user is prompted to enter personal information, which completes the account creation process.

Minimum Deposit

UBB sets specific minimum deposit rates for its clients, tailoring them to the chosen asset class and account type. For individual clients, the minimum deposit for different asset classes varies, with a minimum of $10 required for Forex trading, while Bulgarian Stocks, Commodities, and International Indices each necessitate a minimum deposit of $100. On the other hand, business clients' minimum deposit rates are contingent on their chosen asset class and specific financial requirements, with the exact figures varying accordingly.

Leverage

UBB offers varying leverage ratios across different asset classes, allowing clients to adjust their risk exposure in accordance with their trading preferences. The maximum leverage available for Forex trading is 1:1000, while for Bulgarian Stocks, it stands at 1:500. Commodities and International Indices provide leverage of up to 1:200. Cryptocurrency trading offers a maximum leverage of 1:100. The flexibility in leverage options caters to a range of trading strategies and risk profiles.

Deposit & Withdrawal

UBB offers a range of deposit and withdrawal methods to facilitate financial transactions for its clients. These methods include bank transfers, credit/debit cards, and e-wallets, including Skrill, Neteller, and PayPal. Clients can initiate deposits through these channels, with a minimum deposit amount of $10 for all account types. Additionally, UBB has defined maximum withdrawal limits of $10,000 per day and $50,000 per week. These options provide flexibility for clients to manage their funds effectively and engage in trading activities.

Trading Platforms

UBB provides a range of trading platforms, including MetaTrader 4, MetaTrader 5, WebTrader, and UBB Mobile, ensuring flexibility and convenience for clients.

MetaTrader 4/5: UBB offers the widely recognized MetaTrader 4 platform, known for its advanced charting tools and expert advisors, providing a comprehensive trading experience. Clients can also access the MetaTrader 5 platform, which builds upon the features of its predecessor, offering enhanced capabilities for traders.

WebTrader: UBB provides a user-friendly web-based trading platform, known as WebTrader, which allows clients to access their accounts and trade from any web browser.

UBB Mobile: For traders on the go, UBB offers the UBB Mobile platform, ensuring flexibility and convenience through mobile devices.

Comparison of Trading Platforms:

| Broker | Trading Platforms |

| UBB | MetaTrader 4, MetaTrader 5, WebTrader, UBB Mobile |

| FXTM | MetaTrader 4, MetaTrader 5 |

| Exness | MetaTrader 4, MetaTrader 5, Exness WebTrader, Exness Mobile |

| Pepperstone | MetaTrader 4, MetaTrader 5, cTrader, Pepperstone WebTrader, Pepperstone Mobile |

| FP Markets | MetaTrader 4, MetaTrader 5, IRESS, FP Markets Mobile |

Customer Support

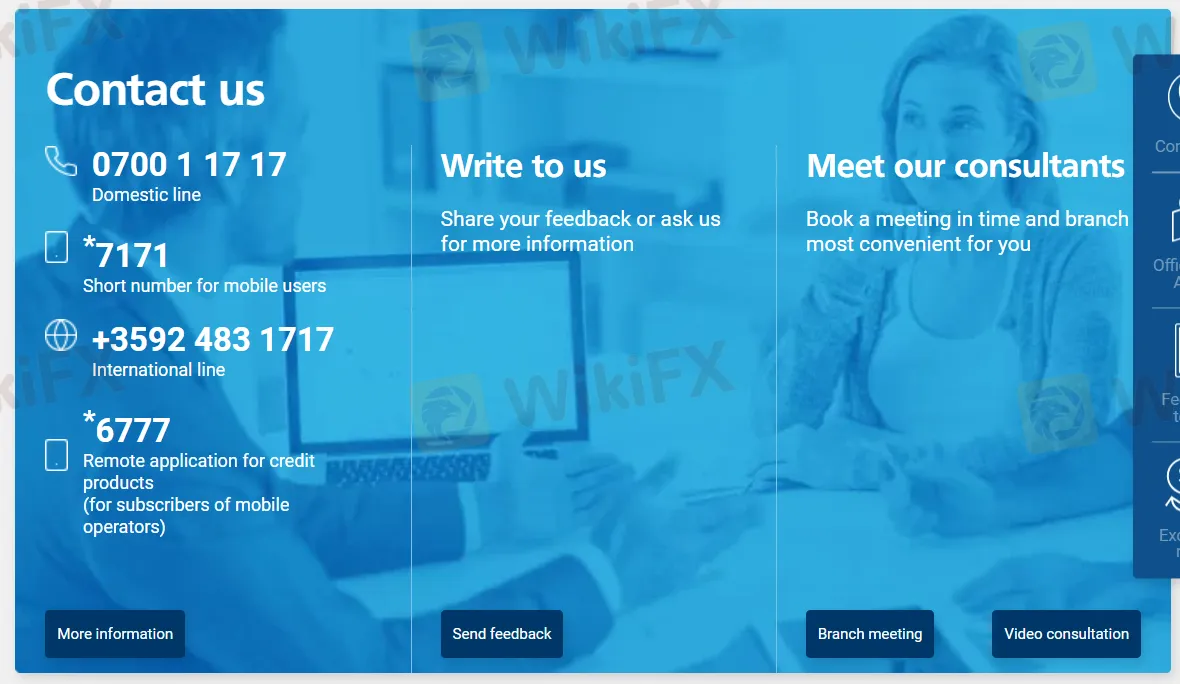

UBB offers customer support through multiple channels to assist clients efficiently. Clients can reach UBB's English-language support through phone at +35924831717 or the dedicated Bulgarian customer support line at 0700 1 17 17. These phone lines provide direct access to assistance for inquiries or concerns.

Community Support

UBB actively engages with its community through various social media platforms, fostering communication, and providing information to clients and interested individuals.

Facebook: UBB maintains an active presence on Facebook, where they share updates and engage with their community. Clients and interested individuals can connect with UBB on their official Facebook page: https://www.facebook.com/UnitedBulgarianBank?fref=ts

Instagram: UBB utilizes Instagram as a platform to share visual content and updates. Those interested can follow UBB on Instagram: https://www.instagram.com/unitedbulgarianbank/

YouTube: UBB offers video content on their YouTube channel, providing informative resources and possibly engaging with their audience: https://www.youtube.com/user/ubbbg

LinkedIn: On LinkedIn, UBB maintains a professional presence, possibly sharing industry insights and updates. Individuals and businesses interested in connecting with UBB can do so on LinkedIn: https://www.linkedin.com/company/united-bulgarian-bank

Conclusion

UBB, a recently established financial institution with operations that are not regulated, extends a comprehensive array of financial services to both individual and business clients. These services encompass a diverse range of market instruments, including forex trading across multiple currencies, access to Bulgarian stocks, commodities, and international indices. UBB offers distinct account types to cater to the varied financial needs of its clientele, each characterized by specific minimum deposit requirements and leverage ratios.

Additionally, clients can access their trading activities through an assortment of platforms, . UBB further supports its clientele through diverse deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets. The company actively engages with its community through a variety of social media platforms, enhancing its outreach and providing updates to its audience. While UBB is an emerging player in the financial industry, its commitment to providing comprehensive financial solutions reflects its dedication to serving the needs of its clients.

FAQs

Q: How does UBB differentiate itself from competitors in terms of market offerings?

A: UBB stands out by providing a wide array of tradable assets, including forex, Bulgarian stocks, commodities, and international indices.

Q: What are the options for individuals looking to start trading with UBB?

A: Individuals can choose from various account types, each with different minimum deposit requirements and leverage ratios.

Q: What trading platforms are available for clients seeking flexibility in their trading experience?

A: UBB offers MetaTrader 4, MetaTrader 5, WebTrader, and UBB Mobile as trading platforms for its clients.

Q: How can clients manage their finances with UBB?

A: Clients can handle their funds through various deposit and withdrawal methods, such as bank transfers, credit/debit cards, Skrill, Neteller, and PayPal.

Q: Does UBB engage with its community, and if so, how?

A: Yes, UBB actively interacts with its community through social media platforms like Facebook, Instagram, YouTube, and LinkedIn.

Q: What sets UBB apart in terms of customer support?

A: UBB provides customer support in both English and Bulgarian through phone channels, ensuring accessibility and assistance to clients.

WikiFX 브로커

요금 계산