DEFX Markets

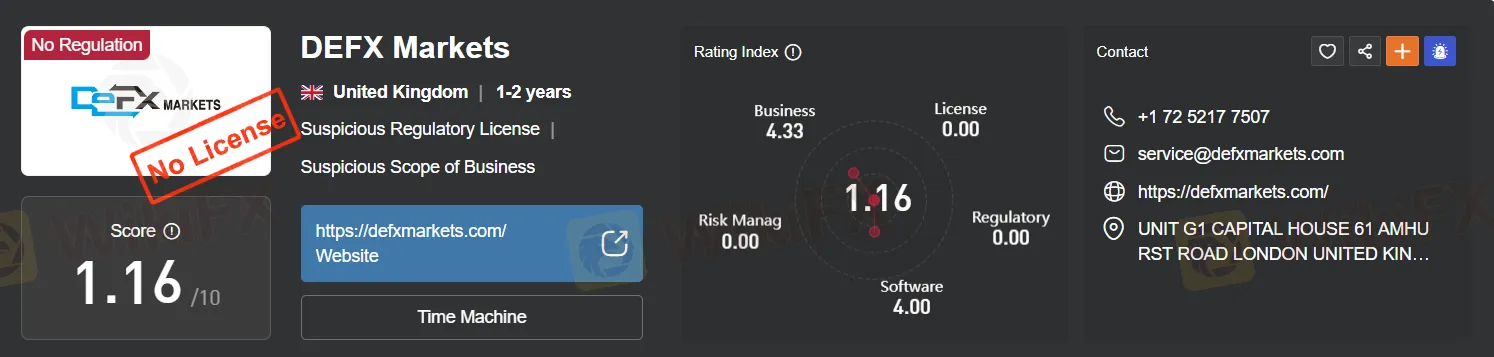

요약: DEFX Markets, based in the United Kingdom (UK) and founded in 2020, operates without any regulatory oversight, which raises significant concerns about the security and transparency of its trading activities. Traders should exercise caution when considering this platform, given the absence of regulation. Additionally, the broker provides limited customer support options, with the only contact method being an email address. Reports of DEFX Markets being labeled as a scam and its website's potentially suspicious behavior, such as redirection to Google.com, further undermine its credibility. The absence of an online presence on popular social media platforms adds to the overall negative tone surrounding this broker.

| Aspect | Information |

| Registered Country/Area | United Kingdom (UK) |

| Founded Year | 2020 |

| Company Name | DEFX Markets |

| Regulation | Not regulated |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Starting from 1.0 pips (varies by account type) |

| Trading Platforms | WebTrader |

| Tradable Assets | Commodities, Stock CFDs, ETFs, Forex, Indices, Metals, Cryptocurrencies |

| Account Types | Live Account |

| Demo Account | Available |

| Islamic Account | Available (Swap-Free accounts) |

| Customer Support | Limited customer support options, Email: service@defxmarkets.com |

| Payment Methods | Bank Transfer, Visa, MasterCard, Cryptocurrency, Online E-wallets |

| Educational Tools | Not provided |

| Website Status | Potentially suspicious website behavior (redirects to Google.com) |

| Reputation (Scam or Not) | Reports of being labeled as a scam, credibility concerns |

| Social Media Presence | Absence on popular social media platforms |

Overview

DEFX Markets, based in the United Kingdom (UK) and founded in 2020, operates without any regulatory oversight, which raises significant concerns about the security and transparency of its trading activities. Traders should exercise caution when considering this platform, given the absence of regulation. Additionally, the broker provides limited customer support options, with the only contact method being an email address. Reports of DEFX Markets being labeled as a scam and its website's potentially suspicious behavior, such as redirection to Google.com, further undermine its credibility. The absence of an online presence on popular social media platforms adds to the overall negative tone surrounding this broker.

Regulation

DEFX Markets operates without any regulatory oversight as a broker, which raises concerns about the security and transparency of its trading activities. Traders should exercise caution when considering this platform, as the absence of regulation can leave them vulnerable to potential risks and fraudulent activities. It is advisable to choose brokers that are properly regulated by reputable authorities to ensure a safer trading experience.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

DEFX Markets presents a mixed picture for traders. On one hand, it offers a diverse range of market instruments, competitive spreads, and high leverage options, catering to various trading preferences. The availability of account types, including Swap-Free accounts, and support for cryptocurrency trading adds to its appeal.

However, significant concerns arise due to the lack of regulatory oversight, which raises doubts about the broker's security and transparency. The absence of educational resources and limited customer support options, including the absence of a social media presence, hinder traders' ability to access educational materials and seek assistance effectively. Additionally, reports of it being labeled as a scam and the suspicious website behavior further erode confidence in the platform. Traders should carefully consider these pros and cons when evaluating whether to trade with DEFX Markets.

Market Instruments

The market instruments offered by this platform encompass a wide range of financial products:

Commodities: Traders can engage in the buying and selling of various physical commodities such as oil, gold, silver, agricultural products, and more, either through futures contracts or spot market trading.

Stock CFDs: Contract for Difference (CFD) products allow traders to speculate on the price movements of individual stocks without owning the underlying assets. This offers flexibility and the potential for profit in both rising and falling markets.

ETFs (Exchange-Traded Funds): ETFs are investment funds that track the performance of a specific index, commodity, or basket of assets. Traders can invest in a diversified portfolio of assets without having to buy each component individually.

Forex (Foreign Exchange): Forex trading involves the exchange of one currency for another in the global foreign exchange market. It is one of the largest and most liquid markets in the world, allowing traders to profit from currency price fluctuations.

Indices: Indices represent a selection of stocks or other assets that collectively reflect the performance of a specific market or sector. Traders can speculate on the overall movement of these indices rather than individual stocks.

Metals: This category typically includes precious metals like gold, silver, platinum, and palladium. Traders can trade these metals, often as commodities or spot market instruments, for investment or hedging purposes.

These market instruments cater to various trading strategies and risk appetites, allowing traders to diversify their portfolios and potentially capitalize on different market conditions and trends. However, it's important for traders to thoroughly understand the risks associated with each instrument and have a well-defined trading strategy before participating in these markets.

Account Types

This broker offers a single account type known as the “Live Account.” To get started, traders are required to make a minimum deposit of $100, making it accessible for both novice and experienced traders. The base currencies supported for trading are USD and EUR, providing flexibility for traders from different regions. The order execution method employed by this broker is Market Execution, ensuring that trades are executed at the prevailing market prices.

One notable feature of this account is the high maximum leverage of 1:500, which can magnify both potential profits and losses. However, traders should exercise caution when using such high leverage, as it comes with increased risk. The starting spreads are competitive, beginning at 1.0 pips, which may vary depending on the specific trading instruments.

Traders can start trading with a trade size as low as 0.01 lots, allowing for precise position sizing and risk management. The range of available instruments is diverse and includes commodities, Stock CFDs, ETFs, Forex, Indices, and Metals. Additionally, the broker offers demo accounts for traders to practice and refine their strategies before committing real capital.

For traders who require specific account types to adhere to their religious beliefs, this broker offers Swap-Free accounts, also known as Islamic accounts. These accounts do not involve interest charges or payments on overnight positions, aligning with Shariah law principles.

Furthermore, the broker supports crypto trading, allowing traders to participate in the cryptocurrency markets. Crypto trading has gained popularity, and this feature provides access to a variety of digital assets.

Finally, the platform offers CopyTrading, allowing traders to follow and replicate the trades of more experienced traders on the platform. This can be a valuable feature for those who wish to benefit from the expertise of others while learning and building their trading skills.

Overall, the broker's Live Account appears to offer a range of features and flexibility, catering to traders with different preferences and experience levels. However, it's essential for traders to thoroughly understand the terms and conditions associated with this account and carefully consider factors like leverage and spreads before opening an account with the broker.

Leverage

This broker provides a maximum trading leverage of up to 1:500, allowing traders to control positions worth 500 times their account balance. While high leverage can amplify gains, it also significantly increases the risk of substantial losses. Traders should exercise caution, employ risk management strategies, and consider their experience and risk tolerance when using such high leverage.

Spreads and Commissions

The spreads and commissions offered by this broker vary depending on the specific trading accounts available. While the provided information mentions starting spreads of 1.0 pips for the Live Account, it does not detail the commission structure.

It's essential for traders to carefully review the broker's website or contact their customer support to get a comprehensive understanding of the spreads and commissions associated with different trading accounts. Understanding these costs is crucial for evaluating the overall cost of trading and making informed decisions based on individual trading preferences and strategies.

Deposit & Withdrawal

This broker offers a range of deposit and withdrawal methods to accommodate the diverse preferences of its clients:

Deposit Methods:

Bank Transfer: Traders can fund their accounts through traditional bank transfers, providing a secure and straightforward way to deposit funds directly from their bank accounts.

Visa and MasterCard: Credit and debit card options, such as Visa and MasterCard, allow for quick and convenient deposits, enabling traders to use their cards to fund their trading accounts.

Crypto: Cryptocurrency deposits are supported, which means traders can use various cryptocurrencies to add funds to their accounts, offering a level of anonymity and flexibility.

Online E-wallets: The inclusion of online e-wallets allows traders to deposit funds via popular e-wallet services, making transactions efficient and often faster than traditional banking methods.

Withdrawal Methods:

Bank Transfer: Withdrawals can be made via bank transfer, ensuring that traders can securely transfer their profits or remaining account balance to their bank accounts.

Visa and MasterCard: Withdrawals to Visa and MasterCard are available, offering a convenient way for traders to access their funds.

Crypto: Withdrawals in cryptocurrency are supported, allowing traders to receive their funds in digital currencies.

Online E-wallets: Similar to deposits, e-wallets can be used for withdrawals, offering a swift and efficient way to access funds.

It's important to note that while these methods are available, the specific processing times, fees (if any), and currency conversion rates may vary depending on the broker's policies and the trader's location. Traders should review the broker's terms and conditions for detailed information on deposit and withdrawal procedures to ensure they align with their needs and preferences.

Trading Platforms

This broker offers a user-friendly trading platform known as WebTrader, which enables traders to access the financial markets directly from their web browsers. WebTrader is a versatile platform, providing convenient web-based trading without the need for software downloads or installations. It offers essential trading tools, real-time market data, charting capabilities, and a seamless user interface, making it accessible to traders on various devices, including desktops and laptops. Additionally, with mobile trading support, traders can also access the platform on smartphones and tablets, allowing for flexibility and convenience in executing trades and managing their portfolios.

Customer Support

The customer support options provided by this broker appear to be severely limited. There is no presence on popular social media platforms such as Twitter, Facebook, Instagram, or YouTube, which are commonly used by companies to communicate with and provide updates to their clients. Additionally, there are no links to professional networking sites like LinkedIn, and the absence of communication channels like WhatsApp, QQ, and WeChat further restricts the avenues for customer interaction. While there is an email address provided for customer service inquiries, the lack of multiple communication channels and a more comprehensive online presence may make it challenging for clients to seek assistance and stay informed about important updates from the broker.

Educational Resources

It appears that this broker does not offer any educational resources to assist traders in expanding their knowledge and improving their trading skills. The absence of educational materials, such as articles, webinars, video tutorials, or written guides, may limit the ability of traders, especially beginners, to gain insights and enhance their understanding of the financial markets. It is advisable for traders to consider brokers that provide comprehensive educational resources to support their trading journey and help them make informed decisions.

Summary

DEFX Markets presents several concerning aspects that potential traders should be cautious about. Firstly, the broker operates without any regulatory oversight, which raises significant concerns regarding the security and transparency of its trading activities, potentially leaving traders vulnerable to risks and fraudulent activities. Additionally, the absence of educational resources limits traders' ability to enhance their trading knowledge and skills.

Moreover, the limited customer support options, including the absence of a presence on popular social media platforms and professional networking sites, as well as the lack of communication channels like WhatsApp and WeChat, may hinder effective client communication and assistance. Furthermore, the website's redirection to Google.com appears suspicious, raising questions about the broker's credibility. Finally, reports of it being labeled as a scam should serve as a red flag and prompt potential traders to exercise extreme caution when considering this platform

FAQs

Q: Is DEFX Markets a regulated broker?

A: No, DEFX Markets operates without any regulatory oversight, which means it lacks the oversight and protections provided by reputable financial authorities.

Q: What is the minimum deposit required to open a Live Account?

A: To open a Live Account with DEFX Markets, you need a minimum deposit of $100.

Q: Does DEFX Markets offer educational resources for traders?

A: No, there are no educational resources provided by DEFX Markets to help traders improve their knowledge and skills.

Q: Are there any social media accounts or active communication channels for customer support?

A: No, DEFX Markets lacks a presence on social media platforms and does not offer communication channels like WhatsApp or WeChat for customer support.

Q: Is DEFX Markets associated with any scam reports?

A: Yes, there have been reports of DEFX Markets being labeled as a scam, which raises significant concerns about its credibility and trustworthiness as a trading platform.

WikiFX 브로커

주요뉴스

"발렌타인 앱테크 이벤트" 당첨자 발표

2025 WikiFX 외환 권리 보호의 날 미리보기: 진실을 밝히고 거래 보안을 보호하다

벚꽃 앱테크 이벤트, 네이버페이 5,000원 받아가세요!

요금 계산