RockFordFX

요약:Established in 2021, RockFordFX is a multi-asset broker registered in the UK, offering various trading options, including forex, indices, stocks, commodities and digital currencies. However, RockFordFX operates without regulatory oversight from any reputable financial body.

Note: RockFordFX's official website: https://www.rockfordfx.com/ is currently inaccessible normally.

| RockFordFXReview Summary | |

| Founded | 2021 |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | Forex, indices, stocks, commodities and digital currencies |

| Demo Account | ❌ |

| Leverage | Up to 1:400 |

| Spread | From 0.1 pips |

| Trading Platform | MT4, RockFordGX Web Trader |

| Min Deposit | $250 |

| Customer Support | Tel: +44 2038073479 |

| Email: support@RockFordFX.com | |

Established in 2021, RockFordFX is a multi-asset broker registered in the UK, offering various trading options, including forex, indices, stocks, commodities and digital currencies. However, RockFordFX operates without regulatory oversight from any reputable financial body.

Pros and Cons

| Pros | Cons |

| Diverse trading choices | Unregulated status |

| Variety of account types | Inaccessible website |

| Commission-free | High minimum deposit |

| MT4 supported | Unusual fees |

Is RockFordFX Legit?

No, RockFordFX is not regulated and their website is not available.

What Can I Trade on RockFordFX?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

RockFordFX offers three account types: Individual, Gr-Trader and Business.

| Account Type | Min Deposit |

| Individual | $250 |

| Gr-Trader | $25500 |

| Business | $25 000 |

Leverage

RockFordFX offers different leverage ratios for three account types.

| Account Type | Leverage |

| Individual | 1:200 |

| Gr-Trader | 1:300 |

| Business | 1:400 |

Spread and Commission

| Account Type | Spread | Commission |

| Individual | 0.1 pips | ❌ |

| Gr-Trader | 0.5 pips | ❌ |

| Business | 1.3 pips | ❌ |

Trading Platform

RockFordFX claims that it offers two trading platforms – the industry flagship MetaTrader 4 (MT4) and its proprietary web platform RockFordGX Web Trader for their traders.

Deposit and Withdrawal

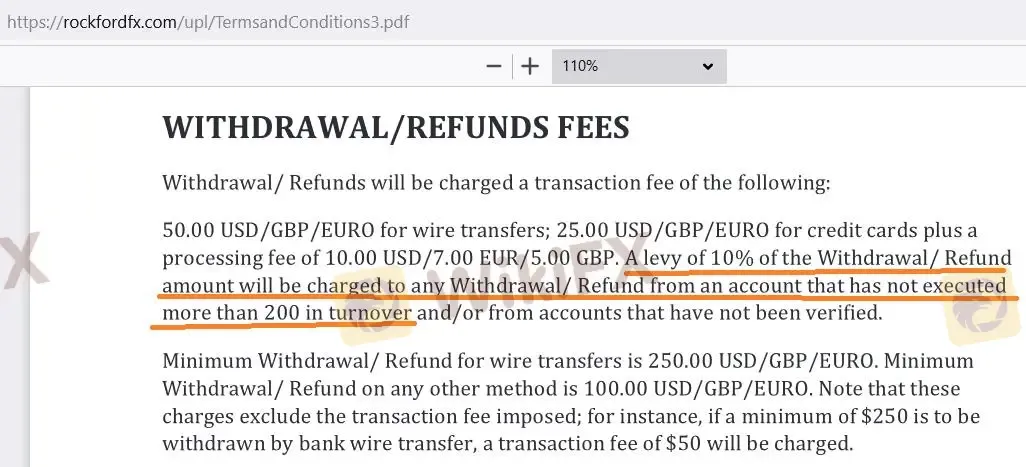

RockFordFX accepts credit cards and wire transfers as payment methods. RockFordFX claims that Minimum Deposit is $250.

Minimum Withdrawal/Refunds for wire transfers is 250 USD/GBP/EURO. Minimum Withdrawal/Refunds for credit cards is 100 USD/GBP/EURO.

| Payment Option | Min Deposit | MinWithdrawal/Refund | Withdrawal/RefundFee |

| Wire transfers | $250 | 250 USD/GBP/EURO | Transaction fee of 50 USD/GBP/EURO |

| Credit cards | $250 | 100 USD/GBP/EURO | Transaction fee of 50 USD/GBP/EURO, processing fee of 10 USD/7 EUR/5 GDP |

WikiFX 브로커

주요뉴스

트럼프 ‘관세 폭탄’에 금값 사상 최고치 경신! 향후 전망은?

WikiEXPO, Liberland 정부 공식 협력 파트너로 선정, 함께 글로벌 금융 거래의 안전을 지켜나갑니다

1월 한국 물가상승률 2.2% 증가, 원·달러 환율이 겪을 난제

요금 계산