2020-10-09 15:08

시장 분석INDIAN RUPEE, USD/INR UPDATE

관련 상품:

외환,기타,기타,기타,기타,기타

시장 분석:

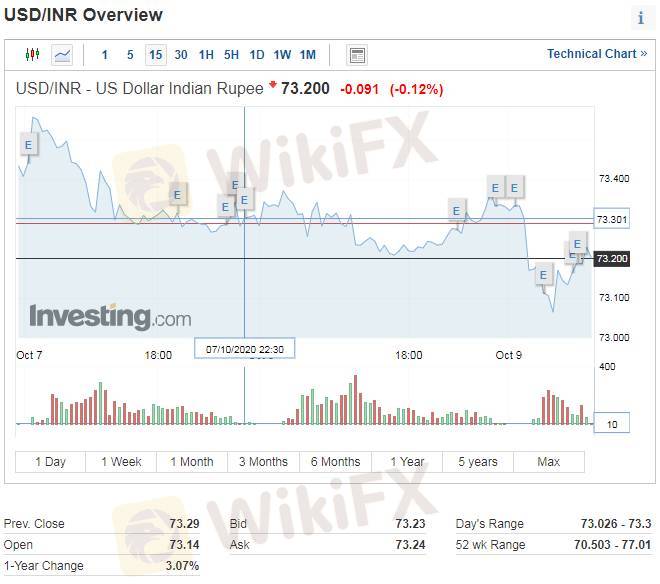

After being postponed to this week, the Indian Rupee and Nifty 50 are awaiting today’s Reserve Bank of India (RBI) monetary policy announcement at 6:15 GMT. The central bank is anticipated to maintain benchmark lending rates unchanged following recent upward pressures on inflation.

The RBI will also offer updated estimates for growth in the new fiscal year. For a further analysis of the interest rate decision, check out my outline here. What are the technical circumstances USD/INR and the Nifty are facing?

The Indian Rupee has been struggling to find further progress against the US Dollar after USD/INR fell under short-term rising support from late August. This has shifted the setting into a consolidative state where the pair is ranging between 72.76 and 74.04. A breakout to the downside would open the door to downtrend resumption towards the 72.14 – 72.40 inflection zone.

For upside scenarios, keep a close eye on the medium-term 50-day Simple Moving Average.

callmemaybe

Trader

인기있는 콘텐츠

시장 분석

투자주체별매매 동향

시장 분석

유로존 경제 쇠퇴 위기 직면

시장 분석

국제 유가는 어디로

시장 분석

미국증시 레버리지(Leverage)·인버스(Inverse)형의 ETF, 최근 사상 최대 신

시장 분석

투기장 된 원유 ETL...첫 투자위험 발령

시장 분석

RBNZ 양적완화 확대

포럼 카테고리

플랫폼

전시회

대리상

신병 모집

EA

업계에서

시장

인덱스

INDIAN RUPEE, USD/INR UPDATE

인도 | 2020-10-09 15:08

인도 | 2020-10-09 15:08After being postponed to this week, the Indian Rupee and Nifty 50 are awaiting today’s Reserve Bank of India (RBI) monetary policy announcement at 6:15 GMT. The central bank is anticipated to maintain benchmark lending rates unchanged following recent upward pressures on inflation.

The RBI will also offer updated estimates for growth in the new fiscal year. For a further analysis of the interest rate decision, check out my outline here. What are the technical circumstances USD/INR and the Nifty are facing?

The Indian Rupee has been struggling to find further progress against the US Dollar after USD/INR fell under short-term rising support from late August. This has shifted the setting into a consolidative state where the pair is ranging between 72.76 and 74.04. A breakout to the downside would open the door to downtrend resumption towards the 72.14 – 72.40 inflection zone.

For upside scenarios, keep a close eye on the medium-term 50-day Simple Moving Average.

외환

기타

기타

기타

기타

기타

좋아요 1

나 도 댓 글 달 래.

제출

0코멘트

댓글이 아직 없습니다. 첫 번째를 만드십시오.

제출

댓글이 아직 없습니다. 첫 번째를 만드십시오.