2024-07-22 11:35

업계AUDUSD H4 Report - 22 July 2024

combined with selling pressure following a rebound in the yen, have dampened bullish sentiment on the Australian dollar (AUD). Although Australia's employment market data should have boosted the AUD, the market reaction has been subdued. Futures suggest only a 20% chance of an interest rate hike by the Reserve Bank of Australia (RBA) at its August meeting. The data failed to provide upward momentum for the AUD. Additionally, the strong rebound of the US dollar (USD) on the day, which rose to 104.4, continued to exert downward pressure on the AUD. President Biden’s withdrawal from the election increased risk aversion, but the upcoming US GDP and PCE data releases this week could result in significant volatility for the AUD.

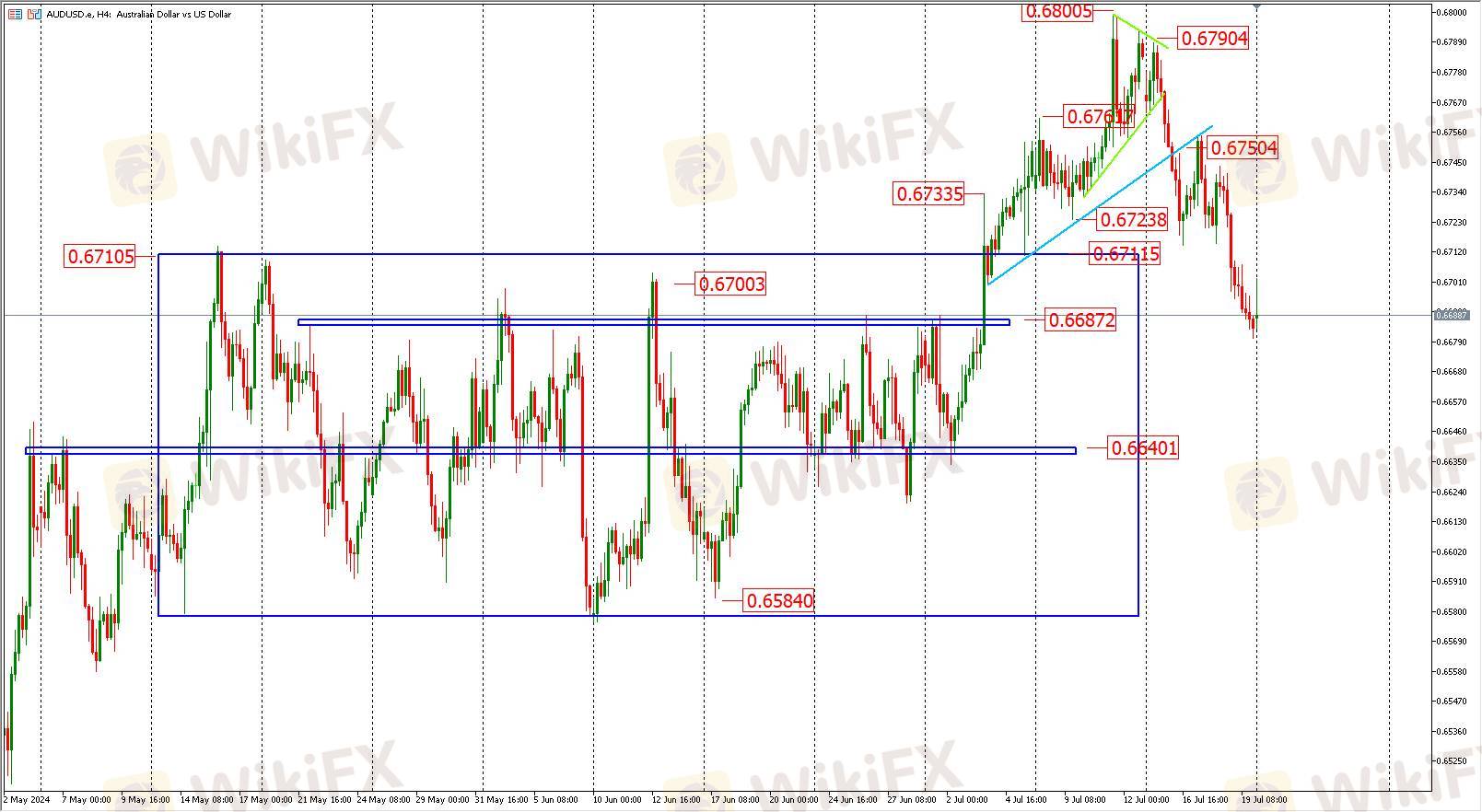

Technical Analysis:

The AUD’s decline last week wiped out the gains from the previous two weeks, closing near the high of the last week of June around 0.668, which serves as the second support platform from the past eight weeks of fluctuations. Close attention should be paid to the support level at 0.668. If this level is breached, the AUD may fluctuate within the 0.668-0.664 range. If the 0.668 support holds, the AUD may continue to trade within the 0.668-0.671 range.

Key Levels:

Resistance: First level at 0.670, second level at 0.671, third level at 0.673.

Support: First level at 0.668, second level at 0.666, third level at 0.664.

좋아요 0

FPGv 我baconjellyy

交易者

인기있는 콘텐츠

시장 분석

투자주체별매매 동향

시장 분석

유로존 경제 쇠퇴 위기 직면

시장 분석

국제 유가는 어디로

시장 분석

미국증시 레버리지(Leverage)·인버스(Inverse)형의 ETF, 최근 사상 최대 신

시장 분석

투기장 된 원유 ETL...첫 투자위험 발령

시장 분석

RBNZ 양적완화 확대

포럼 카테고리

플랫폼

전시회

IB

모집

EA

업계

시세

인덱스

AUDUSD H4 Report - 22 July 2024

| 2024-07-22 11:35

| 2024-07-22 11:35combined with selling pressure following a rebound in the yen, have dampened bullish sentiment on the Australian dollar (AUD). Although Australia's employment market data should have boosted the AUD, the market reaction has been subdued. Futures suggest only a 20% chance of an interest rate hike by the Reserve Bank of Australia (RBA) at its August meeting. The data failed to provide upward momentum for the AUD. Additionally, the strong rebound of the US dollar (USD) on the day, which rose to 104.4, continued to exert downward pressure on the AUD. President Biden’s withdrawal from the election increased risk aversion, but the upcoming US GDP and PCE data releases this week could result in significant volatility for the AUD.

Technical Analysis:

The AUD’s decline last week wiped out the gains from the previous two weeks, closing near the high of the last week of June around 0.668, which serves as the second support platform from the past eight weeks of fluctuations. Close attention should be paid to the support level at 0.668. If this level is breached, the AUD may fluctuate within the 0.668-0.664 range. If the 0.668 support holds, the AUD may continue to trade within the 0.668-0.671 range.

Key Levels:

Resistance: First level at 0.670, second level at 0.671, third level at 0.673.

Support: First level at 0.668, second level at 0.666, third level at 0.664.

좋아요 0

나 도 댓 글 달 래.

제출

0코멘트

댓글이 아직 없습니다. 첫 번째를 만드십시오.

제출

댓글이 아직 없습니다. 첫 번째를 만드십시오.