2024-11-06 22:57

업계에서Trump Sends Gold to 2300?

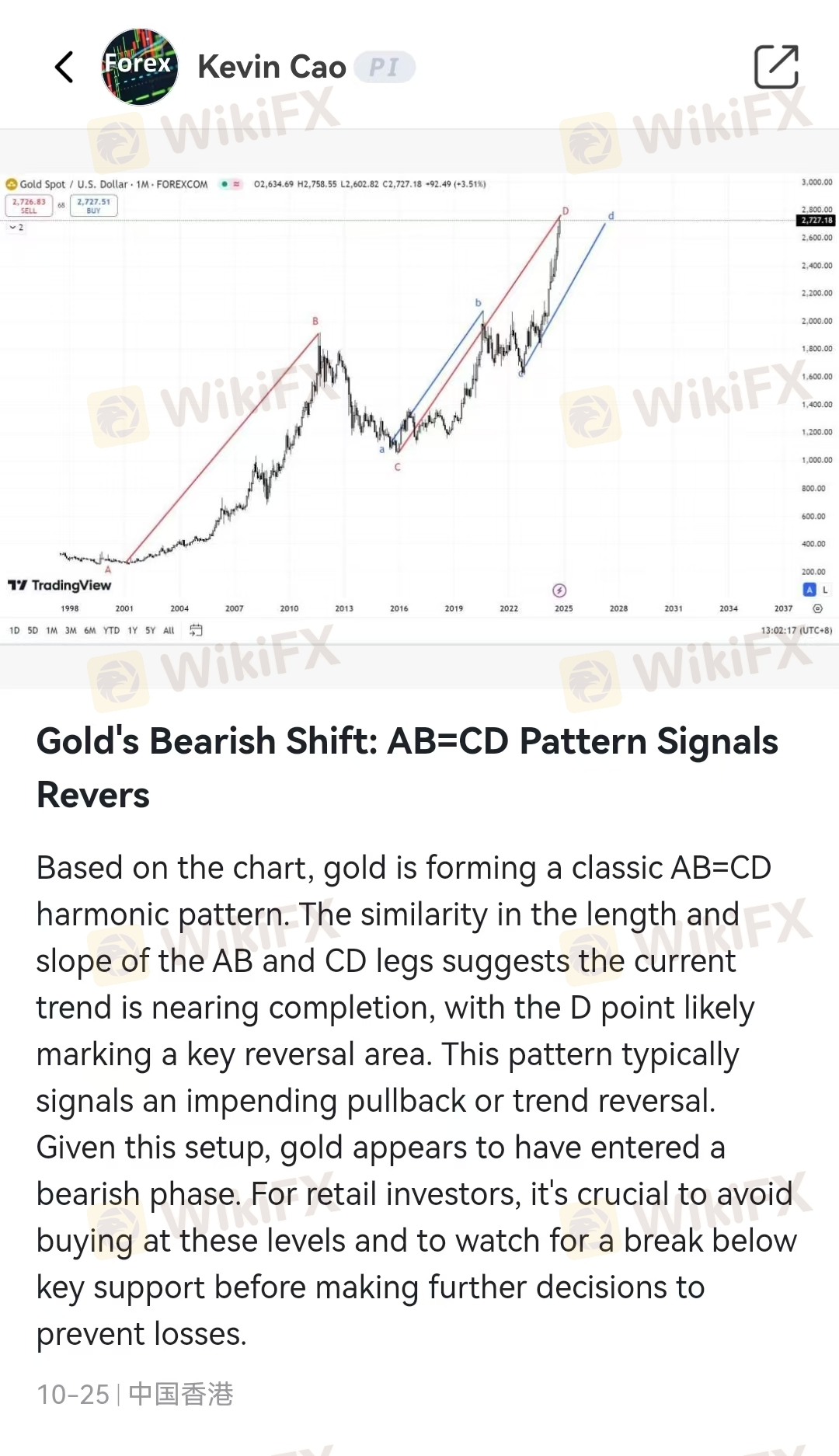

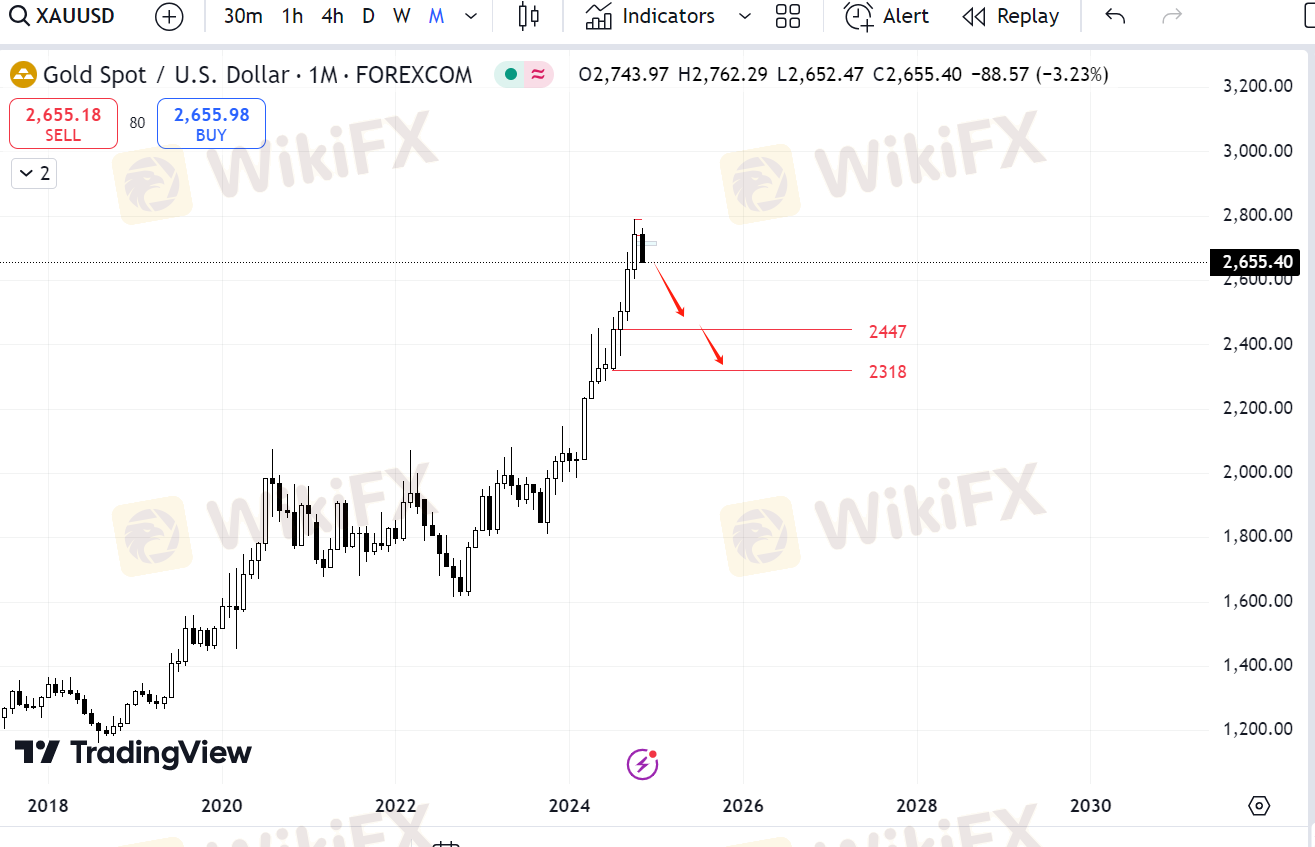

On October 25, the author shared a bearish mid-term outlook for gold, anticipating downward pressure. Today, influenced by the U.S. election, gold prices dropped sharply, entering a mid-term bear market. With political factors affecting sentiment and reduced demand for safe-haven assets, coupled with a stronger dollar, the downward trend has intensified.

US Election Sends Gold to $2300-$2400,,,,,,,,,,,,,,,,,,,,,,,,,,,,,On October 25, the author shared a bearish mid-term outlook for gold, anticipating downward pressure. Today, influenced by the U.S. election, gold prices dropped sharply, entering a mid-term bear market. With political factors affecting sentiment and reduced demand for safe-haven assets, coupled with a stronger dollar, the downward trend has intensified.

The mid-term target range for gold is now set at $2300-$2400. In this range, volatility is expected, yet the overall bearish pressure remains strong. As election results settle, further market adjustments may follow. mid-term target range for gold is now set at $2300-$2400. In this range, volatility is expected, yet the overall bearish pressure remains strong. As election results settle, further market adjustments may follow.

좋아요 0

Kevin Cao

거래자

인기있는 콘텐츠

시장 분석

투자주체별매매 동향

시장 분석

유로존 경제 쇠퇴 위기 직면

시장 분석

국제 유가는 어디로

시장 분석

미국증시 레버리지(Leverage)·인버스(Inverse)형의 ETF, 최근 사상 최대 신

시장 분석

투기장 된 원유 ETL...첫 투자위험 발령

시장 분석

RBNZ 양적완화 확대

포럼 카테고리

플랫폼

전시회

대리상

신병 모집

EA

업계에서

시장

인덱스

Trump Sends Gold to 2300?

홍콩 | 2024-11-06 22:57

홍콩 | 2024-11-06 22:57On October 25, the author shared a bearish mid-term outlook for gold, anticipating downward pressure. Today, influenced by the U.S. election, gold prices dropped sharply, entering a mid-term bear market. With political factors affecting sentiment and reduced demand for safe-haven assets, coupled with a stronger dollar, the downward trend has intensified.

US Election Sends Gold to $2300-$2400,,,,,,,,,,,,,,,,,,,,,,,,,,,,,On October 25, the author shared a bearish mid-term outlook for gold, anticipating downward pressure. Today, influenced by the U.S. election, gold prices dropped sharply, entering a mid-term bear market. With political factors affecting sentiment and reduced demand for safe-haven assets, coupled with a stronger dollar, the downward trend has intensified.

The mid-term target range for gold is now set at $2300-$2400. In this range, volatility is expected, yet the overall bearish pressure remains strong. As election results settle, further market adjustments may follow. mid-term target range for gold is now set at $2300-$2400. In this range, volatility is expected, yet the overall bearish pressure remains strong. As election results settle, further market adjustments may follow.

좋아요 0

나 도 댓 글 달 래.

제출

0코멘트

댓글이 아직 없습니다. 첫 번째를 만드십시오.

제출

댓글이 아직 없습니다. 첫 번째를 만드십시오.