2024-12-19 15:57

업계Yen Hits 5-Month Low as BOJ Stays on Hold

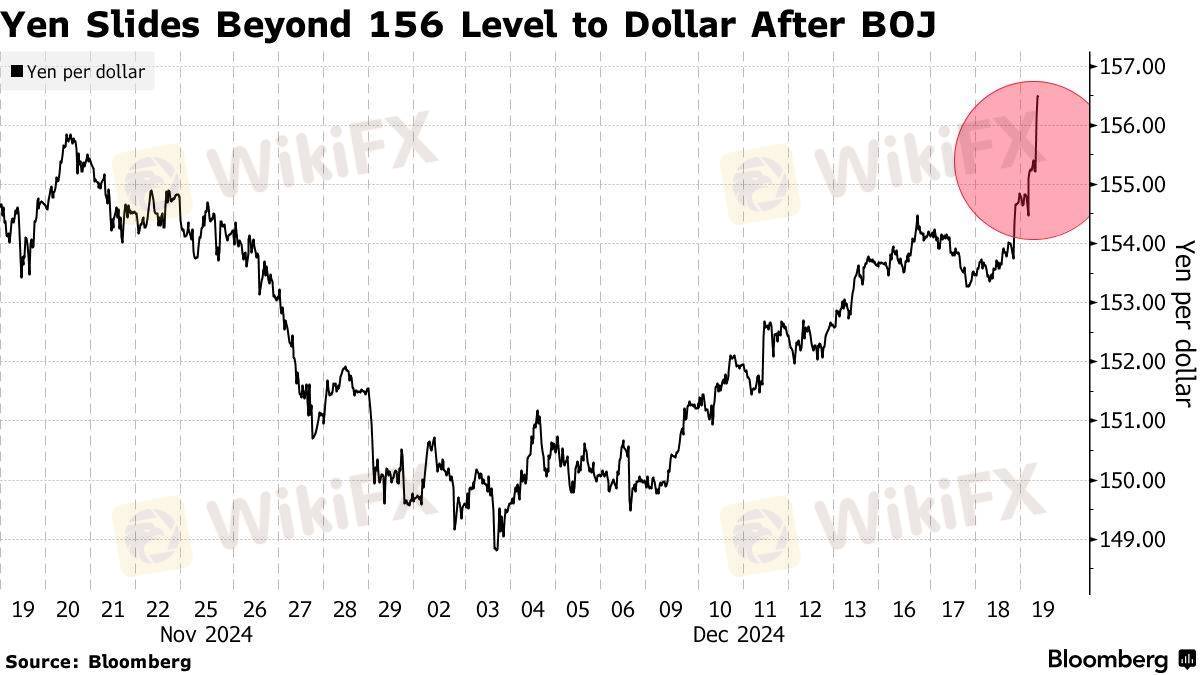

The yen slid 1.3% to 156.77 per USD, its weakest since July, after the BOJ held rates steady. Governor Ueda's remarks about monitoring wage talks dimmed hopes of a January hike, pushing rate hike odds to 49%.

Market doubts on BOJ’s resolve have fueled yen weakness, triggering speculation of verbal intervention from Japanese authorities. Currency strategists warn that yen vulnerability could deepen if the BOJ delays hikes beyond March.

With U.S. rate cuts in motion and Japan holding firm, the yen faces more volatility, with a potential slide to 160/USD in sight.

#Forex#BOJ #InterestRates #USDJPY

좋아요 0

Gamma Squeezer

Trader

인기있는 콘텐츠

시장 분석

투자주체별매매 동향

시장 분석

유로존 경제 쇠퇴 위기 직면

시장 분석

국제 유가는 어디로

시장 분석

미국증시 레버리지(Leverage)·인버스(Inverse)형의 ETF, 최근 사상 최대 신

시장 분석

투기장 된 원유 ETL...첫 투자위험 발령

시장 분석

RBNZ 양적완화 확대

포럼 카테고리

플랫폼

전시회

IB

모집

EA

업계

시세

인덱스

Yen Hits 5-Month Low as BOJ Stays on Hold

| 2024-12-19 15:57

| 2024-12-19 15:57The yen slid 1.3% to 156.77 per USD, its weakest since July, after the BOJ held rates steady. Governor Ueda's remarks about monitoring wage talks dimmed hopes of a January hike, pushing rate hike odds to 49%.

Market doubts on BOJ’s resolve have fueled yen weakness, triggering speculation of verbal intervention from Japanese authorities. Currency strategists warn that yen vulnerability could deepen if the BOJ delays hikes beyond March.

With U.S. rate cuts in motion and Japan holding firm, the yen faces more volatility, with a potential slide to 160/USD in sight.

#Forex#BOJ #InterestRates #USDJPY

좋아요 0

나 도 댓 글 달 래.

제출

0코멘트

댓글이 아직 없습니다. 첫 번째를 만드십시오.

제출

댓글이 아직 없습니다. 첫 번째를 만드십시오.