2024-12-22 11:00

업계에서 Dividend Yields vs. Leverage Costs

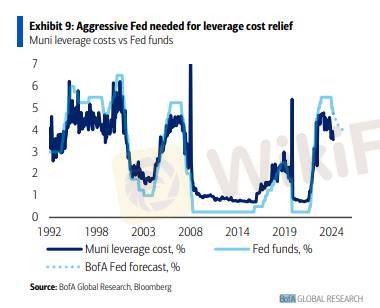

Recently, higher distribution yields have played a key role in narrowing market discounts. However, these distribution increases are essentially a gamble on favorable market conditions—namely, lower leverage costs and/or higher long-term bond yields.

If the Federal Reserve halts rate cuts at 4%, as economists predict, the decline in leverage costs may fall short of fund managers' expectations. In such a scenario, the sustainability of elevated distributions could face challenges, requiring investors to carefully weigh potential returns against underlying risks.

This uncertainty in the market environment serves as a reminder that relying solely on the narrowing of discounts driven by higher yields may lead to unexpected drawdowns. Therefore, prudent management of leverage and return expectations is more important than ever.

좋아요 0

Kevin Cao

거래자

인기있는 콘텐츠

시장 분석

투자주체별매매 동향

시장 분석

유로존 경제 쇠퇴 위기 직면

시장 분석

국제 유가는 어디로

시장 분석

미국증시 레버리지(Leverage)·인버스(Inverse)형의 ETF, 최근 사상 최대 신

시장 분석

투기장 된 원유 ETL...첫 투자위험 발령

시장 분석

RBNZ 양적완화 확대

포럼 카테고리

플랫폼

전시회

대리상

신병 모집

EA

업계에서

시장

인덱스

Dividend Yields vs. Leverage Costs

홍콩 | 2024-12-22 11:00

홍콩 | 2024-12-22 11:00Recently, higher distribution yields have played a key role in narrowing market discounts. However, these distribution increases are essentially a gamble on favorable market conditions—namely, lower leverage costs and/or higher long-term bond yields.

If the Federal Reserve halts rate cuts at 4%, as economists predict, the decline in leverage costs may fall short of fund managers' expectations. In such a scenario, the sustainability of elevated distributions could face challenges, requiring investors to carefully weigh potential returns against underlying risks.

This uncertainty in the market environment serves as a reminder that relying solely on the narrowing of discounts driven by higher yields may lead to unexpected drawdowns. Therefore, prudent management of leverage and return expectations is more important than ever.

좋아요 0

나 도 댓 글 달 래.

제출

0코멘트

댓글이 아직 없습니다. 첫 번째를 만드십시오.

제출

댓글이 아직 없습니다. 첫 번째를 만드십시오.