2024-12-25 21:51

업계에서Overview of the PO3 Trading Strategy

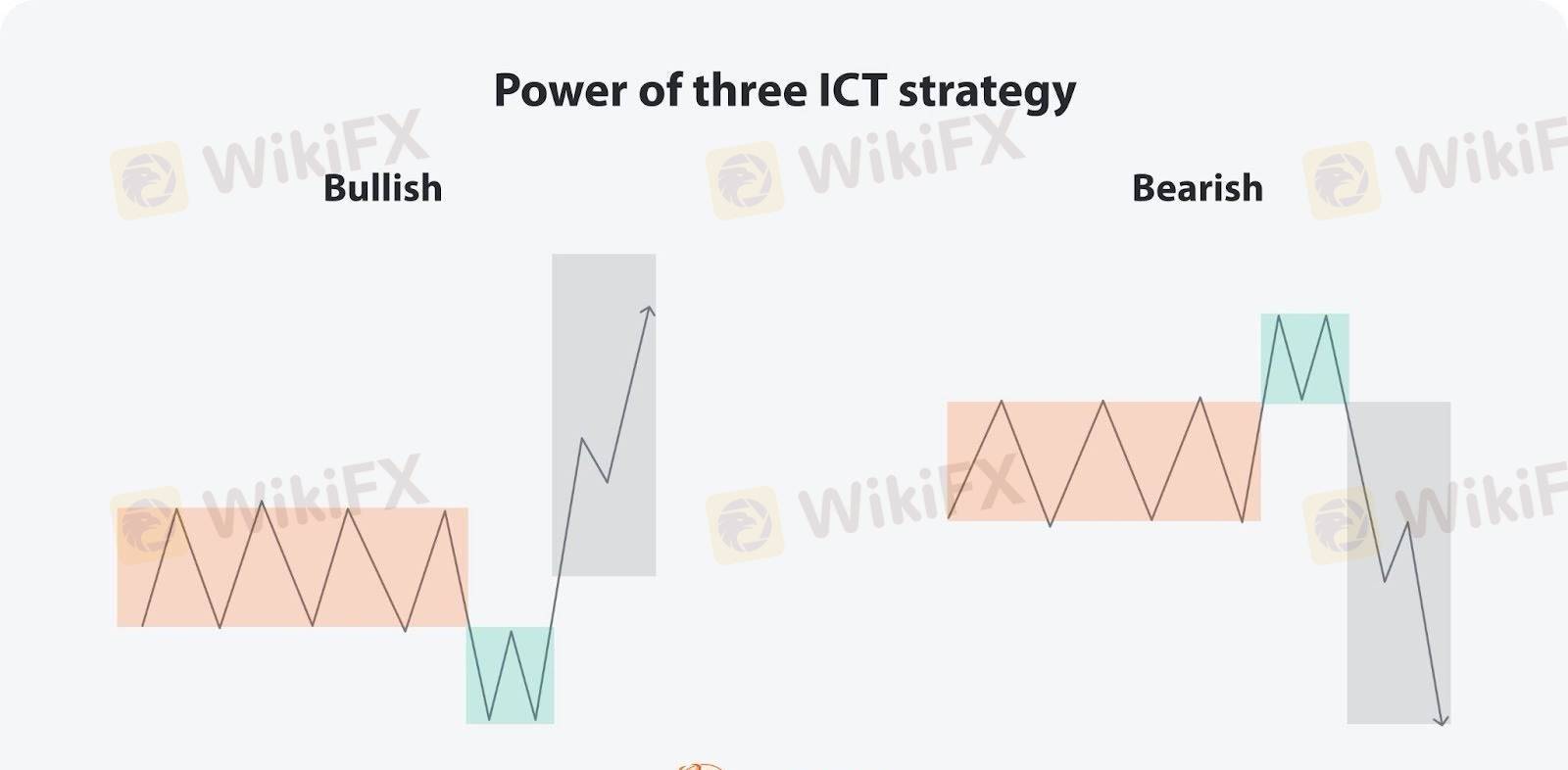

The Power of Three (PO3) is a concept introduced by ICT (Inner Circle Trader) that describes market price movements in three phases: Accumulation, Manipulation, and Distribution.

1. Accumulation Phase

During this phase, the price consolidates within a narrow range as institutional players accumulate positions. The market often exhibits low volatility, typically occurring at the start of the trading day or before significant events.

2. Manipulation Phase

Large players create false breakouts to lure retail traders into the wrong direction, clearing stop-loss orders and building liquidity. Prices may breach key support or resistance levels but quickly reverse afterward.

3. Distribution Phase

The market enters the main trend direction, with prices accelerating toward targeted zones. Institutional players distribute their positions during this phase, marked by increased volatility and a clear price trend.

---

Application and Strategy

In intraday or short-term trading, the PO3 model helps identify key market moves. For example, the opening session often corresponds to the Accumulation phase, false breakouts occur during the Asian session (Manipulation), and trend expansions usually happen during the European or U.S. sessions (Distribution).

Typical Strategy:

1. Wait for Manipulation to Complete: Identify false breakouts and look for reversal signals, such as order blocks.

2. Enter the Main Trend in the Distribution Phase: Enter at key areas (e.g., Fair Value Gaps) and set targets like previous highs or lows.

3. Leverage Time Zones: Use ICT's Kill Zones (e.g., London or New York sessions) to improve accuracy.

By understanding the PO3 concept, traders can better capture market dynamics and enhance the precision and success of their trades.

좋아요 0

Kevin Cao

거래자

인기있는 콘텐츠

시장 분석

투자주체별매매 동향

시장 분석

유로존 경제 쇠퇴 위기 직면

시장 분석

국제 유가는 어디로

시장 분석

미국증시 레버리지(Leverage)·인버스(Inverse)형의 ETF, 최근 사상 최대 신

시장 분석

투기장 된 원유 ETL...첫 투자위험 발령

시장 분석

RBNZ 양적완화 확대

포럼 카테고리

플랫폼

전시회

대리상

신병 모집

EA

업계에서

시장

인덱스

Overview of the PO3 Trading Strategy

홍콩 | 2024-12-25 21:51

홍콩 | 2024-12-25 21:51The Power of Three (PO3) is a concept introduced by ICT (Inner Circle Trader) that describes market price movements in three phases: Accumulation, Manipulation, and Distribution.

1. Accumulation Phase

During this phase, the price consolidates within a narrow range as institutional players accumulate positions. The market often exhibits low volatility, typically occurring at the start of the trading day or before significant events.

2. Manipulation Phase

Large players create false breakouts to lure retail traders into the wrong direction, clearing stop-loss orders and building liquidity. Prices may breach key support or resistance levels but quickly reverse afterward.

3. Distribution Phase

The market enters the main trend direction, with prices accelerating toward targeted zones. Institutional players distribute their positions during this phase, marked by increased volatility and a clear price trend.

---

Application and Strategy

In intraday or short-term trading, the PO3 model helps identify key market moves. For example, the opening session often corresponds to the Accumulation phase, false breakouts occur during the Asian session (Manipulation), and trend expansions usually happen during the European or U.S. sessions (Distribution).

Typical Strategy:

1. Wait for Manipulation to Complete: Identify false breakouts and look for reversal signals, such as order blocks.

2. Enter the Main Trend in the Distribution Phase: Enter at key areas (e.g., Fair Value Gaps) and set targets like previous highs or lows.

3. Leverage Time Zones: Use ICT's Kill Zones (e.g., London or New York sessions) to improve accuracy.

By understanding the PO3 concept, traders can better capture market dynamics and enhance the precision and success of their trades.

좋아요 0

나 도 댓 글 달 래.

제출

0코멘트

댓글이 아직 없습니다. 첫 번째를 만드십시오.

제출

댓글이 아직 없습니다. 첫 번째를 만드십시오.