2025-01-29 17:05

업계에서Swing Trading Strategies

#firstdealofthenewyearFateema

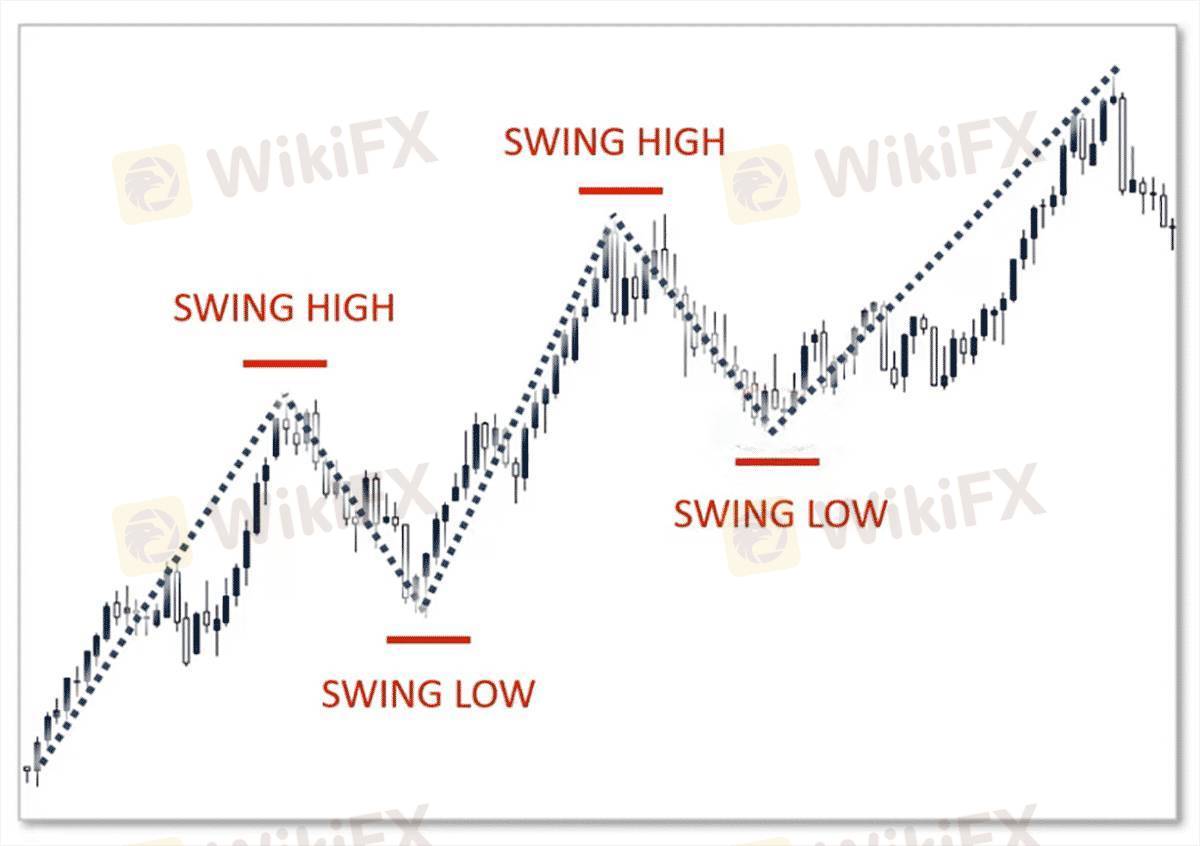

Swing trading strategies aim to capture short- to medium-term price movements within a larger trend. Traders typically hold positions for several days or weeks, taking advantage of price “swings” between support and resistance levels. Key strategies include:

1. Trend-following: This involves identifying the prevailing trend (up or down) and entering trades in the direction of the trend. Traders use technical indicators like moving averages or trendlines to confirm trends.

2. Breakout Trading: Traders enter positions when price breaks key support or resistance levels, expecting strong price movement in the direction of the breakout.

3. Retracement/Correction Trading: This strategy targets price pullbacks within a trend. Traders look for opportunities to buy during an uptrend or sell during a downtrend when the price retraces to a key Fibonacci level or moving average.

4. Divergence Strategy: Traders look for divergences between price and indicators (like RSI or MACD), which can signal potential reversals.

Swing traders use a combination of technical analysis, risk management, and patience to profit from market swings.

좋아요 0

Veinticinco25

โบรกเกอร์

인기있는 콘텐츠

시장 분석

투자주체별매매 동향

시장 분석

유로존 경제 쇠퇴 위기 직면

시장 분석

국제 유가는 어디로

시장 분석

미국증시 레버리지(Leverage)·인버스(Inverse)형의 ETF, 최근 사상 최대 신

시장 분석

투기장 된 원유 ETL...첫 투자위험 발령

시장 분석

RBNZ 양적완화 확대

포럼 카테고리

플랫폼

전시회

대리상

신병 모집

EA

업계에서

시장

인덱스

Swing Trading Strategies

나이지리아 | 2025-01-29 17:05

나이지리아 | 2025-01-29 17:05#firstdealofthenewyearFateema

Swing trading strategies aim to capture short- to medium-term price movements within a larger trend. Traders typically hold positions for several days or weeks, taking advantage of price “swings” between support and resistance levels. Key strategies include:

1. Trend-following: This involves identifying the prevailing trend (up or down) and entering trades in the direction of the trend. Traders use technical indicators like moving averages or trendlines to confirm trends.

2. Breakout Trading: Traders enter positions when price breaks key support or resistance levels, expecting strong price movement in the direction of the breakout.

3. Retracement/Correction Trading: This strategy targets price pullbacks within a trend. Traders look for opportunities to buy during an uptrend or sell during a downtrend when the price retraces to a key Fibonacci level or moving average.

4. Divergence Strategy: Traders look for divergences between price and indicators (like RSI or MACD), which can signal potential reversals.

Swing traders use a combination of technical analysis, risk management, and patience to profit from market swings.

좋아요 0

나 도 댓 글 달 래.

제출

0코멘트

댓글이 아직 없습니다. 첫 번째를 만드십시오.

제출

댓글이 아직 없습니다. 첫 번째를 만드십시오.