2025-01-30 19:39

업계에서Trading Psychology: Overcoming Emotional

#firstdealofthenewyearAKEEL

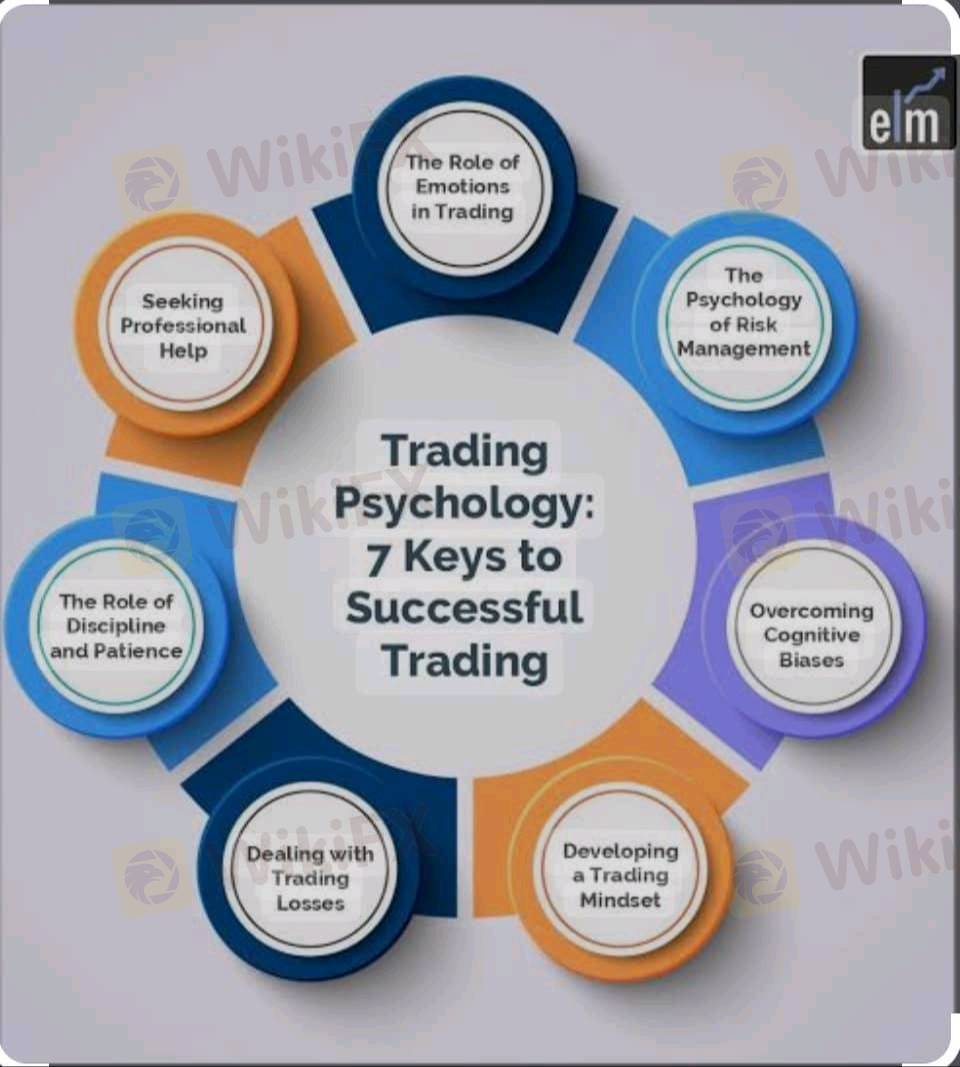

Trading psychology refers to the mental and emotional aspects of trading that can influence decision-making and outcomes. It is important for traders to understand and manage their emotions in order to make rational decisions and avoid impulsive actions that can lead to losses.

One of the key challenges in trading is overcoming emotional biases and impulses. These can arise from fear, greed, and other emotions that can cloud judgment and lead to poor decision-making. For example, a trader may be tempted to take excessive risks in order to make a quick profit, or they may become overly cautious and miss out on potential opportunities.

To overcome these emotional biases, traders can use a variety of strategies. One approach is to develop a clear trading plan and stick to it, regardless of market conditions or emotions. This can help traders stay focused and avoid making impulsive decisions based on fear or greed. Another strategy is to practice mindfulness and self-awareness, which can help traders recognize and manage their emotions in real-time.

It is also important for traders to understand the psychological principles that underlie their behavior and decision-making. For example, they may need to recognize the role of confirmation bias, which is the tendency to seek out information that confirms existing beliefs and ignore information that contradicts them. By understanding these biases and how they can influence their trading decisions, traders can take steps to mitigate their impact and make more rational choices.

Overall, trading psychology is a complex and multifaceted topic that requires ongoing learning and self-reflection. By developing a clear trading plan, practicing mindfulness and self-awareness, and understanding the psychological principles that underlie their behavior, traders can overcome emotional biases and make more rational decisions in the markets.

#firstdealofthenewyearAKEEL

좋아요 0

Galiya

중개인

인기있는 콘텐츠

시장 분석

투자주체별매매 동향

시장 분석

유로존 경제 쇠퇴 위기 직면

시장 분석

국제 유가는 어디로

시장 분석

미국증시 레버리지(Leverage)·인버스(Inverse)형의 ETF, 최근 사상 최대 신

시장 분석

투기장 된 원유 ETL...첫 투자위험 발령

시장 분석

RBNZ 양적완화 확대

포럼 카테고리

플랫폼

전시회

대리상

신병 모집

EA

업계에서

시장

인덱스

Trading Psychology: Overcoming Emotional

나이지리아 | 2025-01-30 19:39

나이지리아 | 2025-01-30 19:39#firstdealofthenewyearAKEEL

Trading psychology refers to the mental and emotional aspects of trading that can influence decision-making and outcomes. It is important for traders to understand and manage their emotions in order to make rational decisions and avoid impulsive actions that can lead to losses.

One of the key challenges in trading is overcoming emotional biases and impulses. These can arise from fear, greed, and other emotions that can cloud judgment and lead to poor decision-making. For example, a trader may be tempted to take excessive risks in order to make a quick profit, or they may become overly cautious and miss out on potential opportunities.

To overcome these emotional biases, traders can use a variety of strategies. One approach is to develop a clear trading plan and stick to it, regardless of market conditions or emotions. This can help traders stay focused and avoid making impulsive decisions based on fear or greed. Another strategy is to practice mindfulness and self-awareness, which can help traders recognize and manage their emotions in real-time.

It is also important for traders to understand the psychological principles that underlie their behavior and decision-making. For example, they may need to recognize the role of confirmation bias, which is the tendency to seek out information that confirms existing beliefs and ignore information that contradicts them. By understanding these biases and how they can influence their trading decisions, traders can take steps to mitigate their impact and make more rational choices.

Overall, trading psychology is a complex and multifaceted topic that requires ongoing learning and self-reflection. By developing a clear trading plan, practicing mindfulness and self-awareness, and understanding the psychological principles that underlie their behavior, traders can overcome emotional biases and make more rational decisions in the markets.

#firstdealofthenewyearAKEEL

좋아요 0

나 도 댓 글 달 래.

제출

0코멘트

댓글이 아직 없습니다. 첫 번째를 만드십시오.

제출

댓글이 아직 없습니다. 첫 번째를 만드십시오.