2025-02-06 15:30

업계Trading with Elliott Wave Theory

#firstdealofthenewyearFateema

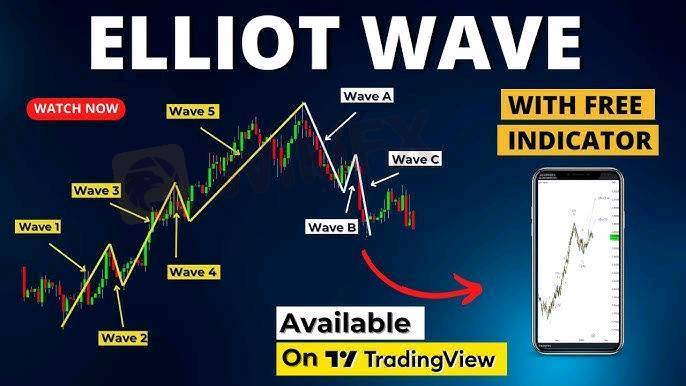

Elliott Wave Theory (EWT) is a powerful technical analysis tool used in trading to predict market movements by identifying repeating wave patterns. Developed by Ralph Nelson Elliott in the 1930s, the theory suggests that financial markets move in fractal patterns based on investor psychology.

Basic Structure of Elliott Wave Theory

Elliott Wave Theory divides price movements into two main phases:

1. Impulse Waves (5-Wave Pattern)

These waves move in the direction of the main trend.

Consists of five waves:

Wave 1: Initial move in the direction of the trend.

Wave 2: Retracement but not beyond the start of Wave 1.

Wave 3: Strongest and longest wave (often extends).

Wave 4: Shallow correction, often sideways.

Wave 5: Final wave in the trend, completing the move.

2. Corrective Waves (3-Wave Pattern)

These waves move against the main trend.

Consists of three waves:

Wave A: Initial move against the trend.

Wave B: Temporary retracement.

Wave C: Final move completing the correction.

Elliott Wave Trading Strategies

1. Identifying the Trend (Impulse Wave Trading)

Enter during Wave 2 pullback or Wave 4 correction.

Ride Wave 3 (strongest move) for maximum profit.

Use Fibonacci retracements to identify entry points.

2. Trading the Correction (Counter-Trend Trading)

Identify corrective patterns (Zigzag, Flat, Triangle).

Short-sell at the end of Wave B or enter long at the end of Wave C.

3. Using Fibonacci for Confirmation

Wave 2 often retraces 50%-61.8% of Wave 1.

Wave 3 often extends 161.8% of Wave 1.

Wave 4 retraces 23.6%-38.2% of Wave 3.

Wave 5 can extend 61.8%-100% of Wave 1-3.

Best Indicators to Use with Elliott Wave

Fibonacci Retracement/Extension (for price targets)

RSI (Relative Strength Index) (divergence at Wave 5)

MACD (Moving Average Convergence Divergence) (momentum confirmation)

Volume (higher in Wave 3, lower in Wave 4)

Challenges in Elliott Wave Trading

Requires experience in wave counting.

Market structure can be subjective.

Works best in trending markets.

Would you like me to analyze a specific chart or asset using Elliott Wave Theory?

좋아요 0

Aniema30

거래자

인기있는 콘텐츠

시장 분석

투자주체별매매 동향

시장 분석

유로존 경제 쇠퇴 위기 직면

시장 분석

국제 유가는 어디로

시장 분석

미국증시 레버리지(Leverage)·인버스(Inverse)형의 ETF, 최근 사상 최대 신

시장 분석

투기장 된 원유 ETL...첫 투자위험 발령

시장 분석

RBNZ 양적완화 확대

포럼 카테고리

플랫폼

전시회

IB

모집

EA

업계

시세

인덱스

Trading with Elliott Wave Theory

나이지리아 | 2025-02-06 15:30

나이지리아 | 2025-02-06 15:30#firstdealofthenewyearFateema

Elliott Wave Theory (EWT) is a powerful technical analysis tool used in trading to predict market movements by identifying repeating wave patterns. Developed by Ralph Nelson Elliott in the 1930s, the theory suggests that financial markets move in fractal patterns based on investor psychology.

Basic Structure of Elliott Wave Theory

Elliott Wave Theory divides price movements into two main phases:

1. Impulse Waves (5-Wave Pattern)

These waves move in the direction of the main trend.

Consists of five waves:

Wave 1: Initial move in the direction of the trend.

Wave 2: Retracement but not beyond the start of Wave 1.

Wave 3: Strongest and longest wave (often extends).

Wave 4: Shallow correction, often sideways.

Wave 5: Final wave in the trend, completing the move.

2. Corrective Waves (3-Wave Pattern)

These waves move against the main trend.

Consists of three waves:

Wave A: Initial move against the trend.

Wave B: Temporary retracement.

Wave C: Final move completing the correction.

Elliott Wave Trading Strategies

1. Identifying the Trend (Impulse Wave Trading)

Enter during Wave 2 pullback or Wave 4 correction.

Ride Wave 3 (strongest move) for maximum profit.

Use Fibonacci retracements to identify entry points.

2. Trading the Correction (Counter-Trend Trading)

Identify corrective patterns (Zigzag, Flat, Triangle).

Short-sell at the end of Wave B or enter long at the end of Wave C.

3. Using Fibonacci for Confirmation

Wave 2 often retraces 50%-61.8% of Wave 1.

Wave 3 often extends 161.8% of Wave 1.

Wave 4 retraces 23.6%-38.2% of Wave 3.

Wave 5 can extend 61.8%-100% of Wave 1-3.

Best Indicators to Use with Elliott Wave

Fibonacci Retracement/Extension (for price targets)

RSI (Relative Strength Index) (divergence at Wave 5)

MACD (Moving Average Convergence Divergence) (momentum confirmation)

Volume (higher in Wave 3, lower in Wave 4)

Challenges in Elliott Wave Trading

Requires experience in wave counting.

Market structure can be subjective.

Works best in trending markets.

Would you like me to analyze a specific chart or asset using Elliott Wave Theory?

좋아요 0

나 도 댓 글 달 래.

제출

0코멘트

댓글이 아직 없습니다. 첫 번째를 만드십시오.

제출

댓글이 아직 없습니다. 첫 번째를 만드십시오.