2025-02-06 20:00

업계Creating a Legacy Through Annual Investment Strate

#firstdealofthenewyearchewbacca

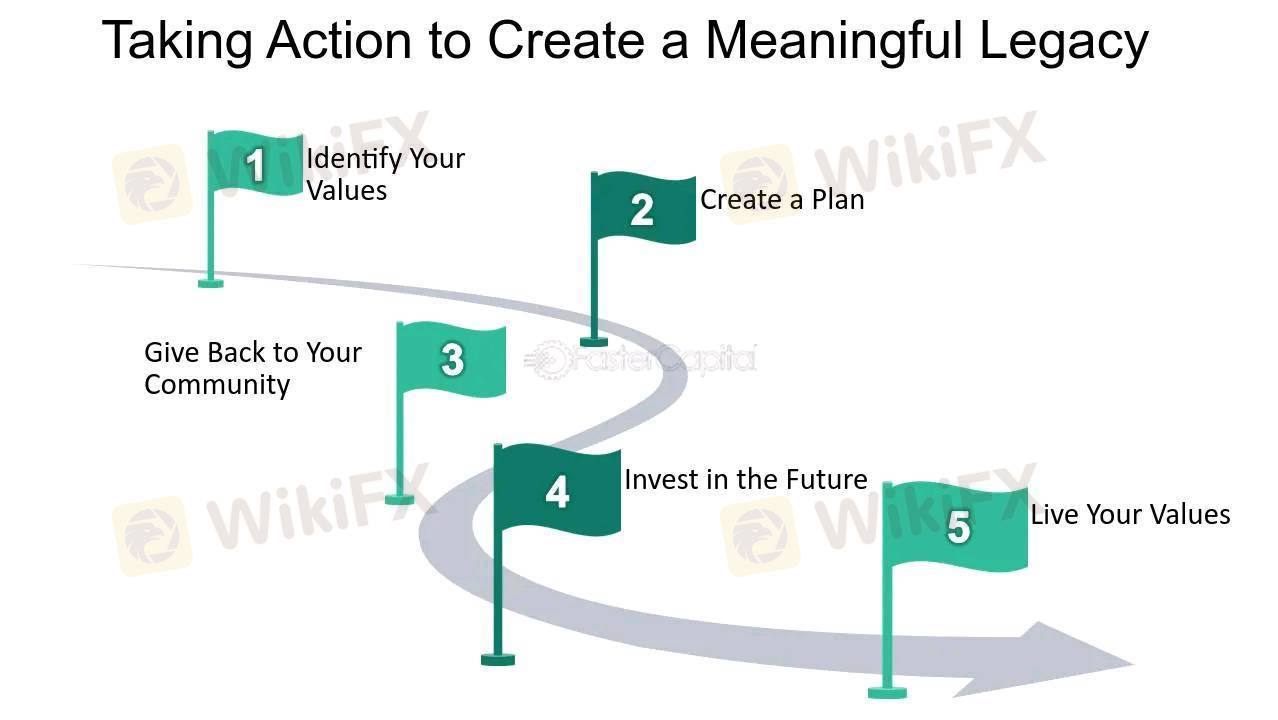

Creating a legacy through annual investment strategies requires a long-term vision, disciplined financial planning, and strategic asset allocation. Here’s a structured approach to building and sustaining a lasting financial legacy:

1. Define Your Legacy Goals

Determine whether your legacy is for family wealth, philanthropy, or business continuity.

Set clear financial and non-financial objectives.

2. Establish a Sustainable Investment Plan

Asset Allocation: Diversify across stocks, bonds, real estate, and alternative investments.

Risk Management: Balance high-risk and stable investments to ensure long-term growth.

Tax Efficiency: Utilize tax-advantaged accounts, trusts, and estate planning to preserve wealth.

3. Commit to Annual Investments

Consistently invest a fixed amount each year, leveraging compound interest.

Increase contributions over time to outpace inflation.

4. Utilize Compounding and Reinvestment

Reinvest dividends, interest, and capital gains for exponential growth.

Choose growth-oriented investments for long-term wealth accumulation.

5. Implement Estate and Succession Planning

Set up wills, trusts, and foundations to ensure smooth wealth transfer.

Involve heirs or beneficiaries in financial education.

6. Review and Adjust Annually

Evaluate investment performance and market conditions.

Adjust asset allocations and contributions based on economic changes.

좋아요 0

bossbaby6527

المتداول

인기있는 콘텐츠

시장 분석

투자주체별매매 동향

시장 분석

유로존 경제 쇠퇴 위기 직면

시장 분석

국제 유가는 어디로

시장 분석

미국증시 레버리지(Leverage)·인버스(Inverse)형의 ETF, 최근 사상 최대 신

시장 분석

투기장 된 원유 ETL...첫 투자위험 발령

시장 분석

RBNZ 양적완화 확대

포럼 카테고리

플랫폼

전시회

IB

모집

EA

업계

시세

인덱스

Creating a Legacy Through Annual Investment Strate

나이지리아 | 2025-02-06 20:00

나이지리아 | 2025-02-06 20:00#firstdealofthenewyearchewbacca

Creating a legacy through annual investment strategies requires a long-term vision, disciplined financial planning, and strategic asset allocation. Here’s a structured approach to building and sustaining a lasting financial legacy:

1. Define Your Legacy Goals

Determine whether your legacy is for family wealth, philanthropy, or business continuity.

Set clear financial and non-financial objectives.

2. Establish a Sustainable Investment Plan

Asset Allocation: Diversify across stocks, bonds, real estate, and alternative investments.

Risk Management: Balance high-risk and stable investments to ensure long-term growth.

Tax Efficiency: Utilize tax-advantaged accounts, trusts, and estate planning to preserve wealth.

3. Commit to Annual Investments

Consistently invest a fixed amount each year, leveraging compound interest.

Increase contributions over time to outpace inflation.

4. Utilize Compounding and Reinvestment

Reinvest dividends, interest, and capital gains for exponential growth.

Choose growth-oriented investments for long-term wealth accumulation.

5. Implement Estate and Succession Planning

Set up wills, trusts, and foundations to ensure smooth wealth transfer.

Involve heirs or beneficiaries in financial education.

6. Review and Adjust Annually

Evaluate investment performance and market conditions.

Adjust asset allocations and contributions based on economic changes.

좋아요 0

나 도 댓 글 달 래.

제출

0코멘트

댓글이 아직 없습니다. 첫 번째를 만드십시오.

제출

댓글이 아직 없습니다. 첫 번째를 만드십시오.