2025-02-12 20:28

업계에서The impact of central bank policy on forex market

#firstdealofthenewyearastylz

The Impact of Central Bank Policy on Forex Market

Introduction

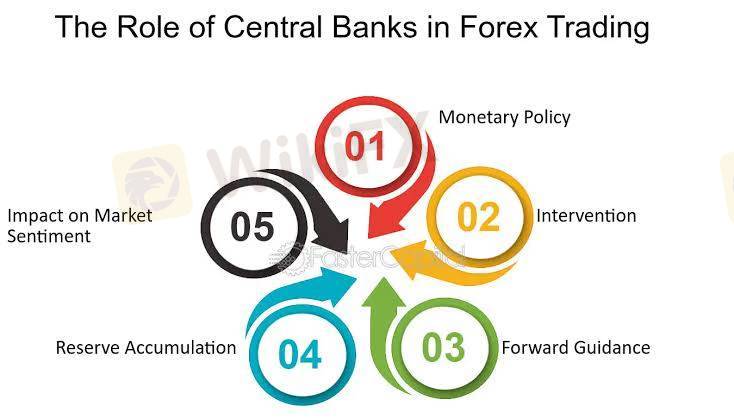

The foreign exchange (forex) market is a dynamic and highly volatile environment, influenced by a multitude of factors. Among these, central bank policy plays a crucial role in shaping the market's trajectory. Central banks, responsible for managing a nation's monetary policy, implement decisions that significantly impact currency values, trading volumes, and market sentiment.

Monetary Policy Tools

Central banks employ various monetary policy tools to achieve their objectives, including:

1. *Interest Rates*: Adjusting interest rates influences borrowing costs, consumption, and investment, ultimately affecting currency demand and value.

2. *Quantitative Easing (QE)*: Central banks create new money to purchase assets, injecting liquidity into the economy and influencing currency values.

3. *Forward Guidance*: Communicating future policy intentions helps shape market expectations, influencing currency prices.

Impact on Forex Market

Central bank policy decisions have far-reaching consequences for the forex market:

1. *Currency Volatility*: Changes in interest rates, QE, or forward guidance can lead to significant currency fluctuations, creating opportunities and challenges for traders.

2. *Currency Strength*: A central bank's decision to raise interest rates or implement hawkish policies can strengthen its currency, while dovish policies can weaken it.

3. *Trade Volumes*: Central bank policy announcements can increase trading volumes, as market participants react to new information and adjust their positions.

4. *Market Sentiment*: Central bank communication can influence market sentiment, with hawkish or dovish tones impacting investor confidence and risk appetite.

Examples and Case Studies

1. *Federal Reserve (Fed)*: The Fed's decision to raise interest rates in 2015 strengthened the US dollar, while its subsequent rate cuts in 2020 weakened the currency.

2. *European Central Bank (ECB)*: The ECB's implementation of QE in 2015 boosted the eurozone economy but weakened the euro currency.

3. *Bank of Japan (BoJ)*: The BoJ's adoption of negative interest rates in 2016 aimed to stimulate the Japanese economy but had limited impact on the yen currency.

Conclusion

Central bank policy has a profound impact on the forex market, influencing currency values, trading volumes, and market sentiment. Understanding central bank decisions and communication is crucial for traders, investors, and policymakers to navigate the complex and dynamic forex market. By analyzing central bank policy, market participants can make informed decisions, manage risk, and capitalize on opportunities in the ever-changing forex landscape.

좋아요 0

Vic.d

Sàn giao dịch

인기있는 콘텐츠

시장 분석

투자주체별매매 동향

시장 분석

유로존 경제 쇠퇴 위기 직면

시장 분석

국제 유가는 어디로

시장 분석

미국증시 레버리지(Leverage)·인버스(Inverse)형의 ETF, 최근 사상 최대 신

시장 분석

투기장 된 원유 ETL...첫 투자위험 발령

시장 분석

RBNZ 양적완화 확대

포럼 카테고리

플랫폼

전시회

대리상

신병 모집

EA

업계에서

시장

인덱스

The impact of central bank policy on forex market

홍콩 | 2025-02-12 20:28

홍콩 | 2025-02-12 20:28#firstdealofthenewyearastylz

The Impact of Central Bank Policy on Forex Market

Introduction

The foreign exchange (forex) market is a dynamic and highly volatile environment, influenced by a multitude of factors. Among these, central bank policy plays a crucial role in shaping the market's trajectory. Central banks, responsible for managing a nation's monetary policy, implement decisions that significantly impact currency values, trading volumes, and market sentiment.

Monetary Policy Tools

Central banks employ various monetary policy tools to achieve their objectives, including:

1. *Interest Rates*: Adjusting interest rates influences borrowing costs, consumption, and investment, ultimately affecting currency demand and value.

2. *Quantitative Easing (QE)*: Central banks create new money to purchase assets, injecting liquidity into the economy and influencing currency values.

3. *Forward Guidance*: Communicating future policy intentions helps shape market expectations, influencing currency prices.

Impact on Forex Market

Central bank policy decisions have far-reaching consequences for the forex market:

1. *Currency Volatility*: Changes in interest rates, QE, or forward guidance can lead to significant currency fluctuations, creating opportunities and challenges for traders.

2. *Currency Strength*: A central bank's decision to raise interest rates or implement hawkish policies can strengthen its currency, while dovish policies can weaken it.

3. *Trade Volumes*: Central bank policy announcements can increase trading volumes, as market participants react to new information and adjust their positions.

4. *Market Sentiment*: Central bank communication can influence market sentiment, with hawkish or dovish tones impacting investor confidence and risk appetite.

Examples and Case Studies

1. *Federal Reserve (Fed)*: The Fed's decision to raise interest rates in 2015 strengthened the US dollar, while its subsequent rate cuts in 2020 weakened the currency.

2. *European Central Bank (ECB)*: The ECB's implementation of QE in 2015 boosted the eurozone economy but weakened the euro currency.

3. *Bank of Japan (BoJ)*: The BoJ's adoption of negative interest rates in 2016 aimed to stimulate the Japanese economy but had limited impact on the yen currency.

Conclusion

Central bank policy has a profound impact on the forex market, influencing currency values, trading volumes, and market sentiment. Understanding central bank decisions and communication is crucial for traders, investors, and policymakers to navigate the complex and dynamic forex market. By analyzing central bank policy, market participants can make informed decisions, manage risk, and capitalize on opportunities in the ever-changing forex landscape.

좋아요 0

나 도 댓 글 달 래.

제출

0코멘트

댓글이 아직 없습니다. 첫 번째를 만드십시오.

제출

댓글이 아직 없습니다. 첫 번째를 만드십시오.