2025-02-18 01:13

업계에서How to calculate position sizing.

#forexrisktip

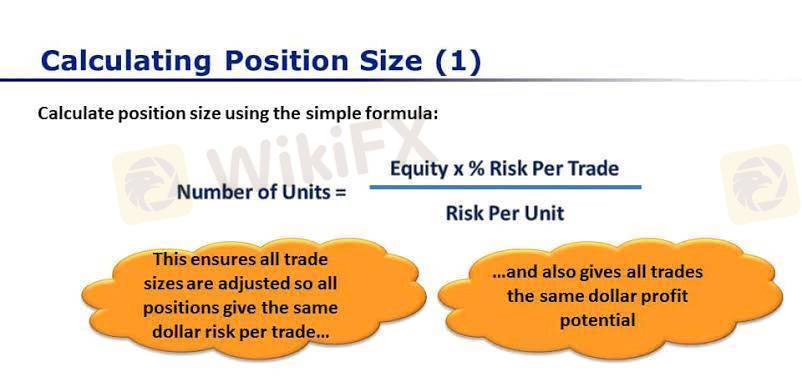

Position sizing is a risk management technique used by traders and investors to determine the appropriate number of units of an asset to buy or sell in order to control the potential loss from a trade. It involves calculating the position size based on the trader's account balance, risk tolerance, and the stop-loss level for the trade.

The basic formula for calculating position size is:

Position size = (Account balance * Risk percentage) / (Entry price - Stop-loss price)

For example, if a trader has an account balance of $10,000, a risk tolerance of 2%, an entry price of $100, and a stop-loss price of $95, the position size would be:

Position size = ($10,000 * 2%) / ($100 - $95) = 200 shares

This means that the trader should buy 200 shares of the asset. If the trade goes wrong and the price falls to the stop-loss level of $95, the trader will lose $1,000, which is 2% of their account balance.

Position sizing is an important risk management tool that can help traders to limit their losses and protect their capital. By carefully calculating the position size for each trade, traders can ensure that they are not risking more than they can afford to lose.

좋아요 0

Forextrederr73

Trader

인기있는 콘텐츠

시장 분석

투자주체별매매 동향

시장 분석

유로존 경제 쇠퇴 위기 직면

시장 분석

국제 유가는 어디로

시장 분석

미국증시 레버리지(Leverage)·인버스(Inverse)형의 ETF, 최근 사상 최대 신

시장 분석

투기장 된 원유 ETL...첫 투자위험 발령

시장 분석

RBNZ 양적완화 확대

포럼 카테고리

플랫폼

전시회

대리상

신병 모집

EA

업계에서

시장

인덱스

How to calculate position sizing.

인도 | 2025-02-18 01:13

인도 | 2025-02-18 01:13#forexrisktip

Position sizing is a risk management technique used by traders and investors to determine the appropriate number of units of an asset to buy or sell in order to control the potential loss from a trade. It involves calculating the position size based on the trader's account balance, risk tolerance, and the stop-loss level for the trade.

The basic formula for calculating position size is:

Position size = (Account balance * Risk percentage) / (Entry price - Stop-loss price)

For example, if a trader has an account balance of $10,000, a risk tolerance of 2%, an entry price of $100, and a stop-loss price of $95, the position size would be:

Position size = ($10,000 * 2%) / ($100 - $95) = 200 shares

This means that the trader should buy 200 shares of the asset. If the trade goes wrong and the price falls to the stop-loss level of $95, the trader will lose $1,000, which is 2% of their account balance.

Position sizing is an important risk management tool that can help traders to limit their losses and protect their capital. By carefully calculating the position size for each trade, traders can ensure that they are not risking more than they can afford to lose.

좋아요 0

나 도 댓 글 달 래.

제출

0코멘트

댓글이 아직 없습니다. 첫 번째를 만드십시오.

제출

댓글이 아직 없습니다. 첫 번째를 만드십시오.