2025-02-21 18:09

업계에서How the speed of rate cuts affects USD trends

#FedRateCutAffectsDollarTrend

How the Speed of Rate Cuts Affects U.S. Dollar Trends

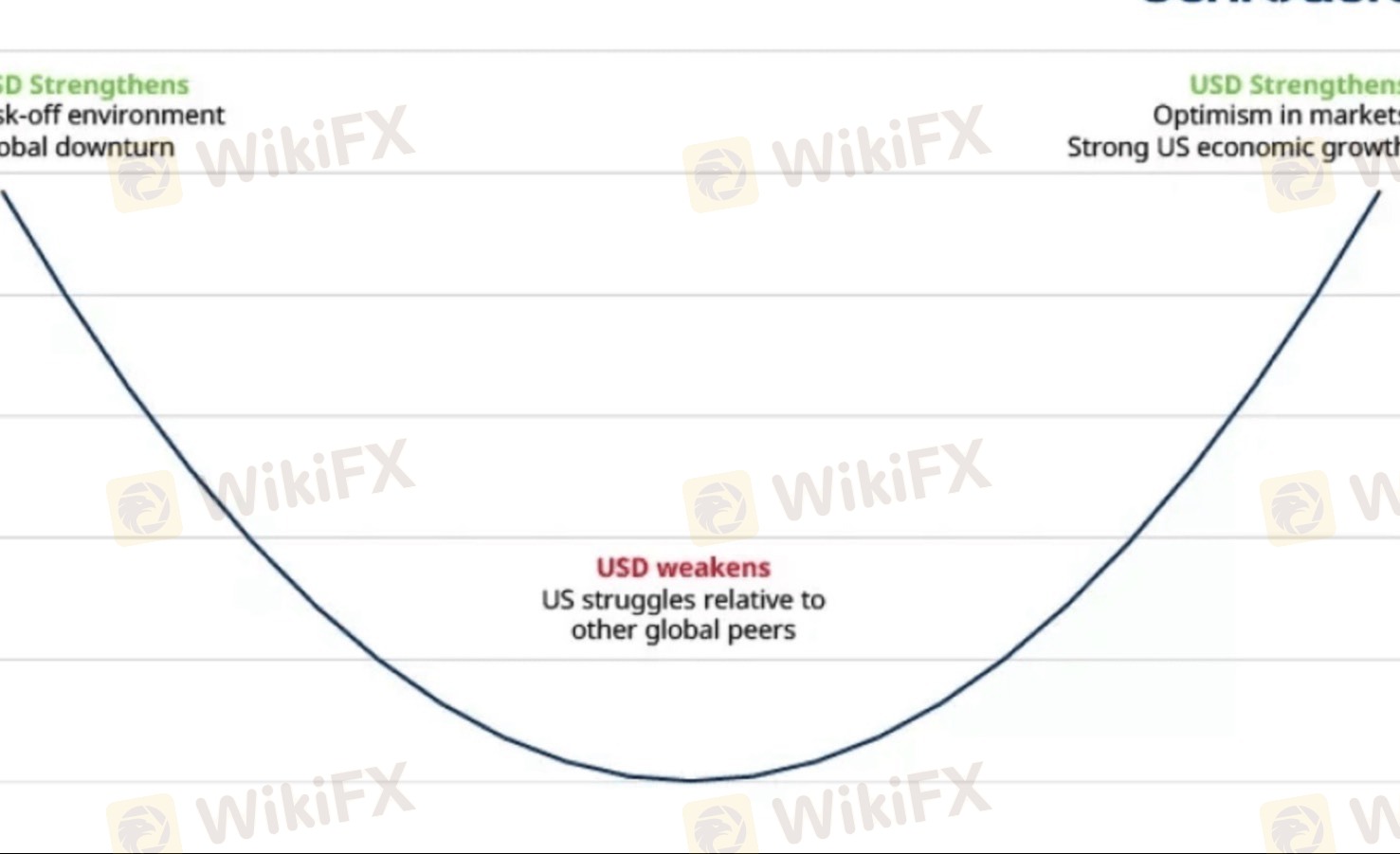

The pace at which the Federal Reserve cuts interest rates can significantly impact how the U.S. dollar reacts. Faster cuts tend to signal economic distress, while gradual cuts can be seen as precautionary.

1. Fast, Aggressive Rate Cuts → Short-Term Dollar Strength, Long-Term Weakness

When the Fed cuts rates aggressively (e.g., multiple cuts within months), it often signals economic trouble, triggering a flight to safety into the U.S. dollar. However, once markets stabilize, the dollar tends to weaken.

Examples of Fast Rate Cuts:

• 2008 Global Financial Crisis:

• The Fed slashed rates from 5.25% to 0% in just over a year.

• The dollar initially strengthened as investors sought safety, but later weakened as easy monetary policy took effect.

• 2020 COVID-19 Crisis:

• The Fed cut rates from 1.75% to near 0% in March 2020.

• The dollar surged temporarily, then declined as liquidity flooded markets.

Why This Happens:

• Safe-haven demand drives short-term dollar strength.

• As liquidity increases and risk appetite returns, the dollar weakens over time.

2. Slow, Gradual Rate Cuts → More Predictable, Less Volatile Dollar Decline

When the Fed cuts rates slowly and incrementally, the impact on the dollar is more predictable. Markets have time to adjust, leading to a gradual depreciation rather than a sharp move.

Examples of Gradual Rate Cuts:

• 2019 Fed Rate Cuts:

• The Fed lowered rates three times by 25 bps each over six months.

• The dollar remained relatively strong because the cuts were slow and other central banks were also easing.

Why This Happens:

• A measured approach prevents panic, limiting short-term safe-haven flows into the dollar.

• Investors shift away from the dollar gradually as yields decline, leading to a more controlled depreciation.

Key Takeaways

Speed of Rate Cuts Short-Term Dollar Impact Long-Term Dollar Impact

Fast & Aggressive Strengthens due to safe-haven demand Weakens as easy policy takes effect

Slow & Gradual Mild decline or stability Gradual depreciation over time

Would you like insights on how upcoming Fed rate cuts in 2024-2025 might impact the dollar?

좋아요 0

FX3557755512

交易者

인기있는 콘텐츠

시장 분석

투자주체별매매 동향

시장 분석

유로존 경제 쇠퇴 위기 직면

시장 분석

국제 유가는 어디로

시장 분석

미국증시 레버리지(Leverage)·인버스(Inverse)형의 ETF, 최근 사상 최대 신

시장 분석

투기장 된 원유 ETL...첫 투자위험 발령

시장 분석

RBNZ 양적완화 확대

포럼 카테고리

플랫폼

전시회

대리상

신병 모집

EA

업계에서

시장

인덱스

How the speed of rate cuts affects USD trends

인도 | 2025-02-21 18:09

인도 | 2025-02-21 18:09#FedRateCutAffectsDollarTrend

How the Speed of Rate Cuts Affects U.S. Dollar Trends

The pace at which the Federal Reserve cuts interest rates can significantly impact how the U.S. dollar reacts. Faster cuts tend to signal economic distress, while gradual cuts can be seen as precautionary.

1. Fast, Aggressive Rate Cuts → Short-Term Dollar Strength, Long-Term Weakness

When the Fed cuts rates aggressively (e.g., multiple cuts within months), it often signals economic trouble, triggering a flight to safety into the U.S. dollar. However, once markets stabilize, the dollar tends to weaken.

Examples of Fast Rate Cuts:

• 2008 Global Financial Crisis:

• The Fed slashed rates from 5.25% to 0% in just over a year.

• The dollar initially strengthened as investors sought safety, but later weakened as easy monetary policy took effect.

• 2020 COVID-19 Crisis:

• The Fed cut rates from 1.75% to near 0% in March 2020.

• The dollar surged temporarily, then declined as liquidity flooded markets.

Why This Happens:

• Safe-haven demand drives short-term dollar strength.

• As liquidity increases and risk appetite returns, the dollar weakens over time.

2. Slow, Gradual Rate Cuts → More Predictable, Less Volatile Dollar Decline

When the Fed cuts rates slowly and incrementally, the impact on the dollar is more predictable. Markets have time to adjust, leading to a gradual depreciation rather than a sharp move.

Examples of Gradual Rate Cuts:

• 2019 Fed Rate Cuts:

• The Fed lowered rates three times by 25 bps each over six months.

• The dollar remained relatively strong because the cuts were slow and other central banks were also easing.

Why This Happens:

• A measured approach prevents panic, limiting short-term safe-haven flows into the dollar.

• Investors shift away from the dollar gradually as yields decline, leading to a more controlled depreciation.

Key Takeaways

Speed of Rate Cuts Short-Term Dollar Impact Long-Term Dollar Impact

Fast & Aggressive Strengthens due to safe-haven demand Weakens as easy policy takes effect

Slow & Gradual Mild decline or stability Gradual depreciation over time

Would you like insights on how upcoming Fed rate cuts in 2024-2025 might impact the dollar?

좋아요 0

나 도 댓 글 달 래.

제출

0코멘트

댓글이 아직 없습니다. 첫 번째를 만드십시오.

제출

댓글이 아직 없습니다. 첫 번째를 만드십시오.