2025-02-21 18:20

업계에서Inflation expectations and the dollar post-Fed rat

#FedRateCutAffectsDollarTrend

Inflation Expectations and the U.S. Dollar Post-Fed Rate Cut

Inflation expectations play a critical role in determining how the U.S. dollar reacts to Fed rate cuts. While rate cuts themselves usually signal a more dovish outlook (potentially weakening the dollar), inflation expectations can significantly influence the magnitude and direction of the dollar’s move after a rate change.

Here’s how inflation expectations interact with rate cuts and affect the dollar:

1. Rising Inflation Expectations After a Fed Rate Cut → Dollar Weakens

• Reasoning:

If inflation expectations rise after a Fed rate cut, the dollar could weaken due to concerns that low rates may exacerbate inflationary pressures in the future. In this case, the market anticipates that the Fed will need to continue easing, which can reduce the appeal of U.S. assets, especially those that rely on the purchasing power of the dollar (like bonds).

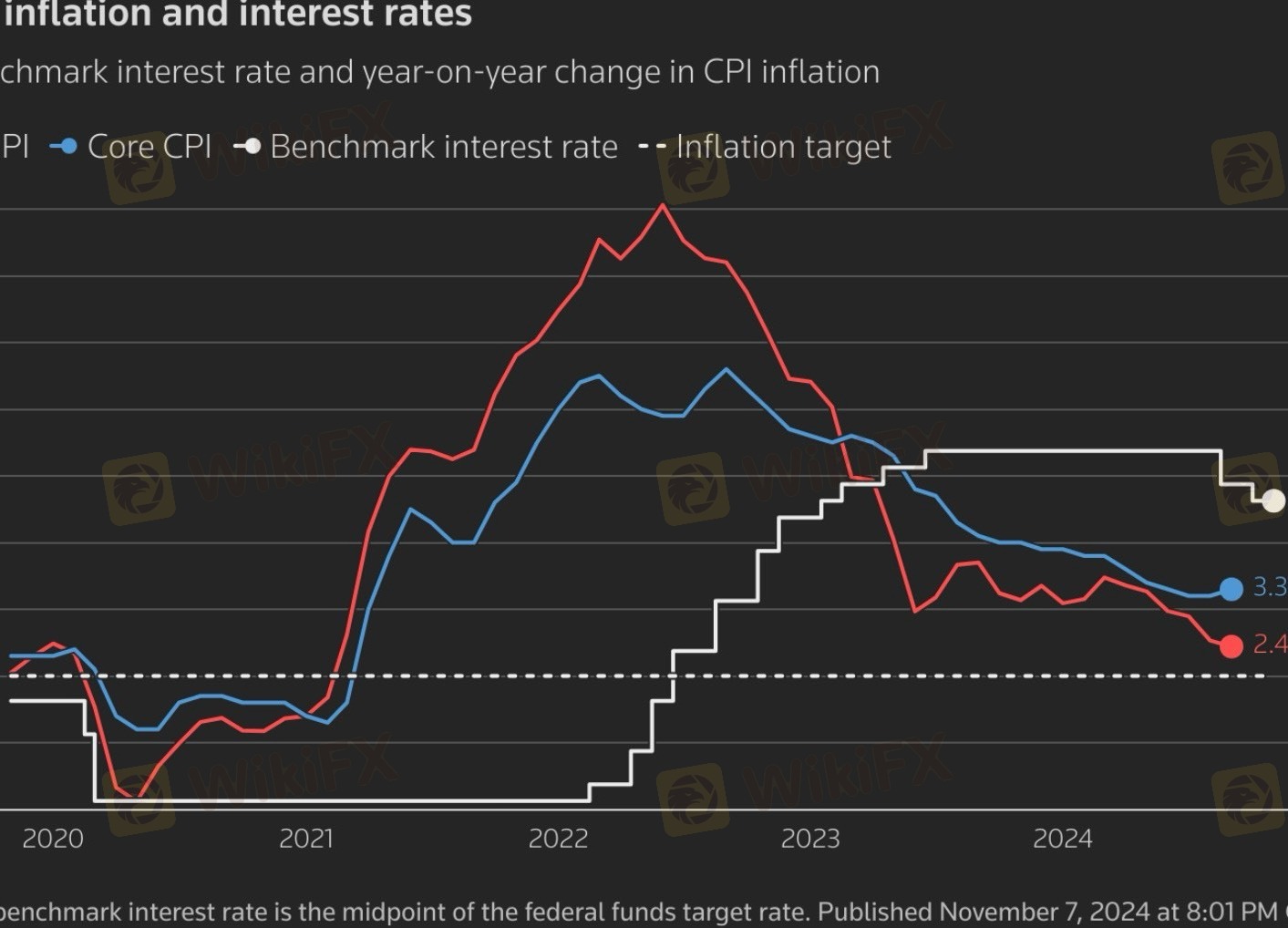

• Example: 2020 Post-COVID Rate Cuts

In 2020, after the Fed aggressively cut rates and implemented quantitative easing, inflation expectations started to rise due to the huge liquidity injections into the economy. The dollar weakened throughout the year as inflation concerns took hold. This was particularly evident in commodity prices (e.g., gold and oil) rising as markets worried about potential future inflation.

• Impact on Dollar:

If inflation expectations rise faster than expected after a rate cut, it diminishes the dollar’s purchasing power, leading to a weaker dollar.

2. Falling Inflation Expectations After a Fed Rate Cut → Dollar Strengthens

• Reasoning:

On the other hand, if inflation expectations decline after a rate cut, the dollar may strengthen. Lower inflation expectations suggest that the rate cuts are successfully keeping inflation under control, which supports the value of the dollar in global markets. The market may perceive the rate cuts as precautionary and conducive to stable growth, which can enhance confidence in holding dollar-denominated assets.

• Example: 2019 Fed Rate Cuts

When the Fed began cutting rates in 2019, inflation remained subdued, and the U.S. dollar appreciated slightly against most major currencies. The cuts were seen as a way to boost the economy without pushing inflation too high. In this case, inflation expectations were contained, and the dollar stayed relatively strong.

• Impact on Dollar:

If inflation expectations stay low or decrease after a rate cut, the dollar may appreciate, as investors will be more confident in holding U.S. assets, which remain relatively attractive due to low inflation.

3. Inflation Expectations Aligning with Fed’s Goal of Stable Prices

• Reasoning:

If the Fed cuts rates to combat low inflation or deflationary pressures, and inflation expectations remain anchored near the Fed’s target (around 2%), the dollar may not experience significant volatility. The market perceives that the Fed’s actions will support stable inflation and sustained growth, which tends to stabilize the dollar.

• Example: 2017-2018 Fed Rate Hikes and Inflation Expectations

The Fed raised rates in 2017 and 2018, but inflation remained in check. As a result, inflation expectations remained anchored, and the dollar stayed relatively strong throughout that period because the market saw that the Fed was addressing inflation risks while maintaining growth. The dollar benefited from the stability provided by this alignment between monetary policy and inflation expectations.

• Impact on Dollar:

If the Fed’s actions lead to stable inflation with anchored expectations, the dollar may remain relatively stable or even strengthen as markets believe the Fed is on track to maintain price stability.

4. Inflation Surging Above Expectations After a Rate Cut → Dollar Weakens Further

• Reasoning:

If inflation begins to rise faster than anticipated after a rate cut, especially if it exceeds the Fed’s target, the dollar may face downward pressure. This can be exacerbated if the market expects the Fed to keep rates low for an extended period in response to inflation. Higher inflation erodes purchasing power and increases concerns about the long-term value of the dollar.

• Example: 1970s – The Fed and Inflation

The Fed’s aggressive rate cuts during the 1970s to address a stagflationary environment led to a surge in inflation. Despite the rate cuts, inflation outpaced expectations, and the U.S. dollar weakened significantly over this period due to the erosion of purchasing power.

• Impact on Dollar:

If inflation rises faster than expected following a rate cut, the dollar may weaken significantly as markets become more concerned about the Fed’s ability to control inflation in the long run.

Summary Table: Inflation Expectations and Dollar Post-Rate Cut

Scenario Inflation Expectations Impact on U.S. Dollar

Inflation Expectations Rise Post-Cut Higher inflation expectations Dollar weakens due to concerns over future inflation

Inflation Expectations Fal

좋아요 0

FX2947890370

거래자

인기있는 콘텐츠

시장 분석

투자주체별매매 동향

시장 분석

유로존 경제 쇠퇴 위기 직면

시장 분석

국제 유가는 어디로

시장 분석

미국증시 레버리지(Leverage)·인버스(Inverse)형의 ETF, 최근 사상 최대 신

시장 분석

투기장 된 원유 ETL...첫 투자위험 발령

시장 분석

RBNZ 양적완화 확대

포럼 카테고리

플랫폼

전시회

대리상

신병 모집

EA

업계에서

시장

인덱스

Inflation expectations and the dollar post-Fed rat

인도 | 2025-02-21 18:20

인도 | 2025-02-21 18:20#FedRateCutAffectsDollarTrend

Inflation Expectations and the U.S. Dollar Post-Fed Rate Cut

Inflation expectations play a critical role in determining how the U.S. dollar reacts to Fed rate cuts. While rate cuts themselves usually signal a more dovish outlook (potentially weakening the dollar), inflation expectations can significantly influence the magnitude and direction of the dollar’s move after a rate change.

Here’s how inflation expectations interact with rate cuts and affect the dollar:

1. Rising Inflation Expectations After a Fed Rate Cut → Dollar Weakens

• Reasoning:

If inflation expectations rise after a Fed rate cut, the dollar could weaken due to concerns that low rates may exacerbate inflationary pressures in the future. In this case, the market anticipates that the Fed will need to continue easing, which can reduce the appeal of U.S. assets, especially those that rely on the purchasing power of the dollar (like bonds).

• Example: 2020 Post-COVID Rate Cuts

In 2020, after the Fed aggressively cut rates and implemented quantitative easing, inflation expectations started to rise due to the huge liquidity injections into the economy. The dollar weakened throughout the year as inflation concerns took hold. This was particularly evident in commodity prices (e.g., gold and oil) rising as markets worried about potential future inflation.

• Impact on Dollar:

If inflation expectations rise faster than expected after a rate cut, it diminishes the dollar’s purchasing power, leading to a weaker dollar.

2. Falling Inflation Expectations After a Fed Rate Cut → Dollar Strengthens

• Reasoning:

On the other hand, if inflation expectations decline after a rate cut, the dollar may strengthen. Lower inflation expectations suggest that the rate cuts are successfully keeping inflation under control, which supports the value of the dollar in global markets. The market may perceive the rate cuts as precautionary and conducive to stable growth, which can enhance confidence in holding dollar-denominated assets.

• Example: 2019 Fed Rate Cuts

When the Fed began cutting rates in 2019, inflation remained subdued, and the U.S. dollar appreciated slightly against most major currencies. The cuts were seen as a way to boost the economy without pushing inflation too high. In this case, inflation expectations were contained, and the dollar stayed relatively strong.

• Impact on Dollar:

If inflation expectations stay low or decrease after a rate cut, the dollar may appreciate, as investors will be more confident in holding U.S. assets, which remain relatively attractive due to low inflation.

3. Inflation Expectations Aligning with Fed’s Goal of Stable Prices

• Reasoning:

If the Fed cuts rates to combat low inflation or deflationary pressures, and inflation expectations remain anchored near the Fed’s target (around 2%), the dollar may not experience significant volatility. The market perceives that the Fed’s actions will support stable inflation and sustained growth, which tends to stabilize the dollar.

• Example: 2017-2018 Fed Rate Hikes and Inflation Expectations

The Fed raised rates in 2017 and 2018, but inflation remained in check. As a result, inflation expectations remained anchored, and the dollar stayed relatively strong throughout that period because the market saw that the Fed was addressing inflation risks while maintaining growth. The dollar benefited from the stability provided by this alignment between monetary policy and inflation expectations.

• Impact on Dollar:

If the Fed’s actions lead to stable inflation with anchored expectations, the dollar may remain relatively stable or even strengthen as markets believe the Fed is on track to maintain price stability.

4. Inflation Surging Above Expectations After a Rate Cut → Dollar Weakens Further

• Reasoning:

If inflation begins to rise faster than anticipated after a rate cut, especially if it exceeds the Fed’s target, the dollar may face downward pressure. This can be exacerbated if the market expects the Fed to keep rates low for an extended period in response to inflation. Higher inflation erodes purchasing power and increases concerns about the long-term value of the dollar.

• Example: 1970s – The Fed and Inflation

The Fed’s aggressive rate cuts during the 1970s to address a stagflationary environment led to a surge in inflation. Despite the rate cuts, inflation outpaced expectations, and the U.S. dollar weakened significantly over this period due to the erosion of purchasing power.

• Impact on Dollar:

If inflation rises faster than expected following a rate cut, the dollar may weaken significantly as markets become more concerned about the Fed’s ability to control inflation in the long run.

Summary Table: Inflation Expectations and Dollar Post-Rate Cut

Scenario Inflation Expectations Impact on U.S. Dollar

Inflation Expectations Rise Post-Cut Higher inflation expectations Dollar weakens due to concerns over future inflation

Inflation Expectations Fal

좋아요 0

나 도 댓 글 달 래.

제출

0코멘트

댓글이 아직 없습니다. 첫 번째를 만드십시오.

제출

댓글이 아직 없습니다. 첫 번째를 만드십시오.