ATC

요약:ATC is a forex trading brokerage company that provides online trading solutions for retail and institutional clients in the forex trading industry. ATC was launched in 2005, headquartered in London, UK, authorized and regulated by the Financial Conduct Authority (FRN 591361). ATC follows an STP model, offering forex and CFDs instruments.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| ATC Review Summary in 10 Points | |

| Founded | 2005 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA |

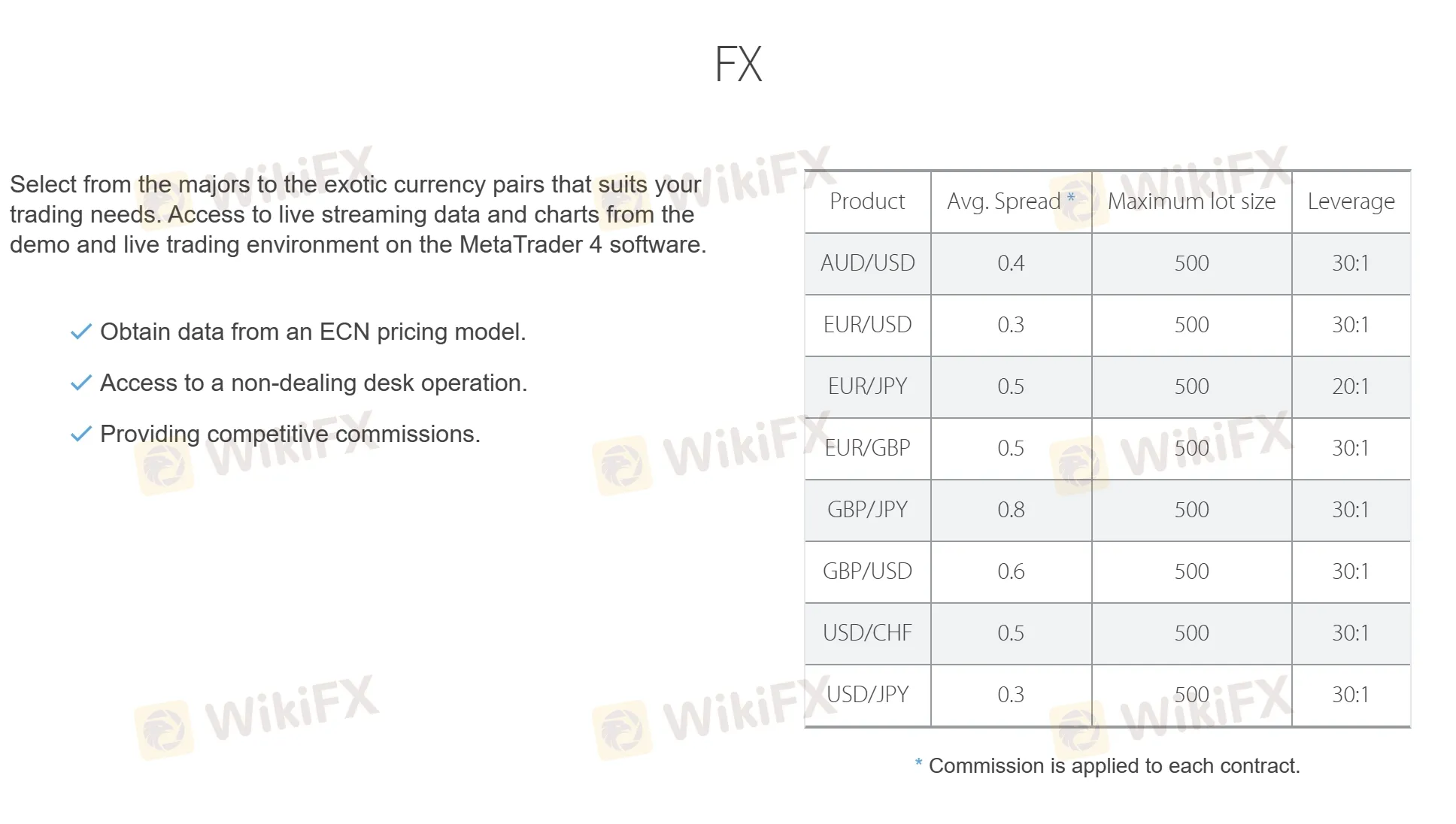

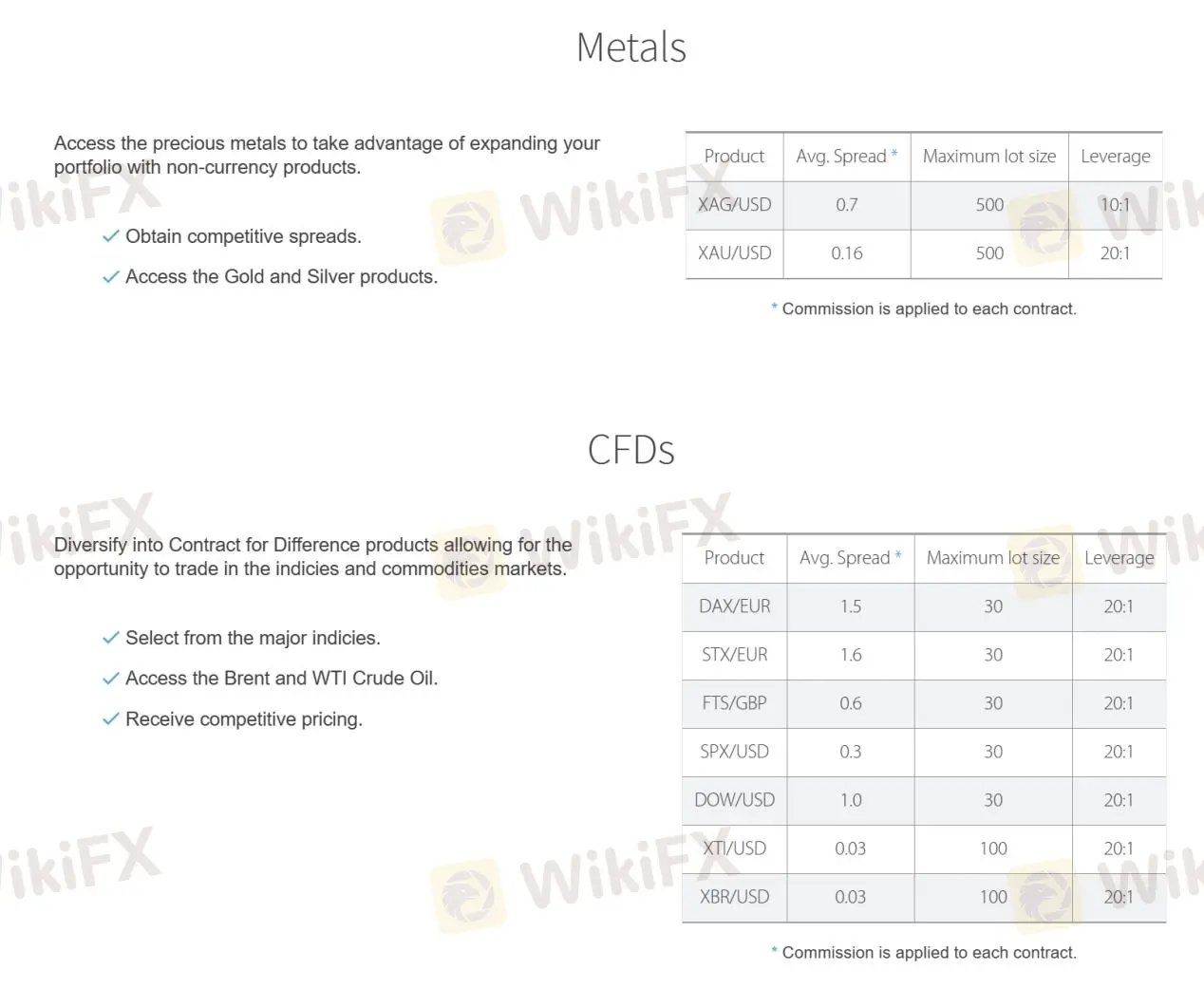

| Market Instruments | Forex, metals, and CFDs |

| Demo Account | Available |

| Leverage | 30:1 |

| EUR/USD Spread | 0.3 pips |

| Trading Platforms | MT Pro, MT4, MT4 Mobile |

| Minimum deposit | $/€/£5,000 |

| Customer Support | live chat, phone, email, and contact request |

What is ATC?

ATC is a forex trading brokerage company that provides online trading solutions for retail and institutional clients in the forex trading industry. ATC was launched in 2005, headquartered in London, UK, authorized and regulated by the Financial Conduct Authority (FRN 591361). ATC follows an STP model, offering forex and CFDs instruments.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

ATC offers several advantages as a regulated broker, providing a range of trading instruments and competitive spreads. The segregation of client funds and multiple deposit/withdrawal methods enhance the security and convenience of trading.

However, reports of withdrawal issues and potential scams raise concerns, and the high minimum account balance may restrict accessibility for some traders. It's crucial for individuals to exercise caution and conduct thorough research before deciding to trade with ATC.

| Pros | Cons |

| • FCA-regulated | • Reports of issues related to withdrawal and potential scams |

| • Segregates client funds | • High minimum deposit requirement of $5,000 |

| • Wide range of trading instruments | • Shares trading not offered |

| • MT4 trading platform supported | • Limited accepted currencies |

| • Competitive spreads | • No additional tools |

| • Supports multiple deposit and withdrawal methods | • Lack of clear information about educational resources and materials |

| • Multi-channel customer support |

ATC Alternative Brokers

ActivTrades - A reliable broker with a wide range of trading instruments and platforms, suitable for both beginner and experienced traders.

Darwinex - A unique social trading platform that allows investors to allocate capital to successful traders, offering a diverse range of trading strategies to choose from.

ForexChief - A broker with competitive trading conditions and a user-friendly platform, suitable for traders of all levels, particularly those focused on forex trading.

There are many alternative brokers to ATC depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is ATC Safe or Scam?

As ATC is regulated by the Financial Conduct Authority (FCA, License No. 591361) and follows the practice of segregating client funds, it suggests a level of legitimacy and adherence to regulatory standards. However, reports of difficulties with withdrawals and scams raise concerns about the reliability and trustworthiness of the broker. It is crucial to exercise caution and conduct thorough research before engaging with ATC or any other broker, especially when it comes to your funds and financial transactions.

Market Instruments

ATC offers various popular financial products, mainly including Forex, metals, and CFDs (Contracts for Difference). Forex trading allows clients to engage in currency pair trading, taking advantage of fluctuations in exchange rates. The availability of metals, such as gold and silver, provides an opportunity for traders to diversify their portfolios and speculate on the price movements of these valuable commodities.

Additionally, ATC offers CFDs, which allow traders to participate in the price movements of various financial instruments without owning the underlying assets. These market instruments provide ATC clients with a diverse set of options to explore and potentially capitalize on market opportunities.

Accounts

ATC offers two types of accounts: demo and live accounts. The demo account allows traders to practice their strategies and familiarize themselves with the platform without risking real money. It provides a simulated trading environment with virtual funds, enabling traders to gain experience and test their trading skills. Everyone can get a 20-day free test of platforms.

On the other hand, the live account is for real trading with actual funds. To open a live account with ATC, a minimum account balance of $/€/£5,000 is required. Indeed, the amount is way too high for most regular traders. So investors should take caution with trading on this platform.

By offering both demo and live accounts, ATC caters to traders at different experience levels, providing them with options to hone their trading skills in a risk-free environment or engage in real trading with capital at stake.

Leverage

ATC provides leverage options for traders, allowing them to amplify their trading positions. The leverage offered by ATC varies depending on the instrument being traded. For major currency pairs, the leverage is set at 30:1, which means that traders can control a position that is 30 times larger than their account balance. Non-major currency pairs, gold, and major indices have a leverage of 20:1, providing traders with the opportunity to control larger positions relative to their account size. For silver and other commodities, the leverage is set at 10:1.

Leverage can be a double-edged sword, as while it allows traders to potentially generate larger profits, it also amplifies the risk of losses. Therefore, it is important for traders to understand the risks associated with leverage and use it wisely according to their risk tolerance and trading strategy.

Spreads & Commissions

ATC offers competitive spreads and commission structures for trading various instruments. The spreads are variable and differ across different trading instruments. For the popular EUR/USD currency pair, the average spread is as low as 0.3 pips, which indicates a tight and competitive pricing.

When it comes to commissions, ATC charges a round turn commission based on the contract size. For a mini contract (10,000 lot size), the commission is set at $0.6, while for a standard contract (100,000 lot size), the commission is $6. It's worth noting that the commission is denominated in USD, and if you are trading pairs that are not in USD, the commission amount will vary based on the prevailing market conversion rate.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission (Round Turn) |

| ATC | 0.3 pips | $6 (standard contract) |

| ActivTrades | 0.5 pips | $1.50 |

| Darwinex | 0.2 pips | $5 (raw spread account) |

| ForexChief | 0.2 pips | $15 (standard account) |

Please note that the provided information is subject to change and may vary depending on account types, trading conditions, and market fluctuations. It's always recommended to refer to the official websites of the brokers for the most up-to-date and accurate information regarding spreads and commissions.

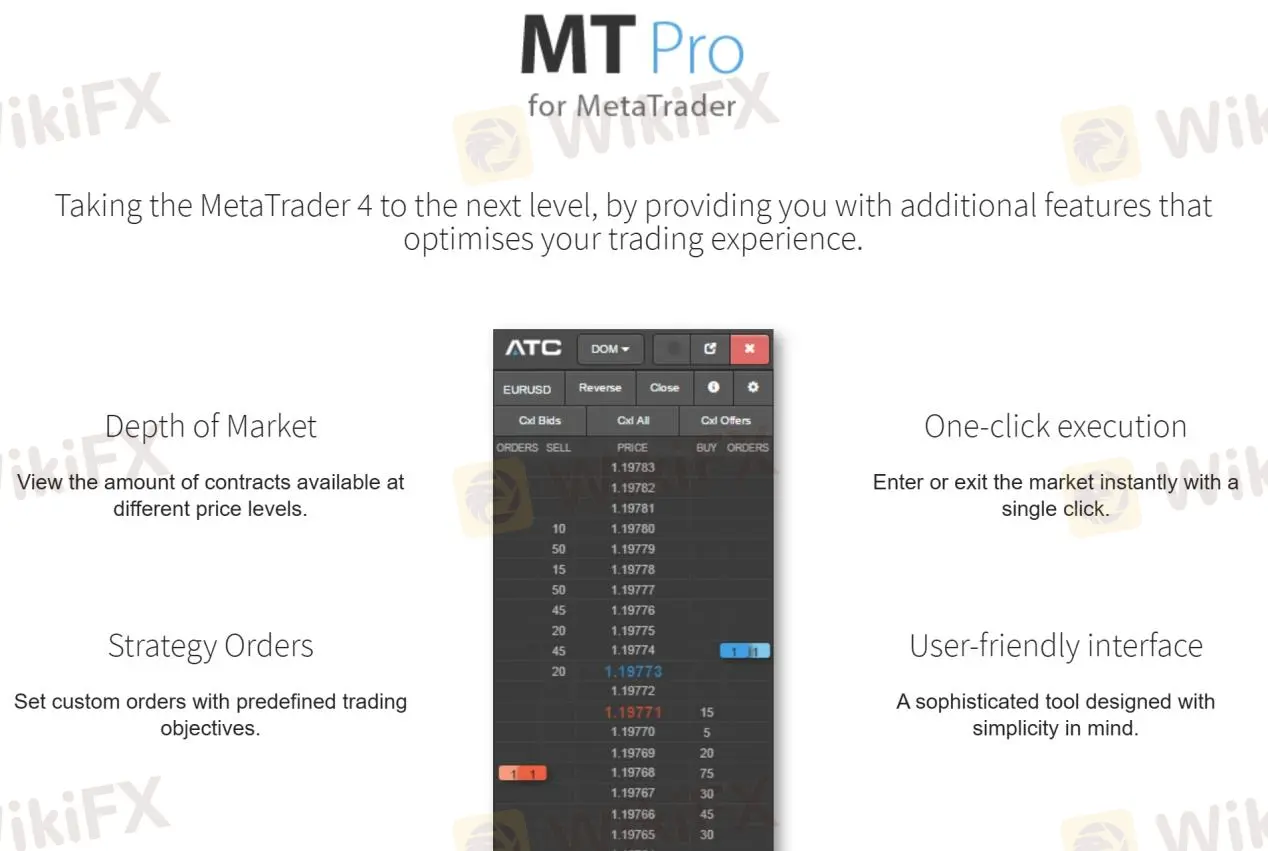

Trading Platforms

ATC provides its clients with a range of trading platforms to cater to their diverse needs. The flagship platform offered by ATC is MT Pro, which is a powerful and advanced trading platform designed for experienced traders. It offers a comprehensive suite of trading tools, advanced charting capabilities, and customizable features to enhance the trading experience.

Additionally, ATC also supports the widely popular MetaTrader 4 (MT4) platform, known for its user-friendly interface, extensive technical analysis tools, and automated trading capabilities. MT4 Mobile is available for traders who prefer to access the markets on their mobile devices, providing convenience and flexibility.

With these trading platforms, ATC ensures that traders have access to robust technology and a seamless trading experience, empowering them to make informed decisions and execute trades efficiently.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| ATC | MT Pro, MT4, MT4 Mobile |

| ActivTrades | ActivTrader, MetaTrader 4, MT5 |

| Darwinex | Darwinex Web Platform, MT4, MT5 |

| ForexChief | MT4, MT5 |

Please note that the availability of trading platforms may vary based on the broker and account type. It's always recommended to visit the official websites of the brokers for the most up-to-date and accurate information regarding their trading platforms.

Deposits & Withdrawals

ATC offers several convenient methods for depositing and withdrawing funds from trading accounts. Clients can choose to deposit funds through bank wire transfers, Visa, MasterCard, Skrill Wallet, and Union Pay.

These options provide flexibility and ease of use for clients in different regions. The accepted currencies for deposits and withdrawals are USD, EUR, and GBP, allowing traders to transact in their preferred currency. The minimum deposit requirement is $/€/£5,000.

ATC minimum deposit vs other brokers

| ATC | Most other | |

| Minimum Deposit | $/€/£5,000 | $/€/£100 |

For deposits, wire transfer requires no fees, debit cards and Skrill e-wallets charge 2.9% transaction fees; For withdrawals, international wire transfer charges $40/€30/£25, debit card requiring no fees, and Skrill e-wallets charge 1.0% transaction fee, Faster Payment charges £10 (only for UK residents). The withdrawal request will be processed within 1-2 working days.

Customer Service

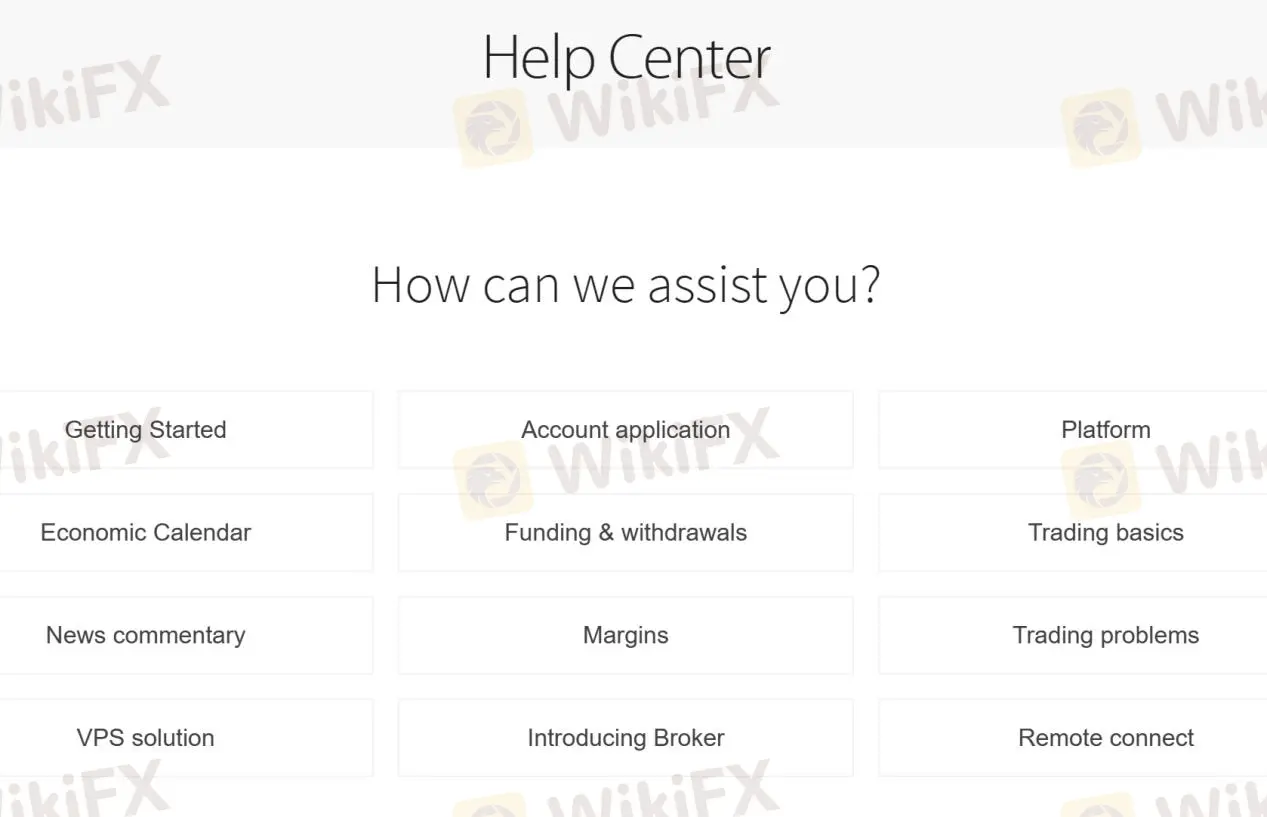

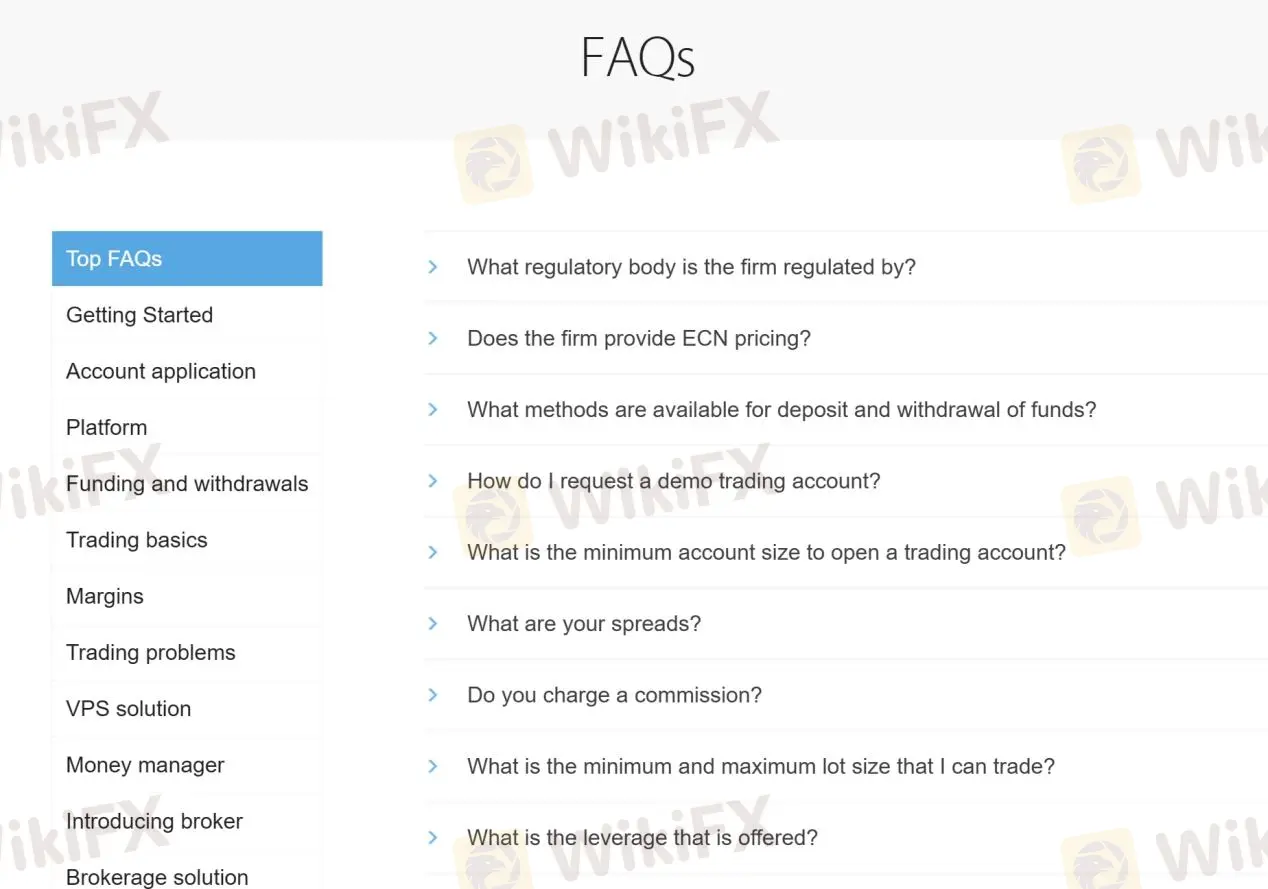

ATC is committed to providing excellent customer service to its clients. They offer multiple channels for customer support, including live chat, phone, email, and contact request, ensuring that clients can reach out for assistance through their preferred method. The live chat feature allows for real-time communication, enabling quick responses to queries and concerns.

Additionally, clients can access the Help Center and FAQ section on the ATC website, which provides comprehensive information and answers to commonly asked questions. This self-help resource can be particularly useful for clients seeking immediate assistance or looking for guidance on various topics.

With a dedicated customer service team, ATC strives to deliver timely and knowledgeable support to ensure a smooth and satisfactory trading experience for its clients.

| Pros | Cons |

| • Responsive and helpful customer support | • No 24/7 support |

| • Multiple contact methods | • Limited languages supported |

| • Professional and knowledgeable staff | |

| • Live chat support | |

| • Help Center and FAQ offered |

Please note that the information provided is based on general knowledge and may not reflect the experience of every customer. It's recommended to assess customer service based on individual needs and preferences and consider other factors such as personal experiences and reviews.

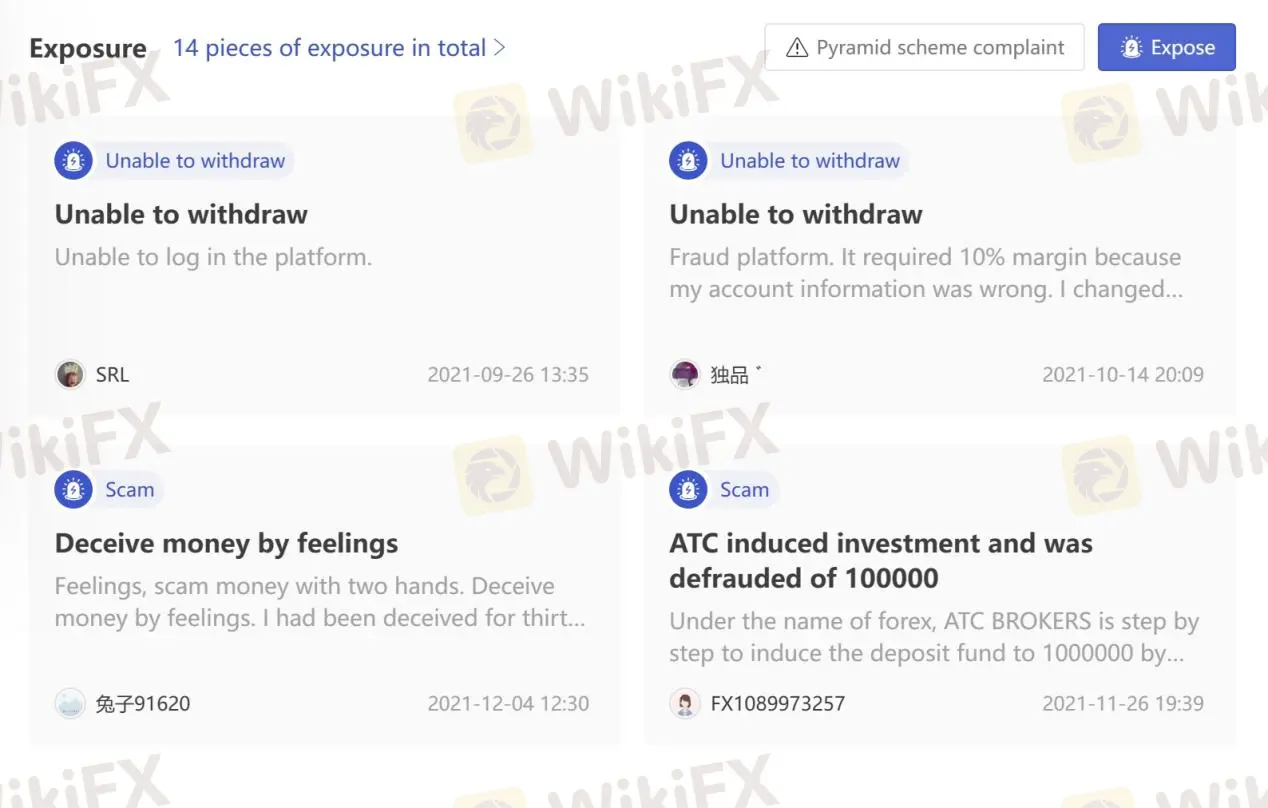

User Exposure on WikiFX

On our website, you can see that reports of unable to withdraw and scams. Before making any investment decisions, it is recommended to gather as much information as possible and consider the experiences and feedback of other traders. Our platform provides valuable resources and information to help you make informed choices. If you encounter fraudulent brokers or become a victim of one, please report it in the Exposure section so that our team of experts can investigate and assist you in resolving the issue.

Conclusion

In conclusion, ATC is a regulated broker offering a variety of trading instruments with competitive spreads. However, there have been reports of withdrawal issues and potential scams, which raise concerns about the reliability of the platform. The high minimum account balance requirement and limited accepted currencies may also pose challenges for some traders. While ATC provides access to popular trading platforms and offers customer support, the availability of educational resources could be improved. It is important for individuals to carefully consider these factors and exercise caution when deciding to trade with ATC.

Frequently Asked Questions (FAQs)

| Q 1: | Is ATC regulated? |

| A 1: | Yes. It is regulated by Financial Conduct Authority FCA, License No. 591361) in the United Kingdom. |

| Q 2: | Does ATC offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does ATC offer the industry leading MT4 & MT5? |

| A 3: | Yes. It supports MT Pro, MT4, and MT4 Mobile. |

| Q 4: | What is the minimum deposit for ATC? |

| A 4: | The minimum account balance to open is $/€/£5,000. |

| Q 5: | Is ATC a good broker for beginners? |

| A 5: | No. Though it is regulated well, there are some reports of unable to withdraw and scams, and the minimum deposit requirement of $/€/£5,000 is too high for beginners. |

WikiFX 브로커

요금 계산