DEGIRO-Some important Details about This Broker

요약:DEGIRO is a Netherlands-based online brokerage platform that has been operational since 2013. Despite its relative novelty, it has made significant strides in becoming a prominent broker in the financial markets, offering a wide array of market instruments such as shares, bonds, and currencies.

| DEGIRO Review Summary | |

| Founded | 2013 |

| Registered Country/Region | Netherlands |

| Regulation | Non-regulated |

| Market Instruments | Shares, Bonds, Currencies, etc. |

| Currency Conversion | 0.25% |

| Trading Platforms | WebTrader and Mobile Applications |

| Customer Support | Phone: +31 20 26 13 072; Email: klanten@degiro.nl |

What is DEGIRO?

DEGIRO is a Netherlands-based online brokerage platform that has been operational since 2013. Despite its relative novelty, it has made significant strides in becoming a prominent broker in the financial markets, offering a wide array of market instruments such as shares, bonds, and currencies. However, DEGIRO is currently a non-regulated broker. This poses a certain degree of risk, as there might not be stringent checks and balances in place to safeguard the client's interests.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Pros:

Well-Made Interface: User-friendliness and navigational ease are significant aspects of DEGIRO's platform. This feature ensures that both new and seasoned traders can efficiently find their way around and make their transactions with minimal hassle.

Competitive Fees: DEGIRO's fee structure is quite competitive, making it an affordable option for traders, especially those dealing with high volumes.

Various Market Instruments: The broker offers a wide array of market instruments for trading, including shares, bonds, and currencies. This wide variety enables traders to diversify their portfolio right from the same platform.

Cons:

Non-Regulated: DEGIRO is currently non-regulated. This lack of regulation may present a higher risk as it implies fewer checks and balances are in place to protect customers.

Is DEGIRO safe or scam?

DEGIRO operates on a non-regulated status, which essentially means that it does not come under the scrutiny or regulations of a prominent financial regulatory body. This lack of regulation can potentially pose various operational and financial risks to clients, primarily because non-regulated brokers do not have to adhere to standard rules and regulations that aim to protect clients' investments and interests.

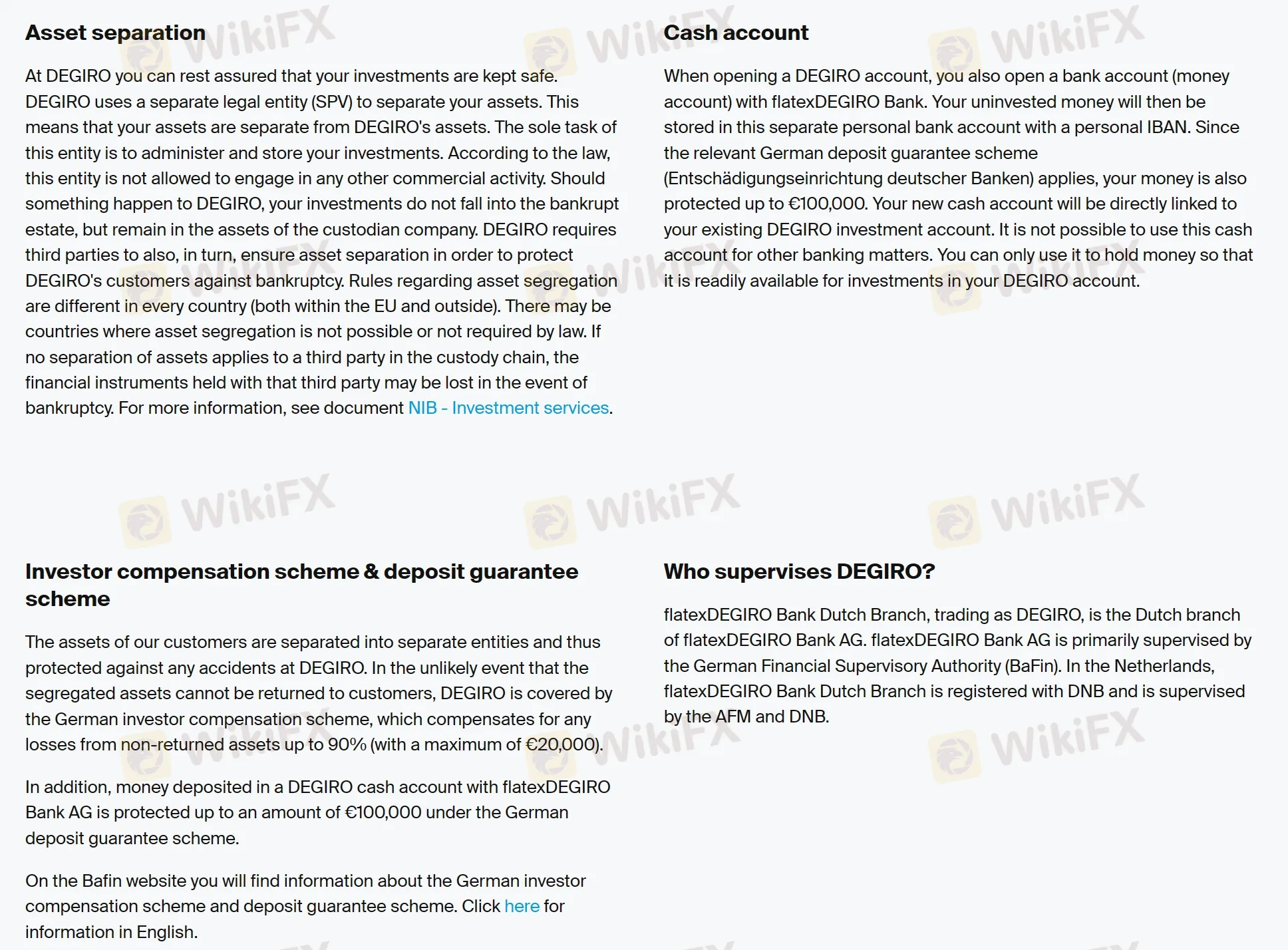

DEGIRO uses asset segregation to secure your assets through a separate legal entity. It also uses Money Market Funds for added security. DEGIRO's clients are protected under the German Investor Compensation Scheme, assuring protection up to 90% of their assets (with a cap at €20,000) in the unlikely event that DEGIRO experiences insolvency. In addition to this, any funds deposited in a DEGIRO Cash Account with flatexDEGIRO Bank AG are protected up to €100,000 under the German Deposit Guarantee Scheme. DEGIRO, operating under flatexDEGIRO Bank AG, is primarily supervised by the German Federal Financial Supervisory Authority and is also subject to the integrity supervision of the Dutch National Bank and AFM in the Netherlands.

Market Instruments

Shares: Traders can buy and sell stocks from various companies listed in different global exchanges.

Bonds: DEGIRO offers the opportunity to invest in the debt of governments or corporations, potentially earning interest over a set period.

Currencies: Traders can engage in forex trading, speculating on the rise or fall of currencies relative to others.

Mutual Funds: DEGIRO provides access to numerous mutual funds, giving less-experienced or time-constrained traders a chance to leverage expertly managed portfolios.

ETFs: Offering Exchange-Traded Funds, the platform enables traders to invest in a diverse selection of market indexes, sectors, or commodities.

Options: DEGIRO allows trading options contracts, providing the rights to buy or sell an underlying asset at a predetermined price before a certain date.

Futures: Traders can engage in futures contracts that obligate the buyer to buy, and the seller to sell a specified quantity of the underlying asset at a specific price, at a future date.

Crypto Trackers: The platform also provides crypto trackers, which are instruments that track the performance of a given cryptocurrency.

Commodities: DEGIRO enables its clients to trade in commodities such as oil, gold, and agricultural products.

Leveraged Products: For traders looking for greater market exposure, DEGIRO offers leveraged products that essentially allow clients to borrow money to trade larger amounts.

Structured Products: These complex financial instruments are also offered, allowing traders to expose themselves to a variety of market conditions with a predetermined return and risk.

Trading Platforms

WebTrader: This platfrom is a user-friendly, web-based platform that is accessible from any internet-enabled device. It offers a comprehensive suite of features that make managing your portfolio and trading easy. The interface is designed to be easy to navigate, with price streaming in real-time and intuitive order capabilities. It also features an integrated news feed, allowing traders to stay up to date with the latest market news. Real-time price data can help keep users abreast of changes in the market or the status of their positions.

Mobile Applications: In addition to their web-based offering, DEGIRO also provides mobile applications for both iOS and Android smartphones and tablets. The mobile platform mirrors the features available on the web, allowing users to manage their portfolio, monitor the market, and execute trades on the go. It includes the added benefit of allowing users to be notified of changes in their portfolio or the market condition at any time, no matter where they are.

Commissions & Fees

| Product | Commission | Handling Fee |

| US Stocks | €1 | €1 |

| London Stock Exchange Stocks | £1.75 | £1 |

| Selected ETFs | €0 | €1 |

| Global ETFs | €2 | €1 |

| Options | €0.75 per contract | N/A |

| Structured Products | €2 | €1 |

The table demonstrates differences in commission and handling fees across various trading products. For US stocks, the broker charges €1 for both. Trading in stocks from the London Stock Exchange incurs a commission of £1.75 with a handling fee of £1. Selected ETFs have zero commission and a €1 handling fee, while other global ETFs carry a €2 commission and €1 handling fee. Derivatives like options have a commission of €0.75 per contract. Structured products require a €2 commission and €1 handling fee per trade.

DEGIRO also charges a 0.25% fee for currency conversion. They do not charge inactivity fees, withdrawal, and deposit fees, or custody fees.

Moreover, DEGIRO has specific charges for real-time quotes Chi-X, no charges for inactivity, withdrawals, deposits, and custody. For currency conversion, a fee of 0.25% is applied.

Connectivity costs are also incurred for DEGIRO to set up trading opportunities outside of your home market. Generally, you will pay a maximum of 0.25% of your total portfolio value (maximum charge of €2.50) per annum for each exchange, excluding the London Stock Exchange.

Finally, DEGIRO includes product costs in their prices, which are fees not paid to DEGIRO, but to the issuer of the products. These could include total expense ratios (TER) for ETFs and fund issuers and finance fees for issuers of leveraged products.

Customer Service

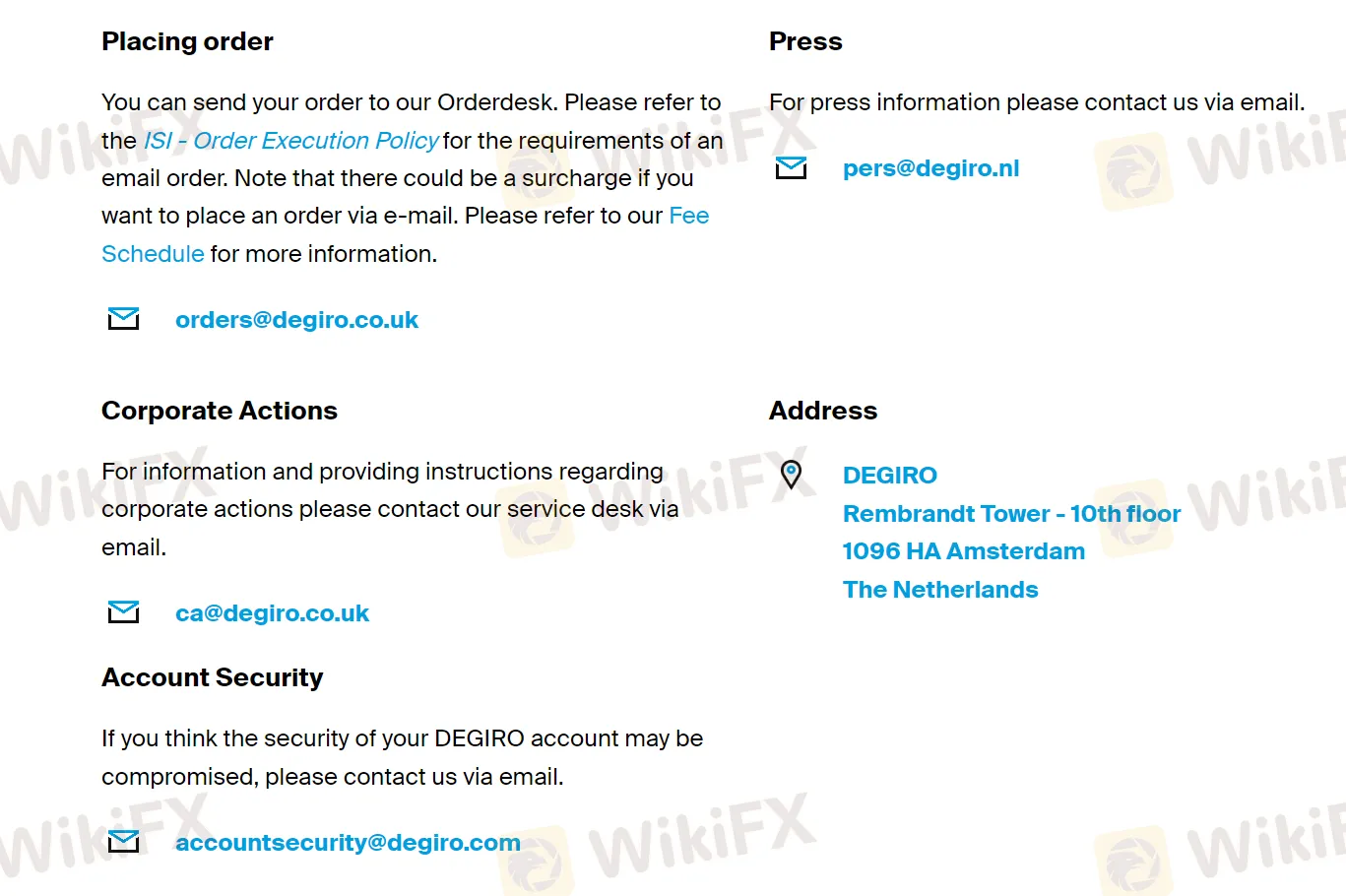

Telephone Support: Clients can reach DEGIRO's customer support over the phone at two different numbers. The first is 020 535 34 96, which operates at local rates and provides service between the hours of 08:00 and 22:00. On the other hand, the second is +31 20 26 13 072, primarily for English-speaking clients. It offers service between the hours of 17:30 and 22:00.

Email Support: For non-urgent or detailed inquiries, clients can reach DEGIRO via email at customers@degiro.nl.

Social Media: DEGIRO maintains a robust presence across various social media platforms, including Twitter, Facebook, Instagram, TikTok, and LinkedIn. These platforms may be used for updates and general queries.

Physical Address: For formal communication, clients can send mail to the company's official address at Rembrandt Tower - 9th Floor, 1096 HA, Amsterdam, The Netherlands.

Conclusion

DEGIRO is a Netherlands-based online broker that provides a wide range of trading instruments including shares, bonds, currencies, ETFs, and more. Despite its non-regulated status, the broker offers a user-friendly trading platform in the form of WebTrader and mobile applications, which provide features like real-time quotes, market news, and extensive order capabilities. Their fee structure is straightforward and competitive, although they charge a 0.25% fee for currency conversions. DEGIRO provides robust customer support via phone, email, and social media. However, potential clients should exercise caution and thoroughly vet their options due to the inherent risks with non-regulated brokers.

Frequently Asked Questions (FAQs)

Q: Is DEGIRO regulated?

A: No, DEGIRO is currently non-regulated but maintains a good reputation within the industry.

Q: What trading platforms does DEGIRO use?

A: DEGIRO uses a WebTrader platform and also offers mobile applications for both iOS and Android devices.

Q: What is DEGIRO's fee for currency conversion?

A: DEGIRO charges a 0.25% fee for currency conversion.

Q: How can I contact DEGIRO?

A: DEGIRO can be contacted via phone at +31 20 26 13 072, via email at customers@degiro.nl, and via their social media accounts on platforms like Twitter, Facebook, and LinkedIn.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

WikiFX 브로커

요금 계산