Flatex-Some important Details about This Broker

요약:The online broker Flatex is a brand of FlatexDERIRO Bank AG has specialized in the advice-free securities business and is aimed at active traders. Flatex offers its clients a “WebBranche” that can be accessed via the Internet for trading in Securities and CFDs. With this trading interface, Flatex enables shares, certificates, warrants, bonds, funds, ETFs and CFDs.

| Aspect | Information |

| Company Name | flatex |

| Registered Country/Area | Germany |

| Founded year | 2-5 years ago |

| Regulation | Unregulated |

| Market Instruments | Stocks, ETFs, Funds, Certificates, CFD, Crypto |

| Minimum Deposit | None |

| Maximum Leverage | N/A |

| Spreads | Starting from €5.90 |

| Trading Platforms | WebBranche Classic, Flatex Trader 2.0, Guide, Products Finder, flatex next |

| Customer Support | Phone: +43 720 518 777 (General), +43 720 518 555 (Interested persons) |

| Deposit & Withdrawal | Only bank transfer available |

| Educational Resources | Online seminars, roadshows, market updates, TV documentaries, podcasts |

Overview of flatex

flatex, headquartered in Germany, has been operating for 2-5 years. It offers a range of trading assets including stocks, ETFs, funds, certificates, CFD, crypto and more.

The platform is unregulated, which poses risks for investors. It provides a user-friendly trading platform with competitive fees, starting from €5.90 for stock trading.

Additionally, flatex offers commission-free savings plans and educational resources. While it lacks various payment methods, its no minimum deposit requirement appeals to many investors.

Regulatory Status

Flatex is not regulated by any financial authority. This lack of regulation means there is no official oversight to ensure the company's practices are fair or transparent. Customers might face risks like unfair fees, lack of recourse in disputes, and potential loss of funds.

Pros and Cons

| Pros | Cons |

| Low commission fees for stock trading: Starting from €5.90 | Unregulated |

| Commission-free savings plans | Limited payment methods: Only bank transfer available |

| Variety of trading assets: Stocks, ETFs, funds, certificates. | |

| No minimum deposit requirement | |

| Great educational tools |

Pros:

Low Commission Fees for Stock Trading: flatex offers competitive commission fees for stock trading, starting from €5.90. This low fee structure can be advantageous for traders looking to minimize transaction costs, especially for smaller trades.

Commission-Free Savings Plans: flatex provides access to over 600 commission-free savings plans, allowing investors to build diversified portfolios without incurring additional fees.

Variety of Trading Assets: flatex offers a wide range of trading assets, including stocks, ETFs, funds, and certificates. This extensive selection provides investors with ample opportunities to diversify their portfolios and pursue various investment strategies.

No Minimum Deposit Requirement: flatex does not impose a minimum deposit requirement, allowing investors to start trading with any amount they are comfortable with.

Great Educational Tools: flatex provides educational tools and resources to help investors enhance their trading knowledge and skills, including online seminars, roadshows, market updates, TV documentaries, podcasts, and live events.

Cons:

Unregulated: One notable drawback of flatex is that it is not regulated by any financial authority. This lack of regulation raise risks about the platform's transparency, accountability, and adherence to industry standards.

Limited Payment Methods: flatex offers limited payment methods, with only bank transfer available for deposits and withdrawals.

Market Instruments

Flatex provides various trading assets for traders, including:

Shares

Traders can invest in shares of various companies listed on multiple stock exchanges.

Savings Plans

ETF or fund savings plans are available, offering regular investment opportunities to secure financial futures.

ETF

With over 600 premium ETFs, traders can gain exposure to broad market indices.

Funds

A wide range of funds is offered, potentially benefiting from professional management and performance.

Bonds

Over 35,000 bonds are available for traders to earn returns through interest payments.

Certificates & Leveraged Products

Traders can trade certificates and leveraged products for opportunities to profit from price movements.

CFD

Contract for Difference trading is available for speculating on the price movements of various assets.

Invest Sustainably: Flatex Green

Sustainable investment options align with environmental and social governance criteria.

Securities Loans

Traders can borrow against their securities portfolio to access liquidity.

Crypto

Popular cryptocurrencies are available for trading, allowing traders to diversify their investment portfolio.

How to Open an Account?

Opening an account with Flatex typically involves the following steps:

Visit the Website: Navigate to the Flatex website to initiate the account opening process.

Provide Personal Information: Fill out the online application form with accurate personal details, including your full name, address, contact information, and identification documents.

Complete Verification: Upload necessary verification documents, such as a valid ID, proof of address, and any additional documents required for verification purposes.

Agree to Terms and Conditions: Review and agree to the terms and conditions of Flatex, including any applicable fees, trading policies, and privacy agreements.

Submit Application: Once all required information and documents are provided, submit your application for review. Upon approval, you will receive confirmation and access to your Flatex account for trading.

Spreads & Commissions

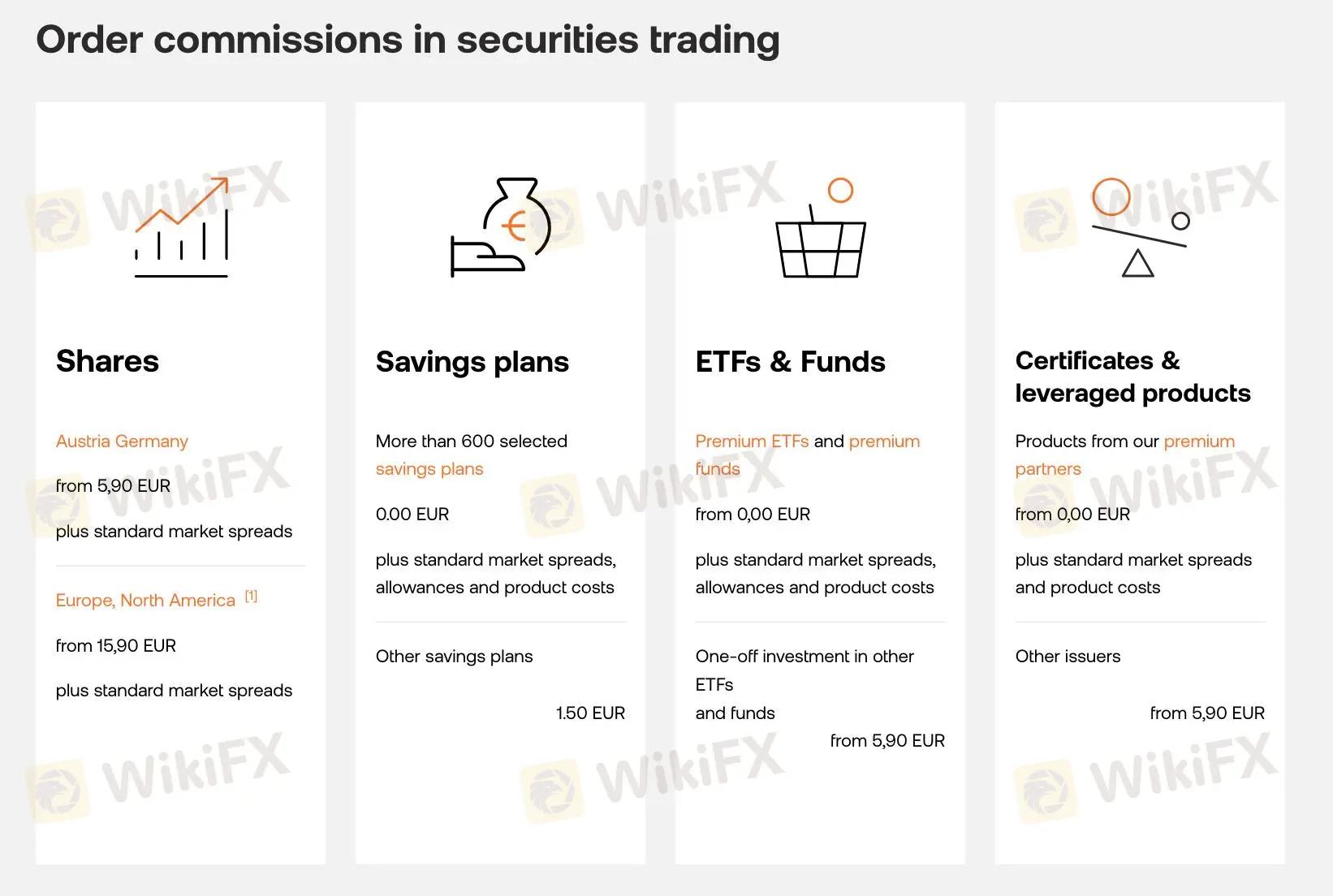

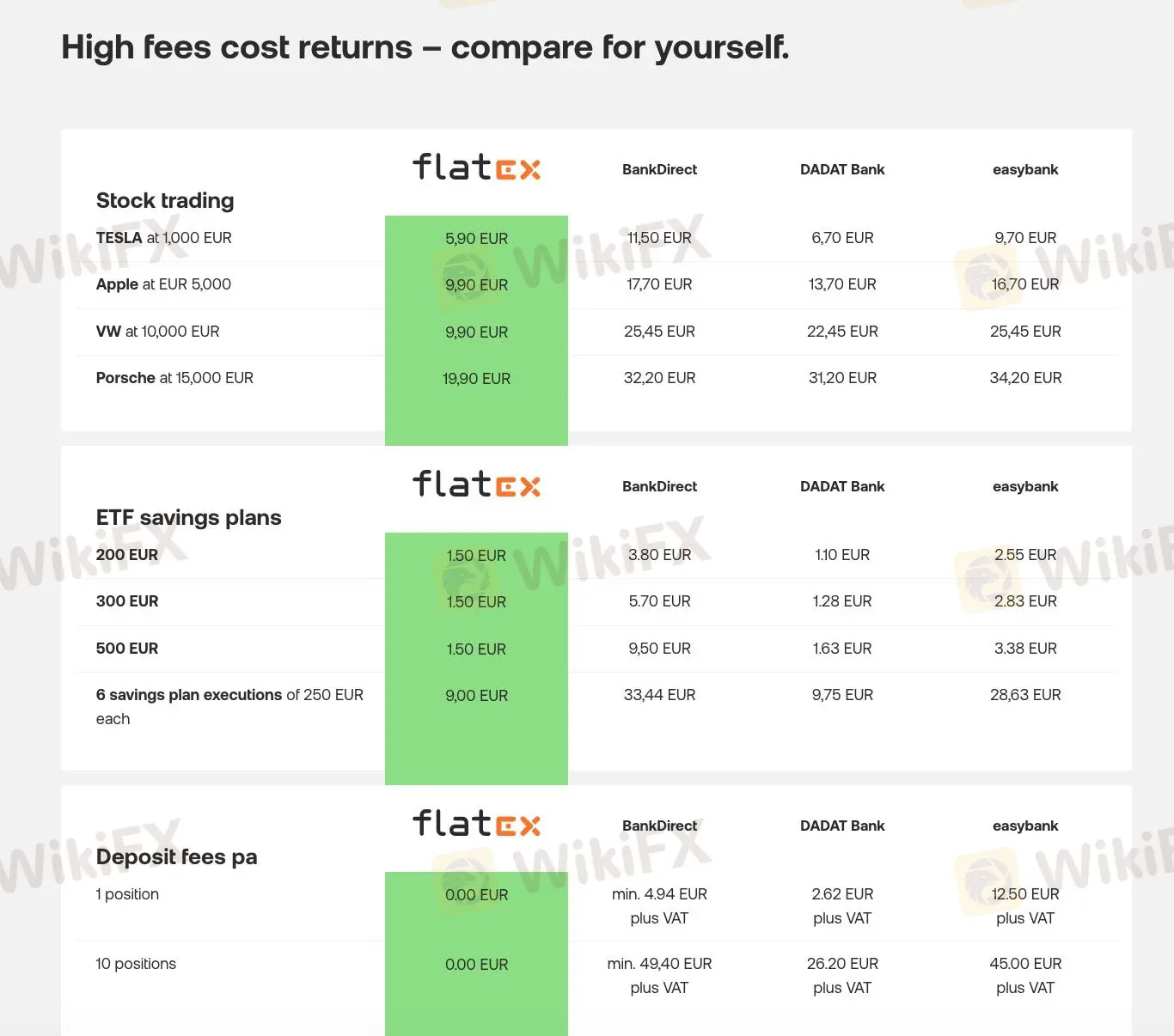

Shares

For trading shares in Austria and Germany, flatex charges commissions starting from €5.90, plus standard market spreads. In Europe and North America, the commission starts from €15.90, also with standard market spreads. Comparing these fees with popular brokers, flatex generally offers competitive rates, especially for lower-value trades. However, for higher-value trades, other brokers may offer more competitive pricing.

Savings Plans

flatex offers more than 600 selected savings plans with commission-free trading. However, for other savings plans, there's a commission of €1.50. This makes flatex suitable for investors looking to save on commission fees, especially for selected savings plans.

ETFs & Funds

For premium ETFs and funds, flatex offers commission-free trading. However, for other ETFs and funds, the commission starts from €5.90. Investors interested in premium ETFs and funds can benefit from commission-free trading with flatex.

Certificates & Leveraged Products

flatex offers commission-free trading for products from premium partners. However, for products from other issuers, the commission starts from €5.90. Investors who prefer products from premium partners can take advantage of commission-free trading with flatex.

Considering the fees, flatex is suitable for various user groups, including those who prioritize commission-free trading in selected savings plans, premium ETFs, and funds. However, investors conducting higher-value trades find other brokers offering more competitive pricing for certain assets.

Trading Platform

Flatex offers multiple trading platforms to accommodate varying trading styles and preferences:

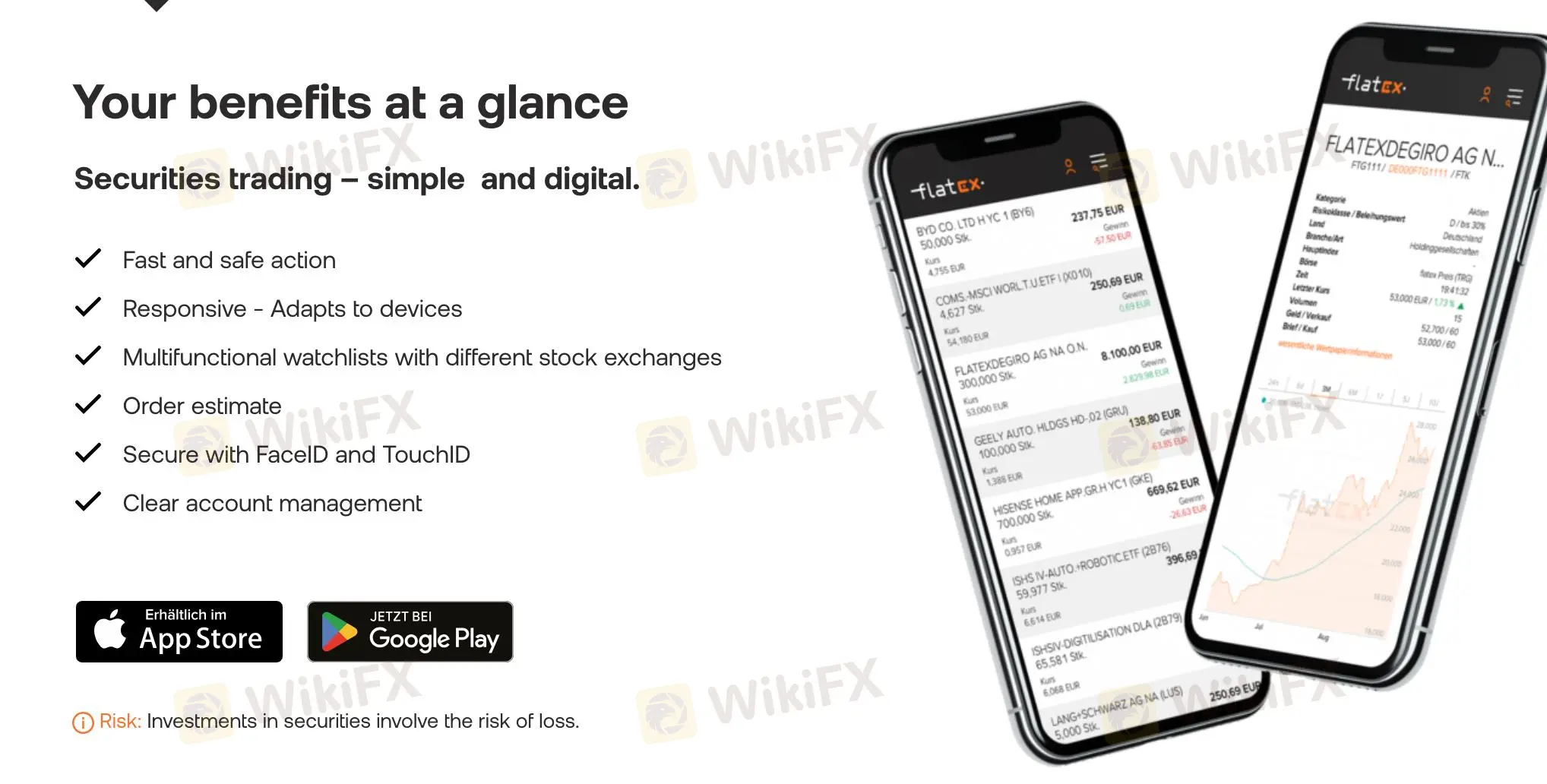

flatex next is a user-friendly platform accessible via desktop and mobile devices. It provides a friendly interface for trading and investment management. The platform prioritizes user-friendliness, providing an intuitive interface that has garnered recognition and awards. With flatex next, traders can access markets and investment products directly from one clear app, available on various devices including smartphones, desktops, and tablets.

flatex-classic offers a simple and functional trading interface accessible through web browsers. It provides essential tools for executing trades efficiently.

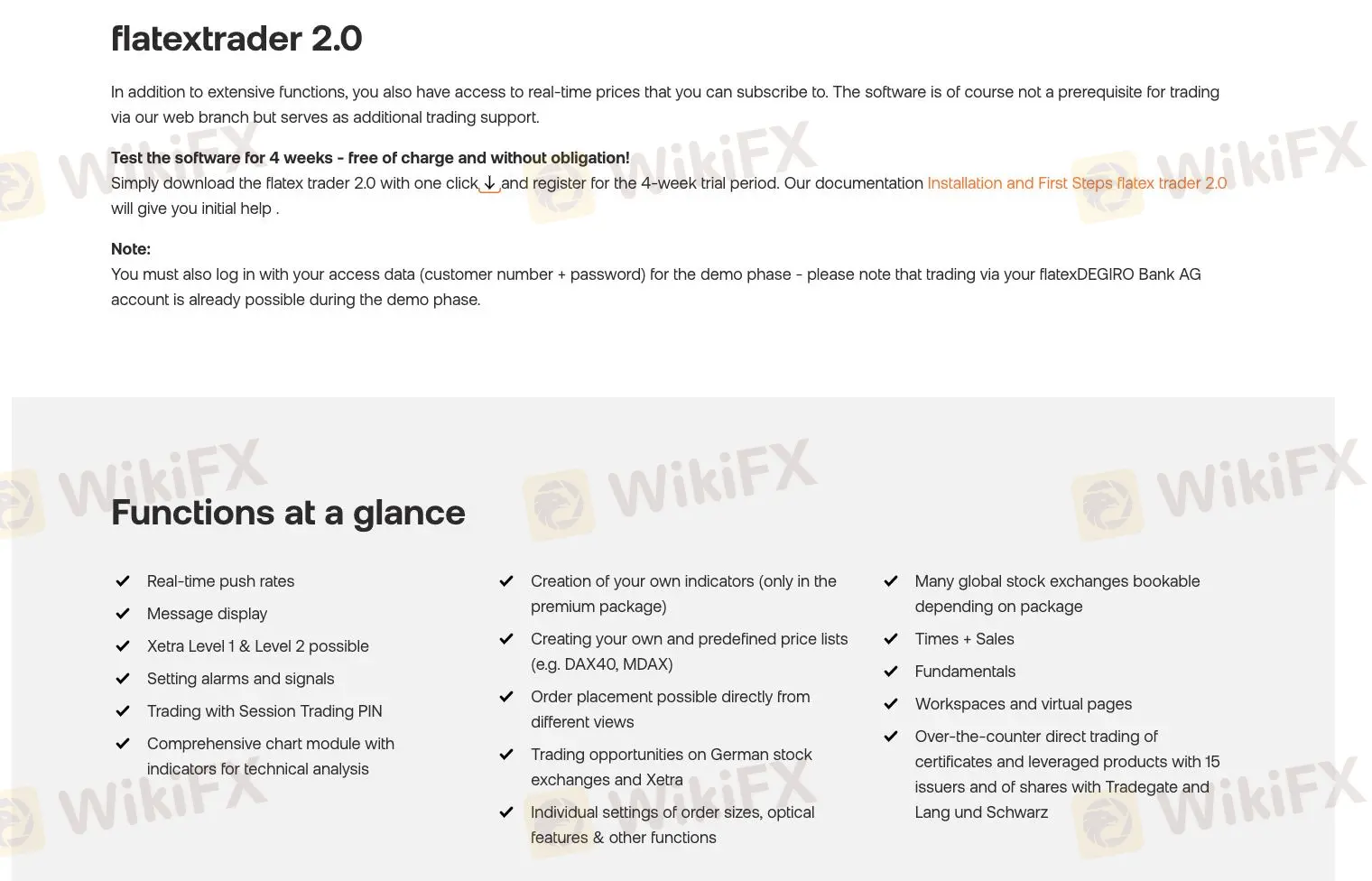

flatextrader 2.0 is a comprehensive trading software with advanced functionalities. It offers real-time market data, customizable charts, and various order placement options. It provides real-time push rates, ensuring traders have access to up-to-date market information. The platform includes a message display feature for important notifications, as well as access to Xetra Level 1 & Level 2 data for detailed market analysis.

stock3:This platform provides access to real-time market prices and trading support tools. It is designed to enhance the trading experience for users.

Product Finder:The Product Finder tool helps users identify suitable financial products based on their investment criteria. It streamlines the product selection process for traders.

Deposit & Withdrawal

Flatex facilitates deposits and withdrawals free of charge, with bank transfer being the sole payment method, which may result in longer processing times spanning a few days.

Notably, there is no minimum deposit requirement, offering flexibility to users. However, the absence of alternative payment methods might inconvenience those seeking quicker transactions or preferring various payment options.

Customer Support

Flatex provides customer support via phone, with the contact number +43 720 518 777. For inquiries from interested individuals, they can call +43 720 518 555.

Educational Resources

Flatex offers a variety of educational resources to enhance stock market knowledge, including online seminars, roadshows, market updates, TV documentaries, podcasts, and live events.

These resources provide valuable insights into stocks, indices, and trading strategies. Additionally, the availability of live events allows for interactive learning opportunities, which can be beneficial for traders seeking real-time market insights.

Conclusion

In conclusion, flatex presents several competitive advantages, including low commission fees starting from €5.90, commission-free savings plans, and a wide range of trading assets.

Moreover, the platform stands out for its absence of a minimum deposit requirement.

However, its unregulated status may discourage certain investors, while the limited availability of payment methods poses accessibility challenges.

Nonetheless, flatex's user-friendly trading platforms and educational resources enhance its appeal, offering valuable tools for traders to navigate the market effectively.

FAQs

Question: What trading assets does flatex offer?

Answer: flatex provides access to a variety of trading assets, including stocks, ETFs, funds, and certificates.

Question: Is flatex regulated?

Answer: No, flatex is currently unregulated, which may impact investor confidence and protection.

Question: What are the commission fees for stock trading on flatex?

Answer: Commission fees for stock trading on flatex start from €5.90, making it a cost-effective option for traders.

Question: What is the minimum deposit requirement on flatex?

Answer: There is no minimum deposit requirement on flatex, providing flexibility for investors of all levels.

Question: What customer support options are available on flatex?

Answer: flatex offers customer support via phone, with dedicated numbers for general inquiries and interested people.

WikiFX 브로커

요금 계산