Westpac Banking Corporation

요약:Westpac Banking Corporation was founded in 1817 as the Bank of New South Wales, an Australian bank, and changed its name in October 1982 following the acquisition of the Commercial Bank of Australia. Westpac offers banking and wealth management services to consumers, businesses, and institutions.

| Aspect | Information |

| Registered Country/Area | Australia |

| Founded Year | 1817 |

| Company Name | Westpac |

| Regulation | ASIC |

| Services | - Personal banking services including accounts, loans, credit cards, investments, and insurance |

| - Business banking services including accounts, loans, credit cards, and industry-specific banking | |

| - Corporate banking services including corporate & institutional banking, transaction banking, financial markets, and ESG advisory | |

| Trading Platforms | Westpac Share Trading |

| Account Types | - Personal accounts |

| - Business accounts | |

| - Corporate accounts | |

| Customer Support | Responsive customer support available through various channels including phone, chat, and online banking |

Overview

Westpac, founded in 1817 and headquartered in Australia, is a renowned financial institution regulated by the Australian Securities and Investments Commission (ASIC). It offers a comprehensive suite of banking services spanning personal, business, and corporate sectors. Individuals can access a range of banking products including accounts, loans, credit cards, investments, and insurance. Businesses benefit from tailored solutions such as accounts, loans, and credit cards, while corporate clients enjoy specialized services including institutional banking, transaction banking, financial markets, and ESG advisory. Westpac's trading platform, Westpac Share Trading, provides investment opportunities, and the institution provides various account types to cater to different customer needs. With responsive customer support available via phone, chat, and online banking, Westpac ensures a seamless banking experience for its clients.

Regulation

Westpac is regulated by the Australian Securities and Investments Commission (ASIC). ASIC oversees Westpac's compliance with financial regulations, ensuring fair and transparent practices in the banking sector. This regulatory oversight aims to maintain the stability and integrity of the financial system in Australia.

Pros and Cons

Westpac offers a comprehensive range of banking services catering to diverse needs, including advanced trading tools and competitive interest rates. Customers benefit from responsive customer support and regulatory oversight by ASIC, ensuring compliance and fair practices. However, potential fees associated with transactions and administration, as well as regulatory constraints, may pose challenges. Additionally, the availability of services may be comparatively limited compared to larger global banking institutions.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Services

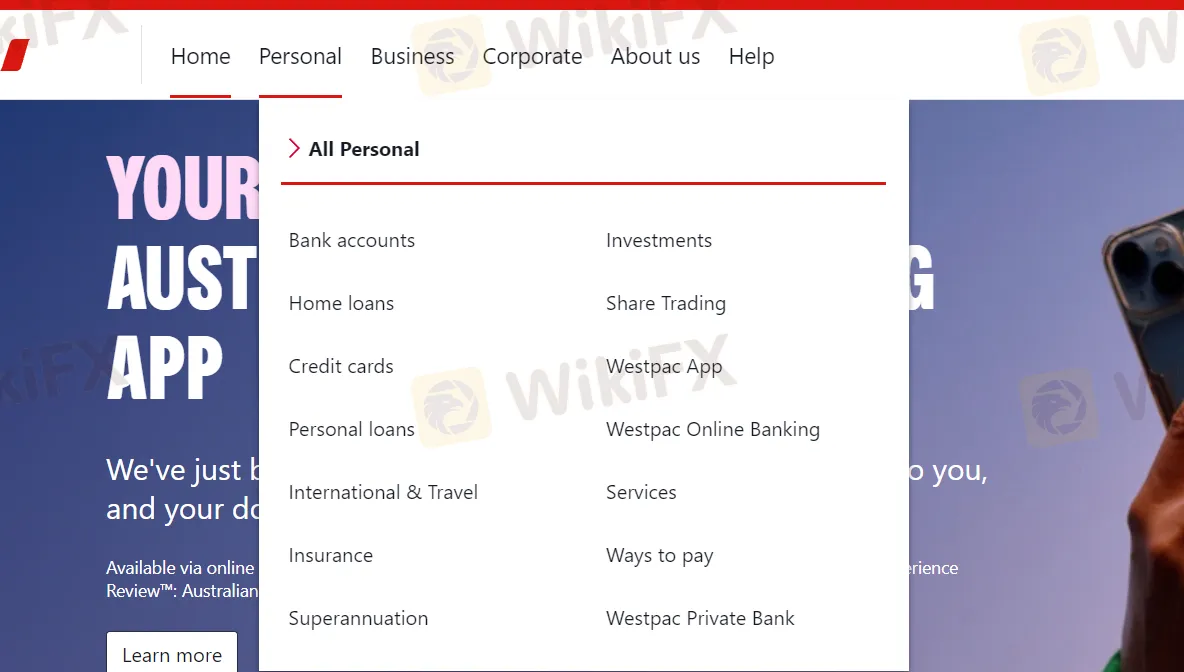

Personal Services:

Bank Accounts: A variety of personal banking options including everyday transaction accounts, savings accounts, and term deposits.

Home Loans: Solutions for purchasing property, refinancing, and investing in real estate.

Credit Cards: A range of credit cards with various features and benefits tailored to different customer needs.

Personal Loans: Options for various purposes such as buying a car, consolidating debt, or funding a holiday.

International & Travel Services: Including foreign currency exchange, international money transfers, and travel insurance.

Insurance: A range of insurance products including home and contents insurance, car insurance, life insurance, and income protection insurance.

Superannuation: Services for superannuation and retirement planning to manage finances for the future.

Investments: Products such as managed funds, term deposits, and share trading platforms.

Westpac App: Mobile banking application for managing accounts, making payments, and accessing other banking services.

Westpac Online Banking: Online banking services for managing accounts, paying bills, transferring funds, and more.

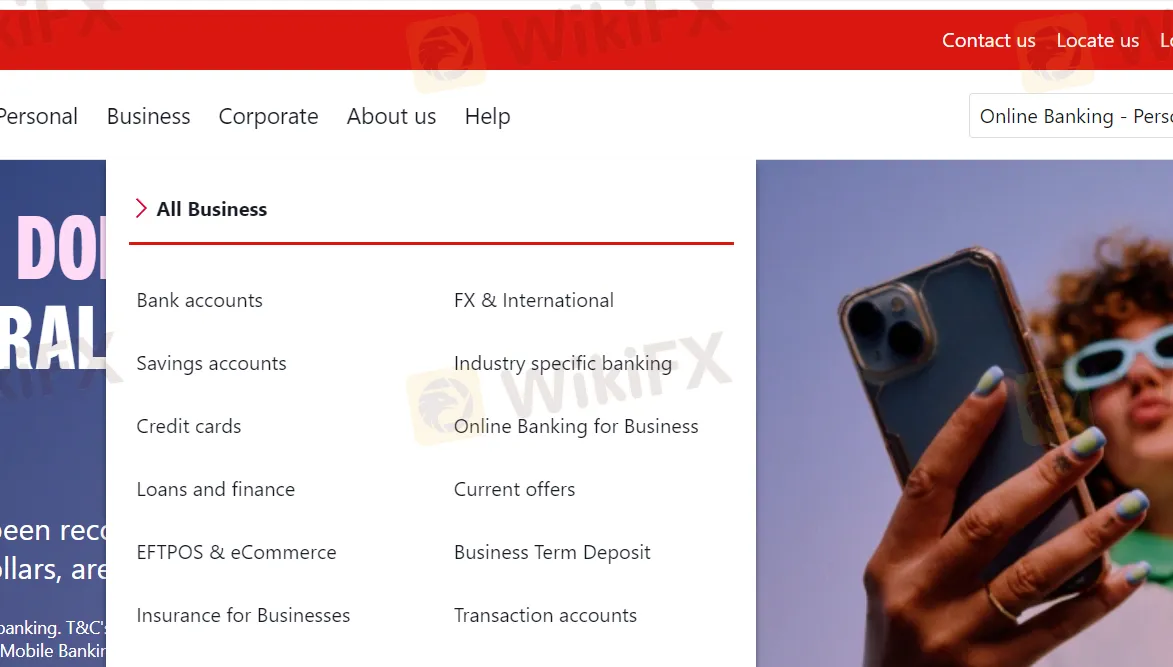

Business Services:

Bank Accounts: Solutions including transaction accounts and savings accounts tailored for businesses of all sizes.

Savings Accounts: Business savings accounts with competitive interest rates to help businesses grow their funds.

Credit Cards: Business credit card options with features such as expense tracking and rewards programs.

Loans and Finance: Options to support business growth and expansion.

EFTPOS & eCommerce: Electronic payment solutions including EFTPOS terminals and eCommerce payment gateways.

Insurance for Businesses: Solutions tailored for businesses including property insurance, liability insurance, and business interruption insurance.

FX & International Services: Foreign exchange services and international trade solutions to manage currency risk and facilitate global transactions.

Industry Specific Banking: Tailored solutions for specific industries such as agriculture, healthcare, and professional services.

Online Banking for Business: Platforms for managing accounts, making payments, and accessing other banking services.

Current Offers: Regular promotional offers and deals on various banking products and services.

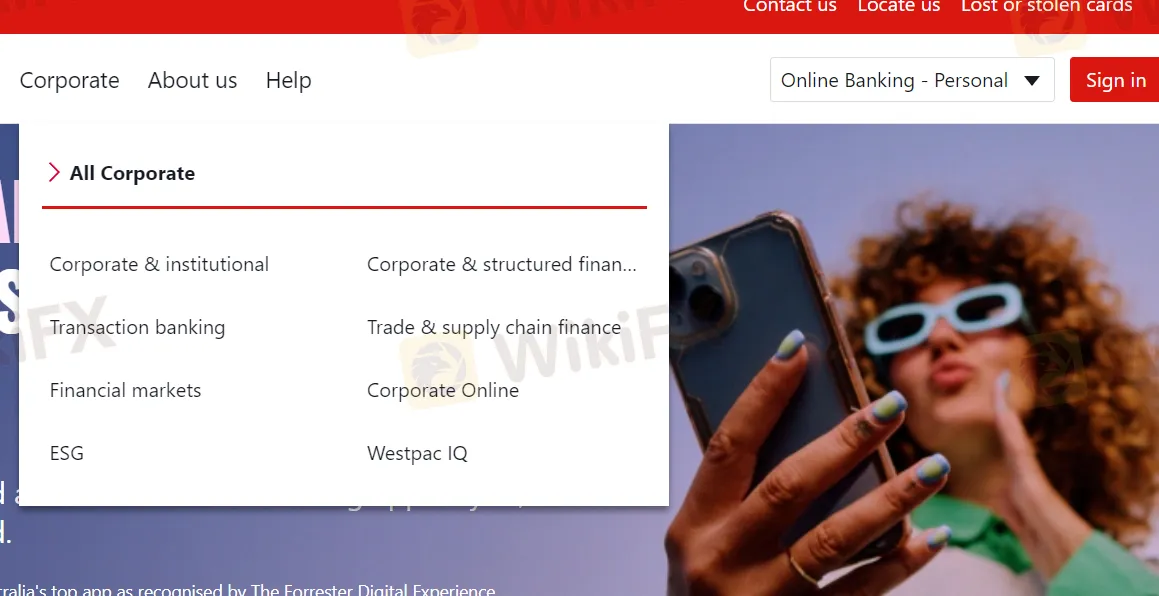

Corporate Services:

Corporate & Institutional Banking: Banking services tailored for large corporations, government entities, and institutional clients.

Transaction Banking: Cash management, payments, and liquidity solutions to optimize cash flow.

Financial Markets: Wide range of financial market products and services including foreign exchange, interest rate products, and commodity hedging.

ESG (Environmental, Social, and Governance): Advisory services and sustainable financing solutions.

Corporate & Structured Finance: Structured finance solutions including project finance, acquisition finance, and corporate lending.

Trade & Supply Chain Finance: Solutions to manage import and export activities.

Corporate Online: Online banking platform for corporate clients to manage accounts, initiate transactions, and access financial information.

Westpac IQ: Insights, research, and analytics platform to help corporate clients make informed financial decisions.

Trading Products

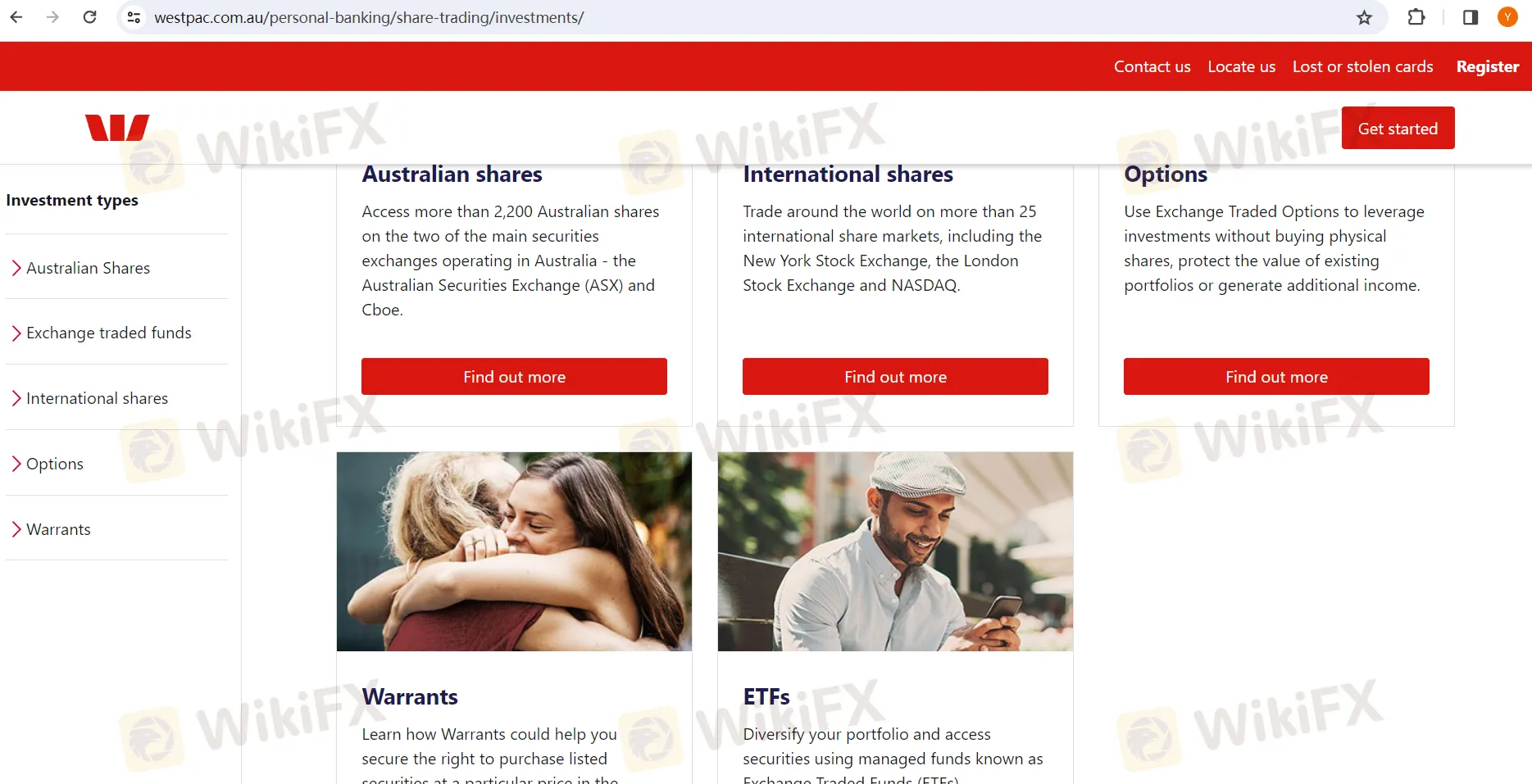

Westpac Share Trading offers a diverse range of trading products to meet various investment needs:

Australian Shares: Access over 2,200 Australian shares listed on the Australian Securities Exchange (ASX) and Cboe, providing investors with opportunities to trade stocks from different sectors of the Australian market.

International Shares: Trade on more than 25 international share markets, including renowned exchanges such as the New York Stock Exchange, the London Stock Exchange, and NASDAQ, allowing investors to diversify their portfolios with global investment opportunities.

Options: Utilize Exchange Traded Options to leverage investments without purchasing physical shares, hedge existing portfolios against market volatility, or generate additional income through options trading strategies.

Warrants: Explore Warrants, financial instruments that grant the holder the right to purchase listed securities at a specified price in the future, offering potential opportunities for capital appreciation or risk management.

ETFs (Exchange-Traded Funds): Diversify portfolios and access a broad range of securities through managed funds known as Exchange-Traded Funds (ETFs), which track indices, sectors, or asset classes, providing investors with exposure to diversified investment strategies.

Overall, Westpac Share Trading empowers investors with a comprehensive suite of trading products, enabling them to trade Australian and international shares, utilize derivative instruments such as options and warrants, and diversify their portfolios through ETFs.

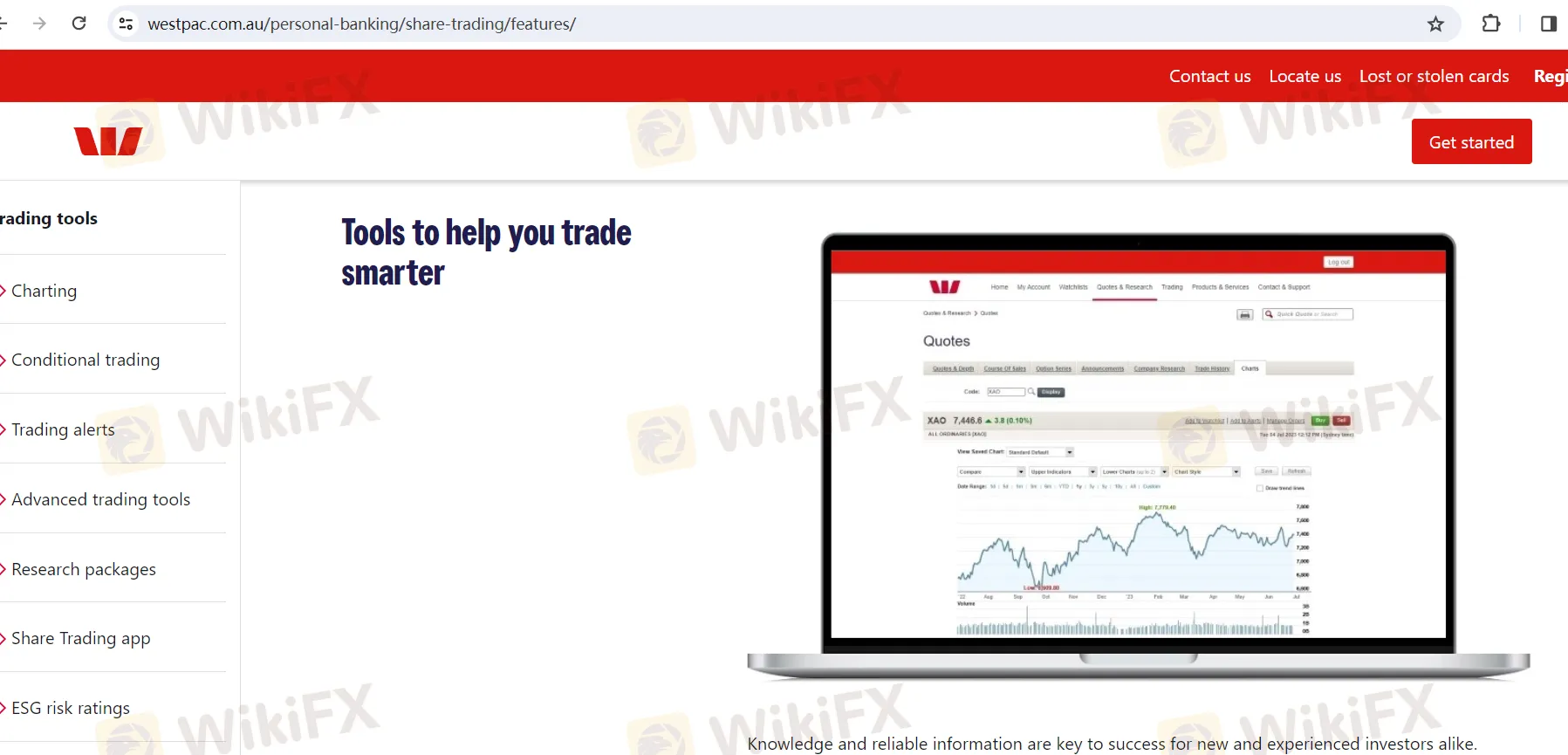

Trading Tools

Westpac Share Trading provides a range of tools to help investors trade smarter:

Independent Insight: Access daily market updates and research from Morningstar for valuable insights.

Real-Time Tracking: Stay informed with customizable watchlists and alerts for potential trading opportunities.

In-Depth Research: Use intuitive charting and heat maps to analyze market performance and compare stocks.

Charting: Track share prices easily with advanced charting tools.

Conditional Trading: Set criteria for trades and execute orders automatically.

Alerts: Receive unlimited custom alerts via email and SMS.

Mobile App: Trade and manage portfolios conveniently with the Westpac Share Trading app.

Advanced Tools: Access features for executing complex trading strategies.

Research Packages: Choose packages for investment ideas, analysis, and portfolio tools.

ESG Risk Ratings: Assess environmental, social, and governance factors for responsible investing.

Rats and Fees

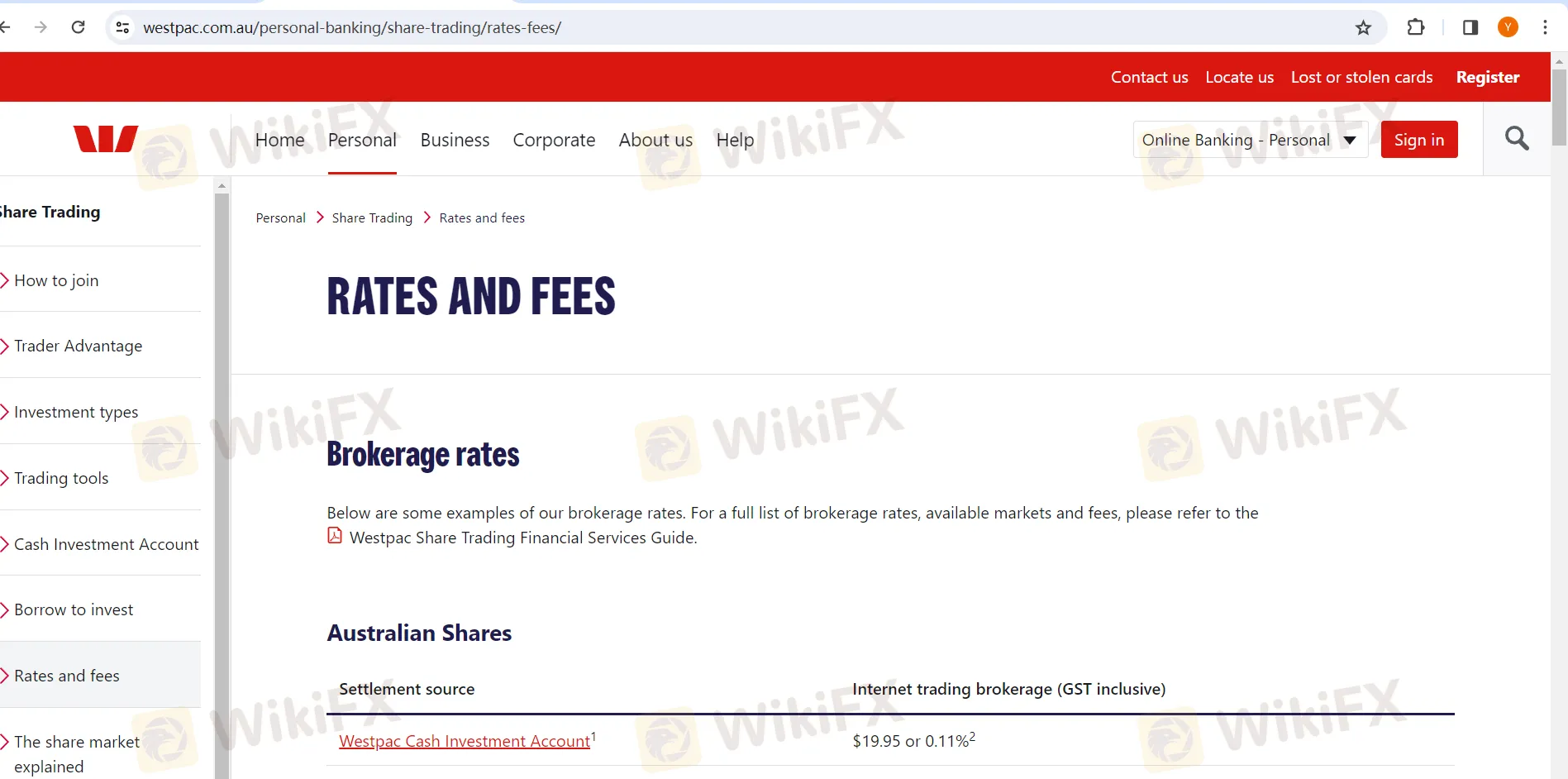

Westpac Share Trading offers transparent rates and fees for various trading activities:

Brokerage Rates:

Australian Shares: Brokerage rates range from $19.95 or 0.11% to $29.95 or 0.29% depending on the settlement source.

Exchange Traded Options: Fees vary from $38.95 or 0.35% to $43.95 or 0.44% based on the settlement source.

Global Markets: Brokerage fees for trading in the United States range from USD $19.95 to USD $29.95 for trades up to certain values, or 0.31% for trades above a certain value.

Interest Rates:

Westpac Cash Investment Account: Offers tiered interest rates ranging from 1.30% to 3.00% per annum based on the account balance.

Fees:

Australian Shares: Additional fees include Issuer Sponsored sales, Confirmation Request fees, Early Settlement fees, Fail fees, Trade Reversal fees, among others.

Exchange Traded Options: Fees include Contract Exercise or Assignment fees, Contract Registration fees for both Equity and Index Options.

Administration Fees: Various administration fees such as Bank Cheque fees, Dishonoured Cheque fees, Off-market Transfer fees, and Telegraphic Transfer fees are applicable.

Global Markets: Fees include Custody fees for inactive accounts, Outgoing account transfer fees, Foreign Securities Custody fees, and Miscellaneous exchange and regulatory fees.

It's important to review the detailed list of rates and fees outlined in the Westpac Share Trading Financial Services Guide for specific charges related to trading activities and account management.

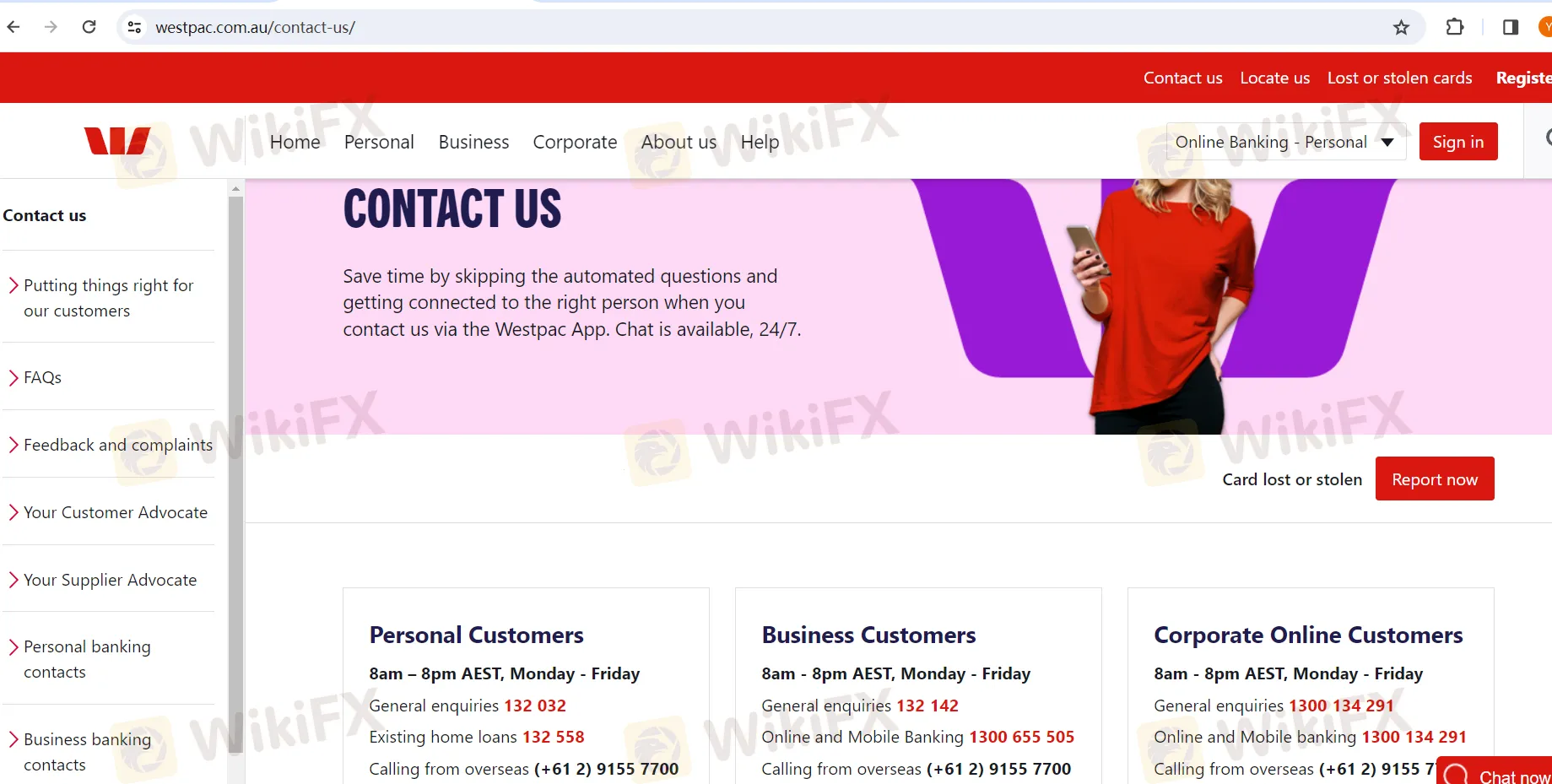

Customer Support

Westpac provides comprehensive customer support through various channels tailored to different needs:

Contact Options:

Phone Support:

Corporate Online Customers: General enquiries - 1300 134 291

Business Customers: General enquiries - 132 142

Personal Customers: General enquiries - 132 032

International Calls:

Corporate Online Customers: (+61 2) 9155 7737

Business Customers: (+61 2) 9155 7700

Personal Customers: (+61 2) 9155 7700

Chat Support:

Available 24/7 via Westpac App or Online Banking.

National Relay Service:

For customers who are Deaf or have hearing impairments.

Interpreter Services:

Assistance in languages other than English.

Specific Support:

Card Lost or Stolen: Immediate assistance for reporting lost or stolen cards, including placing temporary holds.

Financial Hardship and Support: Assistance for customers facing financial difficulties.

Online Banking Support: Dedicated support for online and mobile banking queries.

Additional Services:

Feedback and Complaints: Avenue for providing feedback or lodging complaints.

Banking 24/7 from Home: Guidance on accessing banking services remotely via computer, mobile, or tablet.

Reporting Lost or Stolen Card:

Phone: 1300 651 089 (24/7)

Online: For customers not registered for online banking.

Updating Contact Details:

Ensuring account security by keeping contact details up-to-date.

Global Alliance ATM:

Information on saving on ATM withdrawal fees worldwide.

Subpoenas:

Address and instructions for serving subpoenas relating to Westpac Banking Corporation.

Westpac aims to offer accessible and responsive customer support across a range of services, ensuring customer needs are met efficiently and effectively.

FAQs

Q: How can I report a lost or stolen card?

A: You can report a lost or stolen card by calling 1300 651 089 (24/7) or via online banking for registered users.

Q: How can I update my contact details?

A: Ensure your account security by keeping your contact details up-to-date. You can update your contact details through online banking or by contacting customer support.

Q: What services are available for businesses?

A: Westpac offers a range of services for businesses including bank accounts, loans, credit cards, and industry-specific banking solutions.

Q: How can I access banking services remotely?

A: You can access banking services remotely via computer, mobile phone, or tablet using online banking or the Westpac mobile app.

Q: What regulatory body oversees Westpac?

A: Westpac is regulated by the Australian Securities and Investments Commission (ASIC), ensuring compliance with financial regulations and fair practices.

Risk Warning

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

WikiFX 브로커

요금 계산