GFS

요약:GFS is an ASIC - regulated online forex broker that was established in 2013, offering trading on a wide range of trading instruments, including forex, CFDs, stocks, cryptocurrencies, and indices through the MetaTrader5 platform.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| GFS Review Summary in 10 Points | |

| Founded | 2013 |

| Registered Country/Region | Australia |

| Regulation | ASIC |

| Market Instruments | Forex, CFDs, stocks, cryptocurrencies, indices |

| Demo Account | N/A |

| Leverage | 1:500 |

| EUR/USD Spread | From 0.8 points |

| Trading Platform | MT5, Webtrader |

| Minimum Deposit | N/A |

| Customer Support | 24/5 online messaging, phone, email |

What is GFS?

GFS is an ASIC - regulated online forex broker that was established in 2013, offering trading on a wide range of trading instruments, including forex, CFDs, stocks, cryptocurrencies, and indices through the MetaTrader5 platform.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Regulated by ASIC | • Regional restrictions |

| • Wide range of trading instruments offered | • No info on accounts and commissions |

| • Spreads as low as 0.8 points on more than 60 currency pairs | • Limited info on deposit/withdrawal |

| • MT5 supported | |

| • 24/5 multi-channel support |

GFS Alternative Brokers

There are many alternative brokers to GFS depending on the specific needs and preferences of the trader. Some popular options include:

Swissquote: a reliable and established broker with a wide range of trading instruments and tight spreads.

Exness: a broker with a wide range of account types and leverage options.

LiteForex: a broker with a user-friendly platform and low fees.

Here is a more detailed comparison of the three brokers:

| Feature | GFS | Swissquote | Exness | LiteForex |

| Regulation | ASIC | FCA, MFSA, FINMA, DFSA | CySEC, FCA, FSCA | CySEC |

| Trading instruments | Forex, CFDs, stocks, cryptocurrencies, indices | Forex, CFDs, stocks, ETFs, bonds, indices | Forex, CFDs, stocks, cryptocurrencies, indices | |

| EUR/USD Spread | From 0.8 points | Average 0.2 pips | Average 0.1 pips | Average 0.3 pips |

| Leverage | 1:500 | 1:30 for retail | 1:888 for professional | 1:30 for retail |

| Account types | N/A | Standard, Pro, VIP | Standard, Raw Spread, Zero Spread, Pro, Expert | Standard, ECN, Zero, Cent |

| Fees | N/A | Deposit fees of 1% for credit/debit cards, 0% for bank transfers | No deposit fees | |

| Platforms | MetaTrader5, Webtrader | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | |

| Customer support | 24/5 online messaging, phone, and email | 24/5live chat, phone, and email | ||

Ultimately, the best broker for you will depend on your individual needs and preferences. It is important to do your own research and compare different brokers before making a decision.

Is GFS Safe or Scam?

GFS is a forex broker that is regulated by the Australian Securities & Investments Commission (ASIC, No. 001299400). ASIC is a reputable financial authority that sets high standards for its regulated brokers. This means that GFS is required to comply with a number of regulations designed to protect its customers, such as:

Keeping client funds segregated from company funds

Providing fair and transparent trading conditions

Having adequate financial resources to meet its obligations to its customers

However, being regulated by ASIC does not guarantee that GFS is a safe broker. There have been cases of ASIC-regulated brokers engaging in fraudulent or unethical practices. It is important to do your own research before opening an account with any broker, regardless of its regulation.

If you are concerned about the safety of GFS, you can contact the ASIC to ask questions or file a complaint. You can also contact other regulatory authorities, such as the Financial Conduct Authority (FCA) in the United Kingdom or the Commodity Futures Trading Commission (CFTC) in the United States.

Ultimately, the decision of whether or not to open an account with GFS is up to you. If you are comfortable with the risks involved and you think the broker's features and offerings are a good fit for your trading needs, then you may want to consider opening an account. However, if you are not sure, it is always best to do more research and compare GFS to other brokers before making a decision.

Market Instruments

GFS offers a wide range of trading instruments, including:

Forex: GFS offers over 100 currency pairs to trade, including major, minor, and exotic pairs.

Stocks: GFS offers trading in stocks from over 20 stock exchanges around the world, including the New York Stock Exchange (NYSE), the London Stock Exchange (LSE), and the Tokyo Stock Exchange (TSE).

Cryptocurrencies: GFS offers trading in over 20 cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Indices: GFS offers trading in indices from over 10 different countries, including the S&P 500, the Dow Jones Industrial Average, and the Nikkei 225.

Commodities: GFS offers trading in commodities, such as gold, silver, oil, and natural gas.

Leverage

Leverage is a financial tool that allows traders to control a larger position than they would be able to with their own capital. This is done by borrowing money from the broker to fund the trade.

GFS offers a maximum leverage of 1:500. This means that for every $1 you deposit, you can control a position worth $500. For example, if you deposit $100 and trade EUR/USD with a leverage of 1:500, you will be able to control a position worth $50,000.

Leverage can magnify your profits, but it can also magnify your losses. If the market moves against you, you could lose more money than you deposited. It is important to use leverage carefully and to understand the risks involved before using it.

Spreads & Commissions

GFS offers spreads as low as 0.8 points on more than 60 currency pairs. This means that for every $100 you trade, you will pay a spread of $0.8. For example, if you trade EUR/USD with a spread of 0.8 points, you will pay $0.8 when you open the trade and $0.8 when you close the trade. However, GFS does not reveal any info on commissions.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| GFS | 0.8 pips | N/A |

| Swissquote | 0.2 pips | 0.1% |

| Exness | 0.1 pips | $2 per lot |

| LiteForex | 0.3 pips | $6 per lot |

It is important to note that these spreads are subject to change. You should always check the broker's website for the most up-to-date information.

Trading Platforms

GFS offers MetaTrader 5 (MT5) as its trading platform. MT5 is a popular platform that is used by millions of traders around the world. It offers a wide range of features and tools, including:

Real-time market data: MT5 provides real-time market data for all of the major trading instruments.

Charting tools: MT5 offers a wide range of charting tools, including technical indicators, drawing tools, and backtesting capabilities.

Order execution: MT5 offers a variety of order execution methods, including market orders, limit orders, and stop-loss orders.

Risk management tools: MT5 offers a variety of risk management tools, such as stop-losses and trailing stops.

Automated trading: MT5 allows traders to automate their trading strategies using Expert Advisors (EAs).

See the trading platform comparison table below:

| Broker | Trading Platform |

| GFS | MetaTrader5, Webtrader |

| Swissquote | MetaTrader4, MetaTrader5, cTrader |

| Exness | MetaTrader4, MetaTrader5 |

| LiteForex | MetaTrader4, MetaTrader5 |

As you can see, all four brokers offer MetaTrader4 and MetaTrader5 as their trading platforms. MetaTrader4 and MetaTrader5 are the most popular trading platforms in the world, and they offer a wide range of features and tools for traders.

Swissquote also offers cTrader, which is a newer trading platform that offers some unique features, such as a built-in charting tool and a market maker-free execution model.

GFS and LiteForex only offer MetaTrader4 and MetaTrader5, but they both offer web-based trading platforms that can be accessed from any computer with an internet connection.

Ultimately, the best trading platform for you will depend on your individual needs and preferences. If you are familiar with MetaTrader4 or MetaTrader5, then any of the four brokers would be a good option. If you are looking for a newer trading platform with unique features, then Swissquote may be a better choice.

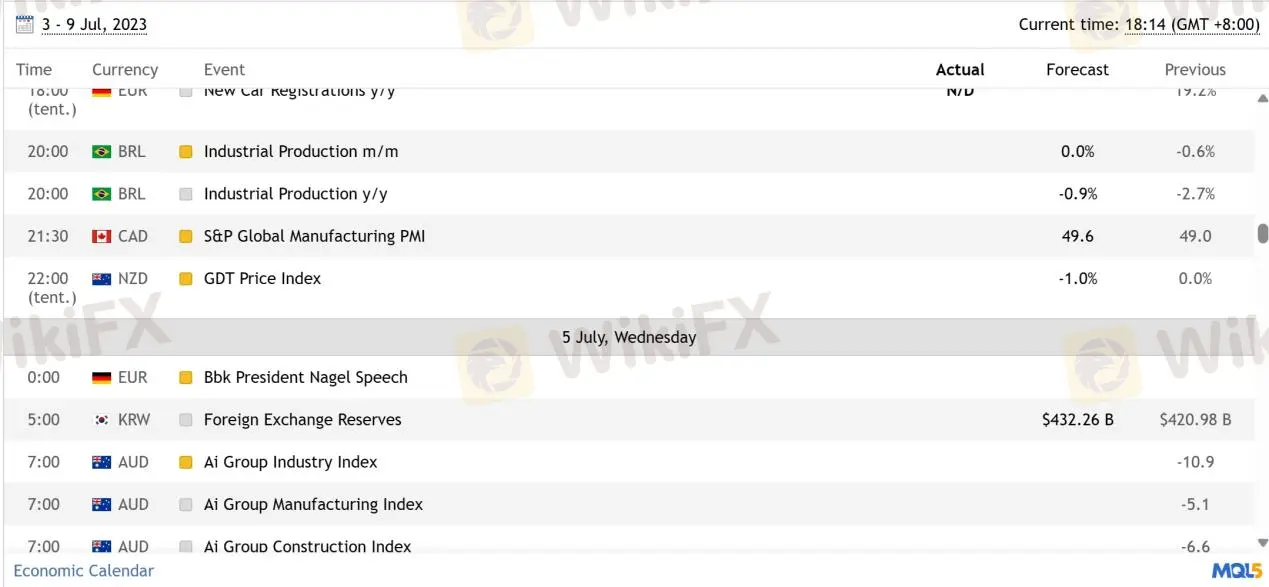

Trading Tools

GFS provides a range of trading tools to assist its customers in making informed investment decisions. One of the notable tools offered by GFS is an Economic Calendar. This calendar compiles and displays key economic events, such as central bank meetings, economic data releases, and other significant financial indicators. The Economic Calendar helps traders stay updated on important events that can impact the financial markets, allowing them to anticipate potential market movements and adjust their trading strategies accordingly. By providing this tool, GFS empowers its customers with valuable information to make well-informed trading decisions based on the latest economic developments.

Deposits & Withdrawals

GFS does not specify deposit and withdrawal, but from the logos at the foot of the home page, we found that GFS appears to accept a variety of deposit and withdrawal methods, including:

Credit/debit cards: GFS accepts MasterCard and Visa.

E-wallets: GFS accepts Skrill, Neteller, and UnionPay.

Bank transfer: GFS accepts bank transfers in a variety of currencies.

GFS minimum deposit vs other brokers

| GFS | Most other | |

| Minimum Deposit | N/A | $100 |

Customer Service

The customer service of GFS is designed to provide convenient and accessible support to its customers. With a 24/5 availability, customers can reach out to GFS for assistance through various channels. They can engage in online messaging, where they can communicate with a representative in real-time, ensuring quick and efficient responses to their queries or concerns. Additionally, customers can contact GFS through the provided phone number, +41 77 226 63 93, allowing for direct and personalized assistance. For those who prefer written communication, GFS offers an email address, cs@gfsmarkets.co, where customers can send their inquiries or feedback.

To further assist customers, GFS also provides an FAQ section, which likely contains answers to commonly asked questions, enabling users to find information independently. Overall, GFS customer service aims to provide reliable and responsive support, catering to the needs of its clients.

| Pros | Cons |

| • 24/5 availability | • No 24/7 support |

| • Multiple contact ways | • No live chat support |

| • FAQ section offered | • No social media presence |

Note: These pros and cons are subjective and may vary depending on the individual's experience with GFS's customer service.

Conclusion

GFS is a regulated broker that offers a wide range of trading instruments through the leading MT5 platform. However, it's always a good idea to conduct your own research, read customer reviews, and consider multiple sources of information before making any decisions or forming opinions about a financial service provider.

Frequently Asked Questions (FAQs)

| Q 1: | Is GFS regulated? |

| A 1: | Yes. It is regulated by Australia Securities & Investment Commission (ASIC, No. 001299400). |

| Q 2: | At GFS, are there any regional restrictions for traders? |

| A 2: | Yes. The information on this site is not directed at residents of the United States, Belgium, North Korea or any particular country outside the Hong Kong and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. |

| Q 3: | Does GFS offer the industry leading MT4 & MT5? |

| A 3: | Yes. It supports MT5 for Windows, Android, MacOS, iOS andWeb Trader. |

| Q 4: | Is GFS a good broker for beginners? |

| A 4: | No. It is not a good choice for beginners. Though it is regulated well and offers the leading MT5 trading platform, it lacks transparency in trading conditions. |

WikiFX 브로커

요금 계산