Royal Forex Ltd

요약:Established in 2006, Royal Forex LTD is a forex broker with Cyprus based background. By means of its user-friendly trading platforms MetaTrader 4 (MT4) and Royal Forex Trader (RFT), the Cyprus Securities and Exchange Commission (CySEC) controls the company and provides traders access to over 125 instruments including forex, commodities, and CFDs.

The official website of royal forex(https://www.royalforex.com/) is unable to access now.

| Royal Forex Review Summary | |

| Founded | 2006 |

| Registered Country/Region | Republic of Cyprus |

| Regulation | Regulated by CySEC |

| Market Instruments | Forex, Commodities, CFDs |

| Demo Account | ✔ |

| Leverage | Up to 1:500 |

| Spread | From 0.0 pips |

| Trading Platform | MT4Royal Forex Trader (RFT) |

| Min Deposit | $0 for Standard Account; $1,000 for Pro Account |

| Customer Support | Phone: +357 22007405Email: info@royalforex.com24/7 Online Chat: ❌Physical Address: Not provided |

Royal Forex Information

Established in 2006, Royal Forex LTD is a forex broker with Cyprus based background. By means of its user-friendly trading platforms MetaTrader 4 (MT4) and Royal Forex Trader (RFT), the Cyprus Securities and Exchange Commission (CySEC) controls the company and provides traders access to over 125 instruments including forex, commodities, and CFDs.

Pros and Cons

| Pros | Cons |

| Regulated by CySEC | Customer support not 24/7 |

| No minimum deposit for Standard Account | Official website unavailable |

| Provide 2 trading platforms (MT4, RFT) | |

| 0 commissions for Standard Account |

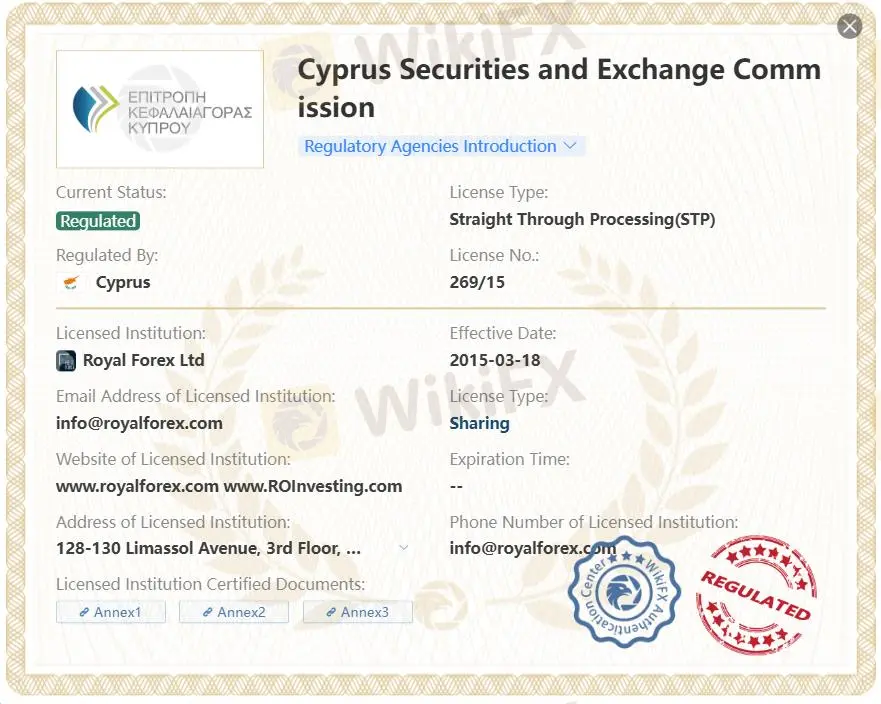

Is Royal Forex Legit?

| Regulatory Status | Regulated |

| License Type | Straight Through Processing (STP) |

| Regulated By | Cyprus (CySEC) |

| License Number | 269/15 |

| Licensed Institution | Royal Forex Ltd |

| Effective Date | 2015/3/18 |

| License Type | Sharing |

What Can I Trade on Royal Forex?

Royal Forex offers over 125 tradable instruments. These including spot forex, commodities, and CFDs.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| CFDs | ✔ |

| Indices | ❌ |

| Shares | ❌ |

| ETFs | ❌ |

Account Types

Royal Forex offers two account types. Also, itprovides a demo account for practice.

| Account Type | Leverage | Spread | Commission | Min Deposit | Minimum Lot Size | Demo Account |

| Standard Account | Up to 1:500 | Starting from 0.0 pips | None | $0 | 0.1 lot | ✔ |

| Pro Account | Up to 1:500 | Starting from 0.6 pips | $3.50 per 100K trade | $1,000 | 0.01 lot | ✔ |

Royal Forex Fees

With spreads from 0 pip and commission-free trading, Royal Forex presents reasonable fees—especially for Standard Accounts.

| Aspect | Standard Account | Pro Account |

| Spread | From 0.0 pips | From 0.6 pips |

| Commission | None | $3.50 per 100K trade |

Trading Platform

Royal Forex provides Meta Trader 4 and its unique royal forex trader for users.

| Trading Platform | Supported | Available Devices | Suitable For |

| MetaTrader 4 (MT4) | ✔ | Desktop, Mobile, Web | Both beginners and experts |

| Royal Forex Trader (RFT) | ✔ | Desktop, Mobile, Web | Traders seeking faster execution |

Deposit and Withdrawal

Royal Forex does not explicitly mention deposit or withdrawal fees. The minimum deposit is $0 for Standard Accounts and $1,000 for Pro Accounts.

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Bank Transfer | $0–$1,000 | - | 1–5 business days |

| Credit/Debit Card | $0–$1,000 | - | Within minutes |

| E-Wallets | $0–$1,000 | - | Within minutes |

| Online Payment Systems | $0–$1,000 | - | Varies |

WikiFX 브로커

요금 계산