BBVA

요약:BBVA Banco Francés S.A., headquartered in Argentina, operates without regulatory oversight, as it lacks regulation, mainly focusing on bank services.

| BBVA Review Summary | |

| Company Name | BBVA Banco Frances S.A. |

| Registered Country/Region | Argentina |

| Regulation | No Regulation |

| Products | Personal Loans, Savings Bank, BBVA Points |

| Demo Account | N/A |

| Leverage | N/A |

| Spread | N/A |

| Commission | N/A |

| Trading Platform | BBVA App, BBVA Go and Banca Online |

| Minimum Deposit | N/A |

| Customer Support | Live Chat, Tel: 0800-333-0303, Email: inversiones-arg@bbva.com, Social Media: Facebook, X, Instagram, YouTube, WhatsApp |

What is BBVA?

BBVA Banco Francés S.A., headquartered in Argentina, operates without regulatory oversight, as it lacks regulation, mainly focusing on bank services.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Pros:

YouTube Guide Video Available: BBVA provides guide videos on YouTube, offering customers additional resources and assistance in navigating their services.

Live Chat Available: Customers have access to live chat support, enabling quick and convenient communication with customer service representatives for immediate assistance.

App Available: BBVA offers a mobile application, which allows customers to manage their accounts, make transactions, and access services on the go with ease.

Cons:

No Regulation: BBVA operates without regulation, which may raise concerns about the safety and security of customers' funds and personal information. This lack of oversight could potentially expose customers to greater risks in terms of financial security and consumer protection.

Is BBVA Safe or Scam?

Regulatory Sight: BBVA is currently operating without regulatory oversight, which means it does not fall under the jurisdiction or supervision of any financial regulatory bodies. It also does not hold any licenses that would enable it to conduct its operations in the financial market. This lack of regulation poses numerous risks to investors, such as a lack of transparency, security concerns, and no guarantee of adherence to industry standards and practices.

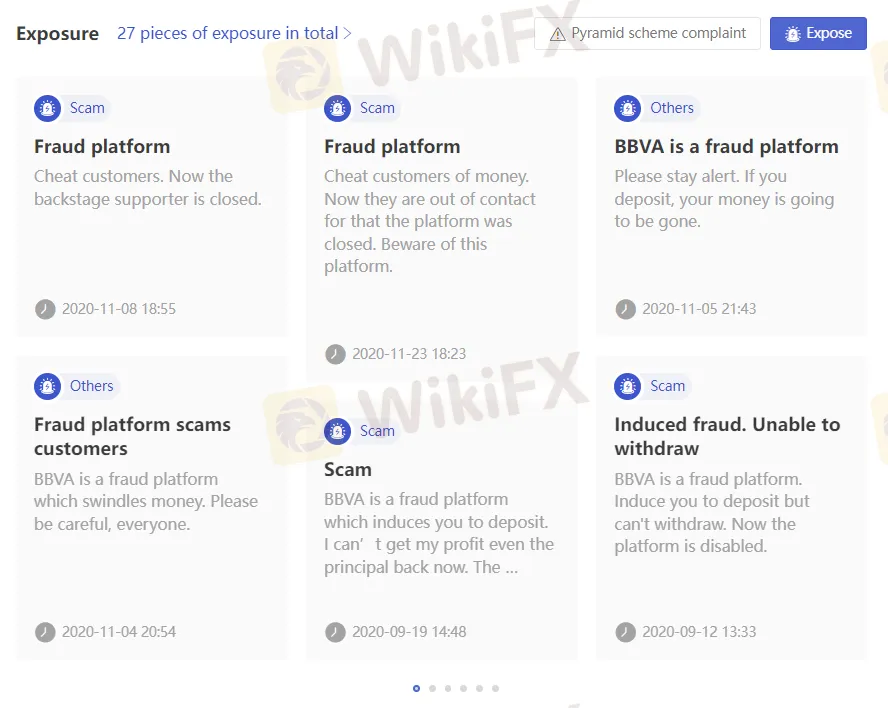

Issues Reported:

Fraudulent activities: Users reported being deceived into depositing money into BBVA, only to find themselves unable to withdraw their funds later on.

Inducement to deposit: Many users mentioned being induced to deposit money into BBVA through various means, such as false promises or misleading information.

Lack of customer service: Users highlighted difficulties in contacting customer service representatives, with some stating that the customer service channels were disabled.

Inability to withdraw funds: Several users reported being unable to withdraw their deposited funds or profits earned through trading on the platform, leading to financial losses.

Platform closure: Users mentioned that the BBVA platform was closed or disabled, further complicating their attempts to access their funds or seek assistance.

Security Measures: So far we haven't found any information about the security measures for this broker.

Products

Personal Loans: These loans can be obtained 100% online, quickly, and easily. Customers can finance them in up to 60 installments.

Savings Bank: Customers have access to their funds whenever needed, along with a debit card associated with the account for secure payments.

BBVA Points: Customers can earn BBVA Points for various transactions. They earn 1 BBVA Point for every dollar or its equivalent in pesos spent with BBVA credit cards. Premium customers accumulate extra points, with Premium customers earning 5% extra and Premium World customers earning 15% extra. These points can be redeemed for trips, accommodations, experiences, and other rewards.

YouTube Video: https://youtu.be/YPaKvZ0l51s

Customer Support

Live Chat: Available on its official website, once you enter its home page, you'll see the live chat icon.

Telephone:

General Inquiry: 0800-333-0303

BBVA Premium Line: 0800-222-2525

BBVA Premium World Line: 0800-333-0540

These lines are accessible Monday to Friday from 7:30 a.m. to 9:00 p.m.

An automatic system is available 24 hours a day, 365 days a year.

Email: Customers can reach out via email at inversiones-arg@bbva.com.

Social Media: BBVA is active on various social media platforms including Facebook, Instagram, YouTube, and WhatsApp.

Conclusion

BBVA is a financial company focusing on bank services, providing convenient trading platforms and multiple customer support channels. However, it does not have any regulations.

Frequently Asked Questions (FAQs)

Q: Can I access BBVA's services using my phone?

A: Yes, you can. It allows users to use the BBVA App or BBVA Go.

Q: Is there a WhatsApp channel for customer support?

A: Yes, there is. You can visit the customer support page on its official website to enter the WhatsApp chat directly: https://www.bbva.com.ar/personas/atencion-al-cliente.html.

Q: Is BBVA regulated or not?

A: No, it is not regulated.

Q: Can I chat with BBVA's customer service online directly?

A: Yes, you can access its live chat channel on its home page.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

WikiFX 브로커

주요뉴스

WikiEXPO, Liberland 정부 공식 협력 파트너로 선정, 함께 글로벌 금융 거래의 안전을 지켜나갑니다

1월 한국 물가상승률 2.2% 증가, 원·달러 환율이 겪을 난제

WikiFX Elites Club 공식 출범 – 글로벌 외환 업계를 선도할 엘리트들의 모임

요금 계산