YUB PRIME

요약:YUB PRIME, established in 2020 and headquartered in Samoa, offers a variety of trading instruments including forex, precious metals, index CFDs, and commodities. The platform operates through the MetaTrader 5 (MT5) system, providing extensive trading features and tools. Despite offering competitive trading conditions and educational resources, YUB PRIME is not genuinely regulated, raising concerns about the safety of funds and operational transparency.

| YUB PRIME | Basic Information |

| Company Name | YUB PRIME |

| Founded | 2020 |

| Headquarters | Samoa |

| Regulations | Not regulated |

| Tradable Assets | Forex, Precious Metals, Index CFDs, Commodities |

| Account Types | PRIME, ECN |

| Minimum Deposit | 1 USD |

| Maximum Leverage | 1:100, 1:200, 1:400 |

| Spreads | From 1.5 pips (PRIME), from 0 pips (ECN) |

| Commission | Not specified |

| Deposit Methods | Wire transfers, USDT (ERC20/TRC20), BTC |

| Trading Platforms | MetaTrader 5 (MT5) |

| Customer Support | Email(info@yubfx.com), Telegram(@yubcsd), and WhatsApp (yubfx) |

| Education Resources | Forex glossary, Trading for Beginners, FAQ, Ebooks, Education videos |

| Bonus Offerings | None |

Overview of YUB PRIME

YUB PRIME is a trading platform that was founded in 2020 and provides a variety of trading products, including commodities, currencies, precious metals, and index CFDs. The MetaTrader 5 (MT5) system, renowned for its extensive feature set and intuitive interface, is utilized by the platform. To assist traders in enhancing their trading tactics, YUB PRIME offers educational materials. But the broker isn't really regulated, which begs questions regarding transparency and the security of funds.

Is YUB PRIME Legit?

YUB PRIME is not regulated. The broker claims to be regulated by the FCA in the United Kingdom (license number: 622574), but this regulation is suspected to be a clone. Therefore, trading with YUB PRIME may involve significant risk due to the lack of genuine regulatory oversight.

Pros and Cons

With so many training resources and trading instruments available, YUB PRIME may appeal to traders. However, the broker's lack of genuine regulation raises significant concerns about the safety and transparency of its operations. The exposure to volatile markets can increase investment risk, and the lack of clarity regarding operational aspects and fee structures adds to the uncertainty, making it essential for potential users to exercise caution.

| Pros | Cons |

|

|

| |

|

Trading Instruments

YUB PRIME offers trading instruments that include forex, precious metals, index CFDs, and commodities. The platform provides rich market conditions and allows a minimum tradable size of 0.01 lot.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indexes | Stocks | ETFs |

| YUB PRIME | Yes | Yes | No | Yes | Yes | No | No |

| AMarkets | Yes | Yes | No | Yes | Yes | Yes | No |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes | No |

| EXNESS Group | Yes | Yes | Yes | Yes | Yes | Yes | No |

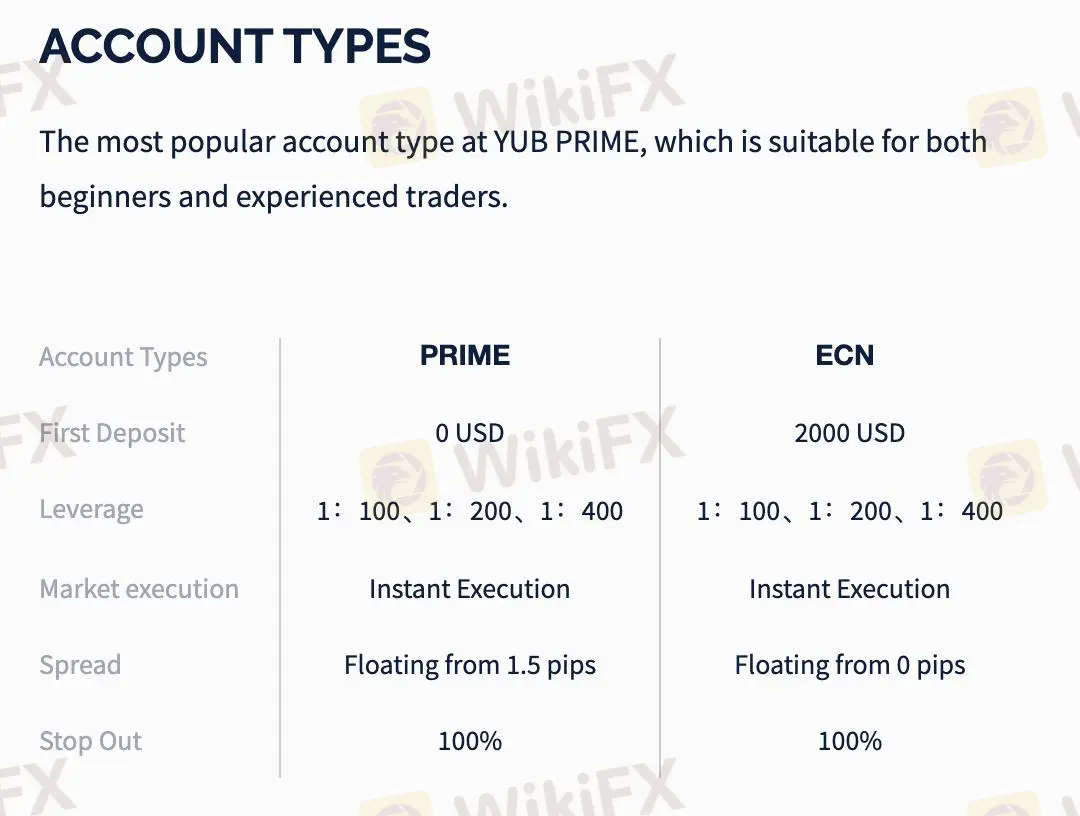

Account Types

YUB PRIME offers two distinct account types to cater to various trading needs: the PRIME account and the ECN account. The PRIME account requires no minimum deposit, offers leverage options of 1:100, 1:200, and 1:400, utilizes instant execution, and features floating spreads starting from 1.5 pips, with a stop-out level at 100%. On the other hand, the ECN account requires a minimum deposit of 2000 USD, offers the same leverage options, and also uses instant execution, but provides floating spreads starting from 0 pips, with the same 100% stop-out level.

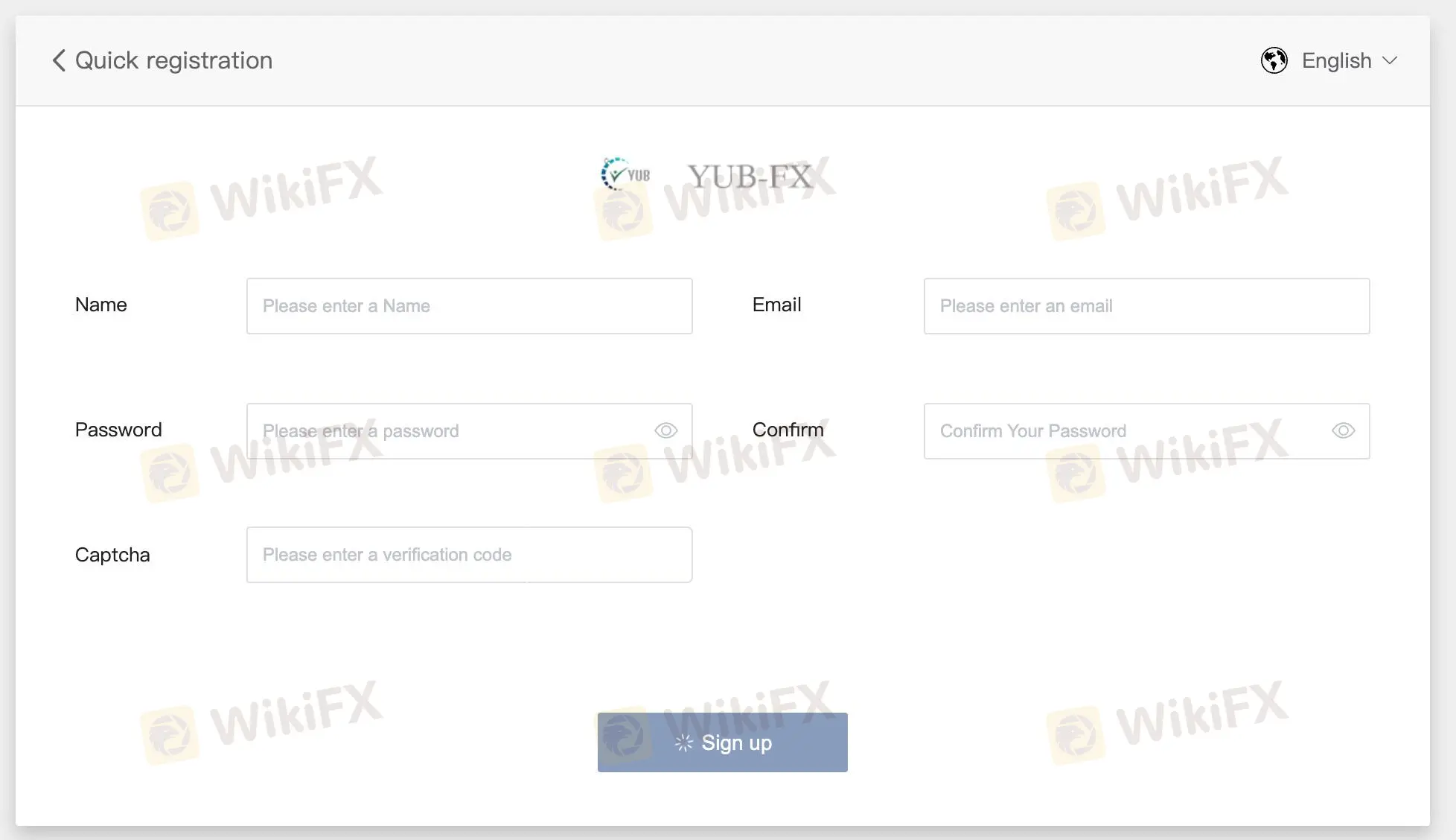

How to Open an Account

To open an account with YUB PRIME, follow these steps.

- Visit the YUB PRIME website. Look for the “CREATE ACCOUNT” button on the homepage and click on it.

- Sign up on websites registration page.

- Receive your personal account login from an automated email

- Log in

- Proceed to deposit funds to your account

- Download the platform and start trading

Leverage

YUB PRIME offers leverage options of 1:100, 1:200, and 1:400 across all its account types.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | YUB PRIME | IC Markets | RoboForex |

| Maximum Leverage | 1:400 | 1:500 | 1:2000 |

Spreads and Commissions

YUB PRIME offers floating spreads starting from 1.5 pips for the PRIME account and from 0 pips for the ECN account. Commissions details are not specified.

Deposit & Withdraw Methods

YUB PRIME supports multiple deposit methods, including traditional wire transfers and digital currency deposits (USDT on ERC20 and TRC20, and BTC). The minimum deposit amount is 1 USD.

Trading Platforms

YUB PRIME uses the MetaTrader 5 (MT5) trading platform, which is available on Windows, iOS, and Android. MT5 offers a customizable and feature-rich environment, providing tools for charting assets, placing orders, and managing positions with an intuitive user interface.

Customer Support

YUB PRIME offers customer support through various channels, including email at info@yubfx.com, Telegram (@yubcsd), and WhatsApp (yubfx).

Educational Resources

YUB PRIME provides educational resources including a forex glossary, trading guides for beginners, a comprehensive FAQ section, an eBooks center, and educational videos.

Conclusion

With its extensive selection of trading tools and training materials, YUB PRIME caters to a diverse group of traders. On the other hand, there are serious questions regarding fund safety and transparency due to the absence of true regulation. When investing, traders should proceed with prudence and take these aspects into account.

FAQs

Is YUB PRIME regulated?

No, YUB PRIME is not genuinely regulated. The claimed FCA regulation is suspected to be a clone.

What is the minimum deposit for YUB PRIME?

The minimum deposit amount is not specified for the PRIME account, but the ECN account requires a minimum deposit of 2000 USD.

What trading platform does YUB PRIME use?

YUB PRIME uses the MetaTrader 5 (MT5) trading platform.

How can I contact YUB PRIME customer support?

You can contact YUB PRIME customer support via email at info@yubfx.com, Telegram (@yubcsd), and WhatsApp (yubfx).

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then.

WikiFX 브로커

요금 계산