Avos Finance

요약:Avos Finance, founded in 2023 and based in China, offers a variety of trading assets including forex, metals, cryptocurrencies, stocks, and indices. The platform operates without regulatory oversight. Trading is facilitated through unspecified platforms with competitive spreads starting from 0.0 pips on certain accounts. Account types range from Standard to Diamond, with minimum deposits ranging from $5,000 to $250,000 and leverage up to 1:Unlimited. Deposit and withdrawal options include WebMoney, Skrill, Perfect Money, Neteller, and others.

| Aspect | Information |

| Company Name | Avos Finance |

| Registered Country/Area | China |

| Founded year | 2023 |

| Regulation | None |

| Market Instruments | Forex, metals, cryptocurrencies, stocks, indices |

| Account Types | Standard, Silver, Gold, Platinum, Diamond |

| Minimum Deposit | $5000 |

| Maximum Leverage | Up to 1:Unlimited |

| Spreads | From 0.0 pips |

| Customer Support | support@avos-finance.ltd, +442034799527 |

| Deposit & Withdrawal | WebMoney, Skrill, Perfect Money, Neteller, Wire transfer, Fasapay, Bank card, Local online banking, ChinaUnionPay, Bitcoin, Tether |

| Educational Resources | FAQ |

Overview of Avos Finance

Avos Finance, founded in 2023 and based in China, offers a variety of trading assets including forex, metals, cryptocurrencies, stocks, and indices.

The platform operates without regulatory oversight. Trading is facilitated through unspecified platforms with competitive spreads starting from 0.0 pips on certain accounts.

Account types range from Standard to Diamond, with minimum deposits ranging from $5,000 to $250,000 and leverage up to 1:Unlimited. Deposit and withdrawal options include WebMoney, Skrill, Perfect Money, Neteller, and others.

Regulatory Status

Avos Finance operates without regulatory oversight. This lack of regulation means there are no external authorities monitoring its activities to ensure compliance with industry standards and investor protection measures. This could potentially expose traders to higher risks, such as unreliable trading practices or limited recourse in case of disputes.

Pros and Cons

| Pros | Cons |

| Competitive spreads starting from 0.0 pips | Operates without regulatory oversight |

| Wide range of trading instruments | High minimum deposit requirements: $5,000 to $250,000 |

| No commission on certain accounts | Limited educational resources |

| Multiple payment methods available | |

| Flexible leverage options up to 1:unlimited |

Pros:

- Competitive Spreads: Avos Finance offers competitive spreads starting from as low as 0.0 pips on certain accounts. Low spreads can potentially reduce trading costs for investors, making it more attractive for frequent traders.

- Wide Range of Trading Instruments: The platform provides access to a wide array of trading instruments, including major and minor currency pairs, commodities like metals, popular cryptocurrencies, global stock indices, and individual stocks.

- No Commission on Certain Accounts: Some accounts at Avos Finance do not charge commissions on trades. This fee structure can be advantageous for traders looking to minimize costs associated with trading activities, especially when coupled with competitive spreads.

- Multiple Payment Methods: Avos Finance supports various payment methods for deposits and withdrawals, including WebMoney, Skrill, Perfect Money, Neteller, bank wire transfers, Fasapay, local online banking options, ChinaUnionPay, Bitcoin, and Tether.

- Flexible Leverage Options: The platform offers flexible leverage options up to 1: unlimitied, allowing traders to amplify their trading positions with borrowed capital.

Cons:

- Operates Without Regulatory Oversight: Avos Finance operates without regulatory oversight, meaning it lacks supervision from financial authorities that typically enforce compliance with industry standards and investor protection measures.

- High Minimum Deposit Requirements: Avos Finance imposes high minimum deposit requirements ranging from $5,000 to $250,000, depending on the account type. Such high entry barriers can deter smaller investors or those with limited capital from accessing the platform and its trading services.

- Limited Educational Resources: The platform offers limited educational resources compared to leading brokers. This can limit opportunities for traders to enhance their trading skills and knowledge, potentially impacting their overall trading success.

Market Instruments

Avos Finance provides a wide range of financial instruments, including major and minor currency pairs, metals, global stock indices, individual stocks, and popular cryptocurrencies like Bitcoin and Ethereum.

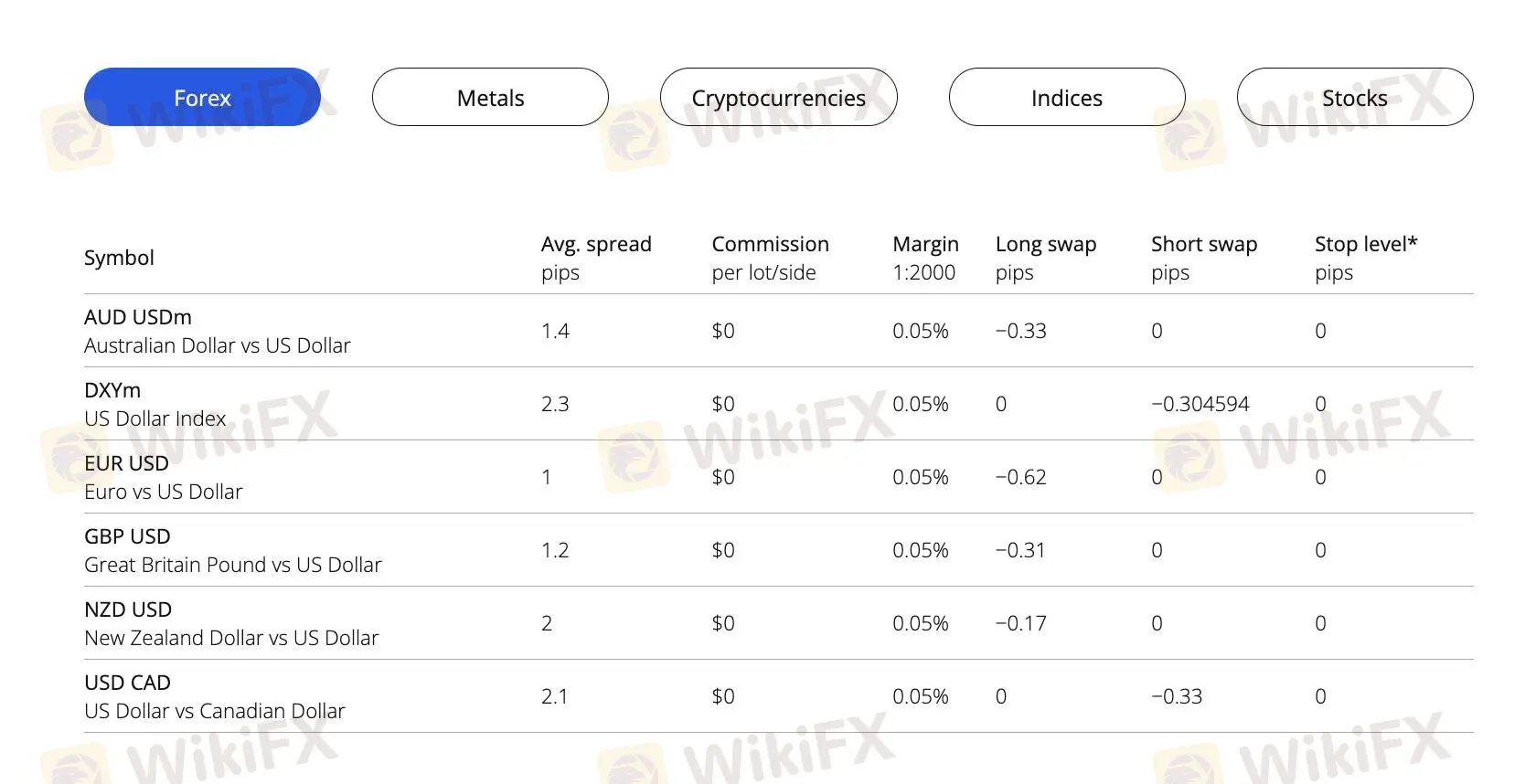

Forex: Avos Finance offers trading on a wide range of major and minor currency pairs, allowing traders to participate in the global foreign exchange market.

Metals: Investors can trade precious metals such as gold and silver, providing opportunities to hedge against market volatility and inflation.

Cryptocurrencies: The platform supports trading in popular cryptocurrencies like Bitcoin and Ethereum, offering access to the rapidly evolving digital asset market.

Stocks: Avos Finance includes a variety of individual stocks, enabling traders to invest in shares of major global companies.

Indices: Global stock indices are available, allowing traders to speculate on the performance of broader market segments.

Account Types

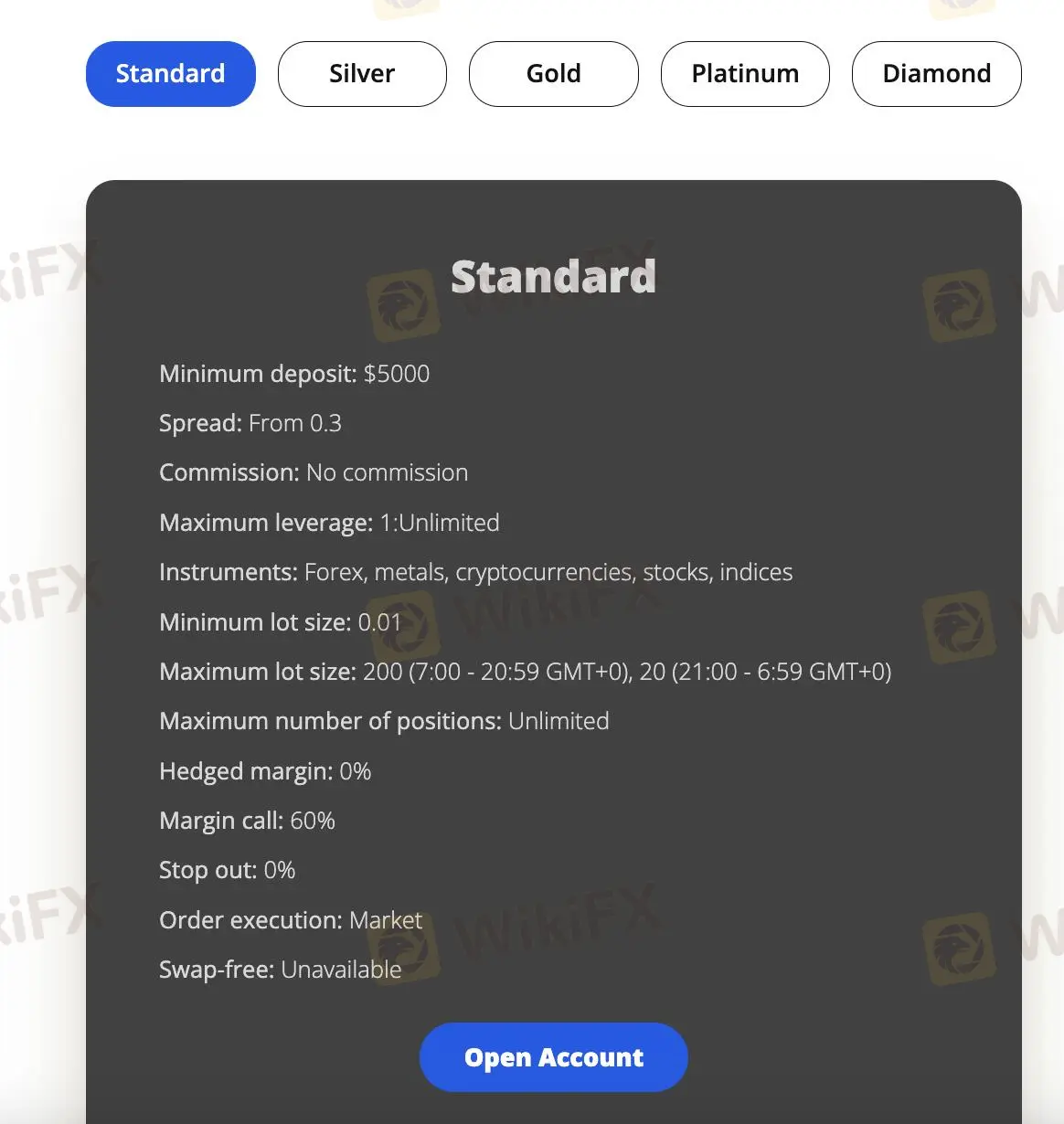

Avos Finance offers a range of account types to accommodate various levels of trading experience and financial capability.

The Standard account, with a minimum deposit of $5,000, provides access to a variety of trading instruments including Forex, metals, cryptocurrencies, stocks, and indices. It features a spread starting from 0.3 and no commission on trades. The maximum leverage offered is 1, and the minimum lot size is 0.01. This account is suitable for traders who are just beginning their journey or those with moderate investment capital who prefer straightforward trading conditions without additional commission costs. However, the margin call is set at 60%, and swap-free options are unavailable, which can not be ideal for all trading strategies.

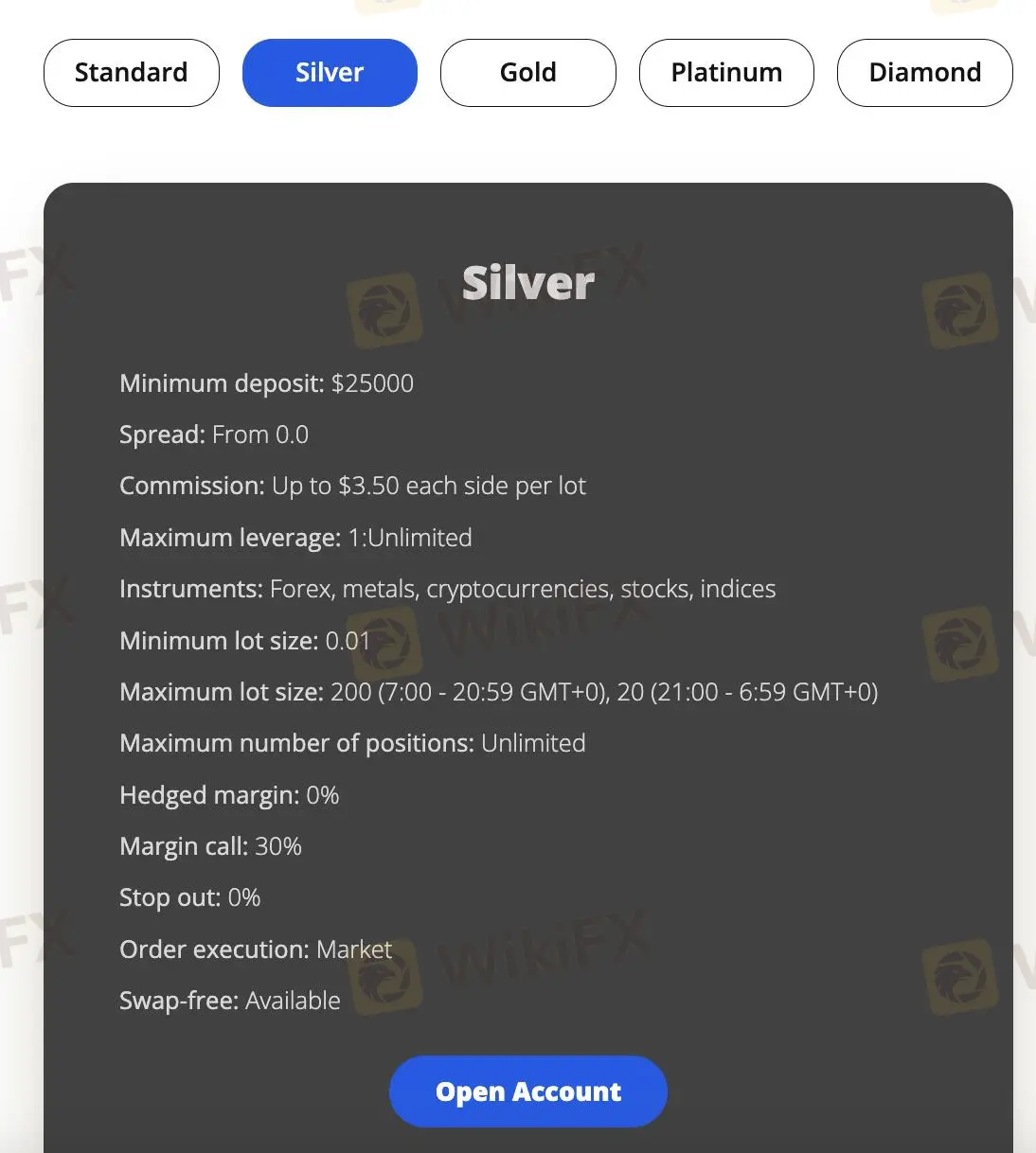

The Silver account requires a higher minimum deposit of $25,000 and offers a spread starting from 0.0. Commissions can go up to $3.50 each side per lot. Similar to the Standard account, it offers access to Forex, metals, cryptocurrencies, stocks, and indices, with a minimum lot size of 0.01 and a maximum lot size of 200 (between 7:00 - 20:59 GMT+0) and 20 (between 21:00 - 6:59 GMT+0). The Silver account is more suitable for experienced traders who can afford a larger initial investment and are looking for lower spreads and the option for swap-free trading. The margin call for this account is set at 30%.

The Gold account, with a minimum deposit of $50,000, provides even lower spreads starting from 0.0 and a commission from $0.2 each side per lot. It maintains the same variety of trading instruments and lot sizes as the Silver account. This account is ideal for seasoned traders with significant capital who seek minimal trading costs and the flexibility of swap-free options. The margin call is also set at 30%.

The Platinum account requires a minimum deposit of $100,000. It offers spreads starting from 0.1 and no commission, making it attractive for high-volume traders. The order execution is instant for Forex, metals, stocks, and indices, but market execution for cryptocurrencies. This account is best suited for professional traders and institutional investors who demand fast execution and can commit substantial funds. The margin call remains at 30%.

The Diamond account, with the highest minimum deposit of $250,000, features spreads from 0.1 and no commission, along with instant order execution for Forex, metals, stocks, and indices, and market execution for cryptocurrencies. This account type is tailored for elite traders and large-scale investors who require the best trading conditions and the ability to handle significant market positions. The margin call for this account is also 30%.

| Feature | Standard | Silver | Gold | Platinum | Diamond |

| Minimum Deposit | $5,000 | $25,000 | $50,000 | $100,000 | $250,000 |

| Spread | From 0.3 | From 0.0 | From 0.0 | From 0.1 | From 0.1 |

| Commission | No commission | Up to $3.50 each side per lot | From $0.2 each side per lot | No commission | No commission |

| Maximum Leverage | 1:Unlimited | 1:Unlimited | 1:Unlimited | 1:Unlimited | 1:Unlimited |

| Instruments | Forex, metals, cryptocurrencies, stocks, indices | Forex, metals, cryptocurrencies, stocks, indices | Forex, metals, cryptocurrencies, stocks, indices | Forex, metals, cryptocurrencies, stocks, indices | Forex, metals, cryptocurrencies, stocks, indices |

| Minimum Lot Size | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| Maximum Lot Size | 200 (7:00 - 20:59 GMT+0), 20 (21:00 - 6:59 GMT+0) | 200 (7:00 - 20:59 GMT+0), 20 (21:00 - 6:59 GMT+0) | 200 (7:00 - 20:59 GMT+0), 20 (21:00 - 6:59 GMT+0) | 200 (7:00 - 20:59 GMT+0), 20 (21:00 - 6:59 GMT+0) | 200 (7:00 - 20:59 GMT+0), 20 (21:00 - 6:59 GMT+0) |

| Maximum Number of Positions | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

| Hedged Margin | 0% | 0% | 0% | 0% | 0% |

| Margin Call | 60% | 30% | 30% | 30% | 30% |

| Stop Out | 0% | 0% | 0% | 0% | 0% |

| Order Execution | Market | Market | Market | Instant (forex, metals, stocks, indices), market (cryptocurrencies) | Instant (forex, metals, stocks, indices), market (cryptocurrencies) |

| Swap-free | Unavailable | Available | Available | Available | Available |

Leverage

Avos Finance offers a fixed leverage ratio of 1:400 for trading indices such as US30, US500, and USTEC, while other indices have a leverage of 1:200. This fixed margin provides consistency in trading, though exceptional circumstances can lead to variations in leverage.

Spreads &Commissions

Avos Finance offers a wide range of spreads and commission structures across its account types, tailored to different levels of trading activity and investment size.

The Standard account has spreads starting from 0.3 pips with no commissions, making it suitable for traders who prefer not to pay additional fees per trade. In comparison, the Silver account features spreads from 0.0 pips but includes a commission of up to $3.50 each side per lot.

The Gold account also offers spreads from 0.0 pips, with a lower commission starting from $0.2 each side per lot.

Both the Platinum and Diamond accounts provide spreads starting from 0.1 pips and no commissions, which are favorable for high-volume traders.

When compared to popular brokers, the spreads and commissions at Avos Finance are competitive. Many brokers offer spreads starting from 0.0 pips, but they typically charge a commission per lot traded. For instance, brokers like IC Markets and Pepperstone offer spreads from 0.0 pips with commissions around $3.50 per lot per side. In this context, Avos Finance's Platinum and Diamond accounts stand out for offering no commission with spreads starting from 0.1 pips, which could be more cost-effective for large-scale traders.

Partnership Program

Avos Finance's Introducing Broker Program offers partners the opportunity to earn up to 40% of the platform's revenue from every active trader referred. The more clients introduced, the higher the potential income. For example, with 52 accumulated clients, an average monthly income could reach $3120. To start earning, partners publish their unique partner link on websites, blogs, social media, or ads. When users click the link and register on Avos Finance, they become clients. As these clients trade, partners earn revenue from every transaction, with daily payouts ensuring prompt compensation.

Deposit & Withdrawal

Avos Finance supports various payment methods, including WebMoney, Skrill, Perfect Money, Neteller, Wire transfer, Fasapay, Bank card, Local online banking, ChinaUnionPay, Bitcoin, and Tether. These options provide flexibility and convenience for accessing funds.

The minimum deposit requirements vary across account types. For the Standard account, it is $5,000. The Silver account requires a minimum deposit of $25,000, while the Gold account requires $50,000. For higher-tier accounts, the Platinum account requires $100,000, and the Diamond account requires $250,000.

Customer Support

Avos Finance provides customer support through email and phone. For assistance, contact them at support@avos-finance.ltd or call +442034799527.

Educational Resources

Avos Finance provides basic educational resources primarily through a FAQ section. While FAQs can be useful for quick reference, they can not suffice for in-depth learning compared to comprehensive educational materials offered by popular brokers.

Conclusion

In conclusion, Avos Finance presents itself as a trading platform, offering a wide range of assets including forex, metals, cryptocurrencies, stocks, and indices.

Operating without regulatory oversight, it provides competitive spreads from 0.0 pips on select accounts. With account types ranging from Standard to Diamond and minimum deposits spanning $5,000 to $250,000, it severs varying investor profiles.

While the platform offers multiple deposit and withdrawal methods, educational resources are reported as limited.

FAQ

- What trading instruments does Avos Finance offer?

- Avos Finance provides a variety of trading instruments, including forex, metals, cryptocurrencies, stocks, and indices.

- What are the minimum deposit requirements for Avos Finance?

- Minimum deposits on Avos Finance range from $5,000 to $250,000, depending on the account type chosen.

- Does Avos Finance charge commissions on trades?

- Certain accounts on Avos Finance do not charge commissions; instead, they offer competitive spreads.

- How can funds be deposited into an Avos Finance account?

- Avos Finance accepts deposits via multiple methods, including WebMoney, Skrill, Perfect Money, Neteller, bank wire transfers, Fasapay, local online banking, ChinaUnionPay, Bitcoin, and Tether.

- Is Avos Finance regulated?

- Avos Finance operates without regulatory oversight.

- What customer support options does Avos Finance provide?

- Avos Finance offers customer support primarily through email and phone channels.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

WikiFX 브로커

요금 계산