Travelex-Some Detailed Information about the broker

Resumo:Travelex is an Australian retail and online currency solutions provider, originally opened by Lloyd Dorfman in 1976 with his first store in London's Southampton Row. Travelex has over forty years of experience in forex trading and has assisted millions of clients in over 70 countries and regions. Travelex currently holds a full license with ASIC in Australia (license number: 222444).

| Travelex Review Summary | |

| Founded | 1976 |

| Registered Country | Australia |

| Regulation | ASIC |

| Products | Foreign Cash, Travel Money Card, International Money Transfer |

| Customer Support | Phone, email, Facebook, Instagram |

What is Travelex?

Travelex is an Australian retail and online currency solutions provider, originally opened by Lloyd Dorfman in 1976 with his first store in London's Southampton Row. Travelex has over forty years of experience in forex trading and has assisted millions of clients in over 70 countries and regions. Travelex currently holds a full license with ASIC in Australia (license number: 222444).

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Competitive fee structure | • A report of unable to withdraw |

| • Multiple products and services offered | |

| • Regulated by ASIC | |

| • Customer-friendly support options | |

| • Many years experience in the industry |

Is Travelex Safe?

Travelex appears to be a regulated company by the Australia Securities & Investment Commission (ASIC, No. 222444). This regulatory oversight adds a layer of safety for investors and helps to ensure that the broker is operating in a fair and transparent manner. It also has many years experience in the industry.

However, it is important for traders to do their own due diligence and research any potential broker before investing funds. Reviews and feedback from other traders can be helpful in determining the safety and legitimacy of a broker, as well as checking for any past incidents of fraud or other issues. Additionally, testing out the available trading platforms and customer support options can help to determine if a broker is a good fit for your individual trading needs and preferences.

Products

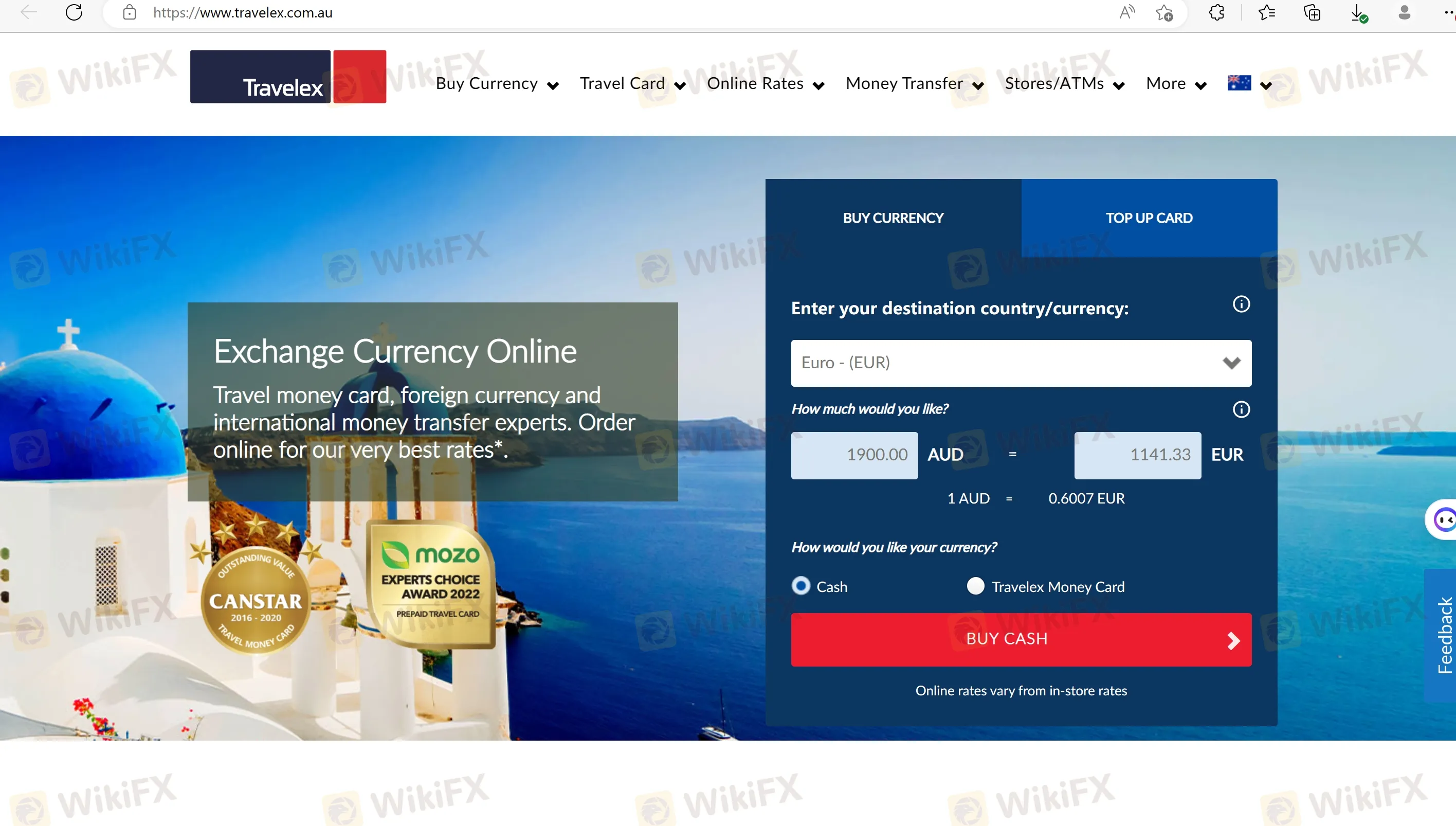

Travelex is a financial company that offers a range of products for individuals traveling internationally. One of their main offerings is Foreign Cash, which allows travelers to exchange their local currency for the currency of their destination country. This can be an important service for those who prefer to have cash on hand when traveling, and Travelex offers competitive rates and a wide range of currencies to choose from, including more than 60 foreign currencies available in-store and online and 12 foreign currencies available at the ATMs.

Another popular product offered by Travelex is the Travel Money Card, which can be loaded up to 10 available currencies and used wherever Mastercard is accepted including at ATMs. Travelex also offers a mobile app to help users manage their Travel Money Card, including tracking balances and reloading funds.

In addition to these travel-focused products, Travelex also offers International Money Transfer services, which enables you easily send money overseas online or in-store. Travelex offers competitive exchange rates and low fees for these services, and they have a range of options to choose from depending on your specific needs.

Overall, Travelex's products are well-suited for individuals who frequently travel internationally or who need to make international payments or transfers. Their competitive rates and convenient services make them a popular choice for many travelers.

Deposits & Withdrawals

Unfortunately, the information provided does not specify the deposit and withdrawal options available for Travelex's products. However, based on the icons visible on the company's website, it appears that Travelex accepts a range of payment methods including Maestro, Visa, BPAY, and more.

It is important for potential customers to confirm the available deposit and withdrawal options before making a purchase or transaction with Travelex. This can typically be found on the company's website or by contacting customer support directly. It is also important to be aware of any associated fees or charges for using specific payment methods, as these can vary and impact the total cost of the transaction.

Fees

Travelex is known for its competitive fee structure, which can help travelers save money when exchanging currency or making international payments. The company charges no Eftpos fees, meaning that customers can use their debit card to purchase foreign currency without incurring additional fees. Travelex also charges no online shopping fees, so customers can make purchases from international merchants without worrying about extra charges.

One of the biggest advantages of Travelex is that the company does not charge international ATM fees. This can be a major cost-saving measure for travelers who need to access cash while abroad, as some banks and financial institutions charge high fees for international ATM usage. Additionally, Travelex offers free delivery to your home for orders over a certain amount, which can further reduce costs for customers.

Another advantage of Travelex is that the company does not charge currency conversion fees. This means that customers can exchange their currency for foreign currency at competitive rates, without worrying about additional fees or charges.

Overall, Travelex's fee structure is designed to be customer-friendly and cost-effective. The company's focus on offering competitive rates and low or no additional fees can help travelers save money and get the most out of their international travels or payments.

Specials and Promotions

Travelex offers an attractive promotion for its Money Card holders. When loading Australian Dollars (AUD) onto the card and spending in specific currencies, including IDR, VND, CNY, TWD,KRW, PHP, KHR, MYR, FJD, and AED, cardholders can enjoy significant savings.

This promotion includes free online AUD loads and top-ups, eliminating fees for funding the card. Additionally, users can withdraw cash from ATMs internationally without incurring any fees. Travelex ensures a secure experience with a safe card and mobile app. Notably, when using the AUD balance on the Travelex Money Card in the aforementioned 10 countries, the international spend rate is capped at a competitive 2.95%, providing substantial savings for travelers.

User Exposure on WikiFX

On our website, you can see that a report of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

Travelex offers a range of customer support options for its users, including both traditional and social media channels. Customers can reach Travelex via phone: 1800 440 039, from Overseas +61 2 9696 9385, email: RetailCSC@travelex.com.au, Facebook: @TravelexANZ, and Instagram: @travelexanz, as well as access a comprehensive FAQ section on the company's website.

Overall, Travelex's customer support options are comprehensive and designed to provide customers with multiple ways to get in touch with the company. The availability of multiple channels can help ensure that customers can receive the assistance they need quickly and efficiently.

| Pros | Cons |

| • Toll-free and non-toll-free support available | • No 24/7 support |

| • Social media support options | • No live chat support |

| • Comprehensive FAQ section |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Travelex's customer service.

Conclusion

Based on the available information, Travelex appears to be a reliable and customer-friendly financial company that offers a range of services and products suited for international travelers. The company is regulated by ASIC, offering an additional layer of safety and transparency for investors. Travelex's competitive fee structure, multiple service offerings, and customer-friendly support options are some of the highlights of the company. It is recommended for customers to carefully review and confirm their options before using Travelex's services.

Frequently Asked Questions (FAQs)

Is Travelex legit?

Yes. It is regulated by Australia Securities & Investment Commission (ASIC, No. 222444).

What products does Travelex offer?

No. It offers Foreign Cash, Travel Money Card, and International Money Transfer.

Are Travelex rates competitive compared to airports or banks?

Travelex offers convenience with locations in airports and tourist areas, but their exchange rates might be less favorable compared to banks or online currency exchangers.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Corretora WikiFX

Últimas notícias

Dólar Hoje: Tendências e Impactos no Mercado Financeiro

Vittaverse: Cliente Perde Bônus de $800 e Lucro de $5609

CPT Markets: Conheça Antes de Investir

Moneda del Mundo: Investimento de 320 mil é Bloqueado

Quais as Vantagens do Mercado Forex?

IC Markets Otimiza Liquidez para CHINA50 e XNG/USD: O Que Isso Significa para os Traders?

TeleTrade Suspende Temporariamente Negociações de USD/BRL e BRA50 Durante o Carnaval

Cálculo da taxa de câmbio