Best Leader-Overview of Minimum Deposit, Spreads & Leverage

Resumo:Best Leader International Ltd is registered in St. Vincent & the Grenadine as an International Business Company with the registration No.: 25515 BC 2019. The Company is said to be regulated by the Financial Services Authority (FSA) of Saint Vincent and the Grenadines. BLI provides transaction products, LLG, LLS, CFDs, Crude Oil, index, with one-stop transaction services. However, there is no legit license in this offshore zone, so it is unsafe to trade with this broker.

| Aspect | Information |

| Company Name | Best Leader International Ltd |

| Registered Country/Area | St. Vincent |

| Founded Year | 2019 |

| Regulation | Unauthorized under NFA supervision |

| Minimum Deposit | $50 USD |

| Maximum Leverage | Up to 1:500 |

| Spreads | From 1.3 pips |

| Trading Platforms | MT4 (MetaTrader 4) |

| Tradable Assets | Foreign Exchange (FX), Precious Metals, Crude Oil, Market Indices |

| Account Types | Mini Account and Premium Account |

| Customer Support | Email(cs@blintl.com), Hotline (4001-200-208) |

| Deposit & Withdrawal | Dah Sing Bank, DBS, OCBC, Wing Hang Bank, Bank of China, UnionPay, Tether (USDT) |

| Educational Resources | Limited resources including Investment Calculation and FAQs |

Overview of Best Leader International Ltd

Best Leader International Ltd, registered as an International Business Company in St. Vincent & the Grenadines (Registration No.: 25515 BC 2019), offers a comprehensive range of trading assets, including foreign exchange, precious metals like gold and silver, crude oil contracts, and various market indices. These offerings aim to provide traders with diverse investment opportunities.

However, it's worth noting that Best Leader operates with an Unauthorized Common Financial Service License (License No. 0532729) under the National Futures Association's (NFA) supervision in the United States, which may raise concerns about regulatory compliance and transparency within the exchange.

Is Best Leader legit or a scam?

Best Leader International Limited operates with an Unauthorized Common Financial Service License (License No. 0532729) under the strict supervision of the National Futures Association (NFA) in the United States. It is crucial to note that their license status is unauthorized, which may raise concerns about the transparency and oversight of the exchange.

Pros and Cons

| Pros | Cons |

| Offers a diverse range of trading assets | Operates with an unauthorized license |

| Comprehensive customer support | Limited educational resources |

| MT4 trading platform | Minimum deposit requirement |

| High leverage | |

| Variable payment methods |

Pros:

Offers a Diverse Range of Trading Assets: Best Leader provides a wide selection of trading assets, including foreign exchange, precious metals, crude oil, and various market indices.

Comprehensive Customer Support: The platform offers comprehensive customer support, which includes various communication channels like phone and email. This can be helpful for traders who need assistance or have inquiries.

MT4 Trading Platform: Best Leader employs the widely recognized MT4 (MetaTrader 4) trading platform. MT4 is known for its user-friendly interface, advanced charting tools, and expert advisors.

High Leverage: Best Leader offers high leverage options, which can amplify potential profits.

Variable Payment Methods: The platform supports a range of payment methods, including Dah Sing Bank, DBS, OCBC, Wing Hang Bank, Bank of China, UnionPay, and Tether.

Cons:

Operates with an Unauthorized License: Best Leader operates with an Unauthorized Common Financial Service License (License No. 0532729). This lack of proper authorization may raise concerns about regulatory compliance and transparency within the exchange.

Limited Educational Resources: Best Leader provides limited educational resources, which can be a disadvantage for traders seeking comprehensive learning materials or tutorials to enhance their trading skills.

Minimum Deposit Requirement: The Premium Account has a relatively high minimum deposit requirement of $1,000 USD. This may pose a challenge for traders with smaller budgets.

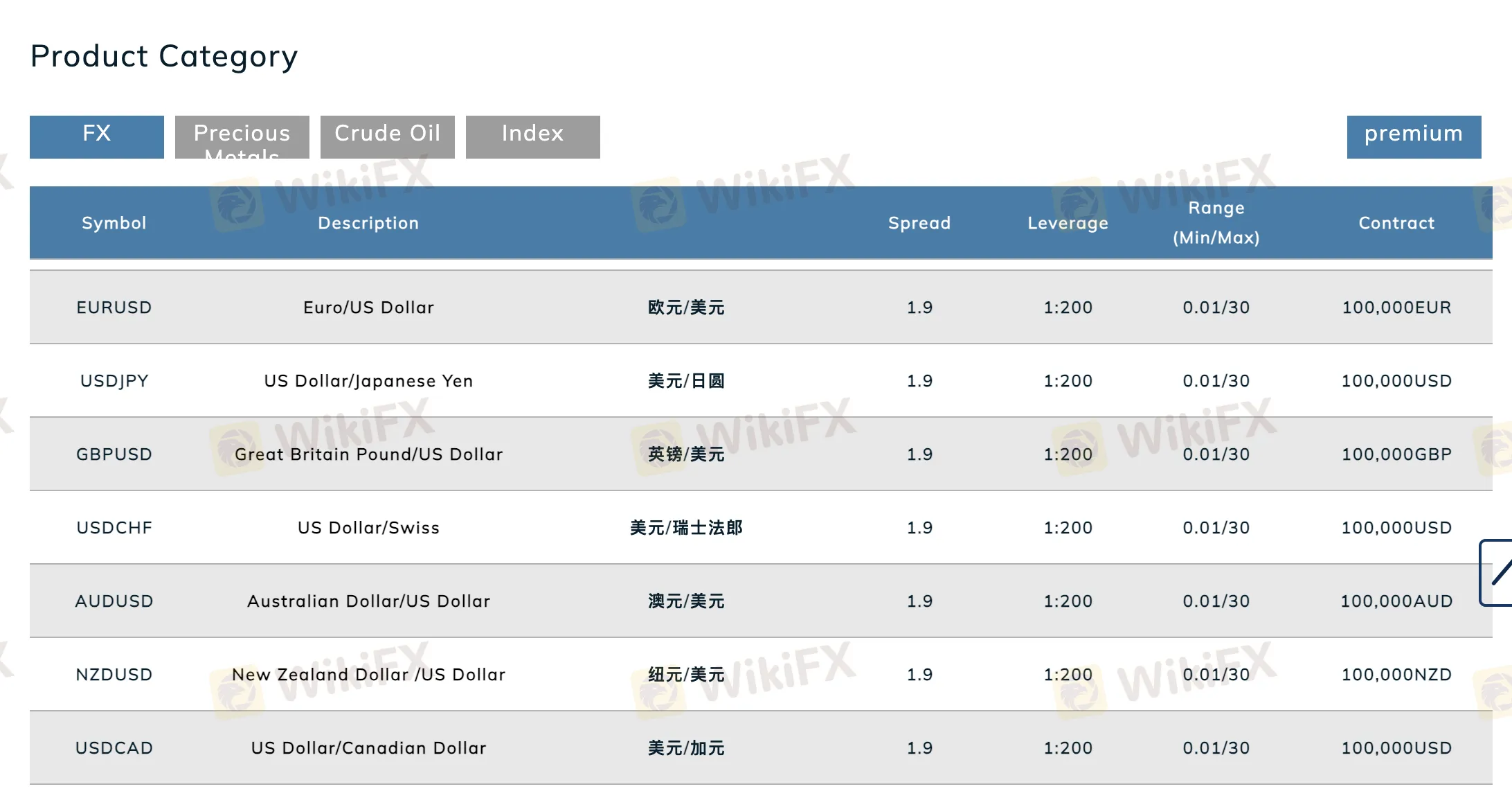

Market Instruments

Best Leader International Ltd offers a comprehensive array of trading assets, ensuring a versatile and inclusive trading experience for its clients.

FX (Foreign Exchange): Clients can engage in the dynamic world of forex trading, exchanging one currency for another. With access to major currency pairs, traders can speculate on fluctuations in exchange rates and seize opportunities in the global currency markets.

Precious Metals: Best Leader International Ltd provides opportunities to invest in precious metals like gold and silver. These metals serve as a store of value and can act as a hedge against economic uncertainty, allowing traders to diversify their portfolios.

Crude Oil: Investors can participate in the energy market by trading crude oil contracts. These contracts offer exposure to the price movements of this essential commodity, making it possible to capitalize on changes in the oil market.

Index: Best Leader International Ltd offers access to a range of market indices, enabling traders to invest in the overall performance of specific markets or sectors. This diversification opportunity enhances portfolio stability.

Through its one-stop transaction services, Best Leader International Ltd empowers traders to explore and engage with these diverse trading assets, facilitating investment diversification and risk management strategies for their clients.

Account Types

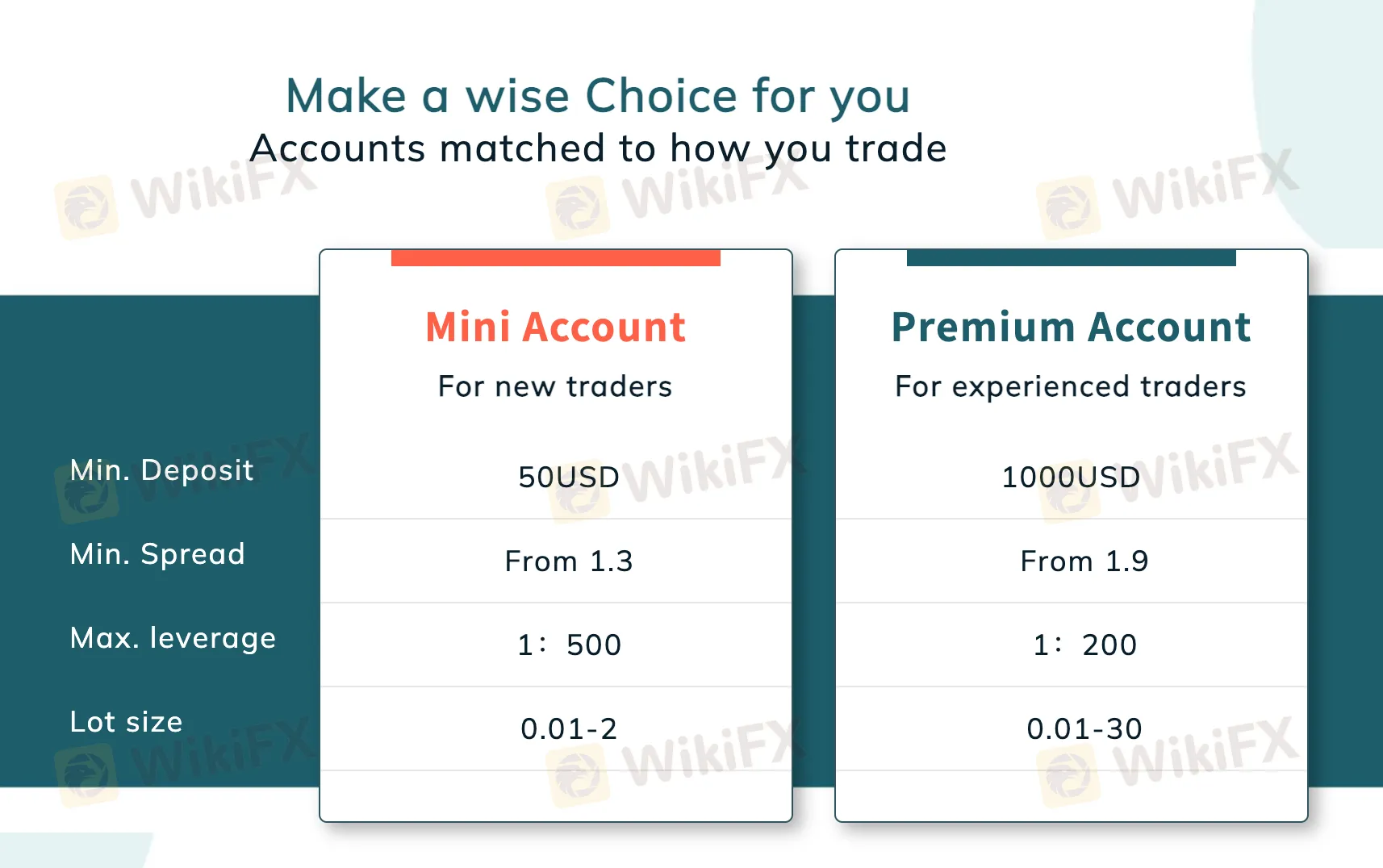

Best Leader offers two distinct account types to cater to a range of trader profiles:

Mini Account (For New Traders): This account is tailor-made for newcomers to the trading world. With a remarkably low minimum deposit requirement of just $50 USD, it provides an accessible entry point. The minimum spread starts from 1.3 pips, allowing cost-effective trading. The Mini Account offers an impressive maximum leverage of 1:500, amplifying potential gains. Traders can work with lot sizes ranging from 0.01 to 2, offering flexibility and risk management.

Premium Account (For Experienced Traders): Designed for seasoned traders, the Premium Account requires a higher minimum deposit of $1,000 USD. The minimum spread starts at 1.9 pips, accommodating more sophisticated trading strategies. While the maximum leverage is set at 1:200, offering substantial trading power. With lot sizes ranging from 0.01 to 30, experienced traders can engage in larger-scale positions, leveraging their expertise.

Best Leader's account types ensure that traders, whether new or experienced, can find a suitable option that aligns with their trading goals and experience level.

| Account Type | Mini Account | Premium Account |

| Trader Profile | For new traders | For experienced traders |

| Min. Deposit | $50 USD | $1,000 USD |

| Min. Spread | From 1.3 | From 1.9 |

| Max. Leverage | 1:500 | 1:200 |

| Lot Size | 0.01 - 2 | 0.01 - 30 |

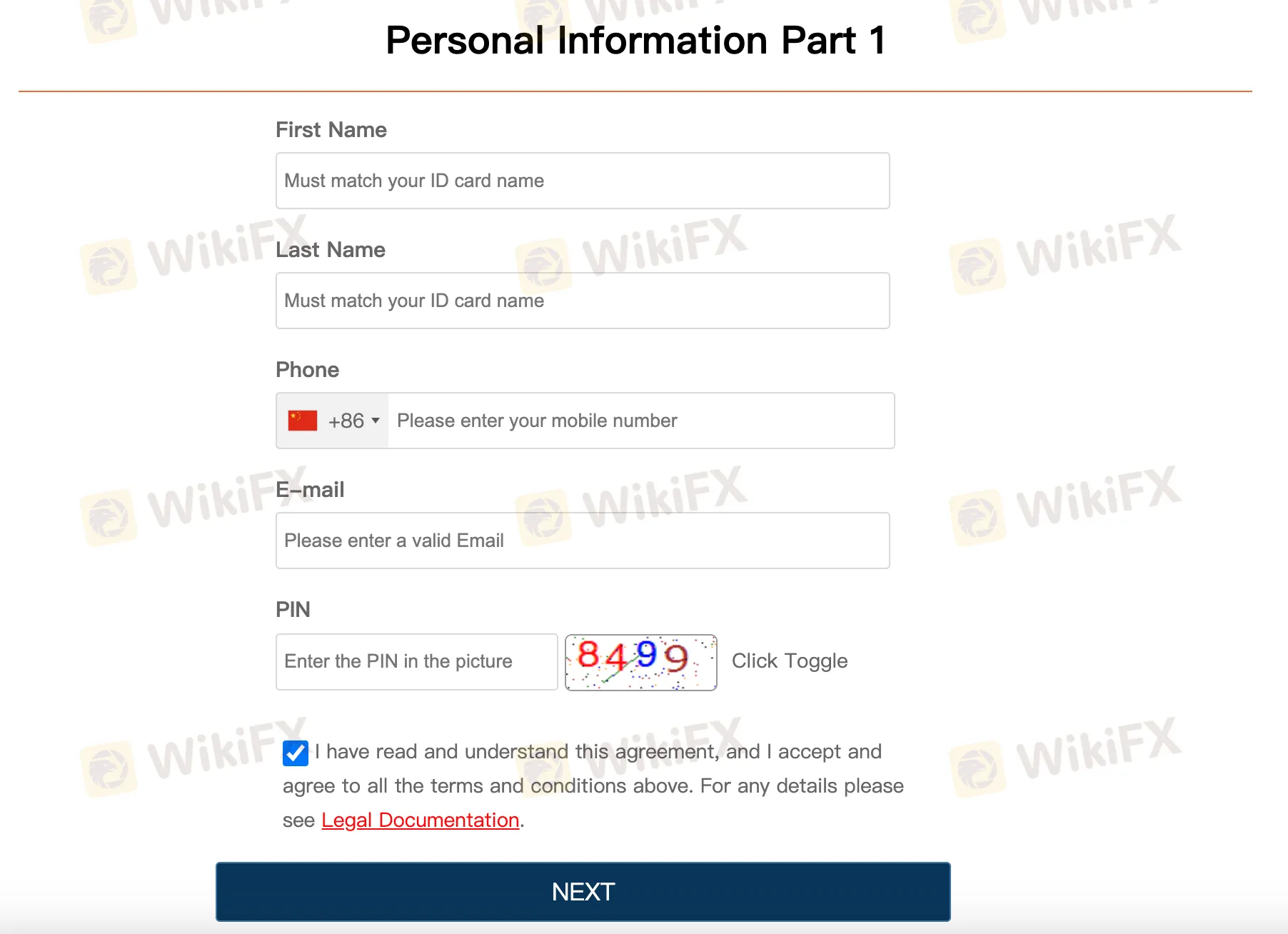

How to Open an Account?

Opening an account with Best Leader involves several straightforward steps. Here are the six key procedures broken down concretely:

Visit the Best Leader Website:Go to the official Best Leader website using a web browser.

Click on “Open an Account”:Look for the “Open an Account” or similar button/link on the website's homepage, and click on it.

Choose Account Type:Select the account type that suits your trading needs, such as “Mini Account” or “Premium Account.”

Complete Registration:Fill out the registration form with your personal information, including your name, contact details, and address. You may also need to provide identification documents for verification, depending on regulatory requirements.

Deposit Funds:Once your registration is approved, deposit the required minimum funds into your trading account using one of the accepted payment methods. Refer to the provided instructions for depositing.

Start Trading:After your funds are deposited and your account is funded, you can start trading. Download the trading platform (if required) and log in with your account credentials. Begin executing trades, managing your portfolio, and accessing trading resources as needed.

By following these six steps, you can successfully open an account with Best Leader and commence your trading journey.

Leverage

Best Leader offers varying maximum leverage levels for different trading products:

LLG (Large Gold Contracts): Traders can access a maximum leverage of up to 20 lots when trading LLG, with a contract size of 100 ounces of gold.

LLS (Large Silver Contracts): For LLS, the maximum leverage is set at 10 lots. These contracts have a larger contract size of 2500 ounces of silver.

CFDs (Contract for Difference): When trading CFDs, traders can utilize a maximum leverage of 30 lots. CFDs typically represent 100,000 units of the basic currency.

Crude Oil: Best Leader offers a maximum leverage of 10 lots for crude oil trading, with each lot representing 1000 barrels of oil.

Index: The leverage for index products varies depending on the specific index being traded. Each index product is traded using different lot sizes, allowing for flexibility in leverage.

Spreads & Commissions

Best Leader offers competitive spreads to its traders. In the Mini Account, the minimum spread starts from 1.3 pips, while the Premium Account offers slightly tighter spreads, beginning from 1.9 pips. These options cater to traders with varying preferences for trading costs and strategies.

| Account Type | Mini Account | Premium Account |

| Min. Spread | From 1.3 | From 1.9 |

Trading Platform

Best Leader relies on the MT4 trading platform, a widely recognized tool in the forex and CFD trading sphere. The platform's appeal lies in its industry-wide usage, a suite of built-in tools, and sophisticated trading capabilities. It facilitates efficient trade execution and technical analysis, catering to the needs of traders seeking a versatile and established trading environment.

Industry Standard: MT4 is a prevalent choice among forex and CFD traders, offering a platform that's widely adopted across the industry.

Built-in Tools: The platform provides access to a set of built-in tools, which includes charting capabilities and technical analysis tools, assisting traders in analyzing market data.

Expert Advisors: Traders can employ expert advisors on MT4, enabling automated trading based on predefined strategies and criteria.

One-Click Trading: The platform offers one-click trading functionality, streamlining the order execution process and providing traders with quick trade placement options.

Advanced Features: MT4 boasts a range of advanced trading features, such as the ability to execute various order types, set stop-loss and take-profit levels, and engage in comprehensive technical analysis.

Deposit & Withdrawal

Best Leader offers a variety of payment methods to accommodate the needs of its traders, making deposits and withdrawals convenient and efficient. Payment methods include Dah Sing Bank, DBS (Development Bank of Singapore), OCBC (Oversea-Chinese Banking Corporation) Bank, Wing Hang Bank, Bank of China, and UnionPay. Additionally, they accept deposits in Tether (USDT), providing a cryptocurrency option.

For the Mini Account, the minimum deposit requirement is $50 USD, making it accessible to a wide range of traders. On the other hand, the Premium Account requires a higher minimum deposit of $1,000 USD, catering to more experienced traders.

The processing time for deposits and withdrawals may vary depending on the chosen payment method and the relevant banking institutions' policies. Typically, bank transfers and card payments may take a few business days to process, while cryptocurrency transactions like Tether may be faster due to blockchain technology.

| Account Type | Mini Account | Premium Account |

| Min. Deposit | $50 USD | $1,000 USD |

Customer Support

Best Leader provides comprehensive customer support for its clients.

They can be reached at their physical address located at 1st Floor, Dekk House, Zippora Street, Providence Industrial Estate, Mahe, Seychelles.

Additionally, clients can contact their support team via telephone at +248 4374 088 or send inquiries to cs@blintl.com through email.

For urgent assistance, a hotline is available at 4001-200-208.

This multi-channel approach ensures that clients have various means to reach out and receive assistance or information promptly from Best Leader's dedicated customer support team.

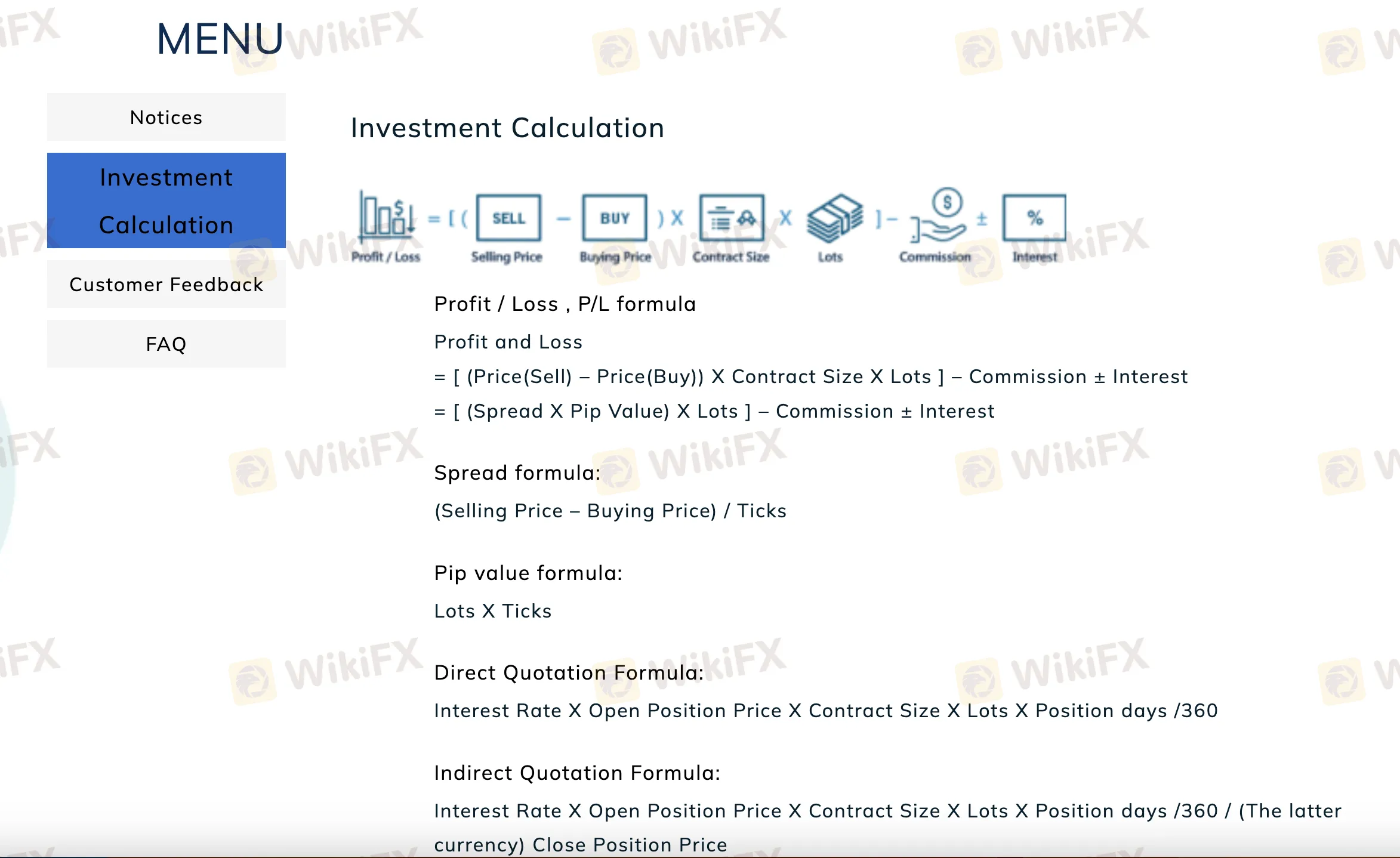

Educational Resources

Best Leader offers a limited yet valuable set of educational resources in English, focusing on Investment Calculation and a Frequently Asked Questions (FAQ) section. These resources aim to assist traders in understanding and navigating the intricacies of investment calculations and addressing common queries. While the offerings may be limited, they provide essential information to enhance traders' knowledge and facilitate informed decision-making within the financial markets.

Conclusion

In conclusion, Best Leader offers a diverse range of trading assets, comprehensive customer support, and the widely used MT4 trading platform, providing traders with versatile options.

However, it operates with an unauthorized license, which raises concerns about regulatory compliance and transparency. Additionally, the limited educational resources and relatively high minimum deposit requirement may pose challenges for some traders. While the platform's high leverage and variable payment methods offer advantages, the overall choice should be made carefully, considering both the pros and cons to align with individual trading preferences and risk tolerance.

FAQs

Q: How do I open an account with Best Leader?

A: To open an account with Best Leader, visit their official website, click on “Open an Account,” and follow the registration process.

Q: What is the minimum deposit required for a Premium Account?

A: The minimum deposit for a Premium Account with Best Leader is $1,000 USD.

Q: What trading assets are available with Best Leader?

A: Best Leader offers a variety of trading assets, including forex, precious metals, crude oil, and market indices.

Q: Can I use the MT4 trading platform with Best Leader?

A: Yes, Best Leader utilizes the MT4 (MetaTrader 4) trading platform, known for its user-friendly features.

Q: Are there educational resources for traders on Best Leader?

A: Best Leader provides limited educational resources, primarily focused on Investment Calculation and FAQs.

Q: What payment methods can I use for deposits and withdrawals?

A: Best Leader accepts various payment methods, including Dah Sing Bank, DBS, OCBC, Wing Hang Bank, Bank of China, UnionPay, and Tether for cryptocurrency transactions.

Corretora WikiFX

Últimas notícias

Dólar Hoje: Moeda Opera Perto de R$5,89 em meio ao Acirramento Guerra Comercial

Ouro Sobe Quase 2%: Oportunidade para Investidores Diante da Instabilidade Global

FXORO: Reclamações de Clientes e Riscos Associados à Corretora

Fusion Markets: Uma Corretora Confiável para Traders de Forex?

Mercado Forex em Alerta: Como os Últimos Eventos Globais Afetam o Câmbio

REALHX: Espanhol tem 30 mil Euros Bloqueados

FBS Celebra 16 Anos com o FBS Birthday IB Contest: Prêmios Exclusivos para Parceiros

Impactos da Guerra Comercial no Mercado Forex: Oportunidades e Riscos para Traders

eToro Expande Seu Catálogo com Novas Cryptoassets

Cálculo da taxa de câmbio