RT FINTECH-The overview of minimum deposit, leverage, spreads

Resumo:RT FINTECH is a financial services provider that operates with a certain degree of ambiguity due to the limited information available about the company. While the company's name and registered country are mentioned as RT FINTECH and an unknown location respectively, there is no clear indication of the founding year or specific regulatory oversight.

| RT FINTECH | Basic Information |

| Registered Country/Area | Canada |

| Founded year | Unknown |

| Company Name | RT FINTECH LIMITED. |

| Regulation | No Regulation |

| Minimum Deposit | 5,000 USD/GBP/EUR |

| Maximum Leverage | 1:100 |

| Spreads | 0.0 pips on the EUR/USD pair |

| Trading Platforms | MetaTrader 5 |

| Tradable assets | Forex, CFDs, Stocks, Indices, Commodities |

| Account Types | Individual, Joint and Corporate |

| Demo Account | Yes |

| Islamic Account | No |

| Customer Support | Email: info@rtvipservice.com |

| Payment Methods | Bank Wire, VISA, MasterCard, Skrill Wallet and Union Pay |

| Educational Tools | Trading tutorials, webinars |

Overview of RT FINTECH

RT FINTECH is a financial services provider that operates with a certain degree of ambiguity due to the limited information available about the company. While the company's name and registered country are mentioned as RT FINTECH and an unknown location respectively, there is no clear indication of the founding year or specific regulatory oversight.

Unfortunately, specific information about the minimum deposit requirement, maximum leverage, and spreads is not provided in the available overview. The lack of transparency regarding these important trading conditions may hinder traders' ability to make informed decisions and evaluate the suitability of RT FINTECH's offerings.

Regarding trading platforms, RT FINTECH is identified as operating on the MT5 platform. The MT5 platform is a popular choice among traders due to its advanced features and user-friendly interface. However, without further details about the platform's functionalities, customization options, and available tools, it is difficult to fully assess the trading experience offered by RT FINTECH.

The overview does not provide information about the account types offered by RT FINTECH, leaving potential traders in the dark about the available options and their associated features. Moreover, the absence of information regarding demo accounts and Islamic (swap-free) accounts may be a disadvantage for traders who value the ability to practice trading strategies risk-free or adhere to Islamic principles of finance.

In summary, the available overview of RT FINTECH leaves much to be desired in terms of transparency and clarity. The lack of specific details about the founding year, regulatory oversight, trading conditions, account types, and customer support options may make potential traders wary of engaging with RT FINTECH. It is essential for traders to conduct thorough research, seek additional information, and consider alternative brokers with greater transparency and comprehensive offerings before making any commitments.

Is RT FINTECHlegit or a scam?

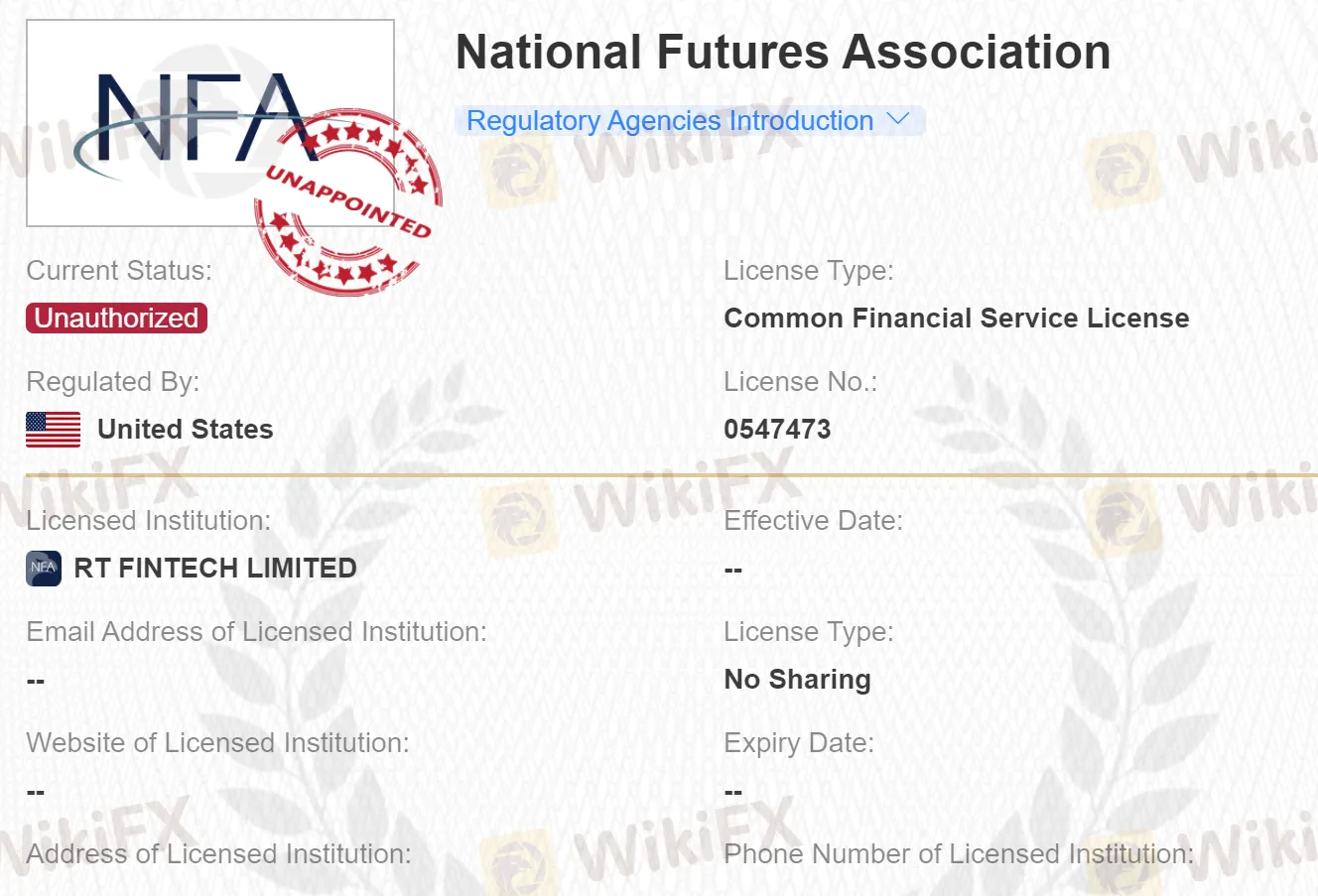

RT FINTECH's claim of being registered with the National Futures Association (NFA) raises concerns when further scrutiny reveals that its regulatory license number cannot be found on the NFA website. This discrepancy between the broker's assertion and the lack of verifiable evidence undermines the credibility of RT FINTECH's regulatory status.

Pros and Cons

| Pros | Cons |

| Multiple account types available | No regulatory oversight |

| Demo account offered for practice | Limited information about founding year |

| MT5 trading platform | High minimum deposit requirement from 5,000 USD/GBP/EUR |

| Moderate leverage limited to 1:100 | |

| Islamic account option not available | |

| No specific information about deposit and withdrawal | |

| Poor customer support | |

Market Instruments

RT FINTECH offers a diverse range of trading instruments to cater to the preferences and investment strategies of its clients. The broker promotes access to various financial markets, including Forex, CFDs, Stocks, Indices, Commodities. These popular instruments allow traders to participate in the dynamic foreign exchange market and potentially benefit from fluctuations in precious metal prices.

In addition to forex and precious metals, RT FINTECH provides opportunities for trading commodity futures and contracts. This broadens the scope of tradable assets, allowing traders to potentially capitalize on price movements in a variety of commodities such as oil, natural gas, agricultural products, and more. Commodity futures and contracts provide exposure to these markets, enabling traders to speculate on price changes or hedge against price volatility.

Furthermore, RT FINTECH includes stock indexes among its offered trading instruments. Stock indexes represent a basket of stocks that reflect the performance of a specific market or sector. By trading stock indexes, investors can gain exposure to a broader market trend without having to trade individual stocks. This approach allows for diversification and potential opportunities based on market indices.

Account Types

There are three live trading accounts offered by RT FINTECH, apart from free demo accounts, namely individual, joint and corporate. Opening an account requires the minimum initial deposit of 5,000 USD/GBP/EUR.

The individual account is designed for individual traders who wish to trade on their own behalf. This account type allows individuals to access the range of trading instruments offered by RT FINTECH and engage in trading activities based on their personal investment strategies and goals.

The joint account option is tailored for multiple account holders who wish to share a trading account. This type of account is suitable for individuals who want to pool their resources or collaborate on trading decisions. The joint account offers the convenience of a shared trading platform while maintaining individual ownership and control over the account.

For corporate clients, RT FINTECH provides a corporate account. This account type is specifically designed for businesses or corporate entities that seek to participate in financial markets. The corporate account offers features and functionalities that cater to the unique requirements of corporate clients, such as enhanced reporting capabilities and the ability to manage multiple trading sub-accounts.

Leverage

RT FINTECH offers leverage of up to 1:100, providing traders with the opportunity to magnify their trading positions relative to their invested capital. With leverage of up to 1:100, traders can access positions that are up to 100 times the value of their account balance. The availability of leverage up to 1:100 signifies that RT FINTECH acknowledges the importance of providing traders with the ability to control larger positions and potentially capitalize on market opportunities. It is crucial for traders to consider their risk tolerance, trading experience, and the specific market conditions before utilizing leverage. While leverage can enhance profitability, it also carries the risk of significant losses if trades do not go as anticipated.

Spreads & Commissions

RT FINTECH advertises that the spread for the popular EUR/USD currency pair starts from as low as 0.0 pips. In addition to the spread, RT FINTECH imposes a commission fee of $10 per trade. Commission fees are charged separately from the spread and are applied on a per-trade basis. The $10 commission is a fixed amount that traders should consider when calculating the total cost of their trading activities.

Non-Trading Fees

RT FINTECH, like many other brokers, may impose non-trading fees that go beyond the costs directly associated with executing trades. These fees can have an impact on the overall trading experience and should be carefully considered by prospective traders. While the specific non-trading fees charged by RT FINTECH are not explicitly mentioned in the available information, it is important for traders to be aware of the potential existence of such fees and to seek clarity from the broker directly.

Trading Platform Available

When it comes to trading platform available, RT FINTECH provides traders with the popular and widely recognized MT5 trading platform.

The MT5 platform offers a wide array of technical analysis tools, charting capabilities, and indicators that enable traders to analyze price movements and make informed trading decisions. It provides access to real-time market data, allowing traders to stay updated with the latest market developments and make timely trading decisions. Additionally, the platform supports the implementation of various trading strategies, including automated trading through the use of expert advisors (EAs).

Deposit & Withdrawal

Traders can utilize various payment methods, including bank wire transfers, VISA, MasterCard, Skrill Wallet, and Union Pay.

Bank wire transfers enable traders to transfer funds directly from their bank accounts to their RT FINTECH trading account. This method is commonly used for larger transactions and is known for its security and reliability. However, it is important for traders to note that bank wire transfers may involve processing fees and longer processing times, as they are subject to the corresponding banks' procedures and regulations. For those who prefer using credit or debit cards, RT FINTECH supports VISA and MasterCard. However, traders should be aware that certain fees or transaction charges may apply when using credit or debit cards for deposits and withdrawals.

Skrill Wallet, a popular digital payment platform, is also supported by RT FINTECH. Additionally, RT FINTECH accommodates Union Pay, a widely recognized payment system primarily used in China. While the available payment methods are offered, traders should be aware that additional fees, processing times, and specific requirements may apply.

Fees

RT FINTECH also charges some inactivity fees. To be more specific, if there are no open positions and there has been no other trading activity for a continuous period of one year, then this kind of account will be considered dormant and have to pay a inactivity fee of £10 per month (the amount depends on your account currency). However, if the balance of a dormant account has reduced to 0, this broker will not deduct further monthly inactivity charges. Attention that if traders decide to reactivate their dormant account by trading again, the inactivity charge for up to 3 previous months (up to a maximum of £30) where this has already been deducted will be refunded to their account.

Customer Support

In terms of customer support available, the primary means of contacting the broker's customer support is through email at info@rtvipservice.com. While this method allows for communication, it is essential for traders to be aware that it may not provide the immediacy or real-time assistance that other contact channels, such as live chat or telephone support, may offer.

Educational Resources

RT FINTECH, unfortunately, does not provide any educational resources for traders.

Is RT FINTECHsuitable for beginners?

Given RT FINTECH's lack of educational resources and limited information about account types and trading conditions, it may not be considered an ideal choice for beginners.

Beginners often require comprehensive educational materials and support to understand the intricacies of trading, develop strategies, and navigate the financial markets effectively. The absence of such educational resources from RT FINTECH may hinder beginners' ability to acquire the necessary knowledge and skills to start their trading journey on a solid foundation.

Additionally, the limited information about account types and trading conditions makes it challenging for beginners to assess the suitability of RT FINTECH for their specific needs. Clear and transparent information about account types, trading platforms, and available services is essential for beginners to make informed decisions about their trading preferences.

Ultimately, beginners should prioritize their education and choose brokers that provide the necessary resources and support to facilitate their learning journey.

Is RT FINTECH suitable for experienced traders?

Given the limited information available about RT FINTECH's trading conditions, account types, and overall services, it is difficult to determine if it is suitable for experienced traders.

Experienced traders typically have specific requirements, such as advanced trading tools, access to a wide range of markets, competitive spreads, and tailored account options. The lack of transparency regarding account types and trading conditions may hinder experienced traders who want to explore detailed information and customization options.

Experienced traders often value advanced trading platforms and tools that facilitate their trading strategies and analysis. Without comprehensive information about the trading platform and available features, it is challenging to evaluate if RT FINTECH meets the expectations of experienced traders in terms of advanced charting capabilities, order types, and customization options.

Furthermore, experienced traders typically seek brokers with a solid regulatory framework, as it provides an additional layer of security and oversight. RT FINTECH's lack of regulation may raise concerns for experienced traders who prioritize a regulated trading environment.

Conclusion

In conclusion, when evaluating RT FINTECH, it is important to consider several factors before making a decision. While the broker offers certain features and services, there are limitations and uncertainties that may impact the overall trading experience.

First and foremost, the absence of regulatory oversight raises concerns about the level of security and protection afforded to clients. Furthermore, the lack of comprehensive information about account types, trading conditions, and spreads makes it difficult for traders to assess the suitability of RT FINTECH for their specific trading needs. Moreover, the limited availability of educational resources may hinder the learning and development of traders, particularly beginners who rely on educational materials to acquire the necessary knowledge and skills. Therefore, considering these factors, traders should exercise caution and carefully evaluate their options before choosing RT FINTECH as their broker.

FAQs

Q: What is the minimum deposit requirement for opening an account with RT FINTECH?

A: The minimum deposit required to open an account with RT FINTECH is 5,000 USD/GBP/EUR.

Q: What trading platform does RT FINTECH offer?

A: RT FINTECH offers the popular MetaTrader 5 (MT5) trading platform.

Q: Does RT FINTECH offer demo accounts for practice?

A: No, RT FINTECH does not offer demo accounts for traders to practice their strategies without risking real money.

Q: Are Islamic (swap-free) accounts available with RT FINTECH?

A: No, RT FINTECH does not offer Islamic (swap-free) accounts.

Q: What are the available payment methods for deposits and withdrawals?

A: RT FINTECH supports bank wire transfers, credit cards, debit cards, and Skrill Wallet as payment methods.

Corretora WikiFX

Últimas notícias

Você Conhece os Principais Tipos de Negociação no Mercado Forex?

Dólar em Queda: Como a Desvalorização Afeta o Mercado Forex Brasileiro

Trading de Ranges no Mercado Forex: Estratégias e Gestão de Risco para Traders Brasileiros

IFA: Cliente Não Consegue Sacar 10 Mil USD da sua Conta

Bitcoin Dispara com Apoio da Casa Branca: Oportunidades para Traders Brasileiros

Super Trades no Japão: O Que Traders de Forex Brasileiros Precisam Saber?

GBP/USD: Perspectivas para Traders Brasileiros Diante da Volatilidade do Dólar

Cálculo da taxa de câmbio